Cross-chain liquidity pools make it possible to move value between separate blockchain networks, highlighting their interconnectedness, without trusting a centralized exchange. In a world with many chains, users want to swap crypto assets across networks quickly, with transparent pricing, and with a security model they understand. Traditional bridges focused on simple token transfers. Modern protocols provide cross-chain DeFi liquidity, which means you can initiate a trade on one network and receive the target asset on another network in a single workflow. Cross chain technology is the foundational mechanism enabling seamless value transfer between blockchain networks.

This article explains exactly how cross-chain liquidity pools work, the main architectures, security models, and failure modes, and how to evaluate the cost and speed of cross-chain asset transfer. We will show how cross-chain liquidity pools allow users to seamlessly swap assets and manage liquidity across networks. We will compare designs used by leading protocols, describe the risks you must manage, and offer a practical checklist for choosing a solution.

[ez-toc]

Introduction to Cross-Chain Liquidity

Cross-chain liquidity is transforming the decentralized finance (DeFi) landscape by enabling assets to flow freely across different blockchain networks. Instead of being limited to a single blockchain, users can now access a broader range of DeFi protocols, services, and opportunities by leveraging cross-chain liquidity pools. These pools aggregate liquidity from multiple blockchain networks, such as BNB Chain, Ethereum, and others, allowing users to execute cross-chain transactions, swap tokens, and participate in yield farming without relying on traditional intermediaries.

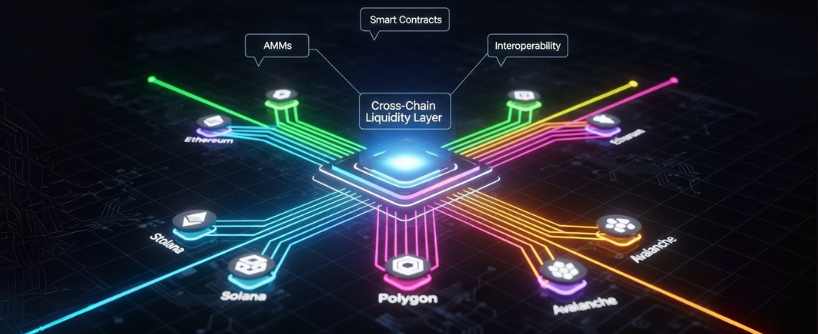

By utilizing smart contracts, automated market makers, and advanced cross-chain interoperability protocols, cross-chain liquidity solutions facilitate trades and provide liquidity across various blockchains. This not only reduces transaction costs but also improves capital efficiency, as assets can be deployed where they are most productive. Enhanced liquidity provision means users benefit from deeper markets and better pricing, while liquidity providers can earn passive income by supplying assets to pools that operate on different blockchain networks. As a result, cross-chain liquidity is a key driver of innovation in the DeFi ecosystem, allowing users to access a wider array of financial products and services with greater flexibility and efficiency.

Why Cross-Chain Liquidity Matters

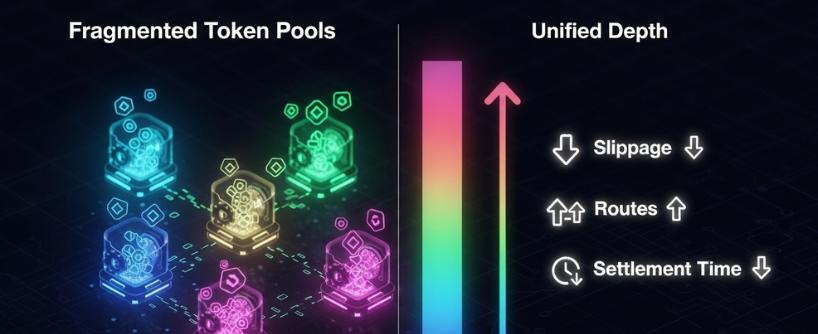

The crypto ecosystem is multi-chain, consisting of different networks such as Ethereum, BNB Smart Chain, Solana, Polygon, Avalanche, Optimism, Arbitrum, Base, and many application-specific chains, each with unique characteristics. Fees, throughput, and application sets vary by chain. Traders and protocols search for the best venue for a specific job. That creates constant demand to swap crypto assets and move capital across chains. However, liquidity fragmentation across these different networks creates challenges for users and protocols, as assets become scattered and harder to utilize efficiently.

