[ez-toc]

The crypto market crash 2026 unfolded quickly and forcefully. What began as a period of weakening momentum turned into a full-scale sell-off that affected Bitcoin first, then spread rapidly across the broader cryptocurrency market.

Within days, prices dropped sharply, volatility surged, and leveraged positions were flushed out. Many traders described the week as one of the most intense periods the market has seen in years, not just because of the size of the losses, but because of how fast they happened.

This was not driven by a single headline or event. Instead, it was the result of multiple pressures building at the same time.

The week opened with fragile sentiment. Buying interest was already fading, and volatility was creeping higher. Traders began reducing exposure, particularly in high-risk positions, which left the market vulnerable to a sharper move once key levels were tested.

As prices fell through important support zones, forced liquidations began to appear across derivatives markets. Once liquidations started, selling pressure intensified. Each wave of liquidations pushed prices lower, triggering the next wave in a classic liquidation cascade.

This phase marked the most aggressive part of the cryptocurrency crash.

By the end of the week, selling pressure showed signs of exhaustion. Bitcoin bounced from its lows and attempted to stabilise, but confidence across the broader market remained fragile. Altcoins recovered more slowly and continued to show higher volatility.

High leverage magnified the downside. When prices moved quickly, leveraged positions were closed automatically, adding sell pressure at the worst possible moments. This forced selling turned a sharp correction into a deeper crypto crash.

During the same period, global markets showed signs of stress. As risk appetite faded, speculative assets like cryptocurrencies came under pressure, accelerating the sell-off.

Liquidity thinned as selling intensified. Outflows from crypto investment products reduced buy-side support, making it harder for prices to stabilise during periods of heavy selling.

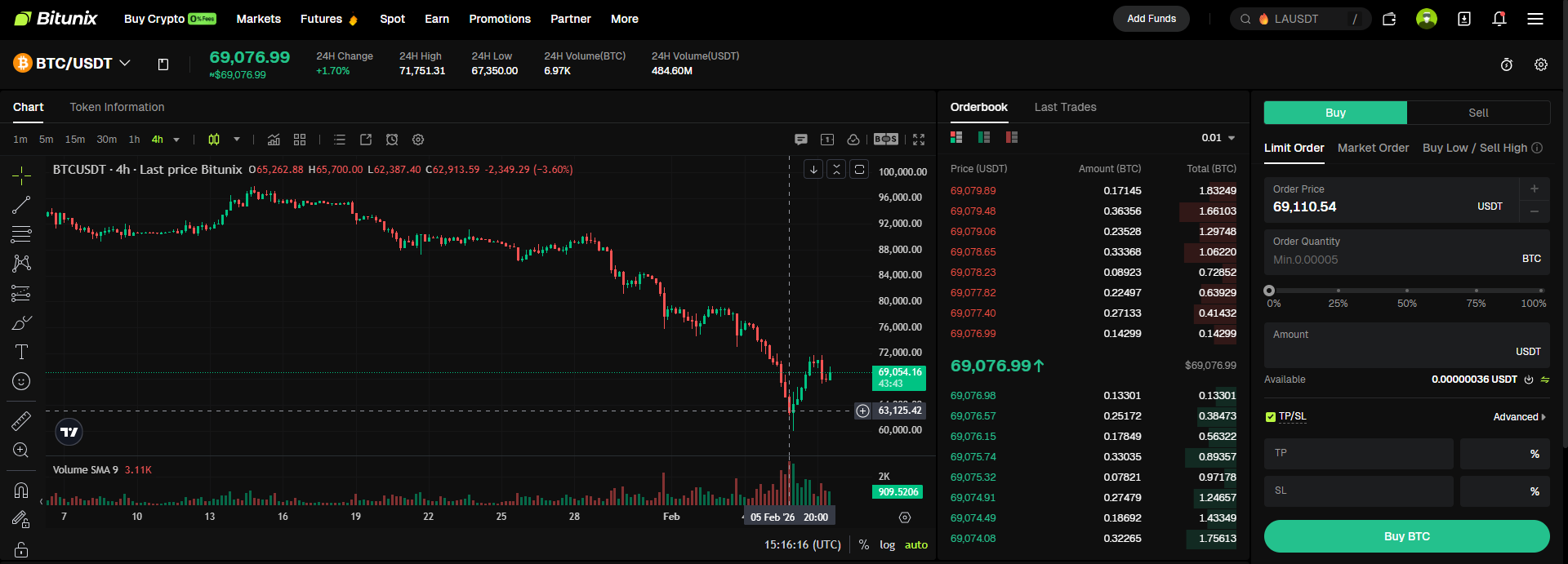

Bitcoin set the tone for the entire market.

