December was a consolidation month for the crypto market, with Bitcoin trading in a tight range and setting the tone across major digital assets. As investors digested the latest Federal Reserve meeting minutes and monitored ongoing regulatory and tax policy developments, risk appetite stayed measured and price action remained largely range-bound. At the same time, derivatives markets stayed active around a large late-December Bitcoin options expiry, while Ethereum’s roadmap discussions continued to develop, including expectations for 2026 hard forks and potential Layer 1 gas limit adjustments.

This December crypto report highlights the key narratives that shaped market direction and sets the context for what investors may watch heading into January.

[ez-toc]

In December, Bitcoin (BTC) price stayed range-bound between $84,000 and $93,000, and the broader market did not form a clear trend. After BTC quickly pulled back from around $110,000 in November to roughly $82,000, December largely served as a digestion phase for that prior downside move.

From a global macro perspective, there were no major shifts in Fed policy expectations or geopolitics during the month that materially changed liquidity expectations or recession risks. Overall risk sentiment remained relatively steady, which also helped keep BTC’s month-to-month volatility contained.

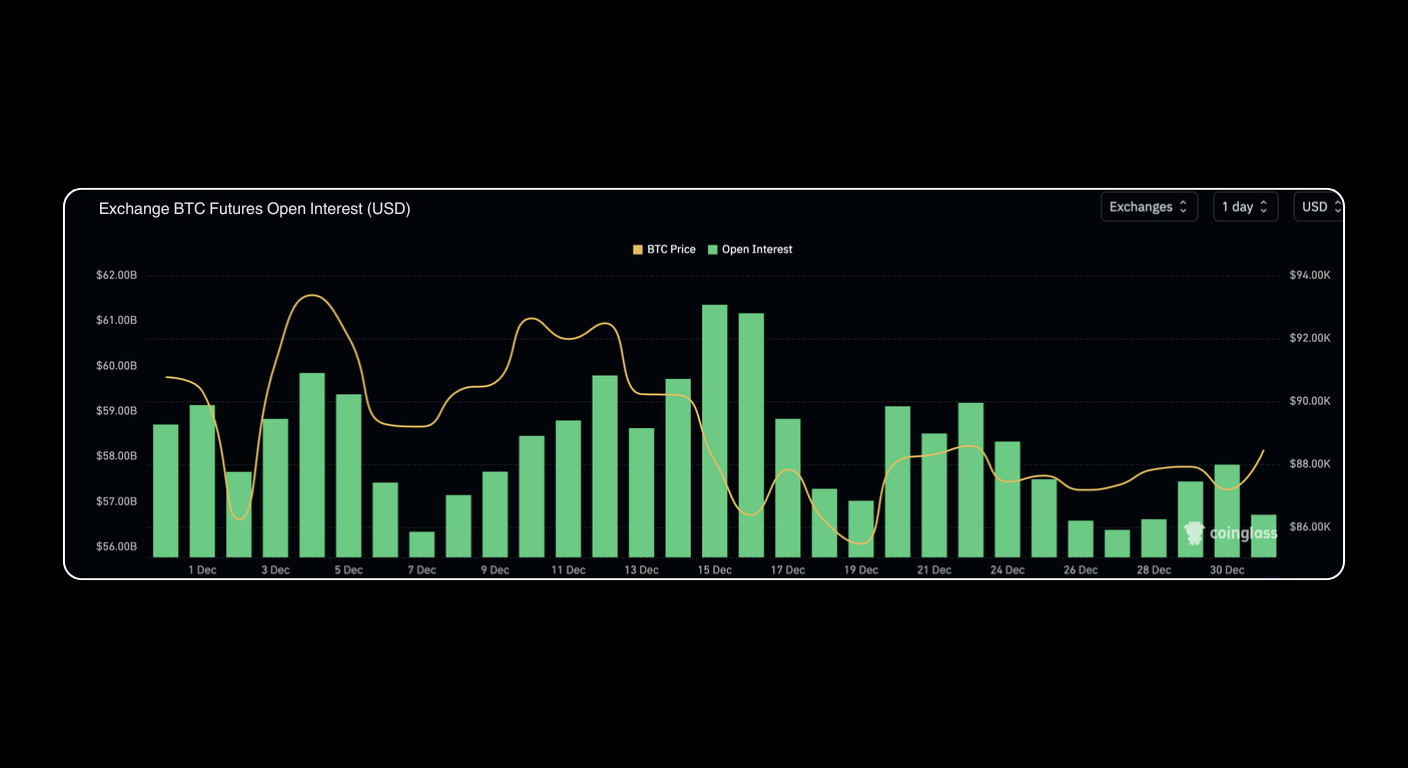

During December, BTC spent extended periods consolidating in a narrow range, with limited directional conviction. Derivatives positioning reflected that. Data shows total BTC futures open interest across exchanges was about $59.1 billion in early December, easing to about $56.7 billion by month end. Overall, futures OI declined modestly, suggesting leverage levels remained relatively restrained.

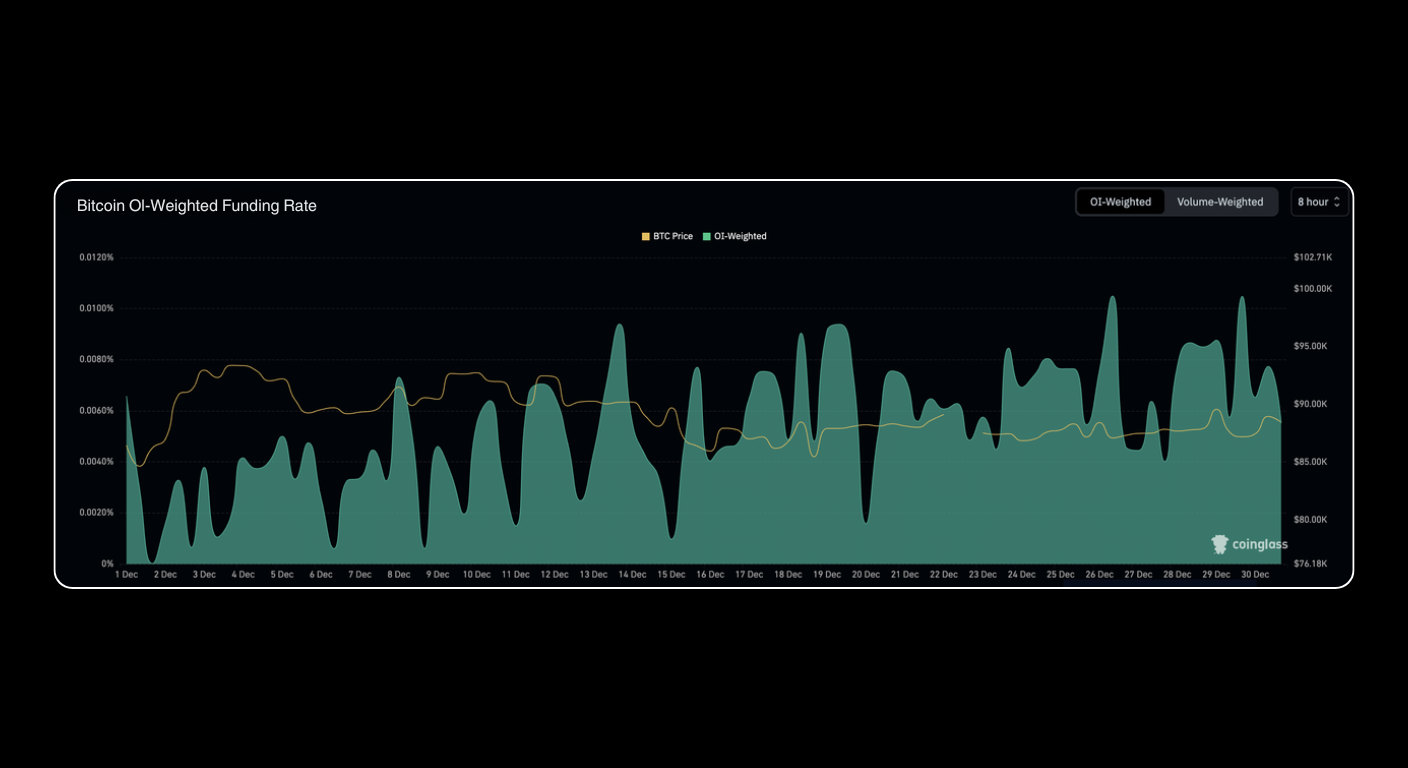

Even with sideways BTC price action, derivatives sentiment still leaned bullish. Across December, BTC perpetual funding rates stayed positive. Funding briefly slipped to 0.00% at the start of the month, then gradually recovered as BTC stabilized and showed mild upside bias during consolidation. By month end, funding rebounded to 0.01%, the highest level recorded in December, indicating stronger long positioning.

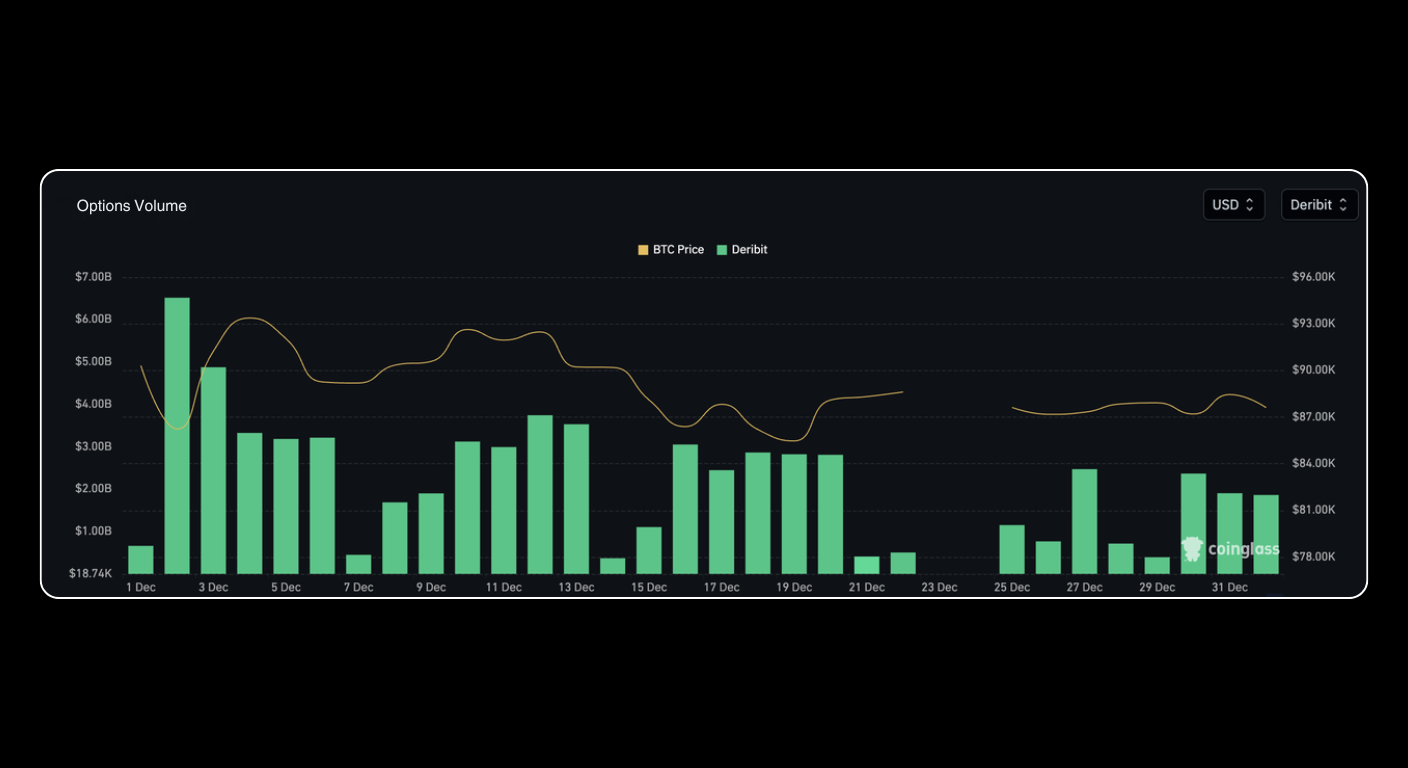

In BTC options markets, about $23 billion in Bitcoin options contracts were set to expire around December 26, which could amplify volatility on top of already elevated market sensitivity. This expiry size represented more than half of total open interest on Deribit, the largest global Bitcoin options venue, suggesting traders continued to price meaningful downside risk.