Historically, users relied on centralized exchanges. You would deposit on one chain, trade, and withdraw on another. This method works but introduces custodial risk and delays. Cross-chain liquidity pools provide a decentralized alternative. Liquidity providers stake assets on multiple chains, and smart contracts route orders between those pools so that a user can receive the destination asset on the target chain quickly.

The benefits are clear:

- Faster settlement: Many cross-chain swaps finalize in minutes because the protocol does not wait for a full light-client verification of the remote chain.

- Better user experience: A single transaction or short sequence replaces the deposit, trade, and withdrawal cycle.

- Capital efficiency for LPs: Liquidity providers can earn fees on multiple chains at once when the protocol is designed well.

- Open access: No account creation or custody is required. You sign with your wallet, and the swap routes through the protocol’s pools.

- More liquid market: Cross-chain liquidity pools aggregate liquidity from multiple sources, reducing slippage and improving trading efficiency.

These advantages come with trade-offs. The security model can vary dramatically across protocols. Some designs rely on external validators who attest to messages. Others lock assets and issue synthetic or derivative tokens on the destination chain. Understanding the trade-offs is essential before you move size.

How Cross-Chain Liquidity Pools Work: Core Models

There is no single standard design. Most protocols use one or a combination of the following models. Cross chain liquidity work relies on interoperability protocols and mechanisms that enable asset movement between different blockchain networks. Cross chain liquidity works by allowing seamless asset transfers and liquidity sharing across multiple blockchains, improving efficiency and security for decentralized exchanges and swaps. These models support cross chain transfers, facilitating the movement of assets between different blockchains.

Liquidity Network Model

A liquidity network deploys pools on multiple chains. LPs deposit native assets on each chain, for example USDC on Ethereum, USDC on Arbitrum, and USDC on Polygon. Pooling liquidity from various blockchains enables more efficient cross-chain swaps. Liquidity aggregation across chains improves capital efficiency and reduces slippage by combining assets from different sources into unified pools. When a user wants to move USDC from Ethereum to Arbitrum, the protocol matches the withdrawal on Arbitrum against its local pool and later refills that pool by rebalancing inventory.

Routing and accounting are handled by smart contracts and, in many systems, by off-chain relayers that watch for deposits and trigger corresponding releases. Fees compensate both LPs and relayers.

Strengths

- Fast settlement because the destination chain can release funds as soon as the protocol sees proof of the source deposit.

- Native assets on both sides, which avoids wrapped tokens.

- Flexible pricing that incorporates real-time pool inventory.

Weaknesses

- Inventory risk. If most users move funds in one direction, a destination pool can run out of liquidity and either halt or increase fees sharply to attract rebalancing.

- Reliance on off-chain agents or validator sets to attest to messages. You must trust the protocol’s security controls.

Where you see it

Protocols that advertise fast cross-chain swaps of stablecoins often use this model. It is also common on layer 2 networks, where cheap fees make rebalancing practical. Some protocols integrate with multiple decentralized exchanges to optimize routing and pricing.

Canonical Bridge or Native Bridge Model

Some networks run a canonical bridge that locks tokens on the source chain and mints a canonical representation on the destination. For example, native ETH can be locked on Ethereum mainnet and a canonical representation is minted on an L2. When moving back, the token is burned on the L2 and released on mainnet after a challenge period.

Strengths

- Security aligned with the destination network’s own design. Canonical bridges usually receive priority attention from core teams.

- Clear redemption flow that burns then releases the original token.

