Volatility is a defining feature of cryptocurrency markets. Unlike traditional assets, crypto often experiences sharp price swings within short timeframes. To navigate this volatility, traders use indicators that measure price ranges and identify potential breakout or reversal opportunities. One of the most popular tools is Bollinger Bands.

Developed by John Bollinger in the 1980s, Bollinger Bands are designed to capture market volatility and highlight periods of overbought or oversold conditions. In crypto trading, they help traders anticipate breakouts, recognize consolidation phases, and manage risk. This guide explains how Bollinger Bands work, how to apply them in different strategies, and how Bitunix platform features enhance their use.

[ez-toc]

What Are Bollinger Bands?

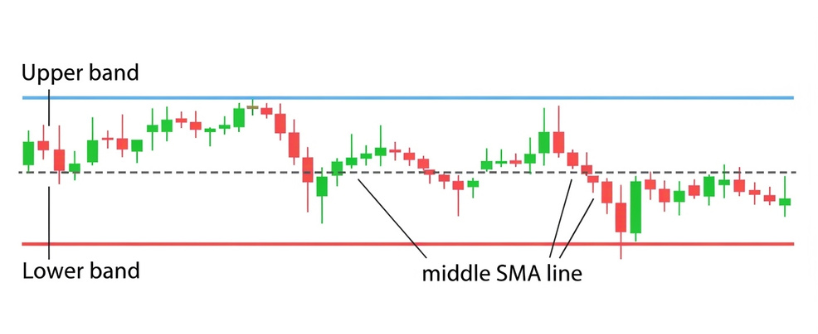

Bollinger Bands consist of three components plotted around price action:

- Middle Band: A simple moving average (usually 20 periods).

- Upper Band: The middle band plus two standard deviations.

- Lower Band: The middle band minus two standard deviations.

The distance between the upper and lower bands expands and contracts based on market volatility. Wide bands indicate high volatility, while narrow bands indicate low volatility.

How to Interpret Bollinger Bands

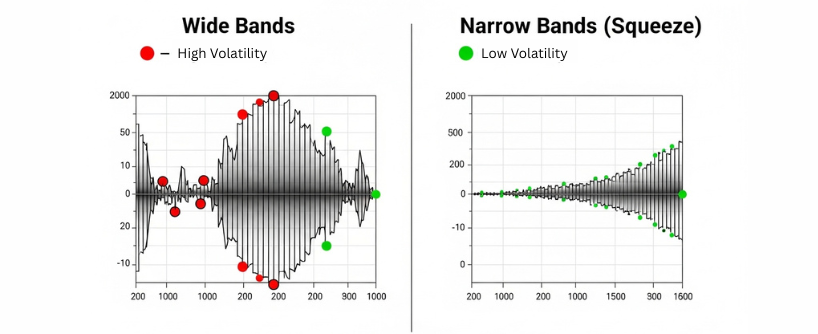

Band Width and Volatility

- Wide Bands: Increased volatility, often after major price movements.

- Narrow Bands: Low volatility, often before a breakout.

Price Touching Upper or Lower Bands

- When the price touches or exceeds the upper band, it may indicate overbought conditions.

- When the price touches or falls below the lower band, it may indicate oversold conditions.

The Squeeze

A “Bollinger Band squeeze” occurs when the bands contract tightly. This signals low volatility and often precedes a sharp breakout in either direction.

Bollinger Band Trading Strategies for Crypto

-

Mean Reversion Strategy

Prices tend to revert back toward the moving average. Traders can:

- Sell when price hits the upper band.

- Buy when price touches the lower band. This works best in ranging or sideways markets.

-

Breakout Strategy

During a squeeze, traders anticipate volatility expansion. A breakout above the upper band signals potential bullish continuation, while a breakout below the lower band signals bearish continuation.

-

Riding the Bands

In strong trends, price can walk along the upper or lower band. Instead of treating these as reversal signals, traders use them to confirm trend strength and hold positions longer.

-

Double Confirmation Strategy

Combine Bollinger Bands with RSI or MACD for stronger signals. For example, an RSI oversold reading combined with price touching the lower band provides a stronger buy confirmation.

-

Stop-Loss and Take-Profit Placement

Bollinger Bands help set dynamic stop-loss and take-profit levels. Placing stops beyond the bands can reduce the risk of premature exits during volatile swings.

