In 2025 crypto markets remain as dynamic as ever. Volatility is the norm in the crypto market, and traders must be prepared, especially when using strategies like shorting. Shorting crypto offers a powerful way to profit in bear markets, but the risks are high. Many exchanges and cryptocurrency trading platforms now make these strategies accessible to a wide range of traders. The key to navigating this landscape is maintaining discipline and following a clear checklist. In this guide you will find step-by-step rules for entry, position sizing, stop management, and post-trade review. By following this checklist, you will approach shorting with clarity and reduce the risk of emotional mistakes.

[ez-toc]

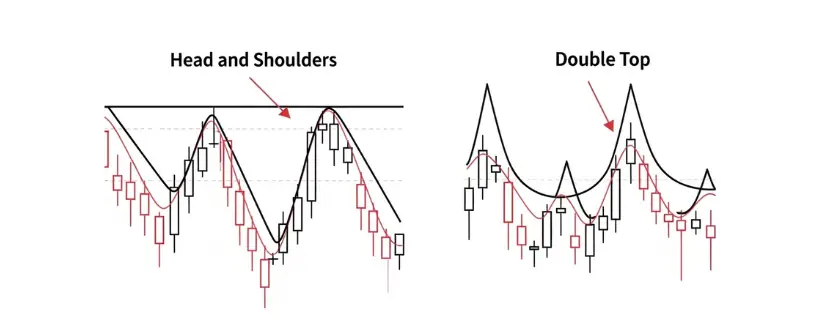

As a short seller, you are betting on price declines. A short should never be a guess. Look for setups that align with broader technical or fundamental signals: Analyzing current market trends and conducting thorough research are essential before entering a short position.

A short seller uses a trading strategy that profits from declining prices.

Allow multiple signals to converge. A clear setup may include a break below support on good volume, occurring against bearish market sentiment.

Price moving low without volume is weak price movement. Monitoring the current market price and price movements in the open market is essential for confirmation. For entry, confirm the move with volume above average. You can wait for candlestick or volume based confirmation, such as:

Never enter a short solely based on price. Wait for entry confirmation.

Market orders guarantee you enter quickly, but with slippage in fast volatile markets you may get filled at worse prices. Market orders execute at the current market price, which may differ from the current price displayed on your trading platform. Limit orders may fail to trigger if the move happens too fast. A smart approach is to use a limit just below the trigger price combined with a fallback market order. This gives you precision with a safety net.

Never risk more than a small portion of your trading capital per trade. Shorting can expose you to potential losses, significant losses, or even potential losses exceeding your initial investment if the market moves against you. A common rule among professional traders is to risk 1 to 2 percent of your total account on any single trade. If your account is 10,000 USDT, for example, the maximum risk should be 100 to 200 USDT.

When trading on margin, you must meet margin requirements and maintain a margin account. If your position moves unfavorably, you may be required to deposit additional funds to cover potential losses.

Crypto platforms offer leverage up to 125x. This is typically done through margin trading, where margin trades allow you to borrow funds to increase profits, but also amplify potential losses. While high leverage entices fast gains, it also accelerates losses. When shorting, conservative leverage such as 3x or 5x gives you room to breathe if price moves briefly against you. Using leverage requires careful risk management, and margin interest may apply when holding positions overnight.

Determine how many contracts to sell short based on your stop loss distance and capital at risk. This calculation is especially important when trading derivatives such as futures contracts, which are based on the price of the underlying asset or crypto asset. For example, if you are risking 100 USDT and your stop is 2 percent away; that equals 200 USDT movement. So you could short 0.5 contracts (100 / 200) to align with your risk tolerance.

Never enter a short without a stop. Begin by placing your stop at or just above a clear resistance level or just above a swing high. The placement should balance risk distance with market noise to avoid unauthorised stopouts. Stops help protect your position if the price rises unexpectedly, especially in volatile assets like Bitcoin, where the price of Bitcoin or Bitcoin’s price can move rapidly.

Once the trade moves in your favour, shift your stop to breakeven or slightly better. If the price drops steadily, consider trailing the stop below each lower high. Monitoring open and closing prices can help you decide when to adjust your stop or take profit. This helps lock in profits while still allowing room for volatility.

Platforms with advanced tools such as Bitunix allow you to set stop loss and take profit levels directly in one order. Many trading platforms offer features designed for advanced traders, such as conditional orders and automated risk controls. You can even use conditional orders to automate exits as price moves. This simplifies risk management and removes emotional delays.