Weaknesses

- Slow withdrawals if a fraud-proof or validity-proof window must elapse. Some canonical bridges require multiple confirmations before releasing assets, which can further delay the process.

- Canonical bridges connect only specific chains, which limits routing flexibility.

Where you see it

Layer 2 networks such as Optimism and Arbitrum, and application-specific chains that publish an official bridge. These networks may require multiple confirmations for security before finalizing cross-chain transfers.

Light-Client and Proof-Based Bridges

A proof-based bridge uses a light client or a verification contract to validate block headers and Merkle proofs from the other chain. When you deposit on chain A, the event can be proven to the verification contract on chain B without trusting external validators.

Strengths

- Strong trust model because verification is on chain and based on cryptographic proofs.

- No reliance on off-chain signers or multi-sig committees.

Weaknesses

- Expensive to maintain because verifying consensus or finality proofs on chain can cost significant gas.

- Design complexity increases with heterogeneous chains, and not all chain pairs are supported.

Where you see it

Bridges between chains with compatible light-client verification, and research projects that focus on trust-minimized interoperability.

Synthetic or Wrapped Asset Model

In the wrapped model, a protocol locks the original token on chain A and mints a synthetic on chain B. The synthetic can be traded and used in DeFi. Redemption burns the synthetic and releases the original token.

Strengths

- Works even when chains have different virtual machines or consensus models.

- Easy to integrate with existing DEXs and lending protocols on the destination chain.

Weaknesses

- Custodial or semi-custodial risk if the entity that holds the originals is compromised.

- Additional market risk because the synthetic can trade at a discount if trust weakens.

Where you see it

Wrapped Bitcoin on Ethereum is a famous example. Several cross-chain systems still rely on wrapped assets for long-tail tokens.

Order Flow: What Happens During a Cross-Chain Swap

While details vary, a typical cross-chain asset transfer through a liquidity network follows this flow:

- Quote: The user requests a quote that includes the expected output amount, all fees, the route, and slippage controls.

- Lock or deposit: The user signs a transaction on the source chain to lock or swap the input token into the protocol’s source pool.

- Observation: A relayer or a validator set observes the confirmed deposit and submits a message to the destination chain.

- Release or mint: The destination pool releases the requested asset to the user’s address, or a synthetic is minted, depending on the model.

- Rebalancing: The protocol later moves inventory between its pools to restore balance, which may involve on-chain trades or off-chain netting.

In a proof-based bridge, step three is replaced by an on-chain verification of a Merkle proof. In a canonical bridge, step four might be delayed by a challenge period. Understanding these differences helps you predict settlement time and risk.

Security Considerations and Failure Modes

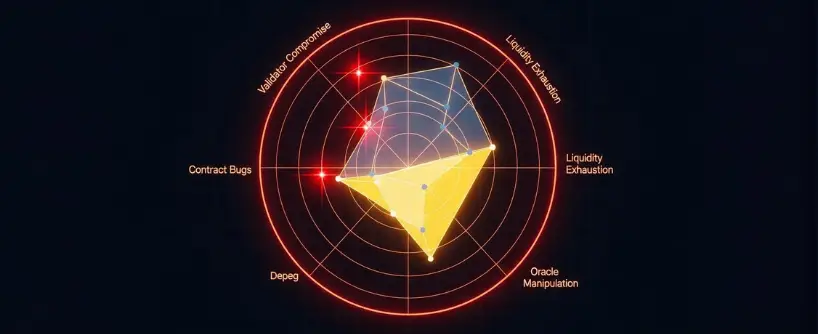

Security and security risks are the most important criteria when evaluating cross-chain liquidity. The main risk categories are:

- Validator or relayer compromise: If a committee signs an invalid message, funds can be released to the wrong address. Protocols mitigate this with large validator sets, stake-slashing, and monitoring.

