Crypto copy trading should feel simple to understand, not just simple to start. When you copy trades, you are still trading real markets, especially in crypto futures copy trading where leverage, funding, and execution costs can shape outcomes. That is why fee clarity matters.

In this guide, we break down the full cost stack for Bitunix copy trading on the Bitunix exchange, explain when each cost applies, and show how to estimate what you keep after fees.

What Is Copy Trading in Crypto?

What is copy trading in crypto? It is a feature that allows you to follow a lead trader and replicate their trading actions automatically, based on the settings you choose.

Copy trading crypto simplifies execution, but it does not remove real trading costs. The most useful way to think about fees is not “Is there a fee?” It is “Which costs apply during execution, and which apply at weekly settlement?”

The Four Cost Categories in Bitunix Copy Trading

When you copy trades on the Bitunix exchange, your total costs can be grouped into four categories:

- Futures trading fees (maker and taker)

- Funding fees for perpetual futures (paid or received)

- Profit sharing to the lead trader (settled weekly when profitable)

- Service fees referenced in the copy trading terms (if applicable)

Understanding these categories makes it much easier to evaluate net results and compare options when searching for the best crypto copy trading platform.

1. Futures Trading Fees: Maker and Taker Costs

Copied orders are still futures orders, so futures trading fees apply. Futures fees are typically shown as maker and taker rates, and your specific rate depends on your VIP level.

Why this matters in copy trading crypto

Fees are not just a “small percentage.” They become meaningful when:

- A lead trader trades frequently

- A strategy scales in and out of positions often

- More execution happens as taker activity during volatility

If you want to understand what you keep, always consider trading frequency alongside performance.

2. Funding Fees: A Perpetual Futures Cost That Depends on Holding Time

Funding applies to perpetual futures. It is not unique to Bitunix copy trading, but it matters in crypto futures copy trading because it can meaningfully affect net results.

How funding works

- Funding is calculated from position value and the funding rate.

- Depending on the funding rate, you may pay funding or receive funding.

- Funding applies only if your position is open at the funding timestamp.

Funding schedule

Funding is typically settled every 8 hours at 00:00, 08:00, and 16:00 UTC. For certain pairs, funding time may be adjusted based on market conditions.

Why followers should care

Two followers can copy the same lead trader and still see different funding outcomes if:

- Their positions open or close at slightly different times

- One follower holds through a funding timestamp and another does not

- The lead trader holds positions longer, increasing exposure to multiple funding intervals

Funding is one of the most important “quiet” costs in crypto copy trading. It is also one of the easiest to plan for once you understand the holding-time factor.

3. Profit Sharing: What You Pay the Lead Trader and When

Profit sharing is the core copy trading mechanic that rewards lead traders when followers profit. On Bitunix, profit sharing is handled through a weekly settlement process.

Weekly settlement schedule

We settle profit sharing every Monday at 00:00 UTC. The earnings calculation period covers the prior week, running from Monday 00:00:00 UTC to Sunday 23:59:59 UTC.

This is why weekly review is a practical routine for copy trading crypto. It aligns with how settlement is calculated.

When profit sharing is charged

Profit sharing applies when you have a profitable settlement cycle. If your settlement cycle result is a loss, profit sharing is not charged for that cycle.

This structure is important:

- Trading fees and funding can apply whether the week is positive or negative

- Profit sharing is designed to apply only when the weekly result is positive

What profit sharing is based on

Profit sharing is calculated using realized results from the weekly cycle, meaning profit from closed or partially closed positions during the calculation window.

A simple way to understand the logic is:

Pending Profit Sharing Amount = Max(Cycle Realized Profit × Profit Sharing Ratio, 0)

If the cycle realized profit is negative, the pending profit sharing amount is zero.