Crypto markets react quickly to news. Sudden market moves or changes in crypto price and cryptocurrency prices can impact your trade, especially if bitcoin pricing shifts rapidly or if Bitcoin falls unexpectedly. If sentiment turns bullish unexpectedly, reevaluate the trade. If long candles with high volume close above your entry level, it may be time to exit.

Monitoring Bitcoin’s performance is crucial for timely trade management.

If the price falls and you are profitable, close part of your position at predetermined levels. The goal is to sell at a higher price and buy back at a lower price, which is the essence of managing a long and short position. This allows you to secure gains while letting the rest of the position benefit if the momentum continues.

Note: This approach contrasts with a long position, where the trader aims to profit from price increases by buying an asset and selling it later at a higher price.

Short positions on perpetual futures incur funding fees. These fees are common in the futures market, especially when trading products like bitcoin futures or executing a short bitcoin futures trade. If funding rates flip too quickly or spike high, your costs may outweigh your profit opportunity. Shorting bitcoin through futures contracts or perpetual swaps exposes you to these funding rate dynamics. Platforms like Bitunix provide live funding rate data—check this before holding long shorts, and note that Bitunix supports short bitcoin strategies for advanced users.

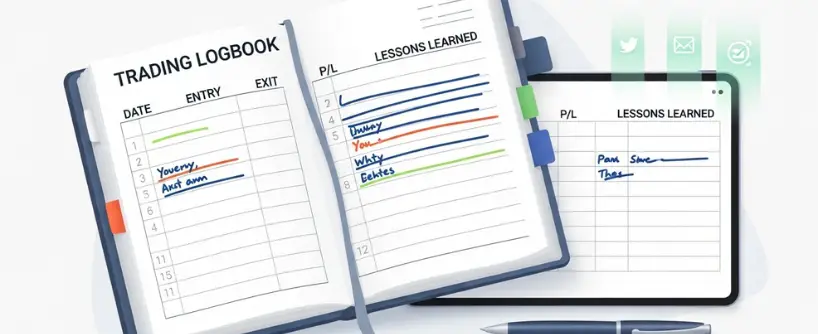

Log details: entry, exit, stop placement, contract size, profit or loss, and trade duration. Number of contracts and funding rate impact should also be included. Most crypto exchanges, including major cryptocurrency exchanges and bitcoin exchanges, provide downloadable trade histories to assist with record-keeping.

Write a short reflection after every trade. These notes are the fastest way to build skill over time.

If you want to dive deeper into any of these checklist elements, check out Bitunix Academy, the learning hub designed for both new and experienced traders. It offers tutorials on blockchain basics, futures trading strategies, platform navigation, K-line patterns, risk control, and case-based learning that put theory into practice. Bitunix Academy also provides a step by step guide to options trading, trading options, and using futures contracts for shorting strategies.

Can I use this checklist for both spot and futures trading?

This checklist applies mainly to futures and margin shorting strategies. Spot markets do not support borrowing assets, so many of the entry rules and stops need adjusting for borrowing costs. Most crypto exchanges and many bitcoin exchanges support opening a short position or short crypto using a crypto exchange or trading platform, making these strategies accessible to a wide range of traders.

How tight should my stop loss be in volatile markets?

Stops should trade off between noise and risk. Conservative traders place wider stops and risk smaller percentages of capital. More aggressive traders with room for loss may tighten. Find your comfort level via post-trade review.

Does position size change if I use leverage?

Yes. Higher leverage increases both profit and loss potential. Make sure your stop loss position size reflects that.

Are there tools to help me plan trade entries and stops?

Yes. Many platforms such as Bitunix offer chart overlays, funding rate data, open interest metrics, and conditional order tools to help you plan risk analytically. Some platforms also allow you to set a strike price for options trades, and settlement may occur in fiat currency depending on the product.

How often should I review my short trades?

After each trade is best. Weekly or monthly reviews are helpful for patterns. Consistency builds discipline and performance.

Shorting crypto in 2025 is not magic. It is strategy plus discipline plus execution. A checklist that guides you through entry, sizing, stop placement, management, and review ensures you approach each trade methodically. Use tools to stay informed and protect your capital. Record your outcomes and learn constantly. Bitunix Academy offers structured learning if you wish to sharpen your edge.

By following this checklist you position yourself to trade with clarity and confidence, improving not just results but your resilience in volatile markets.

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.