- Smart contract bugs: Logic errors in locking, minting, pricing, or accounting can drain pools. Review audits and bug bounty programs and check if the deployed code matches the audited commit.

- Liquidity exhaustion: One-sided traffic can empty a destination pool, causing long delays or very high fees until it is refilled.

- Price oracle manipulation: If a protocol uses an oracle to price cross-chain swaps, poor design can allow manipulation during low-liquidity periods.

- Wrapped asset depegging: If the custodian of original assets is compromised or loses keys, synthetic tokens can lose value relative to the original.

Security trade-offs are unavoidable. Proof-based bridges reduce trust but can be slower and more expensive. Liquidity networks are fast and capital efficient but require strong operational controls. As a user, you must match the security model to the value you are moving and your tolerance for delay.

Fees, Slippage, and Finality

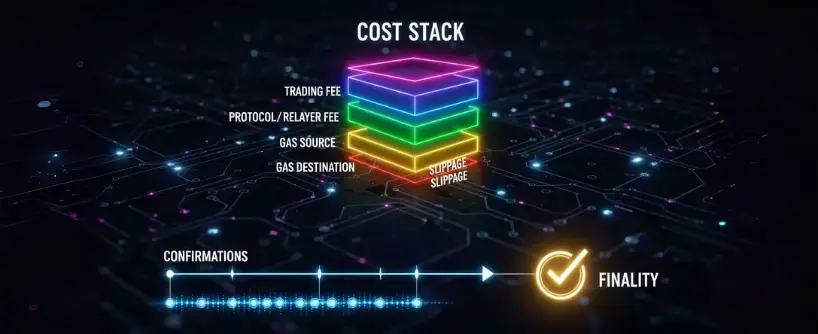

When you swap crypto assets across networks, your total cost includes:

- Trading fee: Paid to liquidity providers on the source and sometimes the destination.

- Bridge fee or protocol fee: Paid to relayers, validators, or the protocol treasury.

- Gas on both chains: You pay for the source chain transaction and, if the design requires, a destination claim transaction.

- Slippage: The difference between the quoted and executed price when pool inventory changes.

- Network congestion: High network congestion can increase transaction costs and delay processing, especially during periods of heavy cross-chain activity.

Time to finality depends on the number of required confirmations on the source chain, the protocol’s observation interval, and any challenge window on the destination chain. Many liquidity networks achieve delivery in a few minutes. Proof-based bridges target stronger assurances and may require more time. Network congestion can also delay finality, as transactions may take longer to be confirmed during busy periods.

How Liquidity Providers Earn and Manage Risk

LPs supply assets to pools on multiple chains. They earn:

- A portion of each trade’s fee.

- Occasionally, additional incentives in the protocol token.

- Rebates for rebalancing activities when inventory becomes unbalanced.

Key risks for LPs include:

- Inventory imbalance: One-sided flows can leave an LP holding mostly one asset on a chain with limited opportunities to redeploy.

- Smart contract risk: LP funds are held by the protocol contracts, so audits and on-chain history matter.

- Market risk: If LPs hold volatile assets, they face price changes between rebalancing cycles.

LPs should monitor pool utilization, average holding periods, rebalancing rewards, and the distribution of volume by route. A pool with stable, two-way flow is ideal. The presence of active buyers and sellers in the pool helps maintain liquidity and minimize price slippage.

Evaluating a Cross-Chain Liquidity Protocol: A Practical Checklist

Use the following questions before committing funds or sending large transfers.

- Security model: Is it a proof-based bridge, a validator committee, or a pure liquidity network? What exactly must be trusted?

- Audits: Are there recent audits from reputable firms, and were high-severity issues fixed?

- Validator transparency: If a committee is used, who are the members and how are keys managed? Is there stake-slashing or insurance?

- Liquidity depth: What is the total value locked on each route, and what percentage of that TVL is utilized during peak hours?

- Quote clarity: Does the interface show all fees, expected time, and guaranteed minimum output?