During the crash week:

Why this mattered is simple. When Bitcoin breaks down quickly, liquidity tightens, spreads widen, and risk is reduced across the entire crypto market. Once Bitcoin weakens, altcoins usually follow with larger percentage moves.

Altcoins experienced even sharper declines, which is typical during fast-moving market sell-offs.

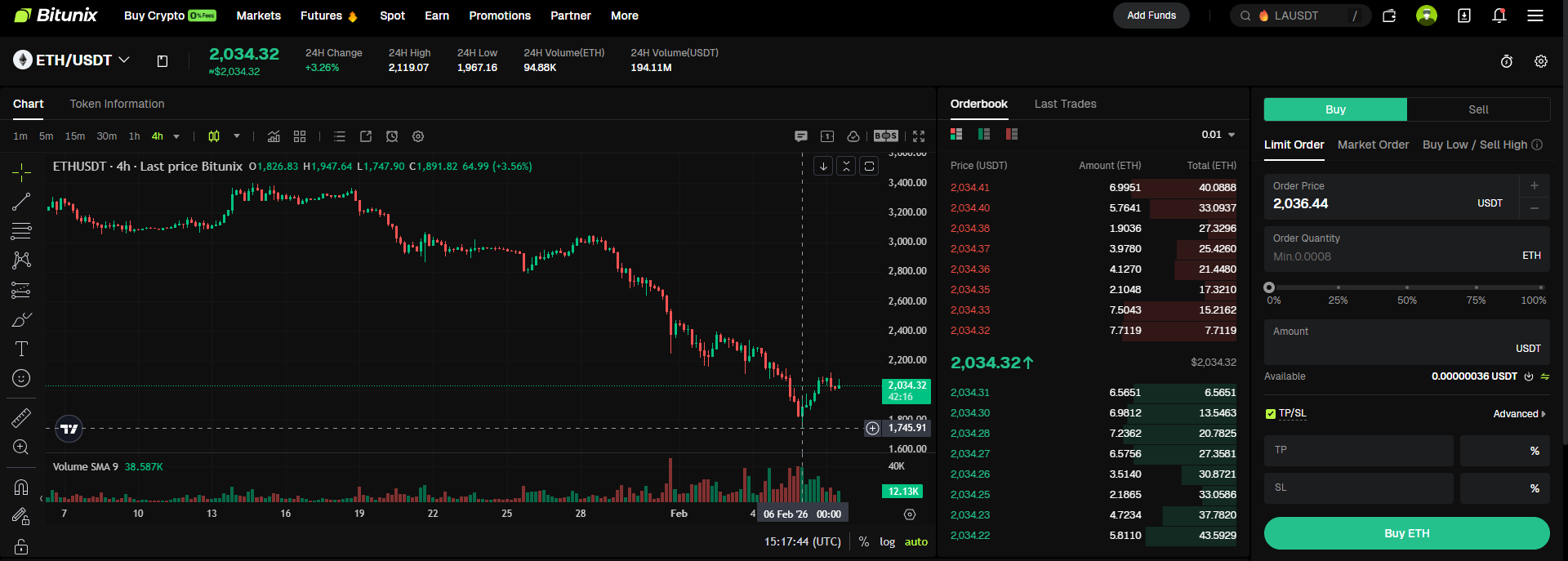

Ethereum dropped roughly 24% over the week. As one of the most widely used assets in crypto trading and liquidity pools, weakness in ETH reinforced broader deleveraging across the market.

