[ez-toc]

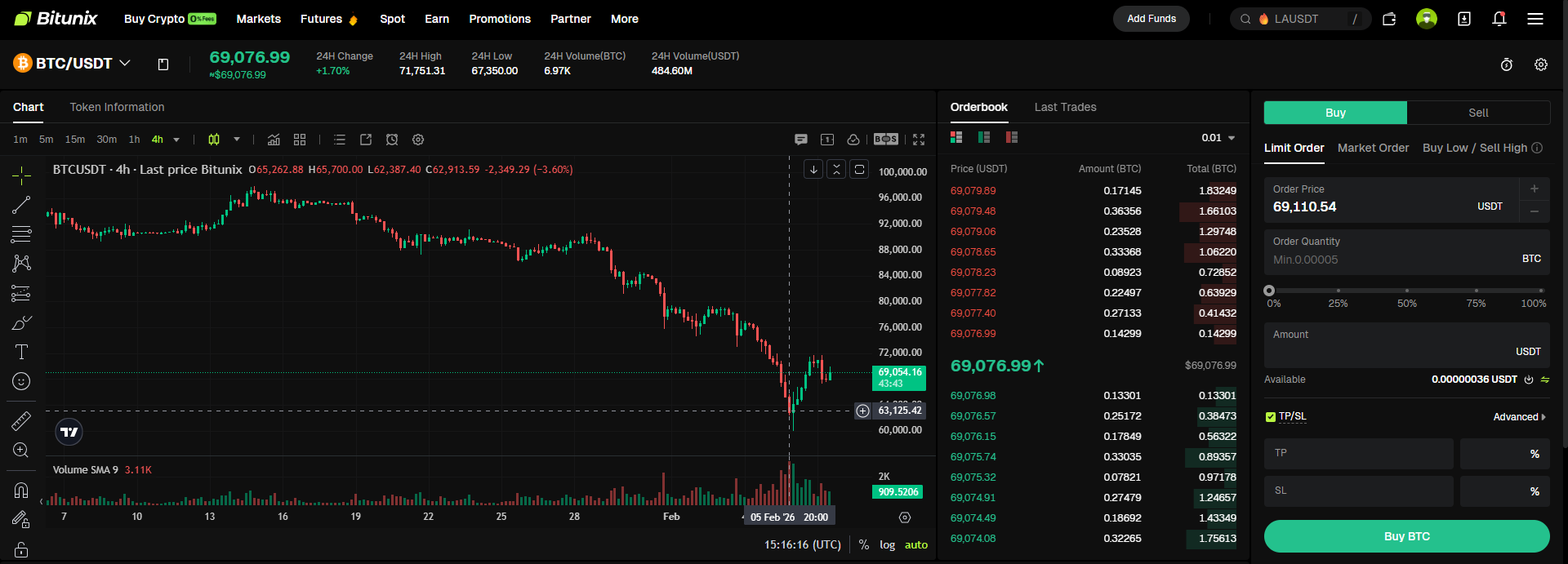

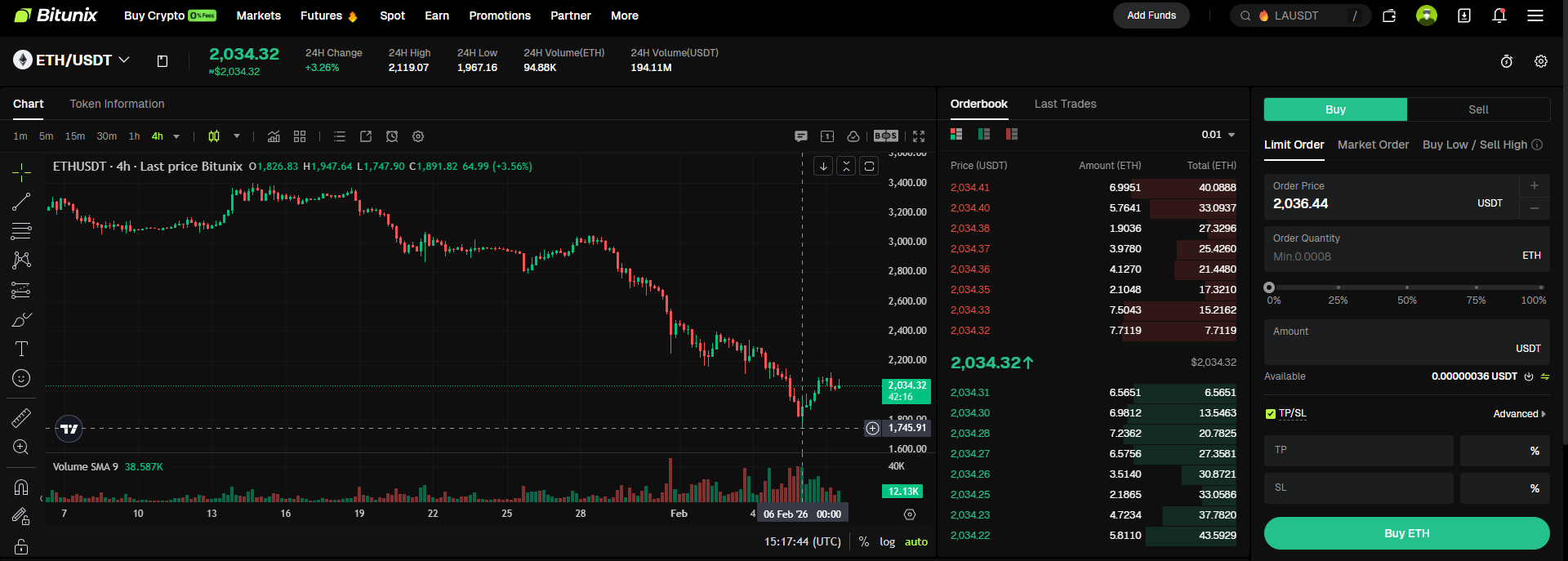

During the crypto crash 2026, both Bitcoin and Ethereum were hit by aggressive selling. Prices fell quickly, volatility surged, and fear spread across the market.

However, as the dust settled, a clear difference emerged. Bitcoin fell, but Ethereum fell more.

This was not accidental. It reflected how the market treats BTC and ETH differently when risk appetite collapses.

At the peak of the sell-off in early February 2026:

Both assets suffered, but ETH absorbed proportionally more damage.

The primary reason Bitcoin fell less is how the market views it.

Bitcoin is widely treated as:

When markets panic, Bitcoin often becomes a temporary safe harbor inside crypto, even while prices are falling.

Ethereum does not enjoy the same status.

Ethereum sits in a more complex position.

While it powers DeFi, NFTs, and smart contracts, that same ecosystem adds risk during crashes:

When markets turn defensive, exposure to complexity becomes a liability. Traders reduce ETH exposure faster than BTC exposure.

Both Bitcoin and Ethereum suffered from leverage unwinding, but the impact differed.

Bitcoin derivatives markets are deep and liquid. ETH derivatives markets, while large, thin out faster under stress.

As ETH price fell:

This created a stronger liquidation cascade in ETH compared to BTC.

Another key difference was institutional flow behavior.

Bitcoin spot ETFs experienced outflows during the crash, but they also provided a clearer structure for re-entry once selling slowed.

Ethereum lacks the same level of institutional flow depth. As capital exited risk assets, ETH did not benefit from the same stabilizing mechanisms that helped Bitcoin slow its decline.

Liquidity was the defining factor.

Once liquidity disappears, price movement accelerates regardless of fundamentals.

The BTC vs ETH divergence was not about technology failure.

The difference was entirely market-driven.

Why did Ethereum fall more than Bitcoin in the 2026 crash?