- Rebalancing strategy: How does the protocol restore inventory when flows are one-sided? Are there incentives for LPs to move assets to the depleted side?

- Incident history: Has the protocol experienced outages, depegs, or security incidents? How were users compensated?

- Supported assets: Are you receiving the true native asset on the destination chain or a wrapped representation?

- User operations: Do you need to manually claim funds on the destination chain, or is delivery automatic?

- Open governance: Are parameters set by a DAO, and are changes visible with a safety delay?

Document the answers. A route that looks cheap but fails several security questions is not a good choice for size.

Common Use Cases

Arbitrage and market-making

Traders move stablecoins or wrapped assets between chains to arbitrage price differences. Fast cross-chain DeFi liquidity can make or break these strategies.

Yield optimization

Farmers migrate stablecoins to chains where lending yields or liquidity mining incentives are temporarily higher. These strategies often involve moving multiple assets across chains to optimize returns or manage risk.

User on-ramping

A user holds USDC on a low-fee chain and wants to buy an NFT on Ethereum. A cross-chain swap can deliver ETH directly to the destination wallet.

DAO treasury management

DAOs maintain diversified treasuries and must rebalance across chains where their products run. Managing multiple assets across different blockchains is essential for effective treasury management. Liquidity networks allow controlled treasury moves with public on-chain records.

User Experience and Community Involvement

A seamless user experience is essential for the widespread adoption of cross-chain liquidity solutions. Intuitive interfaces, clear transaction flows, and transparent information about fees and risks help users feel confident when navigating the DeFi ecosystem. By making it easy to conduct transactions and facilitate communication across multiple blockchain networks, cross-chain liquidity providers can attract a diverse user base and foster broader participation.

Community involvement is equally important. Active communities of users, developers, and liquidity providers contribute to the ongoing improvement and security of cross-chain liquidity protocols. Educational resources—such as guides, tutorials, and FAQs—empower users to understand the benefits and potential risks, including security concerns, smart contract vulnerabilities, and the implications of using wrapped tokens. By prioritizing both user experience and community engagement, cross-chain liquidity solutions can create a more inclusive and accessible DeFi ecosystem, allowing users to participate in various DeFi protocols and manage their assets confidently across different blockchain networks.

Best Practices for Users

Start with a small test

Before sending a large amount, move a small amount on the exact route and asset pair you plan to use. Confirm the destination token and address.

Verify destination token standard

Receive the native token when possible. If a wrapped token is delivered, understand the custodian and redemption rules.

Use official interfaces

Impersonation sites can intercept transactions. Verify URLs from official documentation and bookmarks.

Monitor gas and slippage settings

During busy periods, raise gas to avoid stuck transactions and set slippage carefully.

Track route health

Many protocols display pool inventory and expected times. Avoid routes with depleted destination pools.

Split large transfers

Multiple smaller swaps can reduce the impact of a single failure and may receive better pricing in shallow pools.

Keep records

Store transaction hashes, quotes, and timestamps for accounting and for support if something goes wrong.

Avoid novel routes during outages

If a major chain experiences congestion or an incident, wait until the protocol publishes a green status.

Prefer trust-minimized options for large treasuries

When moving seven figures or more, favor proof-based or canonical bridges even if they are slower.

Plan for the return trip

If you may need to return funds, verify the reverse route fees and times.

Best Practices for Liquidity Providers

Understand inventory dynamics.

Study historical flow between each chain pair. Avoid pools that frequently drain to zero on one side.

Diversify across assets and chains.

Spread exposure to reduce the impact of a single chain outage or depeg.

Check reward sustainability.

If incentives are paid in a protocol token, read the emission schedule and governance controls.

Use monitoring dashboards.

Track pool utilization, net flows by route, fees earned, and pending rebalancing credits.

Review upgrade policies.

Deposited liquidity should not be subject to surprise contract upgrades without a timelock.

Secure LP keys.

