Bitcoin remains the most traded and analyzed digital asset in the world. Its high liquidity, constant volatility, and global adoption make it a prime candidate for artificial intelligence powered trading. Automated bitcoin trading can help shape your financial future by leveraging advanced technology to optimize trading decisions, thanks to the capabilities of modern automated trading platforms. In 2025, neural networks and deep learning have become essential tools for automating Bitcoin strategies.

While theory is important, real world case studies provide the clearest picture of how automated Bitcoin trading works in practice. By examining how traders use AI bots, neural networks, and machine learning models to manage Bitcoin trades, we can better understand both the opportunities and the risks. Traders can also create custom bots or strategies using neural networks to tailor their approach to specific market conditions.

This article explores several case studies that highlight how automated Bitcoin trading with neural networks has been applied successfully, what lessons were learned, and how traders can use these insights to improve their own strategies. We will also briefly describe how to automate crypto trading using neural networks and AI for more efficient and effective trading, and examine how different platforms and their capabilities are explored in case studies.

[ez-toc]

Understanding Neural Networks in Bitcoin Trading

Neural networks are systems inspired by how the human brain processes information. They learn from data, recognizing complex patterns that traditional technical indicators cannot. These neural networks are implemented as specialized software for bitcoin trading. A trading bot powered by neural networks can automate the execution of trading strategies, allowing users to benefit from advanced pattern recognition with minimal manual intervention.

- Input Data: Bitcoin price history, order book depth, funding rates, and even sentiment.

- Hidden Layers: Algorithms that detect relationships between inputs.

- Outputs: Trading signals such as buy, sell, or hold.

In Bitcoin trading, neural networks excel at spotting hidden correlations. For example, they might recognize that when certain funding rates and on chain flows align, a strong momentum move often follows.

Case Study 1: The Scalping Model

A trader built a neural network bot focused on short term Bitcoin scalping. The bot used one minute candles and combined technical inputs such as RSI and MACD with micro order book analysis. Selecting or designing a scalping trading bot often depends on the trader’s skill level.

Some traders also use a grid bot as an alternative strategy to profit from small market fluctuations through automated trading algorithms.

Key Results

- Average trade length: less than five minutes.

- Profitability: 0.4 percent average gain per trade.

- Volume: over 300 trades in two months.

The bot worked because it executed with precision, entering and exiting faster than a human could. However, profits were modest, showing that scalping requires extremely tight risk control.

Case Study 2: The Swing Trading Neural Network

Another trader developed a neural network for swing trading Bitcoin. This model used longer timeframes, from four hour to daily candles, and combined trend indicators with sentiment analysis. The strategy also incorporated take profit levels to secure gains during major moves. The neural network enables users to trade automatically based on its signals, allowing them to start trading without manual intervention.

Key Results

- Held positions for several days to weeks.

- Captured major moves such as Bitcoin’s breakout above 118,000 dollars in 2025.

- Averaged 12 percent monthly returns over six months.

This case shows how neural networks can provide an edge in longer term strategies, not just high frequency trading.

Case Study 3: Machine Learning Portfolio Management

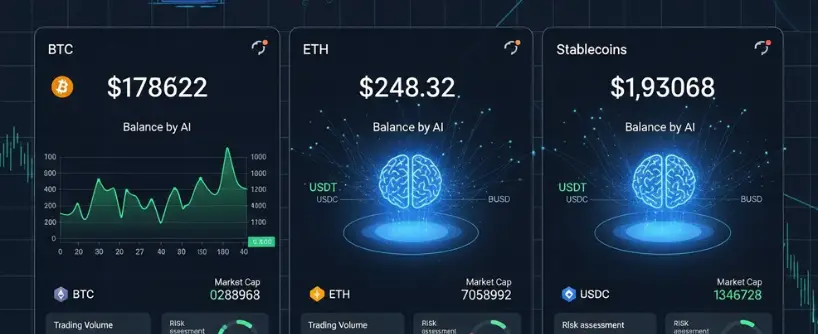

A group of traders created a portfolio bot that used deep learning to manage Bitcoin alongside Ethereum and stablecoins. The bot managed funds across multiple accounts and assets, ensuring optimal allocation and security. Users can link their exchange accounts to the bot through a secure connection, allowing them to manage all assets from one interface. The bot operates via API connections and does not have direct access to the funds in the exchange account. It rebalanced positions based on momentum and volatility models.

Key Results

- Rebalanced portfolio 10 times in four months.

- Bitcoin exposure was increased during bullish sentiment and reduced during corrections.

- Portfolio returned 28 percent in four months with lower volatility than holding Bitcoin alone.

This demonstrates that neural networks are not just for direct trading but also for intelligent portfolio management.

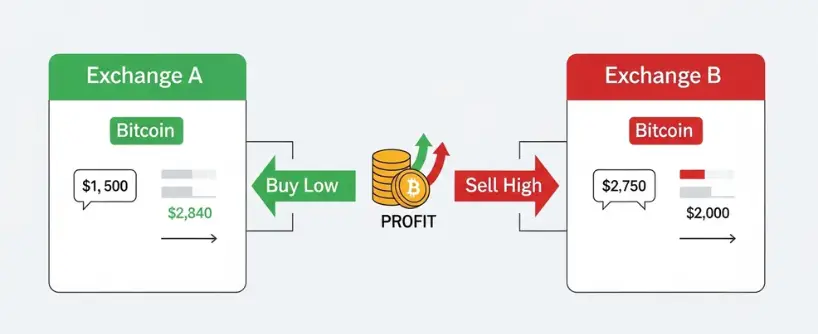

Case Study 4: The Arbitrage Neural Bot

An institutional desk designed a neural network that scanned multiple exchanges for arbitrage opportunities in Bitcoin. To operate efficiently, the bot required secure connections to multiple exchanges, enabling it to identify and execute arbitrage transactions quickly and reliably. The model analyzed price discrepancies, trading fees, and latency. Accurate date and time synchronization was essential for reliable arbitrage execution. This arbitrage neural bot is considered one of the most powerful bots available for automated bitcoin trading.

