Asset tokenization has become one of the most significant innovations in finance, enabling ownership of physical and financial assets to be represented as digital tokens on a blockchain. In 2025, the growing demand for tokenized real estate, commodities, equities, and debt instruments highlights how tokenization is transforming traditional finance into a more accessible and efficient system.

But how does asset tokenization actually work? This article breaks down the full process, from identifying an asset to issuing blockchain-based tokens, and explains the technical components that make tokenization possible. By understanding these mechanics, investors and asset owners can see why tokenization is reshaping global markets and why it is expected to grow into a multi-trillion-dollar industry.

[ez-toc]

What is Asset Tokenization?

Asset tokenization is the process of converting ownership rights of a real-world asset into digital tokens stored on a blockchain. Each token represents a share or fraction of the asset, giving investors the ability to trade, transfer, or hold ownership in a secure and transparent way.

Tokenization can apply to a wide range of assets:

- Real estate (commercial buildings, residential property, land)

- Financial instruments (bonds, equities, private equity)

- Commodities (gold, oil, agricultural goods)

- Intellectual property (patents, royalties, digital rights)

- Collectibles and luxury goods (fine art, jewelry, classic cars)

The Asset Tokenization Process

The process of tokenization can be divided into five technical steps:

Step 1: Asset Identification and Legal Structuring

The first stage involves identifying the asset to be tokenized and ensuring it has a clear legal framework. Ownership rights must be established, and compliance with local regulations is critical. For example, real estate tokenization may require legal agreements linking the property deed to a digital representation.

This step ensures that the digital token has a legitimate claim on the underlying asset, avoiding disputes and regulatory issues.

Step 2: Asset Valuation and Custody

Before tokenization, the asset must be accurately valued. Independent audits, market analysis, or appraisals are often required. Custody arrangements are also essential, particularly for physical assets such as gold or real estate, where secure storage and management are necessary.

For financial instruments, custody may involve regulated institutions holding securities that back the digital tokens.

Step 3: Token Creation on Blockchain

Once the legal and custodial framework is in place, the asset is converted into tokens. Using blockchain platforms like Ethereum, Polygon, or specialized RWA blockchains, smart contracts are deployed to define the rules of ownership, transfer, and compliance.

Tokens can be fungible (identical units, like shares in a property) or non-fungible (unique units, like a piece of art). Smart contracts enforce conditions such as transfer restrictions, dividend distributions, or voting rights.

Step 4: Distribution and Trading

The newly created tokens are distributed to investors through platforms such as tokenization exchanges, decentralized finance (DeFi) protocols, or regulated marketplaces. Investors can purchase fractions of the asset using cryptocurrency or fiat currency, depending on the platform.

These tokens can then be traded on secondary markets, allowing liquidity for assets that were previously difficult to sell.

Step 5: Lifecycle Management

After issuance, tokenized assets require ongoing management. Smart contracts automate processes such as dividend payments, rent distribution, or compliance reporting. Blockchain ensures every transaction is recorded transparently, making it easier for regulators, issuers, and investors to track activity.

Lifecycle management ensures the asset remains tied to its underlying value and can be redeemed if required.

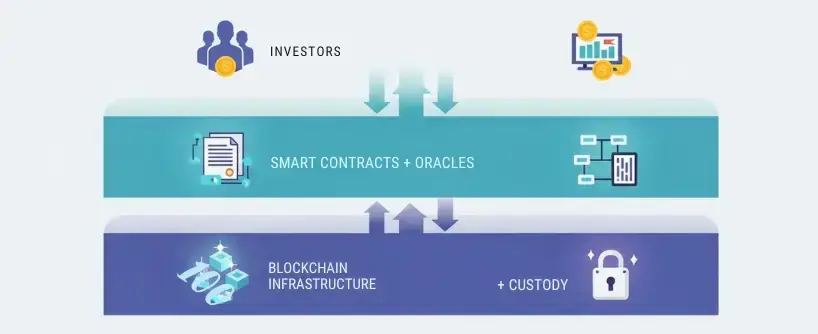

Technical Components of Tokenization

Smart Contracts

Smart contracts are self-executing codes stored on the blockchain. They govern how tokens are issued, transferred, and managed. For example, in tokenized real estate, a smart contract could automatically distribute rental income to token holders every month.