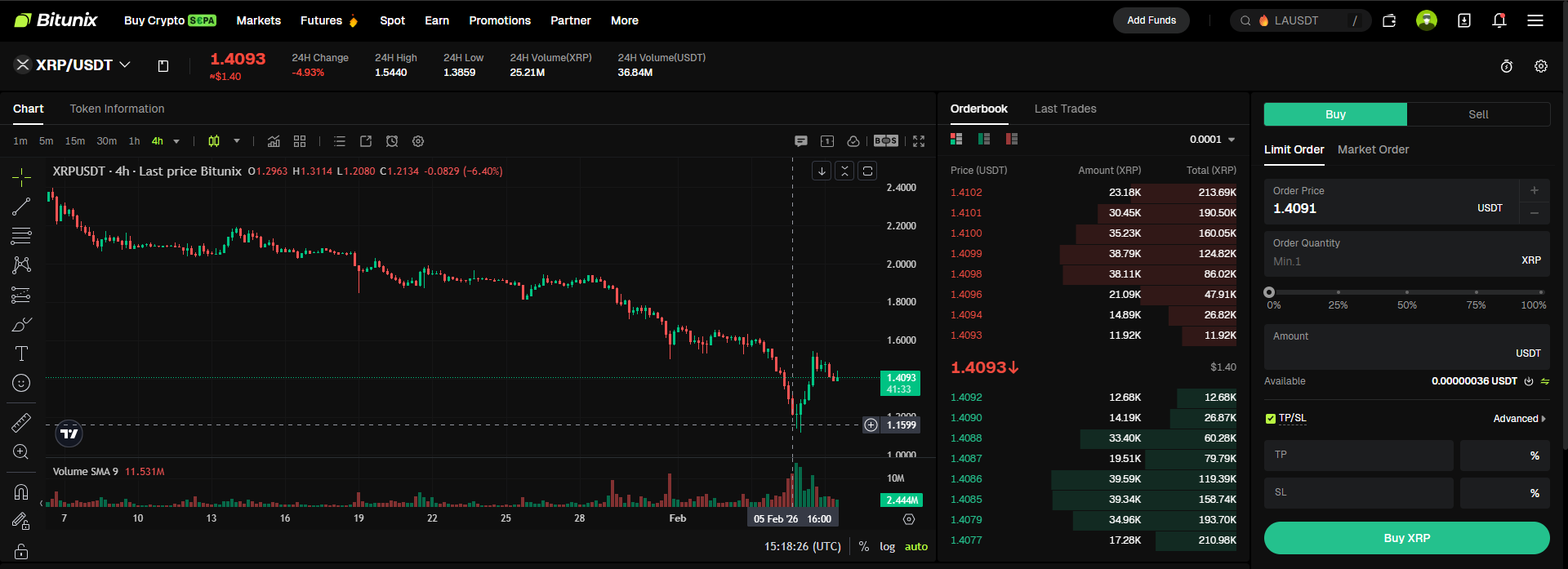

XRP declined by about 15% during the sell-off. As a high-volume large-cap token, XRP often shows amplified moves when sentiment turns negative and liquidity thins.