Key Results

- Executed trades within milliseconds.

- Averaged 1 percent daily profit with minimal directional risk.

- Required significant infrastructure, including low latency connections.

This case shows that neural networks can power advanced strategies, though they require resources beyond what most retail traders have.

Case Study 5: Sentiment Driven Bitcoin Trading

A final example involved a bot trained to combine social media sentiment with Bitcoin price action. Neural classifiers processed millions of tweets daily, assigning sentiment scores that were fed into the trading model. The increased accuracy of the model gave traders greater confidence in their trading decisions. Users also benefited from the bot’s trailing features, which allowed it to automatically follow market trends and optimize trade timing.

Key Results

- Detected positive sentiment surges before Bitcoin rallies.

- Successfully predicted two major upward moves in early 2025.

- Showed that combining sentiment and price signals increased accuracy.

This case highlights how neural networks thrive when combining diverse data inputs.

Lessons Learned from Case Studies

- Data Quality Matters Poor data leads to poor signals. Clean, diverse data sources are essential.

- Risk Management Is Crucial Even the best models fail without stop losses and position limits.

- Strategies Must Match Goals Scalping, swing trading, and portfolio management require different models.

- Infrastructure Counts High frequency neural bots demand advanced computing power.

- Continuous Learning Is Key Markets change, so models must be retrained with fresh data regularly. It’s also important to optimize models during retraining to improve performance and adapt to new market conditions.

Note: To stay ahead in the fast-evolving trading landscape, continuous learning and regular model optimization are essential. Upgrading to a pro plan unlocks advanced features and comprehensive trading tools, helping you maintain a competitive edge.

Risks of Automated Bitcoin Trading

While case studies show success, risks remain.

- Overfitting: A model that works on historical data may fail in live conditions.

- Market Shocks: Unexpected news can override algorithmic predictions.

- Technical Failures: Bots rely on stable connections and accurate feeds.

- Emotional Overreliance: Traders may trust bots too much and neglect oversight.

- Losing Money: Automated trading bots can result in losing money if not properly managed or if market conditions change.

- Hidden Fees: Some trading platforms may have hidden fees that reduce overall profitability; always review fee structures carefully.

Understanding these risks ensures that traders use automation wisely rather than blindly.

For more information, always visit the official website of any trading platform to review risk disclosures, and take advantage of free trials that do not have a credit card required for risk-free testing.

The Role of Bitunix Academy in AI Trading Education

Automated Bitcoin trading with neural networks requires both technical tools and structured education. Bitunix Academy offers resources to help traders understand how neural models work, how to test them safely, and how to integrate them with risk management. In addition, Bitunix Academy provides access to a dedicated support team and comprehensive documentation to assist traders at every step.

By studying real case studies and practicing with simulations, traders can learn how to apply AI responsibly. Search the web for Bitunix Academy to explore tutorials on automated trading, machine learning, and Bitcoin strategies. Users are also encouraged to join live webinars or online communities, such as Discord servers, to engage with educational content and receive further support.

Frequently Asked Questions

How does automated Bitcoin trading with neural networks work?

Automated Bitcoin trading with neural networks uses AI algorithms to analyze price data, order book depth, funding rates, and sentiment. The system processes this information to generate trading signals such as buy, sell, or hold, allowing bots to execute trades with minimal manual input.

What are the main benefits of AI-powered Bitcoin trading?

The key advantages include faster execution, pattern recognition beyond traditional indicators, and the ability to manage multiple strategies like scalping, swing trading, or portfolio management simultaneously. These benefits help traders respond to market changes with greater precision.

What risks should traders consider when using automated Bitcoin bots?

Traders must be aware of risks such as overfitting, technical failures, market shocks, and hidden platform fees. Automated trading also requires ongoing oversight, since relying entirely on bots without monitoring can lead to unnecessary losses.

Can retail traders build their own neural network bots?

Yes. Many platforms now allow retail traders to design or customize bots using neural networks. However, success depends on access to clean data, solid risk management, and regular model retraining to keep strategies effective in changing market conditions.

How can Bitunix Academy help with automated Bitcoin trading?

Bitunix Academy provides tutorials, webinars, and hands-on guidance for traders looking to learn AI trading. It helps users understand how neural networks function, test models safely, and integrate automation with disciplined risk management for more reliable results.

Conclusion

Automated Bitcoin trading with neural networks has evolved from theory into practice. The case studies reviewed here show how traders use AI for scalping, swing trading, portfolio management, arbitrage, and sentiment analysis.

The results prove that neural networks can generate consistent returns, provided that traders respect risk management and retrain models as markets evolve. However, automation is not a guarantee of profit. It is a tool that amplifies both strengths and weaknesses.

For traders in 2025, the combination of advanced AI tools, practical education from platforms like Bitunix Academy, and disciplined execution offers a clear path to mastering Bitcoin trading in the age of automation.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.