Profit-sharing ratio

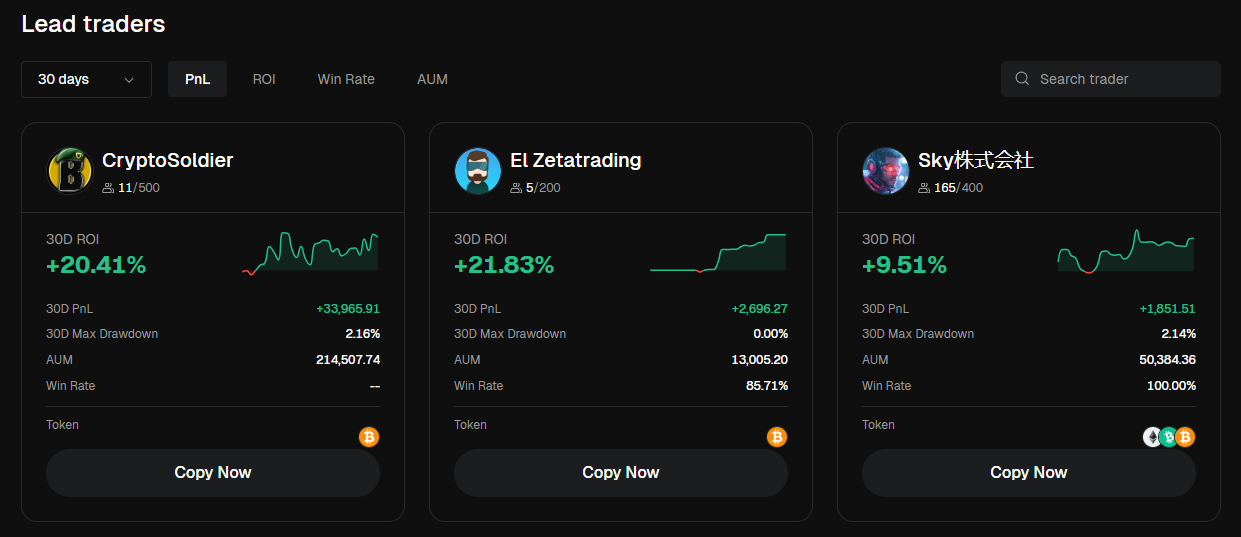

The profit-sharing ratio is shown on the lead trader profile. Always review that ratio before you start copying. It is part of the cost structure you are accepting, and it directly affects what you keep during profitable weeks.

4. Service Fees: What the Terms Allow

In addition to standard trading fees and profit sharing, the copy trading terms also reference possible service fees.

What this means for followers

Service fees, if applicable, are separate from futures trading fees and profit sharing. The terms also allow service fees to be deducted from the digital assets in your account.

Practical takeaway: when you model net outcomes, keep service fees as a potential line item alongside trading fees, funding, and profit sharing.

What You Pay vs What You Keep: A Net Outcome Framework

A clear framework prevents confusion when you compare traders or platforms.

Costs that usually occur during execution

- Futures trading fees on entries and exits

- Funding paid or received if positions are held at funding timestamps

Costs that apply at weekly settlement

- Profit sharing when the cycle is profitable

- Any applicable service fees under the terms

Net result framework

Net result (simplified) =

Cycle realized trading outcome

− futures trading fees

− funding paid (or + funding received)

− profit sharing (only when the cycle is profitable)

− any applicable service fees

This framework is also how we recommend evaluating the best crypto copy trading platform from a fee transparency perspective.

Examples

These examples are simplified to show structure. Your actual outcome depends on VIP tier, maker vs taker execution, funding rates, and the profit-sharing ratio shown on the lead trader profile.