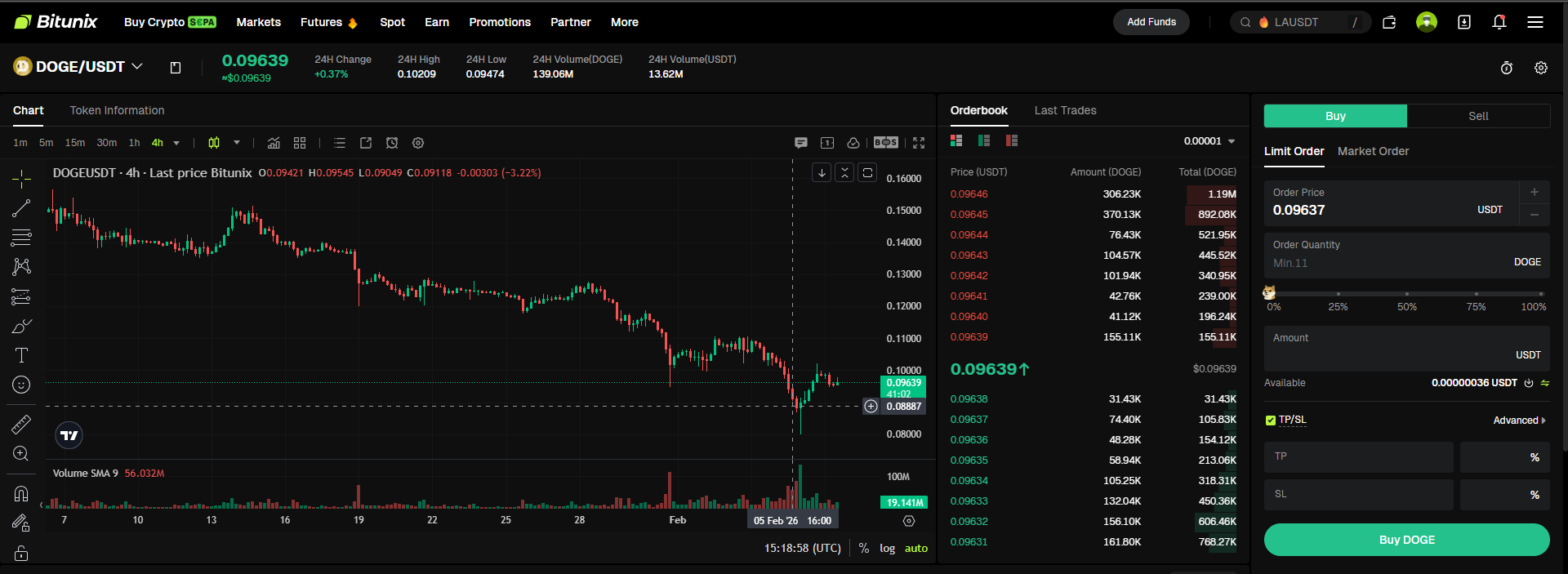

Dogecoin recorded sharp intraday losses, including a single-day drop of nearly 7% during the most volatile session of the week. Meme coins tend to behave like high-beta assets, which makes them especially sensitive during risk-off periods.

There are clear structural reasons why the altcoin crash was more severe:

This combination explains why Ethereum, XRP, Dogecoin, and other altcoins fell harder than Bitcoin.

As volatility remains elevated, traders may focus on several signals to gauge market stability:

Capital preservation remains critical during uncertain market phases.

The crypto market crash 2026 was a reminder of how quickly sentiment can change when leverage, liquidity, and risk appetite collide. Bitcoin’s sharp weekly drop set the direction for the market, but the deeper losses in Ethereum, XRP, and Dogecoin highlighted how vulnerable altcoins can be during fast-moving sell-offs. Once liquidations began, price declines fed on themselves, turning a correction into a broader market shakeout.

While volatility can feel unsettling, these periods often clear excess leverage and reset market structure. For traders, the key takeaway is not to predict the exact bottom, but to manage risk carefully, control position size, and avoid emotional decision-making. Markets eventually stabilise, but capital preservation during downturns is what allows traders to stay positioned for the next opportunity.

Crypto prices fell due to a combination of leverage unwinds, forced liquidations, reduced liquidity, and a shift toward risk-off sentiment across global markets.

Altcoins usually have thinner liquidity and higher leverage exposure than Bitcoin, which makes their price moves larger during rapid sell-offs.

One severe week alone does not confirm a crypto winter. Longer market trends are usually defined over months, not days.

A liquidation cascade happens when falling prices trigger forced closures of leveraged positions, which adds more selling pressure and accelerates declines.

Some crashes resolve quickly, while others lead to longer consolidation phases. Duration depends on leverage levels, liquidity, and broader market conditions.

Crypto crash: A rapid, broad decline in cryptocurrency prices across multiple assets.

Crypto market crash: A market-wide sell-off affecting major cryptocurrencies at the same time.

Cryptocurrency crash: A sharp fall in crypto prices, often driven by leverage and liquidity stress.

Altcoin crash: A steep sell-off in non-Bitcoin cryptocurrencies, typically larger in percentage terms than Bitcoin.

Liquidation: The automatic closure of a leveraged position when margin requirements are not met.

Liquidation cascade: A chain reaction where liquidations trigger further selling and additional liquidations.

Market capitulation: A phase where panic selling peaks and weaker positions exit the market.

Crypto ETF outflows: Net withdrawals from exchange-traded products linked to cryptocurrencies.

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. The platform is committed to providing a transparent, compliant, and secure trading environment for every user. Bitunix offers a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, Bitunix prioritizes user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Crypto trading and investing involve significant risk, including the potential loss of principal. This article is for informational purposes only and does not constitute financial advice.