Blockchain Infrastructure

The blockchain acts as the distributed ledger where ownership and transfers are recorded. Public blockchains like Ethereum are widely used, but private or consortium blockchains are also being developed for institutional adoption.

Scalability and interoperability are key, as tokenized assets must integrate with global financial systems.

Oracles

Oracles are systems that connect blockchain with real-world data. They ensure that off-chain information, such as asset prices, interest rates, or legal updates, is accurately reflected in the tokenized ecosystem.

Custody and Security

For tokenization to succeed, the underlying assets must be securely stored. Custodians, whether regulated institutions or specialized service providers, play a critical role in safeguarding real-world assets while ensuring their digital representation is accurate and secure.

Benefits of Asset Tokenization

- Efficiency: Eliminates multiple intermediaries, reducing settlement times and costs.

- Liquidity: Allows fractional ownership, making illiquid assets tradable.

- Transparency: Blockchain provides immutable transaction records.

- Accessibility: Enables broader participation by lowering entry barriers for investors worldwide.

Market Adoption in 2025

The tokenization market is rapidly expanding. Analysts estimate that by 2030, over $13 trillion worth of assets could be tokenized, with $2 trillion expected as early as 2025.

Notable developments include:

- Financial giants like BlackRock and State Street entering the RWA sector.

- Governments experimenting with blockchain-based bonds.

- Tokenized real estate projects making high-value properties available to global investors.

These trends demonstrate how asset tokenization is becoming a central pillar of blockchain adoption.

Challenges to Address

- Regulatory Compliance: Different jurisdictions require clear legal frameworks.

- Liquidity Depth: Secondary markets for tokenized assets are still developing.

- Custody Risks: Secure links between on-chain tokens and off-chain assets are critical.

- Technology Integration: Scalability and interoperability remain challenges for blockchain platforms.

The Role of Bitunix Academy

As tokenization becomes more technical, understanding smart contracts, custody, and blockchain platforms is essential. Bitunix Academy delivers step-by-step tutorials and deep dives into the technical aspects of asset tokenization, including how oracles connect off-chain data to tokens and how different blockchains handle token standards. This content is particularly useful for developers, asset managers, and advanced investors who want to build confidence in the mechanics behind tokenization.

FAQ

What types of assets can be tokenized?

Virtually any asset can be tokenized, including real estate, commodities, equities, bonds, intellectual property, and even collectibles such as art and luxury cars.

What role do smart contracts play in tokenization?

Smart contracts automate processes such as ownership transfers, rental income distribution, and compliance enforcement. They ensure that transactions follow predefined rules without manual intervention.

What are oracles in the tokenization process?

Oracles act as bridges between blockchains and real-world data. They feed external information, such as property valuations or interest rates, into smart contracts to keep tokenized assets aligned with real-world conditions.

How do investors trade tokenized assets?

Once issued, tokens can be bought or sold on regulated tokenization platforms or secondary markets. These markets provide liquidity, allowing investors to enter or exit positions more easily than with traditional assets.

What technical risks should I be aware of when investing in tokenized assets?

The main risks include smart contract vulnerabilities, platform security breaches, and scalability issues with the underlying blockchain. Conducting due diligence and using regulated platforms can reduce these risks.

Conclusion

Asset tokenization represents a new era of financial innovation, turning ownership rights into programmable digital tokens. The technical process from legal structuring and valuation to blockchain issuance and lifecycle management makes tokenization both powerful and practical.

With advantages in liquidity, efficiency, and accessibility, tokenization is set to redefine global markets. While challenges remain, the momentum is undeniable. Investors, institutions, and developers who embrace tokenization now will position themselves at the forefront of financial transformation.

With platforms like Bitunix Academy providing the knowledge base, market participants can confidently explore tokenized assets and thrive in the future of digital finance.

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.