Diversification is the simplest and most reliable way to improve the stability of a crypto portfolio. Bitcoin and Ethereum remain the core for most investors, but a well built allocation also includes carefully selected altcoins that capture new sources of utility, liquidity, and network growth. Choosing the right mix is not about chasing trends. It is about applying a repeatable selection method, understanding how each asset earns its place, and sizing positions so that your overall portfolio remains resilient during volatile markets.

This guide explains how to evaluate altcoins for diversification beyond Bitcoin and Ethereum. You will learn the key categories to consider, the metrics that matter, how to align altcoin choices with risk tolerance, and how to combine assets into a balanced structure that supports long term growth. The focus is educational and practical. You will find criteria, examples, risk controls, and portfolio templates that you can implement immediately on Bitunix or any reputable platforms.

[ez-toc]

What Diversification Means in Crypto

Diversification does not mean owning dozens of tokens. It means mixing assets that respond differently to market forces so that one setback does not dominate performance. In traditional finance, diversification blends stocks, bonds, and cash. In crypto, diversification blends functions and ecosystems. When you add altcoins with different roles and adoption drivers, you reduce dependence on a single narrative and improve the chance that at least part of your portfolio is compounding in any environment.

A diversified crypto sleeve typically includes:

- Large caps for stability and broad market exposure.

- Layer 1s and Layer 2s for execution capacity and user activity.

- Infrastructure tokens for data, oracle, and cross-chain services.

- DeFi tokens linked to real usage and protocol replatforms.

- Stablecoins and conservative yield instruments for liquidity and buffers.

- A measured research bucket for early stage themes.

Your goal is to hold a set of assets that complement one another, not a pile of highly correlated bets.

How To Evaluate Altcoins Before Buying

Use a transparent, repeatable checklist

A disciplined investor applies the same questions to every candidate. The following framework keeps research consistent:

- Real users and on-chain activity: Look for evidence of utility. Examine daily active addresses, transactions, fees paid, and total value locked if relevant. Sustained activity over multiple months is more credible than short spikes during incentive campaigns.

- Token economics that support holders: Review supply schedule, unlock calendars, and how tokens capture value from protocol usage. Favor designs with clear sinks or replatforms sharing that link adoption to token demand. Be cautious when emissions are heavy and persistent.

- Security posture and transparency: Confirm audits by credible firms, public disclosure of incidents, and an upgrade process with time locks and community review. Mature projects publish postmortems when issues occur and provide simple access to contract addresses.

- Developer traction and ecosystem depth: Check code repositories, grant programs, hackathon participation, and the health of third-party projects. Strong ecosystems grow because builders find it practical and rewarding to ship on that network.

- Market structure and liquidity: Screen for multiple liquid platforms, consistent order book depth, and a market capitalization that fits your risk budget. Illiquid assets are difficult to rebalance and are inappropriate for large position sizes.

- Competitive advantage and differentiation: Ask what the asset does better than competitors. If another network or protocol can deliver the same service more efficiently, the token has limited advantage.

This checklist avoids guesswork. It also makes it easier to explain holdings to teammates or stakeholders, which builds internal discipline.

How To Match Altcoins With Risk Tolerance

Conservative investors

Conservative portfolios favor resiliency. Appropriate altcoin exposure includes proven infrastructure and high adoption Layer 1s and Layer 2s. Allocate modestly to DeFi protocols with long operating histories and visible replatforms. Maintain a stablecoin buffer between 15 and 25 percent to handle liquidity needs and rebalancing.

Balanced investors

Balanced portfolios mix growth and protection. They add a larger share of execution platforms and oracles, and a small exposure to emerging themes. A 10 to 20 percent research sleeve is acceptable if the rest of the structure remains stable. Stablecoin buffers typically range from 10 to 20 percent.

Aggressive investors

Aggressive portfolios intentionally hold more small caps and experimental sectors, but they still respect sizing rules and rebalancing schedules. Stablecoin buffers remain important, usually no lower than 10 percent. Aggressive investors must document exit rules and accept that variance will be higher.