Ethereum is treated as a higher-risk asset. During risk-off events, traders reduce ETH exposure faster than BTC exposure.

Is Bitcoin safer than Ethereum?

Bitcoin is considered lower risk from a market structure perspective, especially during crashes. This does not mean Ethereum is weak, only that it carries higher volatility.

Did leverage affect both BTC and ETH?

Yes, but leverage unwind had a stronger impact on ETH due to thinner liquidity and higher beta.

Does this mean ETH is a bad long-term asset?

No. The crash reflects short-term market behavior, not long-term value.

Risk hierarchy: The order in which assets are sold during market stress.

Leverage unwind: The forced reduction of leveraged positions during price declines.

Liquidation cascade: A chain reaction of forced selling triggered by margin breaches.

Market liquidity: The ability to buy or sell without causing large price changes.

Risk-off environment: A market phase where investors reduce exposure to volatile assets.

The 2026 crypto crash showed that Bitcoin and Ethereum behave very differently under stress. Bitcoin fell, but acted as a relative anchor inside crypto. Ethereum fell harder due to higher risk perception, leverage exposure, and liquidity sensitivity.

This difference does not reflect weakness in Ethereum’s technology. It reflects how markets price risk when fear takes over.

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. The platform is committed to providing a transparent, compliant, and secure trading environment for every user. Bitunix offers a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, Bitunix prioritizes user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Crypto trading and investing involve significant risk, including the potential loss of principal. This article is for informational purposes only and does not constitute financial advice.

Choose a market, set your order, and manage risk in one place.

Choose a market, set your order, and manage risk in one place.