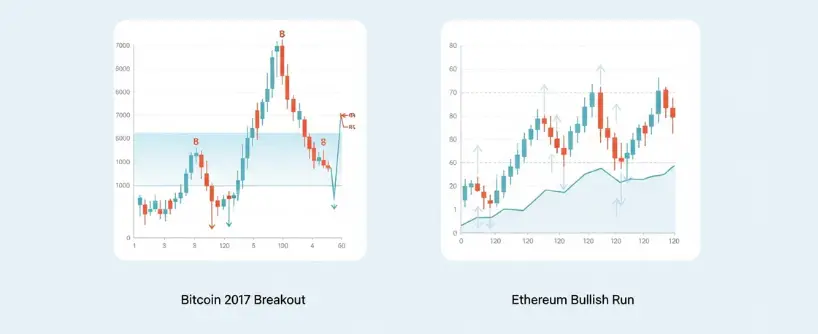

Real-World Examples in Crypto

- Bitcoin squeezes in 2017 and 2020 preceded explosive breakouts that led to new all-time highs.

- Ethereum rallies often showed prices walking along the upper band, confirming strong bullish momentum.

- Altcoin consolidations in 2023 demonstrated the effectiveness of Bollinger Band squeezes for anticipating large moves in coins like Solana and Avalanche.

These examples illustrate how Bollinger Bands adapt to different market phases.

Benefits of Using Bollinger Bands

- Highlights volatility in real time.

- Identifies overbought and oversold conditions.

- Works across timeframes from 1-minute charts to weekly charts.

- Useful for both range trading and breakout strategies.

- Can be combined with other indicators for stronger signals.

Limitations of Bollinger Bands

- Alone, they do not indicate trend direction.

- In strong markets, touching the upper or lower band does not always mean reversal.

- They are lagging indicators since they use moving averages.

- False breakouts can occur after squeezes.

This is why confirmation with tools like RSI, MACD, or trading volume is recommended.

How Bitunix Enhances Bollinger Band Trading

Bollinger Band strategies are most effective when paired with advanced trading tools. Bitunix provides the features needed to execute these strategies with precision:

- K-Line Ultra charts: Apply Bollinger Bands with customizable settings across multiple timeframes.

- Order types: Use limit, stop, and conditional orders to act quickly during squeezes or volatility expansions.

- Copy trading: Follow professional traders who specialize in volatility strategies using Bollinger Bands.

- Price alerts: Get instant notifications when price breaks above or below the bands.

- Futures trading: Apply Bollinger Band breakout strategies on perpetual contracts to maximize opportunities with leverage.

- Mobile app access: Monitor band squeezes and price action in real time, even on the move.

By combining Bollinger Band insights with Bitunix’s professional-grade platform, traders can manage volatility with confidence.

FAQ

What is the default Bollinger Band setting for crypto trading?

The default setting is a 20-period moving average with bands set at two standard deviations. This works well for most traders but can be adjusted based on volatility.

Do Bollinger Bands work for short-term trading?

Yes. Many day traders use Bollinger Bands on 5-minute or 15-minute charts to spot intraday volatility and breakout opportunities.

Can Bollinger Bands be used in trending markets?

Yes. In strong trends, price may ride the bands instead of reversing. Traders use this to confirm trend strength.

Are Bollinger Bands reliable on their own?

They are most effective when combined with other indicators such as RSI, MACD, or support and resistance.

How does Bitunix support Bollinger Band strategies?

Bitunix provides TradingView chart integration, order execution tools, alerts, and futures trading to help traders take full advantage of Bollinger Band signals.

What is a Bollinger Band squeeze?

A squeeze occurs when the bands contract tightly, indicating low volatility. This often precedes a major breakout in either direction.

Conclusion

Bollinger Bands are one of the most powerful tools for navigating crypto volatility. They help traders identify overbought and oversold conditions, anticipate breakouts, and confirm trend strength.

While they are not perfect and should not be used alone, Bollinger Bands become highly effective when combined with other indicators and disciplined risk management.

On Bitunix, traders can maximize Bollinger Band strategies with customizable charts, advanced order execution, copy trading, alerts, and futures integration. This combination gives traders the edge they need to master volatility in the fast-moving world of crypto.

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.

One reply on “Bollinger Bands Crypto Trading: Master Volatility-Based Strategies”

Clear and well-explained.

This is a solid breakdown of how Bollinger Bands actually work in crypto markets, especially for managing volatility. The examples make it easy to understand when to expect breakouts vs fake moves. Great read for beginners and a good refresher for active traders too.