Key Altcoin Categories For Diversification

Layer 1 smart contract platforms

Layer 1s are base networks that process transactions and host applications. Examples include Solana and Avalanche. They contribute throughput, cost profiles, and unique developer communities. When you add one or two quality Layer 1s, you gain exposure to different design choices and user flows.

What to evaluate

- Transactions per second during normal usage.

- Fee structure and finality times.

- Validator set size and geographic distribution.

- Application diversity, for example DeFi, gaming, and payments.

- Bridges and fiat ramps that increase accessibility.

Layer 1 exposure should be diversified across at least two architectures if your budget allows. Avoid overconcentration in a single chain unless it is part of a defined research bet.

Layer 2 scaling on Ethereum

Layer 2s, such as Arbitrum, Optimism, Base, and zkSync, scale Ethereum by processing transactions off the main chain and submitting proofs to L1. Layer 2s bring lower fees and high throughput while inheriting Ethereum security assumptions. They are useful for active traders and developers who want access to the Ethereum ecosystem with faster settlement.

What to evaluate

- Proof model and security assumptions.

- Canonical bridge design and withdrawal times.

- On-chain replatforms, sequencer fees, and plans for decentralization.

- Availability of stablecoin liquidity and fiat ramps.

- Breadth of applications and partners.

Layer 2 tokens add exposure to Ethereum’s growth, but each carries different governance and fee sharing models. Read the token documentation carefully to see how value accrues.

Infrastructure and oracle networks

Infrastructure tokens power data feeds, cross-chain messaging, and indexing. Chainlink is the best known oracle provider. Other examples include messaging or interoperability networks that carry proofs and structured data between chains.

What to evaluate

- Number of paying integrations and the diversity of clients.

- Historical uptime and incident response.

- Pricing, replatform capture, and any fee distribution to token holders.

- Partnerships that increase switching costs for customers.

Infrastructure tends to correlate less with short-term market narratives. It is a useful diversifier because core services remain relevant in bear and bull cycles.

DeFi protocols with clear cash flows

Decentralized exchanges, lending markets, and liquid staking protocols can be solid additions when there is sustained usage. The best DeFi tokens are closely tied to protocol value creation, for example through fee sharing, buybacks, or governance that tangibly influences economics.

What to evaluate

- Total value locked and its composition.

- Protocol replatforms and how it flows to token holders.

- Concentration risk in top pools or top borrowers.

- Audit history, oracle design, and liquidation rules.

- Emissions schedules and incentives.

Avoid DeFi tokens where rewards depend almost entirely on inflation. Look for organic replatforms that persists after incentives.

Real-world asset and yield protocols

Tokenized treasuries, short term debt instruments, and on-chain funds offer conservative returns inside the crypto environment. They diversify risk and help you manage the stablecoin buffer productively. These tokens are not speculative in the same way as growth assets, but they contribute to portfolio stability and income.

What to evaluate

- Legal structure, custodians, and redemption process.

- Transparency of holdings and daily price reporting.

- Settlement rules and jurisdictional restrictions.

- How the token integrates with wallets and DeFi platforms.

Data availability and modular architecture tokens

Modular designs split execution, settlement, and data availability into separate layers. Data availability networks and modular execution layers have gained adoption because they let projects tailor capacity and costs. Small, measured exposure to modular components adds a different kind of growth driver to your portfolio.

What to evaluate

- Developer adoption and number of deployed rollups or chains that rely on the network.

- Roadmap for scalability and cost reduction.

- Token utility beyond speculation, for example staking and payment for services.

Thematic buckets with strict size limits

Themes such as decentralized compute, storage, or AI-adjacent services can be included in a research sleeve. The decision to include them should be tied to a clear thesis, not headlines. Size them so that a full loss does not compromise the portfolio.

Example Altcoin Shortlist By Category

The following examples illustrate how the selection process might produce a shortlist. They are not recommendations to buy, and they must always be weighed against your own research and risk tolerance.

- Layer 1s: Solana for high throughput and strong payments activity, Avalanche for subnet architecture and enterprise partnerships.

- Layer 2s: Arbitrum for DeFi depth and ecosystem grants, Optimism for its role in the Superchain and shared sequencing roadmap.

- Infrastructure: Chainlink for oracles and data services, plus one messaging or interoperability network with visible integrations.