Provide liquidity through a hardware wallet or a multi-signature wallet when size is meaningful.

Assess insurance options

Some protocols and third-party insurers offer coverage for bridge failure or contract exploits. Read exclusions carefully.

Rebalance actively

Earn additional incentives by shifting assets to the side that needs inventory. Understand the gas and execution costs before committing to active strategies.

Simulate worst-case exits

If you had to exit during a chain outage, what path would you use and what discount would you accept? Planning avoids panic.

Stay engaged with governance

Vote on fee tiers, validator changes, and security improvements that protect both LPs and users.

Cross Chain Solutions and Innovations

The rapid evolution of cross-chain solutions is addressing some of the most pressing challenges in decentralized finance, such as fragmented liquidity and limited interoperability between different blockchain networks. Cross-chain bridges, liquidity pools, and interoperability protocols are at the forefront of this innovation, enabling users to execute cross-chain transactions and access liquidity across multiple chains.

Cross-chain bridges facilitate asset transfers between different blockchains, while liquidity pools aggregate assets to provide a single, unified source of liquidity for users on various networks. Interoperability protocols further enhance this ecosystem by enabling seamless communication and interaction between blockchains, allowing users to participate in DeFi protocols and execute cross-chain transactions with ease. Advanced technologies like hash time-locked contracts, token swaps, and atomic swaps add additional layers of security and efficiency, ensuring that asset transfers are both reliable and trust-minimized.

These cross-chain solutions offer numerous benefits, including improved capital efficiency, reduced transaction costs, and enhanced liquidity provision. By overcoming the limitations of fragmented liquidity, they empower users to access a broader range of assets and DeFi services, making the entire blockchain ecosystem more interconnected and efficient.

Future of Cross-Chain Liquidity

The future of cross-chain liquidity is bright, with its role in the DeFi ecosystem expected to grow significantly as blockchain networks and protocols continue to proliferate. As more users seek to access a broader range of assets and services, the demand for robust cross-chain liquidity solutions will only increase. Innovations such as proof-of-stake consensus mechanisms, decentralized exchanges, and advanced interoperability protocols are paving the way for more efficient price discovery, minimal slippage, and seamless user experiences across multiple blockchain networks.

Cross-chain liquidity will be central to enabling yield farming, liquidity mining, and other DeFi activities on a global scale, allowing users to move capital efficiently and participate in a wider array of protocols. As the technology matures, we can expect to see even greater integration between different blockchains, improved security measures, and more user-friendly interfaces. Ultimately, cross-chain liquidity will remain a foundational element of the DeFi ecosystem, driving broader adoption and enabling users to unlock the full potential of decentralized finance across multiple networks.

Frequently Asked Questions

What is the difference between a bridge and a cross-chain liquidity pool?

A bridge focuses on moving a token from one chain to another. It locks or burns on the source and releases or mints on the destination. A cross-chain liquidity pool enables a full swap. You can deposit token A on chain X and receive token B on chain Y. Many systems combine both features, but a liquidity network optimizes for fast pricing and routing while a pure bridge optimizes for verification guarantees.

Are cross-chain swaps always faster than canonical bridges?

Often yes, because a liquidity network can release funds from an existing destination pool as soon as it observes a valid source deposit. Canonical bridges may require a waiting period for security reasons. However, speed depends on the route, pool inventory, and the protocol’s design. Always check the estimated time shown in the quote.

Do I receive native tokens or wrapped tokens?

It depends on the protocol and the asset. Liquidity networks that hold native assets on both chains can deliver the native token. Some systems mint a wrapped representation. If you receive a wrapped token, research the custodian, the mint and burn process, and whether major applications accept that representation.

How do protocols price a cross-chain swap?

The price typically combines these inputs: the DEX price on the source chain, the inventory level on both sides, relayer fees, and a target utilization for pools. Some protocols include an additional spread to compensate for inventory risk. The best systems quote a guaranteed minimum output so you know the floor on what you will receive.

