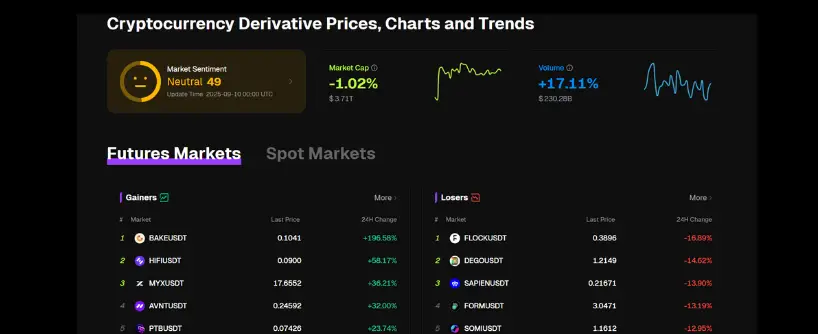

Crypto markets have always been influenced by sentiment as much as by fundamentals. Tweets, news headlines, and online community discussions can trigger massive swings in price. In 2025, artificial intelligence has made it possible to track, measure, and trade on these signals with greater precision than ever before. AI trading algorithms are now used across the financial market, including stocks, forex, commodities, and futures, and operate on various exchanges, providing users with access to a wide range of trading opportunities and asset classes. The benefit of automated trading and automating trades is that these platforms provide valuable insights for investors by reducing emotional biases, allowing traders to focus on key features and specific trading strategies.

AI trading algorithms now process vast streams of unstructured market data and real time data from social media, news, and blockchain activity. They analyze sentiment patterns, market trends, and price trends in real time and feed this information into trading strategies, helping users make more informed decisions. These advanced tools and platforms allow traders and investors to access actionable trading signals and adapt to changing market conditions for better outcomes.

This article explores the five best AI trading algorithms for crypto sentiment analysis in 2025, explains how they work, and shows how traders can combine them with risk management to turn emotion-driven markets into opportunity. AI trading bots, trading bots, and AI crypto trading bots are key advanced tools that automate trading, allowing traders to access trading opportunities and trading signals in the cryptocurrency market. These bots and tools are created and analyzed to adapt to changing market conditions and provide access to the global world of cryptocurrency markets.

Why Sentiment Analysis Matters in Crypto

Unlike traditional markets, crypto often lacks earnings reports or established valuation models. As a result, price is heavily driven by perception and community mood. Investors and traders rely on valuable insights from market data, social media posts, and price trends to make informed decisions and identify trading opportunities. Understanding market trends, market conditions, and the various factors that influence investment decisions is crucial in the cryptocurrency market. While emotional biases and human judgment can impact traditional trading, AI-powered trading tools use a data-driven approach to help users make more informed decisions.

- Bull runs are fueled by hype and optimism.

- Bear phases are intensified by panic and fear.

- Meme coins live and die by social buzz.

Sentiment is not a side effect of crypto trading. It is one of its core drivers. That is why algorithms designed to read sentiment data are becoming indispensable in 2025.

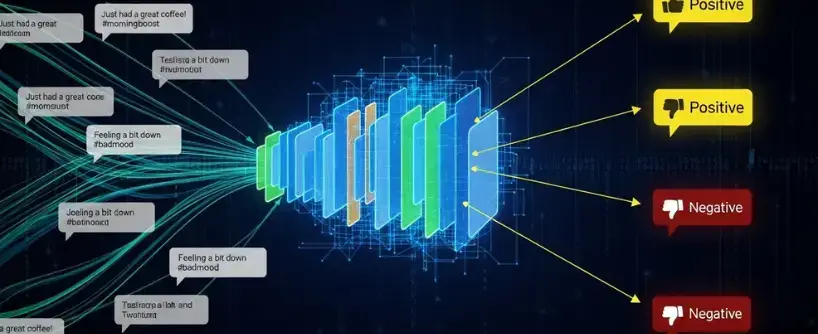

Algorithm 1: Neural Network Sentiment Classifiers

Neural networks are powerful at detecting patterns in language. In sentiment trading, these classifiers act as advanced tools created to analyze real time data and market data from social media posts, news, and exchanges, providing users with valuable insights and trading signals. These trading tools and platforms are versatile, allowing traders to access and analyze sentiment across various asset classes, including stocks, forex, commodities, and futures, thereby opening up a wide range of trading opportunities. By identifying market trends, price trends, and changing market conditions, these tools help users make more informed decisions. The effectiveness of these classifiers depends on multiple factors, such as the quality of data, evolving market conditions, and technological advancements, all of which are continually analyzed and improved to adapt to new market environments. In practice, they process millions of tweets, Reddit posts, and Telegram chats, labeling them as positive, negative, or neutral.

- Strengths: Adaptability to new slang, memes, and sentiment expressions common in crypto communities.

- Use Case: Detecting early hype around altcoins before mainstream media coverage.

- Example: When a sudden surge of positive posts about a new DeFi token appears, the algorithm can trigger a long position before price action reflects the shift.