- DeFi: One leading decentralized exchange on your chosen chain, one conservative lending market, and one liquid staking protocol with audited contracts.

- RWA and yield: A tokenized treasury product available to your jurisdiction for conservative income.

- Modular and data availability: One project with active rollup deployments and ecosystem growth.

A shortlist like this adds functional diversity without overwhelming the portfolio. Your final selection should always reflect the liquidity you need and the time you are able to spend monitoring positions.

Position Sizing and Allocation Templates

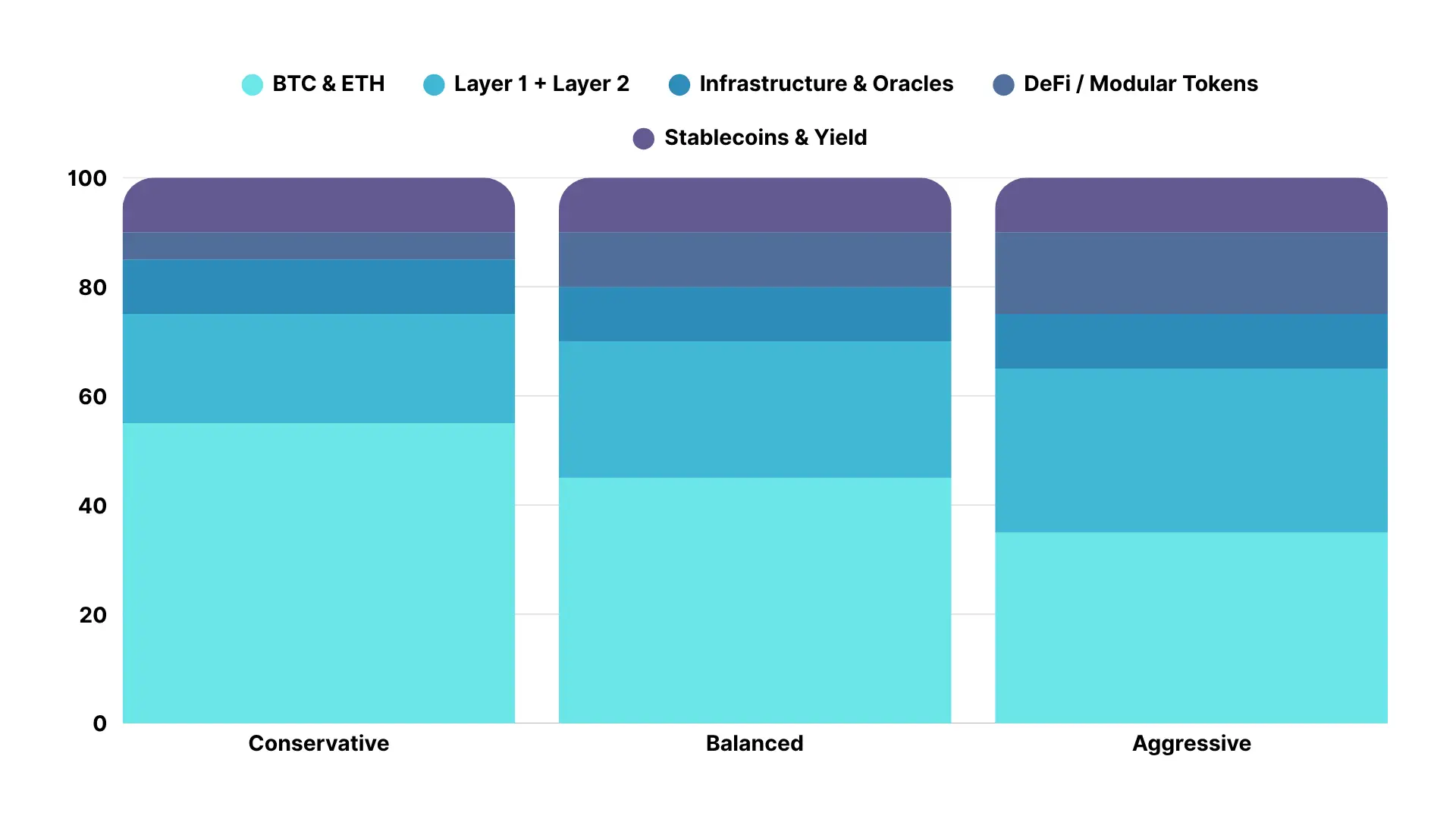

Conservative diversification template

- 55 percent BTC and ETH in roughly equal parts.

