The crypto spotlight is evolving in 2025. While Bitcoin remains the market leader, altcoins are gaining massive momentum in spot trading. From retail investors to institutions, more traders are asking the same question: what’s the best crypto to buy now? For many, the answer lies in altcoins with high growth potential, strong liquidity, and active development ecosystems.

Whether you’re new to crypto or a seasoned trader, understanding altcoin trading within the spot market is essential for capturing upside while managing risk.

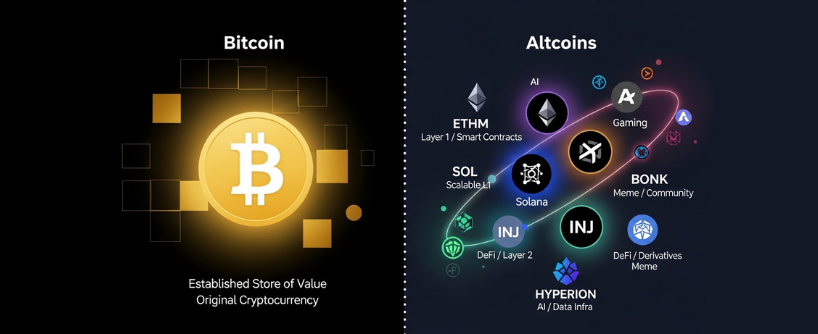

What Are Altcoins, and Why Do They Matter in 2025?

Altcoins refer to any cryptocurrency that isn’t Bitcoin. In 2025, this includes thousands of assets, from high-profile tokens like Ethereum and Solana to emerging coins powering AI, gaming, or decentralized finance (DeFi).

The surge in altcoin trading reflects growing investor interest in:

- New use cases beyond Bitcoin

- Lower-cost entry points for new traders

- Volatility that creates short-term profit potential

- Decentralized ecosystems backed by active development

Altcoins now represent over 60 percent of daily trading volume on some altcoin exchanges. That growth is primarily taking place in crypto spot trading, where buyers directly purchase and hold coins.

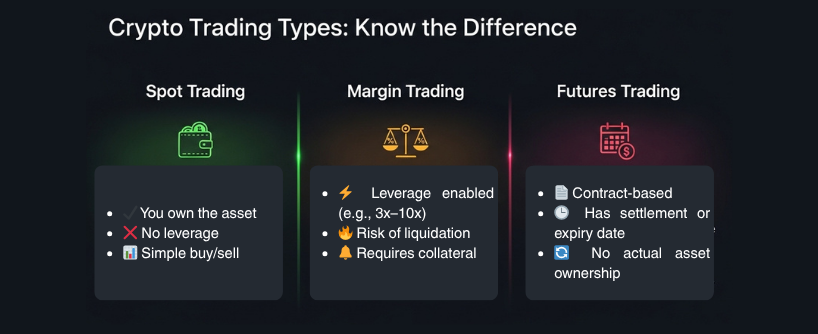

What Is Crypto Spot Trading?

Crypto spot trading involves the immediate exchange of cryptocurrency for another asset, such as USDT or BTC, at current market prices. There’s no leverage or future delivery. When you buy SOL/USDT on a spot exchange, for example, you own the SOL tokens directly.

In contrast to margin or futures trading, spot trading offers:

- Less risk of liquidation

- No interest or borrowing costs

- Full ownership of assets

Altcoin exchanges like Bitunix have made spot trading faster, safer, and more accessible to everyday users.

Why Altcoin Trading Is Surging in Spot Markets

Altcoins are becoming increasingly dominant in crypto spot trading due to five major trends:

Strong Community Hype and Social Momentum

Tokens like BONK, PENGU, and PEPE benefit from massive community followings on platforms like Reddit, X, and Telegram. This social momentum often drives short-term rallies and brings in liquidity.

Real Utility and Ecosystem Growth

New altcoins tied to functional networks like Arbitrum or Injective are solving real problems in DeFi, Layer 2 scalability, and decentralized infrastructure. These tokens are being actively used, not just traded.

Lower Entry Costs

Unlike BTC or ETH, which may feel out of reach to some new users, altcoins often trade at prices under $1. This psychological affordability brings in small investors looking for high upside.

Exchange Listings and Easy Access

Altcoin exchange platforms like Bitunix and Binance are listing more coins than ever before. That means more liquidity, tighter spreads, and access to promising projects early.

Long-Term Portfolio Diversification

Altcoins allow investors to diversify their crypto holdings beyond BTC and ETH, balancing high-growth potential with risk management strategies.

