Every crypto trader has seen how quickly the crowd can change its mood. One week, the market is euphoric, with social media filled with price predictions and celebratory posts. On platforms like X and Reddit, thousands of messages are posted every minute, making it nearly impossible to track sentiment manually. These messages include both emotional and informative content, and distinguishing between an emotional message and an informative message is crucial, as each can drive sentiment shifts in different ways.

The next week, panic dominates as charts turn red and traders sell in despair. In 2025, these sentiment swings are faster than ever, and they present both risks and opportunities. Understanding sentiment is important for traders, as it can be a key factor in predicting market movements and making informed decisions.

This article explains how bullish and bearish crowds form, how to analyze sentiment shifts, and how to turn those shifts into trade setups. By understanding the psychology of the market, you can stop reacting emotionally and instead use crowd behavior to your advantage.

[ez-toc]

The Nature of Bullish and Bearish Crypto Crowds

Crowds in the crypto market often act as a single emotional force. Both traders and investors contribute to these collective mood swings. While individuals may analyze rationally, the collective tends to swing between extremes of optimism and fear.

- Bullish crowds form when prices rise, funding rates turn positive, and social media fills with profit screenshots. Optimism grows until traders believe the rally will never end.

- Bearish crowds form when markets correct, fear spreads online, and traders expect further crashes. Pessimism deepens until many sell at the bottom.

These cycles are not unique to crypto, but crypto’s 24/7 trading, retail dominance, and thin liquidity make them sharper.

Why Sentiment Shifts Matter in 2025

Sentiment shifts often signal turning points in price action. Markets rarely stay in one emotional state for long. A crowd that is too bullish eventually runs out of buyers, while a crowd that is too bearish eventually runs out of sellers.

By tracking shifts from bullish to bearish or vice versa, traders can anticipate corrections or reversals. Analyzing sentiment helps determine the factors driving price movements in the crypto market. This approach does not guarantee success, but it improves odds by aligning trades with psychology rather than fighting it.

Tools for Tracking Sentiment Shifts

Social Media Trends

Bullish crowds push hashtags and memes to the top of feeds. Bearish crowds spread fear posts and warnings. Tracking engagement levels provides insight into which mood dominates. Thousands of messages are posted daily by users across platforms, making it essential for traders to monitor user sentiment trends.

Funding Rates and Open Interest

High positive funding rates indicate a bullish crowd paying to stay long. Extreme negative rates show bearish dominance. Shifts in these numbers often precede reversals.

On-Chain Data

Whale inflows to exchanges often accompany bearish crowds preparing to sell. On-chain data leverages blockchain technology to track the movement of various coins and identify sentiment shifts. Outflows to cold wallets often signal bullish accumulation.

Fear and Greed Index

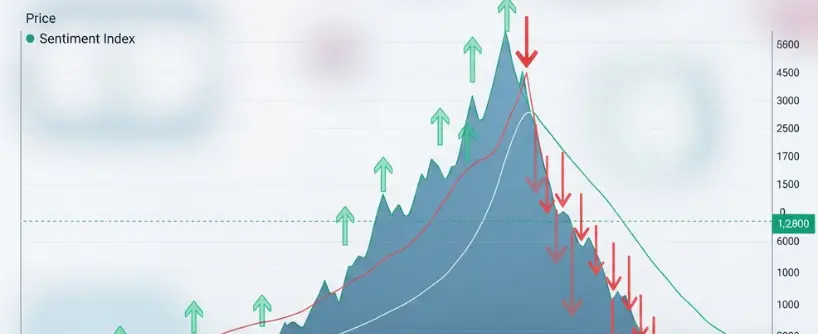

Sentiment indexes condense multiple indicators into a single score. The index measures market sentiment by integrating various quantitative indicators, and can also indicate a neutral state when the market is neither overly fearful nor greedy. Extreme greed signals risk of correction, while extreme fear suggests possible bottoms.

Search Trends and News Flow

Retail crowds reveal themselves in Google searches like “how to buy Bitcoin” during rallies or “is Bitcoin dead” during crashes. News headlines also amplify moods. News articles are analyzed and labeled for sentiment, helping traders understand the prevailing market mood.

Trade Setups Based on Bullish to Bearish Shifts

When the crowd is euphoric, disciplined traders prepare for caution.

- Take Partial Profits: If funding rates spike and social media is full of optimism, scale out of positions. Sentiment analysis can help traders discover potential buying opportunities and make more informed trading decisions by identifying shifts in market mood and crowd behavior.

- Look for Divergences: If price rises but volume weakens, it may signal exhaustion.

- Short Opportunities: Tactical shorts may be profitable when bullish crowds reach extremes. Use stops to protect against sudden squeezes.

Example: In early 2025, Bitcoin surged above 118,000 dollars while funding rates hit extreme levels. Social media turned euphoric. Soon after, the market corrected, rewarding traders who recognized the shift. Evaluating the performance and accuracy of sentiment-based strategies can improve investment outcomes in cryptocurrency trading, helping investors navigate market cycles and make more informed decisions.

