Trading crypto is as much a mental battle as it is a technical one. Charts, indicators, and market news matter, but the most decisive factor in your performance is often your own psychology. Traders who fail to manage their emotions may fall into destructive habits that sabotage long-term profitability. Psychology plays a significant role in trading outcomes, especially in the fast-moving crypto markets.

In 2025, the stakes are higher than ever. The crypto market runs around the clock, volatility can wipe out positions in seconds, and social media amplifies emotional swings. If you want to succeed, mastering your emotions is crucial for navigating the unique challenges of crypto markets. This article explains how to detect emotional mistakes, defuse them before they spiral, and reverse bad crypto trades through discipline and mindset.

[ez-toc]

The Role of Emotions in Crypto Trading

Emotions influence every decision you make. When trading, two of the most powerful forces are fear and greed. Understanding the importance of how emotions impact trading decisions is crucial for long-term success.

- Fear drives panic selling. When markets fall, fear magnifies losses in your mind, pushing you to close positions at the worst possible moment.

- Greed fuels overtrading and reckless risk. When markets pump, greed convinces you to hold longer than planned or add too much leverage.

Both emotions cloud judgment and push you away from logical trading strategies. Developing the ability to recognize and control these emotions is key to regaining control.

Detecting Emotional Trading

Before you can fix bad habits, you must learn to spot them. These are the main signals that your trading psychology is compromised:

Developing a sense for when emotions are influencing your trades is essential.

Many traders follow the crowd during emotional market swings, which can amplify mistakes.

Crypto Panic Selling Signals

- Exiting positions without a clear plan, simply because prices are falling. Both traders and investors may exit positions impulsively during panic, often without disciplined exit strategies.

- Selling at strong support levels without checking charts or news.

- Feeling physical anxiety or stress during price drops, leading to impulsive actions. Investors are also prone to panic selling during sharp price drops.

Overconfidence and Revenge Trading

- Doubling down after a loss in an attempt to win it back.

- Increasing leverage beyond your usual risk tolerance.

- Ignoring your own rules and risk limits. Losing focus on your strategy can lead to reckless decisions and emotional trading.

- Going all in after a loss, hoping to recover quickly. This approach often results in even greater losses and is a common pitfall for overconfident traders.

Lack of Objectivity

- Relying on social media hype for trade decisions, where being swayed by prevailing market sentiment on social platforms can cloud your judgment.

- Refusing to cut a losing position due to emotional attachment to a project.

- Focusing only on information that confirms your bias while ignoring warnings.

Once you recognize these signs, you can begin to defuse them before they damage your account.

How to Defuse Emotional Trading in the Moment

Defusing emotional reactions requires conscious effort. These methods can help you pause before making a damaging choice:

- Step Away from the Screen: If you feel panic rising, step back. Even ten minutes away from charts can reset your perspective.

- Breathe and Reset: Stress triggers fight-or-flight responses. Practicing controlled breathing lowers adrenaline and restores clarity.

- Check Your Trading Plan: Ask yourself: does this trade align with my predefined strategy? Review your plan to ensure you manage risk appropriately, including how you will handle losses and protect profits.

- Reduce Position Size: If emotions are too strong, trade smaller. Lower exposure reduces the intensity of psychological pressure.

- Use Automation: Pre-set stop losses and take profits so your plan executes without interference. Setting stop loss orders at key support or resistance levels is an effective way to automate risk management and prevent emotional decisions. Platforms such as Bitunix allow you to program trades in advance, minimizing emotional decision-making.

How to Reverse a Bad Crypto Trade

Everyone makes mistakes. The real skill lies in reversing them before they grow into disasters. This process is essential for long-term trading success.

Learning from these mistakes can also be beneficial for future trades.

Accept the Mistake Quickly

Many traders struggle to accept mistakes and exit losing trades, but it is important not to let pride or hope keep you in a losing trade. Acknowledge the error and exit as soon as your stop level is hit.

Analyze Objectively

Ask yourself: why did this trade fail? Consider all factors, including emotional and technical ones. Was it poor timing, bad analysis, or emotional reaction? Writing it down in a trading journal helps turn losses into lessons.

Adjust Risk Immediately

If you took a larger position than planned, reassess the risks involved in your trading approach after a loss and scale down on the next trade. Returning to normal size prevents a spiral of overtrading.

Use Recovery Strategies

Some traders choose to hedge rather than close immediately, especially if they hold long-term crypto, as using recovery strategies can give traders an advantage in managing losses. For example, if your spot holdings are down, you can short a small futures contract to offset losses.

Reset Your Mindset

Do not jump straight back into another trade to chase losses. Take a pause, review your plan, and only re-enter the market when you feel calm—resetting your mindset is essential before re-entering the market.

Building a Strong Trader Mindset

Reversing mistakes is easier with the right mindset. Traders who cultivate discipline are more resilient. Experienced traders are more likely to develop and maintain a strong mindset, enabling them to navigate emotional challenges effectively.