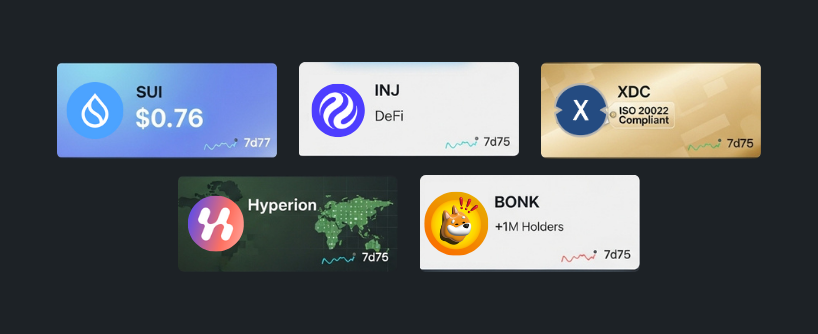

Best Crypto to Buy Now? Altcoins Leading the Pack

Here are five altcoins leading the charge in 2025 across major spot trading platforms:

1. SUI

A Layer 1 blockchain known for fast execution and scalability. With a growing DApp ecosystem and low gas fees, SUI is becoming a go-to for developers and traders alike.

- Current Market Cap: ~$12.9 billion

- SUI Price (July 2025): ~$3.73

- Use Case: Decentralized apps and smart contracts

2. INJ (Injective)

INJ powers a blockchain optimized for derivatives, DeFi protocols, and cross-chain interoperability. Spot trading volume for INJ has spiked as DEX adoption grows.

- INJ Price (July 2025): ~$13.66

- Notable Feature: Built for DeFi-focused applications

3. XDC Network

XDC is bridging traditional finance and blockchain with its enterprise-grade infrastructure. Its low-latency network supports smart contracts, tokenization, and trade finance.

- XDC Price (July 2025): ~$0.09823

- Strength: ISO 20022 compatibility for institutional payments

4. Hyperion (HYN)

A newer token seeing huge trading volume, Hyperion focuses on decentralized location-based services. While still volatile, traders are betting on long-term utility.

- HYN Volatility: High

- Use Case: Map-based decentralized apps

5. BONK

BONK remains a meme coin favorite, trading actively across Solana-based altcoin exchanges. While speculative, it’s holding strong thanks to deep community roots.

- BONK Price (July 2025): ~$0.00002725

- Community Size: Over 300K wallets

Each of these altcoins is available on major crypto spot trading platforms and is seeing consistent volume in 2025.

Altcoin Exchange Platforms: What Traders Should Look For

Choosing the right altcoin exchange can significantly impact trade execution and fees. Here are key features to prioritize:

- Spot trading support for both USDT and BTC pairs

- High liquidity for smooth order fulfillment

- Security protocols including cold wallet storage and 2FA

- Mobile and desktop parity for flexible access

- SL/TP (Stop Loss / Take Profit) order features

Bitunix is one exchange delivering on these requirements, with a strong focus on both emerging altcoins and institutional-grade security.

How to Spot Promising Altcoins

With thousands of tokens on the market, how do you separate the hype from real opportunity?

Here’s what to look for:

- Development Activity: Is the project updating frequently on GitHub?

- Real Use Case: Does the token solve a problem or enable a service?

- Exchange Volume: Is it traded regularly on high-volume exchanges?

- Community Engagement: Does the project have active support?

- Tokenomics: Are the supply mechanisms sustainable?

Doing your research is non-negotiable in 2025’s competitive altcoin landscape.

Are Altcoins the Best Crypto to Buy Now?

If you’re looking for diversification, utility, and upside potential, the answer might be yes. Altcoins in 2025 are no longer just speculative bets. Many have real technology, active ecosystems, and expanding use cases.

But don’t just follow the hype. Whether you’re trading on an altcoin exchange or building a portfolio, approach every token with a clear strategy. Use spot trading to your advantage by owning the asset outright, avoiding unnecessary leverage risks.

Altcoins are rising — and crypto spot trading is their launchpad.

FAQs: Altcoins and Spot Trading

What is altcoin trading?

Altcoin trading involves buying and selling cryptocurrencies other than Bitcoin. In spot trading, this means directly owning the token.

Where can I find the best altcoin exchange?

Top platforms like Bitunix offer competitive fees, fast execution, and a wide range of altcoins for spot trading.

What’s the best crypto to buy now?

Top-performing altcoins in 2025 include SUI, INJ, XDC, and BONK — each offering unique utility and strong trading volume.

Is spot trading crypto safer than margin trading?

Yes. With spot trading, you own the asset directly and are not at risk of liquidation due to borrowed funds.

How do I pick altcoins with real value?

Look for active development, high liquidity, solid community support, and transparent tokenomics.

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.