Have you ever looked at your collection of digital assets and wondered, “Is this really the best it can be?” You’re not alone. Most crypto investors assemble a few tokens they believe in, only to watch the market’s wild swings turn their careful picks into a source of anxiety. But what if you could transform that anxiety into confidence? What if your crypto portfolio wasn’t just a random assortment of coins, but a finely-tuned engine built for long-term growth?

The truth is, the difference between sporadic gains and sustained success isn’t luck – it’s strategy. Optimizing your crypto portfolio is a continuous process of strategic allocation, vigilant management, and informed rebalancing, designed to maximize returns while consciously managing risk. It’s about being the architect of your financial future, not a passenger on a rollercoaster.

[ez-toc]

Key Takeaways

- A crypto portfolio is more than a list of tokens; it’s your financial roadmap.

- Optimization requires diversification, disciplined rebalancing, and informed decisions.

- Use crypto portfolio trackers and in-depth analytics for a bird’s-eye view.

- Avoid emotional decisions and always define an exit strategy.

- Balance crypto assets with traditional assets to manage risk effectively.

What Is a Crypto Portfolio

Before we dive into optimization, let’s lay the foundation. Think of your crypto portfolio not just as a list of coins, but as a detailed map of your journey in the digital economy. It is the complete collection of your cryptocurrency investments, from the big names like Bitcoin (often called digital gold) to the smallest altcoins, and even your involvement in DeFi protocols.

Every asset, every token, and every staking reward contributes to your portfolio’s overall value and performance. Understanding this is the first step toward true crypto portfolio management. It’s the difference between having a pile of bricks and having a blueprint for a castle.

How to Build a Crypto Portfolio from the Ground Up

Building a robust portfolio is the most critical step. A shaky foundation will crumble under market pressure. Here’s how the pros do it.

Define Your Financial Goals and Risk Tolerance

This is the “why” behind your build. Are you saving for a distant future, generating passive income, or aiming for aggressive growth? Your financial goals dictate everything.

Next, be brutally honest about your risk tolerance. Use risk questionnaires, stress tests, and scenario planning to quantify whether you are conservative, moderate, or aggressive. Does a 20% dip in a week make you panic-sell or see a buying opportunity? Your answers will determine the materials you build with.

The Cornerstone of Success: Strategic Asset Allocation

This is where your investment strategy comes to life. Asset allocation is the process of dividing your investment capital among different asset classes within the crypto world. The goal? Diversification. Don’t put all your eggs in one basket.

A common strategy is to model allocation after the market, but adjusted for your risk appetite:

- The Foundation (50-70%): Large-cap assets like Bitcoin and Ethereum. They are generally considered less volatile than smaller altcoins.

- The Growth Engine (20-30%): Mid-cap altcoins with strong fundamentals and real-world use cases.

- The High-Potential Speculation (5-10%): Low-cap tokens and projects. This is high-risk, high-reward territory.

This is just one example. Some may allocate a portion to staking or DeFi yields, treating them as the fixed-income component of their crypto portfolio. Diversifying beyond crypto, into gold or ETFs, can further stabilize returns.

Choose Your Tools: Wallets and Exchanges Wisely

Your assets need a secure home. This means understanding the difference between holding coins in wallets and exchanges. For long-term holdings, self-custody solutions (like a hardware wallet or a non-custodial option like Trust Wallet) are often recommended for maximum security.

Exchanges are great for trading, but “not your keys, not your coins” remains a fundamental mantra. Always do your own research (DYOR) on the security and reputation of any platform you use.

Recommended tools include hardware wallets like Ledger or Trezor, and software options like Trust Wallet. For portfolio tracking, apps such as CoinStats, CoinLedger, and CoinTracking provide real-time performance, analytics, price alerts, and even crypto tax reports.

From Building to Managing: The Art of Optimization

Once your portfolio is built, the real work begins. Optimization is an active, ongoing process.

The Indispensable Tool: Using a Crypto Portfolio Tracker

You cannot manage what you cannot measure. A crypto portfolio tracker is your mission control center. By connecting APIs for read-only access to your exchange accounts and other wallets, these tools aggregate all your holdings into one dashboard, giving you a bird’s-eye view of your entire financial landscape.

The best crypto portfolio tracker apps offer:

- Real-time performance data: See your total net worth and daily P&L at a glance.

- In-depth analytics: Break down your allocation by asset classes, market caps, and more.

- Custom alerts and price alerts: Get notified of significant price movements or when a token hits your price targets, helping you avoid emotional decisions.

- Crypto tax reports: Simplify your tax season by automatically generating reports on your transactions.

Using a tracker is non-negotiable for making informed decisions. It turns overwhelming data into actionable intelligence.