Example 1: Profitable weekly cycle with profit sharing

Assume for one weekly cycle:

- Cycle realized profit: 500 USDT

- Total futures trading fees: 30 USDT

- Funding impact: −10 USDT

- Profit-sharing ratio: 10%

Step 1: Result after trading fees and funding

500 − 30 − 10 = 460 USDT

Step 2: Profit sharing for the cycle

460 × 10% = 46 USDT

Estimated net you keep

460 − 46 = 414 USDT

Example 2: Losing weekly cycle with no profit sharing

Assume for one weekly cycle:

- Cycle realized profit: −200 USDT

- Total futures trading fees: 18 USDT

- Funding impact: −4 USDT

Because the cycle result is negative, profit sharing is not charged for that cycle.

Estimated net result

−200 − 18 − 4 = −222 USDT

How to Keep Costs Efficient Without Increasing Risk

Cost efficiency should come from better processes, not higher leverage.

Choose execution-friendly lead traders

High-frequency strategies can create higher fee drag and greater sensitivity to slippage. A copy-friendly style is often easier to follow reliably in live market conditions.

Understand holding time for funding exposure

If a strategy tends to hold positions through multiple funding intervals, funding can become a larger part of net outcomes. That is not automatically bad, but it should be understood.

Maintain a margin buffer

A buffer helps reduce skipped copies due to insufficient available margin and supports smoother execution during volatility.

Review performance weekly

Because profit sharing is settled weekly, a weekly review cadence fits how results are measured:

- Did trade frequency change?

- Did average holding time change, increasing funding exposure?

- Did the net outcome justify the profit-sharing ratio?

Best Crypto Copy Trading Platform Cost Checklist

When comparing platforms, these are the cost questions that matter:

- Are futures maker and taker fees clearly published by tier?

- Are funding rules, timing, and the “position must be open at funding time” rule clearly explained?

- Are profit sharing rules clear, including weekly settlement timing and when profit sharing is not charged?

- Are service fees disclosed in terms, including how they may be deducted?

- Can you estimate net results using a simple framework before copying?

A platform that answers these clearly is closer to “best crypto copy trading platform” standards for transparency.

Conclusion

Clear fee expectations are part of responsible crypto copy trading. On the Bitunix exchange, Bitunix copy trading costs can include futures trading fees, funding fees when positions are held at funding timestamps, weekly profit sharing when the settlement cycle is profitable, and potential service fees described in the terms.

If you want to estimate what you keep with confidence, review the lead trader’s profit-sharing ratio before copying, understand the weekly settlement schedule, and evaluate net outcomes using the cost framework above.

FAQ

Do I still pay futures trading fees when I use Bitunix copy trading?

Yes. Copy trades are futures trades, so futures trading fees apply.

When is profit sharing settled?

Profit sharing is settled weekly on Monday at 00:00 UTC. The earnings calculation period runs from Monday 00:00:00 UTC to Sunday 23:59:59 UTC.

Do I pay profit sharing if I have a losing week?

No. If your settlement cycle result is a loss, profit sharing is not charged for that cycle.

What is profit sharing based on?

Profit sharing is calculated using realized results from closed or partially closed positions during the weekly calculation window.

Do funding fees affect crypto futures copy trading?

Yes. Funding applies if your perpetual futures position is open at the funding timestamp, and it can be paid or received depending on the funding rate and your position direction.

Glossary

- Maker fee: A fee rate typically associated with adding liquidity.

- Taker fee: A fee rate typically associated with removing liquidity via immediate execution.

- Funding fee: Periodic payments in perpetual futures that can be paid or received depending on funding rate and position side.

- Profit sharing: A percentage of weekly profit distributed to the lead trader when the settlement cycle is profitable.

- Settlement cycle: The weekly calculation window used for profit sharing, from Monday to Sunday in UTC time.

- Realized PnL: Profit or loss from positions that have been closed or partially closed.

- Perpetual futures: Futures contracts with no expiry that use funding to align with spot pricing.

- VIP tier: A fee tier that can change maker and taker rates based on platform rules.

About Bitunix

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. At Bitunix, we are committed to providing a transparent, compliant, and secure trading environment for every user. Our platform features a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, we prioritize user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium