Every trader enters the crypto market with the dream of financial freedom. Yet, the majority lose money not because they lack access to charts, news, or tools, but because they lack discipline. In a market as fast and volatile as crypto, trading discipline is the foundation that separates consistent winners from those who get wiped out by emotional decisions.

In 2025, with Bitcoin trading near record highs and new altcoins creating unpredictable rallies and crashes, new coins are frequently emerging in the crypto market, adding to its dynamic and fast-changing environment. Discipline matters more than ever. This article explains what trading discipline means, how to build rules that survive volatility, and how platforms like Bitunix and resources such as Bitunix Academy can help traders stay consistent in an unpredictable environment.

[ez-toc]

Why Trading Discipline Matters in Crypto

Crypto markets are unlike traditional financial markets. They run 24 hours a day, seven days a week, and they can move 10 percent or more in a single session. That volatility creates opportunity, but it also creates traps.

Without clear rules, traders fall victim to overtrading, panic selling, chasing hype, or holding onto losing trades for too long. Discipline provides a framework to avoid these mistakes. It helps traders stick to their trading strategies, ensuring consistent and rational decision-making. It forces you to act according to your plan rather than your emotions.

Core Principles of Trading Discipline

Stick to Your Plan

Discipline means you follow your strategy even when emotions urge you to deviate. Having a clear strategy is essential, as it provides a structured approach to guide your actions and helps you avoid impulsive decisions. If your plan says exit at 5 percent profit, you exit, regardless of the temptation to hold longer.

Manage Risk First

Understanding your risk tolerance is crucial when determining how much capital to risk per trade. Profits are secondary to survival. By limiting the percentage of capital you risk per trade, you ensure that even a string of losses will not destroy your account.

Avoid Overtrading

Discipline includes knowing when to step back. If no clear setups exist, wait. Forcing trades just to stay active is a common path to losses. Overtrading often leads to impulsive decisions that can undermine your trading discipline.

Control Leverage

Crypto leverage magnifies both gains and losses. Discipline requires you to respect limits and avoid high leverage unless it is part of a carefully tested system.

Keep Records

Journaling every trade enforces accountability. It allows you to see patterns, identify errors, and refine your rules. Adopting a reflective approach to journaling can further enhance self-awareness and trading discipline, helping you make more mindful decisions.

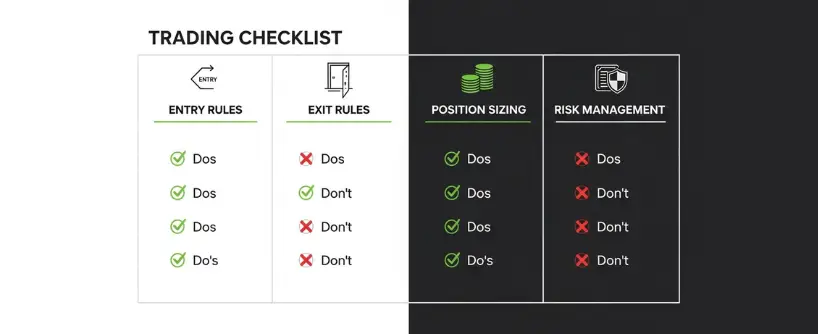

Creating Crypto Trading Rules

Your trading rules should act like guardrails, keeping you safe when volatility tries to throw you off course. Well-defined trading rules help you stay focused on your trading goals, ensuring that your actions align with both your short-term and long-term objectives. Here are key areas to address.

Entry Rules

- Enter only when at least two or three technical signals align.

- Use technical analysis, market sentiment, and market trends to inform your entry decisions and increase the probability of success.

- Confirm moves with volume to avoid false breakouts.

- Avoid trades based purely on social media hype.

Exit Rules

- Always define stop loss levels before entering a trade.

- Use take profit orders to secure gains rather than hoping for perfect tops. Monitor price movements to determine optimal exit points and adjust your strategy accordingly.

- Scale out gradually during strong moves to lock in profits.

Position Sizing Rules

- Risk no more than 1 to 2 percent of total capital per trade.

- Adjust size downward in highly volatile conditions.

- Avoid betting the majority of your portfolio on one asset.