Permanent Review: Rebalancing Your Portfolio

The cryptocurrency market is dynamic. What started as a 10% allocation to a small altcoin might balloon to 30% of your entire portfolio after a bull run. This unintentionally exposes you to more risk than you initially planned.

Rebalancing is the process of buying and selling assets to return to your target allocation. It enforces a discipline of “buying low and selling high.” If one asset class has outperformed, you take some profits and reinvest them into the underperforming areas. This is a core tenet of disciplined crypto portfolio management.

Advanced Strategies for the Seasoned Builder

As you mature in your crypto journey, you can explore sophisticated tactics:

- Tax Loss Harvesting: Strategically selling assets at a loss to reduce taxable capital gains – a technique commonly employed by hedge funds.

- Dollar-Cost Averaging (DCA): Regularly investing a fixed amount of money, regardless of price, to smooth out volatility.

- Defining an Exit Strategy: Knowing your price targets for taking profits before you invest prevents greed from clouding your judgment.

- Portfolio Diversification Beyond Crypto: Allocate 10–20% of your portfolio to traditional assets like ETFs, stocks, or gold to improve risk-adjusted returns.

Psychology and Continuous Learning

The most advanced algorithm can’t compensate for poor psychology. The market is driven by fear and greed, and the most common pitfall is making emotional decisions.

- Stick to Your Plan: Your investment strategy is your anchor in a storm. Trust the blueprint you created when you were thinking clearly.

- Stay Informed, Not Overwhelmed: Follow crypto news and market trends, but avoid the noise of endless price predictions. Focus on fundamental developments in blockchain technology.

- Never Stop Learning: The crypto space evolves at lightning speed. Continuous learning is your greatest asset.

Crypto Portfolio Optimization in Action

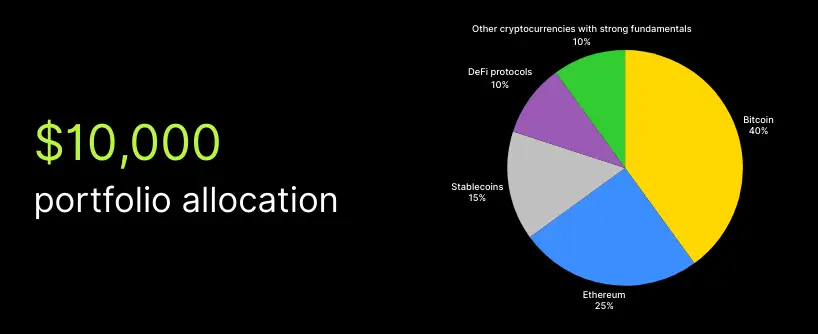

To have a real-life example, imagine an investor with $10,000. The standard and safe allocation will look like this:

- 40% in Bitcoin (digital gold, stability)

- 25% in Ethereum (blockchain technology exposure)

- 15% in stablecoins (risk hedge and liquidity)

- 10% in DeFi protocols (higher-risk, innovative projects)

- 10% in other cryptocurrencies with strong fundamentals

This mix strikes a balance between growth potential and risk tolerance, while leaving room for rebalancing as market trends shift. By integrating traditional assets or staking yields, the portfolio becomes even more resilient.

Final Remarks: Your Portfolio is Your Masterpiece

Optimizing your crypto portfolio is not a one-time task; it’s a craft. It begins with a solid foundation based on your financial goals, is constructed with deliberate asset allocation, and is refined through vigilant management using tools like a crypto portfolio tracker.

Having a deep understanding of these strategies, you cease to be a mere spectator. You become the architect, the crypto portfolio manager of your own destiny. You make informed decisions based on data, not hype. You build not just wealth, but confidence and financial freedom.

FAQs

What are crypto assets, and why are they important?

Crypto assets are digital currencies and blockchain-based tokens. They form the core of a cryptocurrency portfolio and must be managed carefully to optimize returns and reduce risk.

How can a crypto portfolio manager help?

A crypto portfolio manager, like the platform Bitunix, helps track digital assets, analyze portfolio performance, and implement a disciplined crypto investment strategy for smarter financial decisions.

Why diversify across asset classes?

Using different asset classes – Bitcoin, altcoins, stablecoins, or exchange-traded funds (ETFs) – reduces risk while maintaining growth potential. Diversification is key in volatile crypto markets.

What is an exit strategy for digital currency investments?

An exit strategy defines profit-taking and stop-loss targets for each asset. Many investors set thresholds in advance to avoid emotional decisions and protect their portfolio’s performance.

How can I track my cryptocurrency portfolio efficiently?

Platforms like Bitunix, integrated with CoinStats, allow investors to monitor all crypto assets in one place, receive alerts, and analyze portfolio performance in real time.

Why is continuous learning important for crypto investors?

The crypto market changes rapidly. Staying informed about digital assets, trends, and regulations helps investors optimize their cryptocurrency portfolio and make confident financial decisions.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.