- Patience: Waiting for clear setups instead of forcing trades.

- Resilience: Accepting losses without emotional collapse.

- Objectivity: Making decisions based on facts, not feelings.

- Adaptability: Adjusting strategies when market conditions change.

The strongest trader mindset is not about eliminating emotions entirely but about recognizing and managing them.

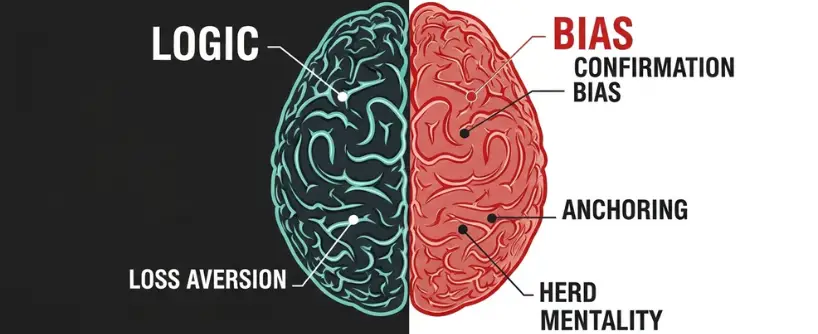

The Science Behind Emotional Trading

Behavioral finance research shows that losses feel twice as painful as gains feel rewarding. This is called loss aversion, and it explains why traders panic sell during downturns.

Cognitive biases also play a major role:

- Confirmation Bias: Only seeking information that agrees with your trade.

- Anchoring: Focusing too much on entry price and refusing to exit at a loss.

- Herd Mentality: Copying others without analysis, especially during pumps or crashes.

These biases can form collective trader psychology, where the emotions and thoughts of individual traders combine to influence market movements, liquidity, and volatility, particularly around key psychological levels.

Understanding these biases and the role of trader psychology is key to overcoming them.

Case Studies of Emotional Trading in Crypto

Panic Selling in March 2020

When Bitcoin crashed below 4,000 dollars, many traders sold in panic, a phenomenon that was not limited to crypto but also affected financial markets globally. Those who acted emotionally missed the rebound that took Bitcoin above 60,000 dollars within a year.

Overconfidence in 2021

During the bull market, a surge of buyers entered the market, with traders using extreme leverage expecting endless gains. When corrections came, many were liquidated, losing months of profits in hours.

Meme Coin Mania of 2025

Hyped coins fueled by social media and the crypto community created emotional frenzies. Traders who ignored fundamentals and chased pumps often suffered heavy losses once the hype faded.

These examples show how emotional trading destroys discipline, while patient and rational traders often come out ahead.

Practical Steps for Better Trading Psychology

These steps are beneficial for both trading and investing, helping you build discipline and improve decision-making.

- Write a Clear Trading Plan: Creating a clear trading and investing plan is essential. Define your goals, risk per trade, and exit strategies. Follow it strictly to understand the value of discipline and planning.

- Use Journaling: Record not just numbers but emotions. Note how you felt during entries and exits. Recognize the value of journaling for long-term improvement in both trading and investing.

- Limit Social Media Influence: Do not let X or Telegram dictate your moves. Follow data and research instead.

- Practice Mindfulness: Simple techniques like meditation or breathing exercises help reduce stress.

- Study Market Psychology: Learn from structured resources like Bitunix Academy, which covers emotional trading and mindset building. Search the web for Bitunix Academy to find guides on trading discipline and psychology.

Frequently Asked Questions

What is crypto emotional trading?

It refers to trading decisions driven by fear, greed, or stress instead of logic and strategy.

What are panic selling signals in crypto?

Selling assets quickly during price drops without a plan, often near support levels, is the clearest panic signal. Panic selling can affect any asset, including stocks.

Can you reverse a bad crypto trade?

Yes. Accept the mistake, exit quickly, analyze the cause, and reduce risk for future trades.

How do I build a stronger trader mindset?

Through patience, journaling, mindfulness, and continuous learning from resources like Bitunix Academy.

Why is trading psychology so important?

Because emotions lead to poor risk management. Mastering psychology keeps your strategy consistent and protects capital. Retail investors in both crypto and the stock market are influenced by emotions, which can impact their trading decisions.

Conclusion

Emotional trading psychology can make or break your success in crypto. Fear pushes you to sell too soon, greed tempts you into overtrading, and stress clouds judgment. Emotional trading psychology is a key topic across the entire crypto industry. By detecting panic signals, defusing emotions in the moment, and reversing bad trades with discipline, you can turn mistakes into growth.

In 2025, with crypto more volatile and more accessible than ever, mastering psychology is not optional. Platforms like Bitunix provide tools for risk management, while Bitunix Academy helps traders build the mental resilience needed to succeed. The market will always test your emotions, but your mindset determines whether you fall victim or turn volatility into opportunity. Mastering your mindset is essential for anyone trading or holding a crypto asset in the industry.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.