- 20 percent Layer 1 and Layer 2 combined, with no single chain above 10 percent.

- 10 percent infrastructure and oracles.

- 5 percent DeFi tokens tied to protocols with replatforms.

- 10 percent stablecoins and tokenized treasuries.

This structure improves diversification while keeping variance low. It suits investors who prefer measured growth and strong downside control.

Balanced diversification template

- 45 percent BTC and ETH.

- 25 percent Layer 1 and Layer 2 combined.

- 10 percent infrastructure and oracles.

- 10 percent DeFi tokens with fee share or buyback mechanics.

- 10 percent stablecoins and conservative yield.

This template aims for steady compounding. It keeps enough cash to buy dips, while allocating meaningfully to growth sectors.

Aggressive diversification template

- 35 percent BTC and ETH.

- 30 percent Layer 1 and Layer 2 combined.

- 10 percent infrastructure and oracles.

- 15 percent DeFi and modular tokens with evidence of adoption.

- 10 percent stablecoins and yield instruments.

This template adds upside potential and requires stricter rebalancing and risk limits. It fits investors who can tolerate variance and monitor positions weekly.

Rebalancing Rules That Work

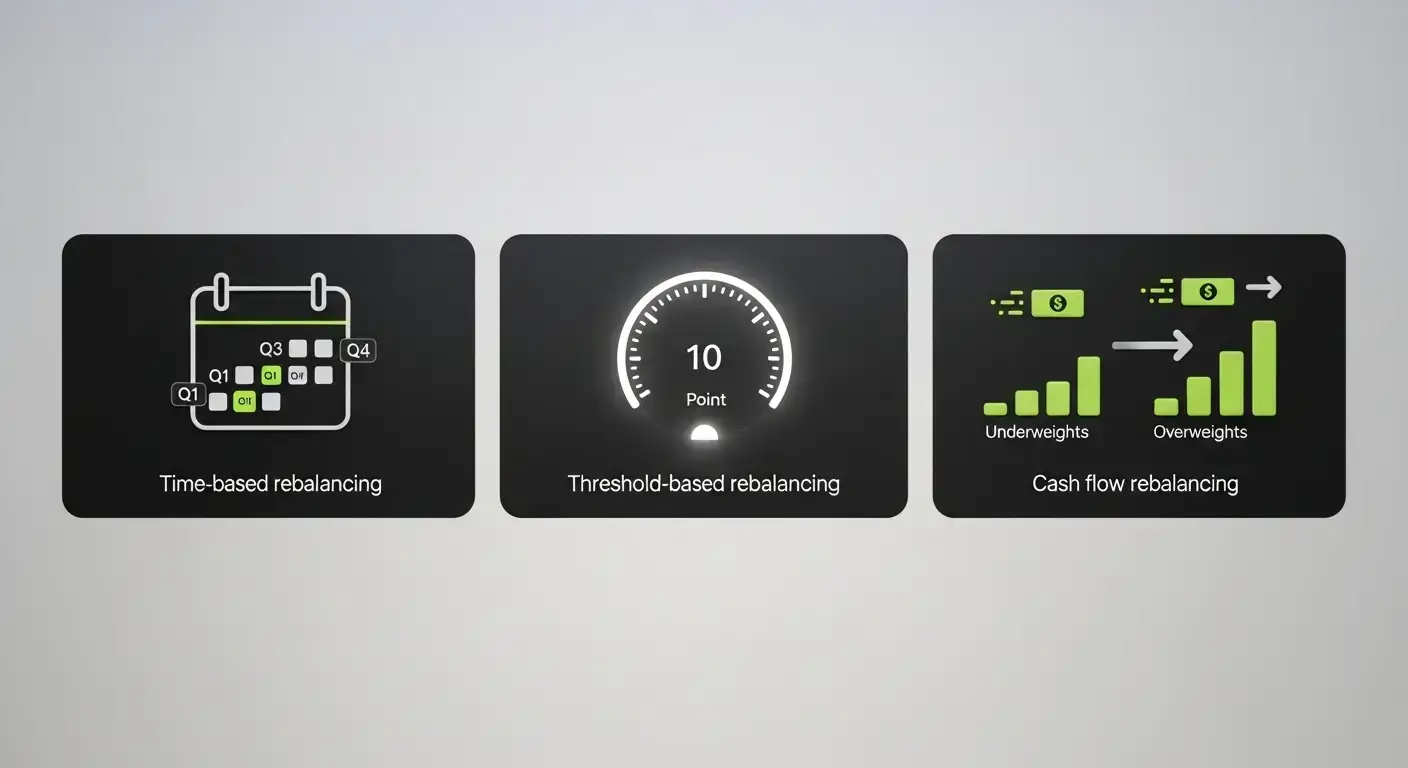

Time based rebalancing

Rebalance quarterly. On each date, move weights back to targets using the least number of transactions. This method is predictable and pairs well with reporting.

Threshold based rebalancing

Rebalance when a holding deviates more than 10 percentage points from its target weight. Thresholds let you react to market moves without trading constantly.

Cash flow rebalancing

Direct new contributions to underweight assets and take withdrawals from overweight assets. This reduces fees and taxes while keeping weights near targets.

Document the method in a one-page policy. The clarity of the rule prevents emotional decisions when markets are volatile.

Using Bitunix Tools To Implement Your Plan

Bitunix Spot for execution and cost control

Use Bitunix spot markets to build allocations and to rebalance on schedule. Review fee tiers and use limit orders for tight control of entry prices. Keep a small buffer of stablecoins on exchange for working liquidity, and move long term holdings to secure wallets after settlement.

Bitunix Earn for productive cash management

Use Flexible Savings to earn on the liquidity buffer without sacrificing access. Ladder a portion in Fixed Savings if you do not expect to redeploy for one to three months. Configure Spot Auto-Invest for recurring accumulation of chosen altcoins, and consider Dual Investment only when the strike and expiry match predefined buy or sell levels. These tools help the cash and yield sleeve contribute to total return while remaining aligned with your policy.

Risk Controls You Should Not Skip

- Limit per asset and per sectorPlace caps so that no single token or category can overwhelm results. Caps create natural sell discipline when an asset rallies aggressively.

- Security hygieneUse hardware wallets for long term holdings, two factor authentication on all accounts, and separate devices for transacting. Review token approvals quarterly and revoke permissions you no longer need.

- Documentation and runbooksKeep a short document that lists your goals, allocations, rebalancing rules, custody procedures, and a checklist for purchasing new assets. This keeps the plan teachable and reduces stress when you need to act quickly.

- Incident responseBookmark official channels for each project. If a protocol suffers an exploit or a governance incident, follow the runbook. Reduce exposure in measured steps and avoid chasing rumors.

- Jurisdiction and complianceVerify that each asset and yield product is available in your region. Keep records of transactions for tax reporting, and use accounting software for exports at the end of each quarter.

Common Mistakes When Picking Altcoins

- Confusing marketing with adoptionReal adoption shows up in sustained on-chain activity and replatforms, not in social metrics alone.

- Overdiversifying into illiquid assetsA long tail of thinly traded tokens adds admin work and makes rebalancing expensive. Focus on a shortlist that you can monitor well.

- Ignoring token unlocksSupply that enters the market on a set schedule can pressure price. Study unlock calendars before sizing a position.

- Chasing high quoted yields without risk analysisHigh rates can be compensation for hidden risks. Favor protocols with transparent replatforms and conservative collateral rules.

- Holding too many assets on a single chainOutages or congestion can affect your ability to exit. Hold a mix of chains and maintain gas tokens on each destination wallet.

Sample Diversified Altcoin Portfolios

Starter diversified portfolio for a $5,000 altcoin sleeve

- $1,250 Layer 1s across two chains.

- $1,250 Layer 2s across two networks.

- $750 infrastructure and oracles.

- $750 DeFi protocol tokens with visible replatforms.

- $1,000 stablecoins in Flexible Savings, with a plan to ladder $500 into Fixed Savings over two months.

- Gas tokens on each chain for operations.

Advanced diversified portfolio for a $25,000 altcoin sleeve

- $7,500 distributed across three Layer 1s.

- $7,500 across three Layer 2s with different proof models.

- $3,000 infrastructure and oracles that your existing apps already consume.

- $3,000 DeFi tokens tied to protocols you use.

- $2,500 modular or data availability token with active deployments.

- $1,500 stablecoins for liquidity, split between Flexible and Fixed.

These templates exclude BTC and ETH. They represent the altcoin sleeve that sits beside your core holdings. Adapt numbers to your total portfolio size and risk profile.

Frequently Asked Questions

What is an altcoin in practical terms, and why should I hold any at all?

An altcoin is any crypto asset that is not Bitcoin. Many altcoins represent networks, protocols, or services that add functions beyond store of value and smart contract settlement. Examples include execution layers with different speed and cost profiles, oracle networks that link on-chain and off-chain data, and DeFi systems that facilitate trading, lending, or staking. Including selected altcoins gives your portfolio access to new sources of usage and replatforms. If you only hold Bitcoin and Ethereum you have stability, but you miss the chance to benefit from growth in other parts of the ecosystem. The key is to select assets with real users and clear value capture rather than chasing narratives.

How many altcoins should a diversified investor hold at one time?

The answer depends on your monitoring capacity. A practical range for most investors is between six and twelve altcoins across three to five categories. This range allows cross-sector exposure without diluting focus. If you hold more, you will struggle to follow updates, audits, and governance. If you hold fewer, a single incident can weigh heavily on returns. Start small and add a new position only when you have a clear thesis, a sizing rule, and a specific plan for rebalancing.

Should I prioritize Layer 1s or Layer 2s when adding diversification?

Both categories are useful, but they serve different purposes. Layer 1s add architectural diversity and sovereign execution environments. Layer 2s extend Ethereum’s reach and bring you closer to the DeFi and application depth of the largest smart contract ecosystem. A balanced approach holds at least one of each. If you already use Ethereum heavily, a Layer 2 may integrate more naturally with your existing wallets and apps. If you want independent throughput characteristics and alternative developer communities, include a second Layer 1.

Do DeFi tokens belong in a long term portfolio, or are they only for trading?

DeFi tokens can be long term holdings when they are linked to real protocol usage and transparent economics. Look for fee sharing, buybacks, or governance that directs measurable value to the token. Avoid tokens that rely on constant inflation to attract liquidity. When you treat DeFi exposure as part of a planned sleeve and size it modestly, you capture upside from on-chain financial activity while limiting downside. Review replatforms, audits, and dependency on oracles at least once per quarter.

How do I size altcoin positions relative to Bitcoin and Ethereum?

Think in layers. Your core layer is Bitcoin and Ethereum. Your altcoin sleeve is a separate layer that should not exceed the level of risk you can tolerate. A common approach is to keep the altcoin sleeve between 30 and 45 percent of the total crypto portfolio for balanced investors, with single altcoin positions capped between 3 and 8 percent. If a holding grows beyond the cap, take partial profits and rotate back into the core or into conservative yield. The goal is to let winners contribute without allowing them to dominate risk.

What role do stablecoins play in an altcoin diversification plan?

Stablecoins are the control system for your portfolio. They provide operating cash for gas and fees, they let you buy weakness without selling core assets, and they contribute conservative yield through Flexible and Fixed Savings. Without a stablecoin buffer you are forced to sell altcoins to fund new opportunities or to manage fees during congestion. Maintain at least a 10 percent buffer and raise it to 15 or 20 percent when volatility increases or when you plan to deploy across new chains.

How can I avoid buying into hype during a bull run?

Write down your research checklist and position size rules before market sentiment heats up. During bull phases, only add assets that already passed your checklist during calm periods. Require a cool-down period between research and purchase. Limit how many new positions you can open per month. If you feel urgency, direct that energy into your stablecoin buffer or your DCA plans for existing positions. A rules-based approach prevents impulse buys and keeps your thesis intact.