What happens if the destination pool runs out of liquidity?

Your transfer may be queued or executed at a worse price if you agree to higher slippage. Well-designed networks raise incentives for LPs to refill the depleted side and may throttle new swaps until balance is restored. Always check pool status on the interface before confirming a large transaction.

Are validator committees safe?

They can be safe when members are independent, keys are managed with hardware security modules, and stake-slashing or legal agreements align incentives. However, they are not as trust-minimized as light-client verification. For large transfers, favor proof-based designs or canonical bridges when available.

What fees should I expect?

Expect a trading fee paid to LPs, a protocol or relayer fee, and gas costs on both chains. Some routes also require a destination claim transaction that you must sign. Total cost varies by chain congestion and pool depth. A good interface breaks the quote into each component so you can compare alternatives.

Can I route complex trades, such as ETH on one chain to USDC on another?

Yes. The protocol will swap ETH to USDC on the source chain, route through its cross-chain pools, and deliver USDC on the destination. Multi-hop trades add price impact and fees, so compare against doing part of the trade locally if liquidity is better.

What is the main risk for liquidity providers?

Inventory risk is primary. If flows are heavily one-sided, a pool can be stuck with the less desirable asset. LPs must rely on rebalancing incentives, automated strategies, or their own active management to correct the imbalance. Smart contract and validator risk also apply.

How do I verify that a protocol is real and not a phishing site?

Use links from official documentation, verified social media, or reputable aggregators. Bookmark the correct URL. Before signing, check that the contract address matches the one listed in documentation. Be cautious with airdrop bait or urgent prompts.

Can I cancel a swap after sending the source transaction?

Generally no. Once the source transaction confirms, the protocol will execute the route. If you entered a very low gas price and the transaction has not confirmed, you can attempt to replace it with a higher fee and cancel, but that is a race and not guaranteed.

How do taxes work for cross-chain swaps?

Tax treatment depends on jurisdiction. A transfer that does not change the economic exposure may be non-taxable, while a swap from one asset to another often is taxable. Keep detailed records and consult a professional who understands digital assets.

Glossary

Cross-chain liquidity pools: Pools of assets deployed on multiple blockchains that allow users to swap crypto assets from one chain to another, often with native asset delivery.

Bridge: A system that locks or burns tokens on one chain and releases or mints them on another chain.

Canonical bridge: The official bridge supported by a network’s core team, typically used for that network’s native assets.

Light client: A contract that verifies block headers and proofs from another chain, enabling trust-minimized message verification.

Relayer: An off-chain agent that observes events on one chain and submits messages to another chain, sometimes bonded with stake.

Wrapped token: A token that represents an asset locked on another chain or with a custodian.

Inventory risk: Risk that a cross-chain pool is left holding an imbalanced mix of assets due to one-sided user flows.

Utilization: Portion of a pool’s inventory that is currently allocated to pending swaps or withdrawn to the destination chain.

Finality: Point at which a blockchain transaction is considered irreversible for practical purposes.

Rebalancing: Process by which a protocol moves assets between its chain pools to restore target inventory levels.

Conclusion

Cross-chain liquidity pools are a critical building block in a multi-chain world. They enable fast and often seamless cross-chain asset transfer while preserving the open access and transparency that define decentralized finance. To use them safely, match the protocol’s security model to the value you are moving, verify audits and governance, watch pool inventory, and understand exactly which asset you will receive on the destination chain.

For liquidity providers, strong opportunities exist where flow is two-way and where rebalancing incentives are well designed. Manage inventory risk, diversify across chains, and monitor pools with the same rigor you would apply to any market-making strategy.

If you adopt the checklists and best practices in this guide, you can route swaps with confidence and participate in multi-chain liquidity with a clear view of costs, time to finality, and risk. Cross-chain DeFi liquidity is still evolving, but the principles of careful security review, transparent pricing, and disciplined operations do not change.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.