Neural classifiers are essential because crypto sentiment often emerges from niche groups before it reaches the broader market.

Algorithm 2: Natural Language Processing for News Analysis

News headlines can move crypto markets instantly. Natural language processing (NLP) algorithms are advanced tools created to analyze real time data and market data from news sources, social media posts, and exchanges, providing users with valuable insights and trading signals. These platforms access and process news data across multiple asset classes, including stocks, forex, commodities, and futures, allowing traders to identify trading opportunities and respond to changing market conditions. By analyzing market trends, price trends, and the various factors that influence news-driven market movements, these tools help users make more informed decisions. NLP algorithms scan thousands of news outlets for tone, urgency, and relevance.

- Strengths: Fast reaction to breaking stories, filtering fake news, and rating credibility of sources.

- Use Case: Capturing sudden changes such as ETF approvals, exchange hacks, or regulatory announcements.

- Example: An NLP model may flag a regulatory update as positive for institutional adoption, prompting algorithmic buying.

By integrating NLP with automated execution, traders avoid delays caused by manually scanning headlines.

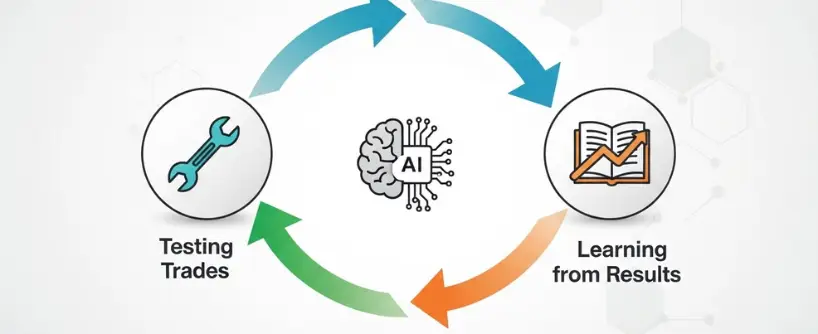

Algorithm 3: Reinforcement Learning Sentiment Strategies

Reinforcement learning allows algorithms to learn through trial and error. Applied to sentiment, these advanced tools are created to analyze real time data and market data from social media posts, news, and exchanges, providing users with valuable insights and trading signals. The system tests trades based on sentiment signals and adapts rules according to outcomes, allowing traders to benefit from continuous adaptation.

These platforms are highly adaptable, accessing and processing data across multiple asset classes including stocks, forex, commodities, and futures, allowing traders to identify trading opportunities and respond to evolving market conditions. By continuously analyzing market trends, price trends, and the various factors that influence sentiment-driven trading, these tools help users make more informed decisions.

- Strengths: Continuous improvement, adapting to new conditions over time.

- Use Case: Managing complex strategies that combine social sentiment, on-chain activity, and technical indicators.

- Example: The model may initially overreact to hype, but after repeated feedback, it learns to trade only when sentiment aligns with on-chain accumulation.

Reinforcement learning is ideal for traders seeking adaptable algorithms that evolve with changing markets.

Algorithm 4: Hybrid Technical and Sentiment Models

Hybrid models combine sentiment data with technical analysis. These advanced tools are created to analyze real time data and market data from social media posts, news, and exchanges, providing users with valuable insights and trading signals. The platform can access and process data across multiple asset classes, including stocks, forex, commodities, and futures, allowing traders to identify trading opportunities and respond to both technical and sentiment-driven market conditions. By analyzing market trends, price trends, and the various factors that influence trading outcomes, these tools help users make more informed decisions.

For example, an algorithm may open trades only when bullish sentiment coincides with moving average crossovers or volume spikes.

- Strengths: Reduces false signals by requiring multiple confirmations.

- Use Case: Avoiding emotional traps when social media sentiment spikes without real market backing.

- Example: If sentiment on Ethereum turns strongly positive but technicals show overbought conditions, the model waits for confirmation before entering.

This integration is especially valuable for traders who want more balanced signals.

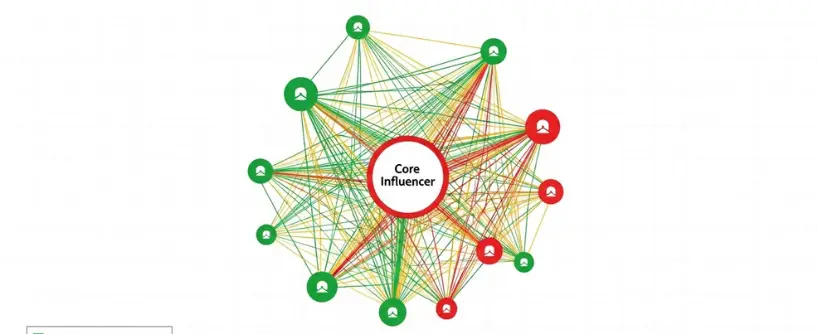

Algorithm 5: Social Media Graph Analysis

Graph analysis algorithms are advanced tools created to analyze real time data and market data from social media posts, news, and exchanges, providing users with valuable insights and trading signals. These platforms can access and process data across multiple asset classes, including stocks, forex, commodities, and futures, allowing traders to identify trading opportunities and respond to evolving market conditions. By analyzing market trends, price trends, and the various factors that influence sentiment propagation and trading outcomes, these tools help users make more informed decisions.