What is the fastest way to ruin an otherwise good diversification plan?

Overtrading and abandoning rules. Investors often start with a sensible allocation, then chase headlines and rotate too often. Each unplanned switch adds fees and increases the chance of buying high and selling low. The second fastest way is neglecting security. A single compromised wallet or phishing incident can erase years of work. The solution is boring and powerful. Follow your rebalancing schedule, use hardware wallets for long term storage, and keep approvals tight.

Can I earn yield on altcoins without adding too much risk?

Yes, if you focus on simple and transparent methods. Staking on established networks is the first choice. Conservative lending of large caps and stablecoins comes second. For cash management, Flexible Savings provides access, and Fixed Savings adds predictable returns for specific terms. Avoid complex farms or strategies that require multiple tokens and unusual derivatives unless you fully understand the risks and can monitor positions daily.

How do I measure whether diversification is actually helping me?

Track both performance and risk. Measure total return, volatility, and maximum drawdown for the portfolio with and without the altcoin sleeve. If the diversified version shows similar or better return with lower volatility and shallower drawdowns, diversification is working. Review these metrics quarterly. Do not judge the plan after a single month. Diversification delivers its benefits over cycles, and it is most valuable when a single sector suffers while others remain healthy.

Glossary

Address: Public identifier for receiving crypto assets.

Allocation: The percentage of total capital assigned to each asset or strategy.

Altcoin: Any crypto asset that is not Bitcoin.

APR: Annual percentage rate without compounding.

APY: Annual percentage yield with compounding.

Auto-Invest: Recurring purchase plan for a selected asset and amount.

Bridge: Software that moves assets or messages between blockchains.

Cold Wallet: Offline hardware wallet for secure long term storage.

Data Availability: The guarantee that transaction data is published so that others can verify and reconstruct state.

DeFi: Decentralized finance applications on public blockchains.

Diversification: Holding different assets so that one setback does not dominate results.

Drawdown: The decline from a portfolio’s peak to its subsequent low.

Dual Investment: A product with a target price and settlement date that pays an estimated rate and settles in one of two assets.

Emission: New token supply that enters circulation on a schedule.

Finality: The point at which a transaction is considered irreversible.

Flexible Savings: Yield product that allows deposit and redemption at any time.

Fixed Savings: Yield product with a defined lock period and payout rule.

Gas: Network fee for processing a transaction.

Layer 1: Base blockchain that verifies and records transactions.

Layer 2: Scaling solution that processes transactions off the main chain and posts proofs to L1.

Modular Architecture: Design that separates execution, settlement, and data availability.

Multi-Signature Wallet: Wallet that requires more than one approval to move funds.

Oracle: Service that brings external data to smart contracts.

Rebalancing: Adjusting holdings to return to target weights.

RWA: Real-world asset that is tokenized on chain.

Sharpe Ratio: Measure of risk-adjusted return compared to a risk-free benchmark.

Stablecoin: Token designed to maintain a stable value, commonly one U.S. dollar.

TVL: Total value locked in a protocol.

Validator: Participant who secures a proof-of-stake network and earns rewards.

Volatility: Degree of price fluctuation for an asset over time.

Conclusion

Diversification beyond Bitcoin and Ethereum is not a scavenger hunt for the next quick winner. It is a thoughtful blend of networks, infrastructure, and protocols that each contribute a different source of return. The right altcoins improve the stability and growth potential of your portfolio when they are chosen for clear reasons, sized appropriately, and maintained through a documented process.

Follow the selection checklist, pick one allocation template that fits your temperament, and implement it with tools that reinforce discipline. Use Bitunix Exchange for execution, Bitunix Portfolio Tracker for monitoring, and Bitunix Earn to keep your liquidity productive without losing control. Review the plan quarterly, measure performance and risk, and adjust with data rather than emotion. Over a full market cycle, a well diversified altcoin sleeve can be the difference between a portfolio that merely survives and one that steadily compounds.

About Bitunix

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. At Bitunix, we are committed to providing a transparent, compliant, and secure trading environment for every user. Our platform features a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, we prioritize user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 125x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.