Risk Management Rules

- Use isolated margin instead of cross margin where possible to limit exposure, as this approach is effective for minimizing risk.

- Review funding rates and fees before holding leveraged positions overnight.

- Avoid doubling down on losing positions in the hope of recovery.

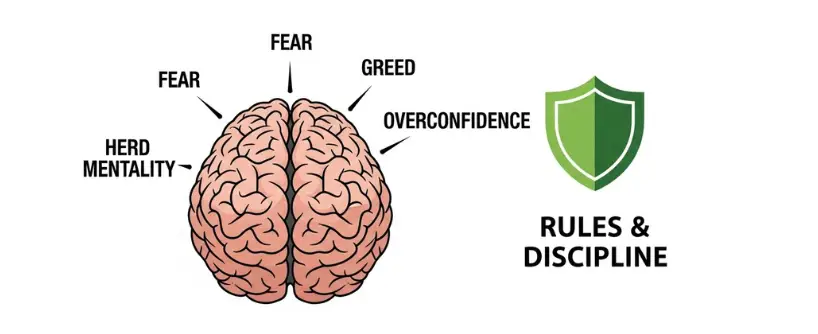

Trading Discipline and Market Psychology

Trading discipline is not just about numbers. It is about mastering psychology.

- Fear leads to panic selling. Discipline keeps you aligned with stop loss levels rather than exiting in a rush.

- Greed leads to holding too long. Discipline makes you respect your targets.

- Overconfidence leads to reckless trades. Discipline reminds you to stay humble in front of market volatility.

Personality traits and individual thought processes play a significant role in shaping trader behavior. Factors such as self-awareness, cognitive biases, and mental strategies can influence trader behavior by affecting how decisions are made under pressure. Both internal factors (like emotions and personality traits) and external factors (such as social media trends and market sentiment) can strongly influence trader behavior in the crypto market, impacting risk-taking, impulsivity, and overall trading outcomes.

By connecting psychology to rules, you create a system that keeps emotions from dictating your trades.

Volatility Management in Crypto

Volatility is both the friend and enemy of traders. With proper management, it becomes opportunity rather than risk.

- Use Wider Stops in High Volatility: In wild markets, too-tight stops may trigger unnecessarily. Balance stop distance with position size.

- Trade Smaller in Extreme Conditions: Reduce exposure when volatility spikes, protecting yourself from sudden whipsaws.

- Avoid Overleveraged Positions: Extreme volatility combined with leverage is a recipe for liquidation. Keep leverage low unless your system is tested.

- Time Your Trading Sessions: High volatility often occurs during major announcements or overlapping trading hours between Asia, Europe, and the US. Choose trading windows wisely.

Volatility can also mean that opportunities arise for disciplined traders who are patient and prepared. During sharp downturns, some assets may eventually rebound, rewarding those who avoid emotional decisions and stick to their strategy. The anticipation of potential gains during volatile periods can influence trading decisions, so it’s important to stay focused and avoid impulsive risk-taking.

Discipline in volatility management means respecting market conditions instead of fighting them.

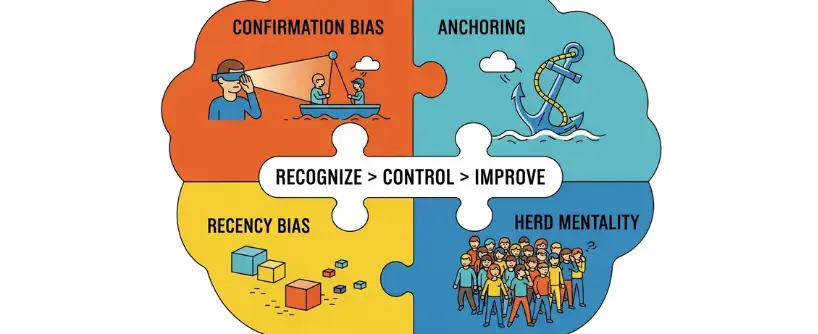

The Role of Cognitive Bias in Discipline

Cognitive biases are mental shortcuts that distort decision-making. Controlling them is part of trading discipline.

- Confirmation Bias: Only looking for data that agrees with your trade. Discipline means seeking evidence both for and against your position.