Trade Setups Based on Bearish to Bullish Shifts

When the crowd is fearful, opportunity often hides beneath the panic.

- Accumulate Gradually: Extreme fear combined with oversold indicators may provide entry points. Traders can access free sentiment analysis tools to identify which assets investors are most interested in during periods of extreme fear.

- Watch for Whale Accumulation: On-chain data showing large outflows from exchanges is a bullish sign.

- Use Tight Risk Management: Bear markets produce false starts. Position sizing and stops are essential.

Example: In 2020, during the COVID crash, bearish sentiment dominated as Bitcoin dropped below 4,000 dollars. Traders who recognized the shift and accumulated saw huge returns during the following bull market.

Combining Sentiment with Technical Analysis

Sentiment by itself is not enough. It should be combined with technical and fundamental tools. Combining sentiment analysis with statistics can lead to more robust trading strategies, as statistical analysis helps interpret probability and market behavior over previous cycles.

- Bullish to Bearish Example: RSI divergence and weakening volume at the same time social media sentiment peaks can confirm a short opportunity, especially if sentiment leads market trends.

- Bearish to Bullish Example: Positive whale flows plus a breakout above resistance suggest panic is fading and recovery is starting.

Discipline means waiting for confirmation rather than guessing when sentiment will flip.

Psychology Behind Crowd Behavior

Crowds amplify individual emotions through social proof. The emotional tone of online discussions, such as those on social media and forums, shapes overall crypto sentiment and drives collective behavior in the market. Traders feel more confident when others act the same way. This leads to herd mentality, which drives extreme price moves.

- In bullish crowds, greed makes traders overconfident, pushing prices above sustainable levels.

- In bearish crowds, fear makes traders panic, leading to capitulation.

Understanding these dynamics helps traders resist joining the crowd blindly.

Risk Management When Trading Sentiment Shifts

Crowd trading is powerful but dangerous. Without proper risk control, sentiment trades can backfire.

- Position Size: Keep positions small relative to capital.

- Stops: Always define exit points. Sentiment can stay extreme longer than expected.

- Diversification: Avoid betting everything on one asset or one trade.

- Patience: Sentiment trades may take time to play out. Avoid chasing moves too late.

Case Studies of Sentiment Shifts

Bitcoin 2021 Bull Market

Greed dominated as Bitcoin climbed to 69,000 dollars. Social media was euphoric, but sentiment indicators flashed red. Soon after, a deep correction followed.

Terra Luna Collapse 2022

Bearish panic took over as Luna crashed. Yet traders who spotted accumulation during the capitulation phase positioned for recovery trades elsewhere.

Bitcoin 2025 Short Squeeze

A bearish crowd shorted heavily in July 2025. When prices unexpectedly surged, shorts were squeezed, flipping sentiment rapidly to bullish and creating massive volatility.

These examples show how shifts from one extreme to another provide trade opportunities.

How Bitunix Academy Supports Sentiment-Based Trading

Trading sentiment shifts requires not just tools but also discipline and education. Bitunix Academy offers resources on psychology, risk management, and strategy building. Bitunix Academy also helps traders develop advanced sentiment analysis strategies for the crypto market. Lessons cover how to interpret funding rates, analyze social media signals, and combine sentiment with technical setups.

By using structured education rather than relying on emotional reactions, traders can learn to approach sentiment shifts logically. Search the web for Bitunix Academy to find guides and tutorials that explain how to apply these principles in real trading.

Frequently Asked Questions

What is a bullish crypto crowd?

It is when most traders are optimistic, funding rates are high, and social media shows widespread confidence.

What is a bearish crypto crowd?

It is when fear dominates, funding rates turn negative, and traders expect further price declines.

How do sentiment shifts create trade setups?

Extreme greed often signals tops, while extreme fear often signals bottoms. Recognizing shifts allows for strategic entries and exits. Shifts in sentiment can directly impact cryptocurrency prices, so traders should always consider the source of sentiment data before making decisions.

Should I trade only on sentiment?

No. Use sentiment alongside technical and fundamental analysis for confirmation.

Does Bitunix provide sentiment education?

Yes. Bitunix Academy offers lessons on psychology and sentiment analysis, helping traders avoid emotional mistakes.

Conclusion

In 2025, crypto markets remain defined by emotion. Bullish and bearish crowds form quickly, pushing prices to extremes. For disciplined traders, these shifts are not threats but opportunities. By monitoring social media, funding rates, on-chain flows, and sentiment indexes, you can identify when the crowd is too optimistic or too fearful. Tracking crypto market sentiment in 2025 helps traders stay ahead of market trends and monitor the status of crowd psychology to make informed decisions.

Turning sentiment into trade setups requires patience, discipline, and risk management. Platforms like Bitunix provide trading tools, and Bitunix Academy delivers structured education to help traders interpret crowd psychology effectively.

The crowd will always swing between greed and fear. The question is whether you follow it blindly or use it as a signal to trade smarter.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.