Graph analysis algorithms study how information spreads across networks. Instead of just counting tweets, they map the influence of users and track how quickly sentiment flows between groups.

- Strengths: Distinguishes between noise and influential voices.

- Use Case: Identifying whether hype is spreading organically or being manipulated by bots.

- Example: If influential accounts drive momentum around a token, the algorithm flags it as more credible than if low-engagement accounts generate noise.

In an era where social media manipulation is common, graph analysis provides much-needed depth.

How Traders Use These Algorithms

Each algorithm has unique strengths, but traders achieve the best results when combining them. For example:

- Neural classifiers detect rising hype.

- NLP confirms the narrative through news headlines.

- Hybrid models check technical conditions before execution.

By layering signals, traders reduce the risk of acting on false sentiment and improve consistency. This approach allows traders to identify more trading opportunities and act with greater confidence, allowing traders to optimize their strategies.

Benefits of AI Sentiment Trading in 2025

AI sentiment trading offers significant benefit to traders by improving efficiency, speed, and decision-making. Its key features include the use of advanced tools for data analysis and execution, setting it apart from traditional trading methods.

- Speed: Algorithms process millions of data points per second.

- Accuracy: Machine learning filters irrelevant chatter and hones predictions.

- Scalability: Multiple coins can be tracked at once.

- Adaptability: Reinforcement learning strategies improve over time.

- Risk Management: Sentiment insights help avoid chasing emotional pumps.

Risks of Sentiment-Based AI Trading

AI sentiment trading is powerful, but it is not perfect. Various factors, including data quality, market volatility, and technological limitations, contribute to the risks of AI sentiment trading.

- Noise Sensitivity: False hype can still trigger signals.

- Data Quality: Biased or manipulated data skews results.

- Overreliance: Sentiment must be paired with technical and fundamental analysis, and human judgment is still necessary to interpret complex signals and manage risks beyond what AI can handle.

- Emotional Biases: While AI can help reduce emotional biases in trading decisions, it cannot fully replace the nuanced decision-making of experienced traders.

- Costs: Running advanced AI systems may require higher fees or computing resources.

Recognizing these risks keeps expectations realistic and strategies sustainable.

How Bitunix Academy Helps Traders Learn AI Sentiment Trading

Sentiment trading requires not only the right tools but also education. Bitunix Academy provides structured content that explains how AI trading algorithms work, how to interpret sentiment data, and how to combine it with broader trading strategies. The academy supports users by guiding them to create their own AI trading strategies and tools, enhancing the user experience and enabling customization.

By offering case studies, tutorials, and interactive lessons, Bitunix Academy helps traders understand both the potential and the pitfalls of AI-driven sentiment analysis. Beginners can start with simple concepts, while advanced traders can explore reinforcement learning and hybrid strategies.

Case Study Social Media Sentiment and Bitcoin 2025

In early 2025, Bitcoin sentiment surged on social media after speculation about a major ETF approval. Neural classifiers detected the spike, while NLP models confirmed positive media tone. Hybrid models checked technical conditions, confirming support levels held. The combined signals prompted a wave of algorithmic buying.

Within days, Bitcoin gained over 8 percent. Traders who relied solely on charts reacted late, while those using AI sentiment models, both traders and investors were able to make more informed decisions and capture the move early. This shows the power of combining multiple algorithms for better results.

Frequently Asked Questions

What are AI trading algorithms in crypto?

They are systems that use artificial intelligence to analyze data and execute trades automatically.

Why is sentiment analysis important in crypto?

Because price is often driven by perception, hype, and community mood rather than traditional fundamentals.

Which AI algorithms work best for sentiment in 2025?

Neural classifiers, NLP models, reinforcement learning, hybrid strategies, and graph analysis are among the most effective.

Do I need coding skills to use these algorithms?

Not necessarily. Platforms like Bitunix offer tools and educational support to help traders use AI without coding, and you can connect your trading account to the platform for automated execution.

Can sentiment trading be profitable?

Yes, when combined with risk management and technical analysis. No system guarantees profit, but sentiment insights and AI tools provide access to valuable data and insights that can improve trading outcomes.

Conclusion

AI trading algorithms have transformed sentiment analysis into crypto. These algorithms have been created to address the challenges of sentiment analysis in crypto markets. By 2025, traders can use neural classifiers, NLP models, reinforcement learning systems, hybrid strategies, and graph analysis to understand market mood and trade accordingly.

These tools are not perfect, but they provide speed, scale, and adaptability beyond human ability. With proper risk management and education from resources like Bitunix Academy, traders can use AI to turn crowd psychology into actionable trade setups.

In a market where emotions drive volatility, sentiment trading powered by AI gives disciplined traders the edge they need.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.