- Anchoring: Becoming attached to entry price and refusing to exit at a loss. Discipline requires accepting when the market proves you wrong.

- Recency Bias: Believing recent outcomes predict the future. Discipline reminds you that each trade is independent.

- Herd Mentality: Following the crowd. Discipline forces you to act based on your rules, not group emotions.

Overconfidence bias can cause traders to fall prey to poor investment decisions, especially in volatile markets like crypto. When investors overestimate their knowledge or underestimate risks, they are more likely to make impulsive trades that result in negative outcomes. Recognizing and managing these biases is crucial for improving investment decisions and avoiding costly mistakes.

Identifying these biases helps prevent them from undermining your system.

Case Studies of Trading Discipline in Action

The Patient Trader

A disciplined trader waits for setups that align with their rules, which enables them to make more informed decisions based on careful analysis and strategy. They may trade less often, but their consistency allows profits to compound.

The Overtrader

An undisciplined trader jumps into every move they see on social media. Their wins are small, but their losses are large. Over time, they lose capital and confidence.

The Volatility Survivor

In 2021 and 2022, disciplined traders survived sudden crashes because they managed risk and respected stops. Many undisciplined traders, however, saw entire portfolios erased.

These examples show how discipline is the real differentiator in long-term success. Profitable traders consistently apply discipline to navigate market volatility and achieve sustained gains over time.

How Bitunix Academy Supports Trading Discipline

Discipline is not something you build overnight. It requires learning, practice, and reinforcement. Bitunix Academy offers structured content that helps traders develop trading psychology, risk management, and practical strategies. Courses cover topics like volatility management, trading rules, and controlling cognitive bias. Bitunix Academy helps crypto traders develop effective trading practices and learn from the habits of successful traders, focusing on skills and strategies that lead to long-term success.

By studying structured lessons instead of relying on random social media tips, traders can build the foundation needed to survive crypto volatility. Search the web for Bitunix Academy to explore these resources and strengthen your approach.

Frequently Asked Questions

What is trading discipline in crypto?

Trading discipline in cryptocurrency trading is the ability to follow predefined rules and strategies consistently, regardless of emotions, market sentiment, or value changes in digital assets. It helps crypto investors and cryptocurrency traders avoid impulsive trading activities and make objective investment decisions in the fast-paced crypto space.

Why is discipline more important in crypto than in stocks?

Because the cryptocurrency market trades 24/7, unlike traditional markets such as the stock market, which have set trading hours. The higher volatility and continuous operation of crypto markets amplify emotional mistakes, making discipline even more crucial for investors and day traders to manage risk and avoid market bubbles.

How do I build trading rules that survive volatility?

By defining entry and exit signals, using technical analysis tools like moving averages, monitoring trading volume and market trends, setting strict risk limits, and adjusting position sizes based on thorough market analysis and current market conditions. This approach helps both new investors and experienced investors make informed investment decisions.

What role does psychology play in trading discipline?

Psychology is central. Fear, greed, and cognitive biases influence crypto investors and cryptocurrency traders, often leading to poor decision-making and risky trading activities. Discipline helps override those impulses, supporting better outcomes when investing in crypto or managing crypto assets.

Can Bitunix help me learn discipline?

Yes. Bitunix Academy provides educational resources on trading psychology, discipline, and blockchain technology. The Bitunix platform includes tools such as isolated margin and conditional orders to support risk control, as well as access to cryptocurrency exchanges with low fees and support for fiat currency deposits, helping investors and day traders develop sound trading habits in the crypto space.

Conclusion

Trading discipline is the foundation of success in the crypto market. Without it, fear and greed dictate decisions, volatility becomes overwhelming, and losses mount quickly. With it, you can survive downturns, capitalize on opportunities, and build long-term consistency.

The rules that survive volatility are not glamorous but effective: respect stop losses, size positions carefully, manage leverage, and stay objective. Combine these with psychological awareness and structured learning from platforms like Bitunix Academy, and you create a system that keeps you in the game when others are wiped out.

In 2025, discipline is your true edge. Markets will always fluctuate, but your rules and mindset will determine whether you survive and thrive.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.