By the end of December, total BTC options market value fell from about $47.3 billion at the start of the month to about $27.6 billion. This figure was also described as the lowest level since April 2025, following the period when global markets were heavily focused on tariff-related tensions.

BTC options trading volume also dropped sharply in December. By month end, Deribit’s options volume fell to below $1 billion. A key driver was low realized volatility, with BTC holding the $84,000 to $93,000 range and failing to produce large swings. Since a core use case for options is trading volatility, muted price movement reduced participation and activity.

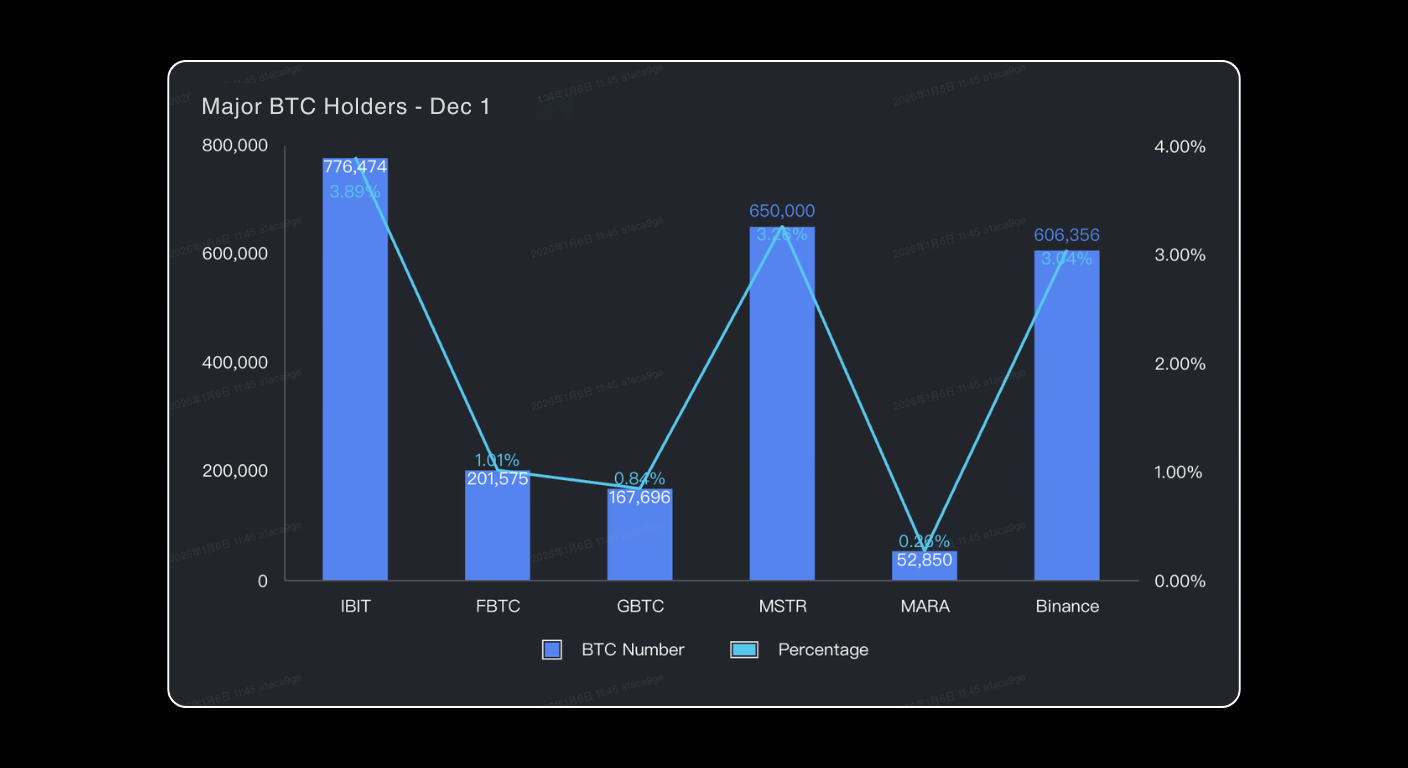

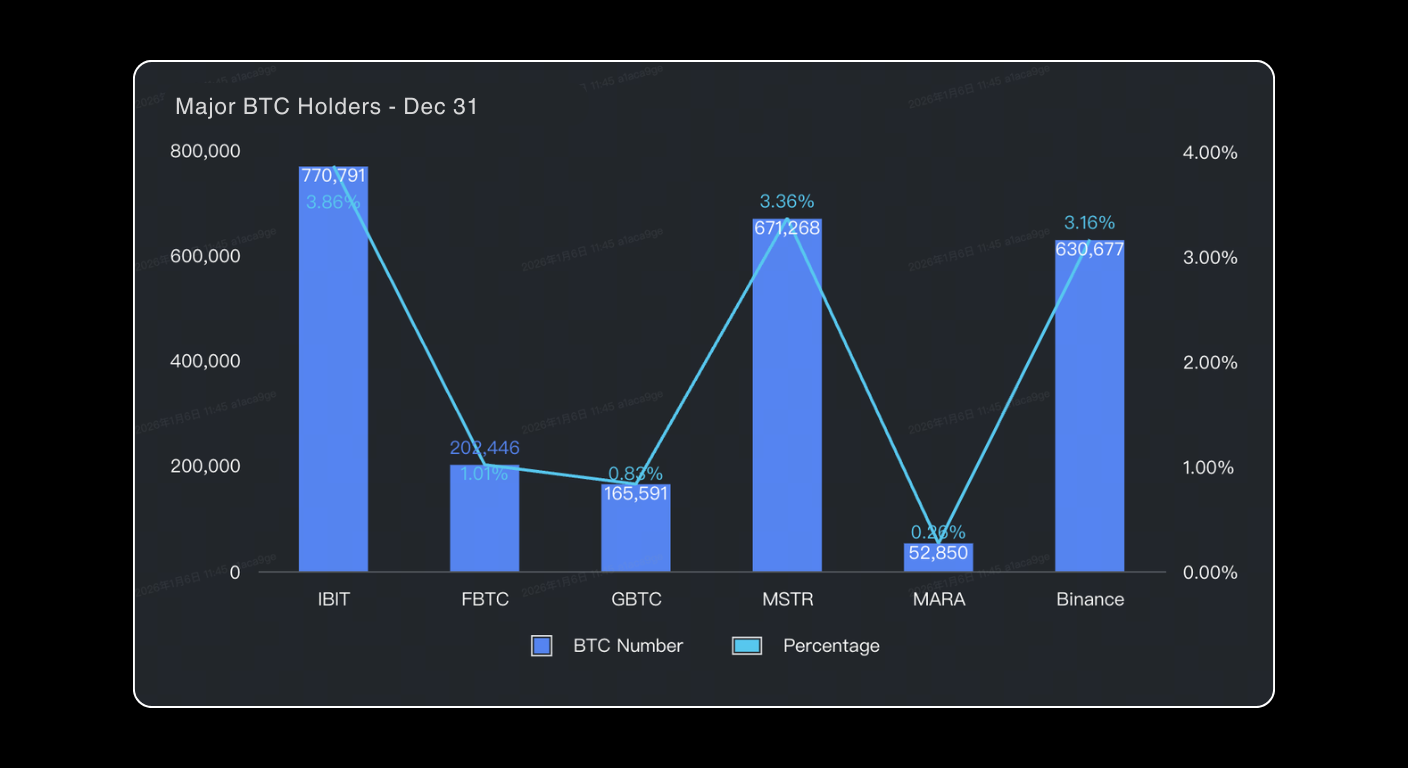

Institutional BTC holdings shifted modestly in December. According to a year-end reserve disclosure, Binance reported its BTC holdings increased from about 606,000 BTC to about 630,000 BTC, a net increase of 24,321 BTC.

As a leading corporate treasury-style BTC holder, MicroStrategy (MSTR) continued accumulating Bitcoin, purchasing 21,268 BTC during December.

In contrast, IBIT, currently the largest spot Bitcoin ETF by scale, saw noticeable net outflows in December. The fund recorded net outflows of 5,683 BTC, and its share of BTC holdings declined slightly from 3.89% to 3.86%.

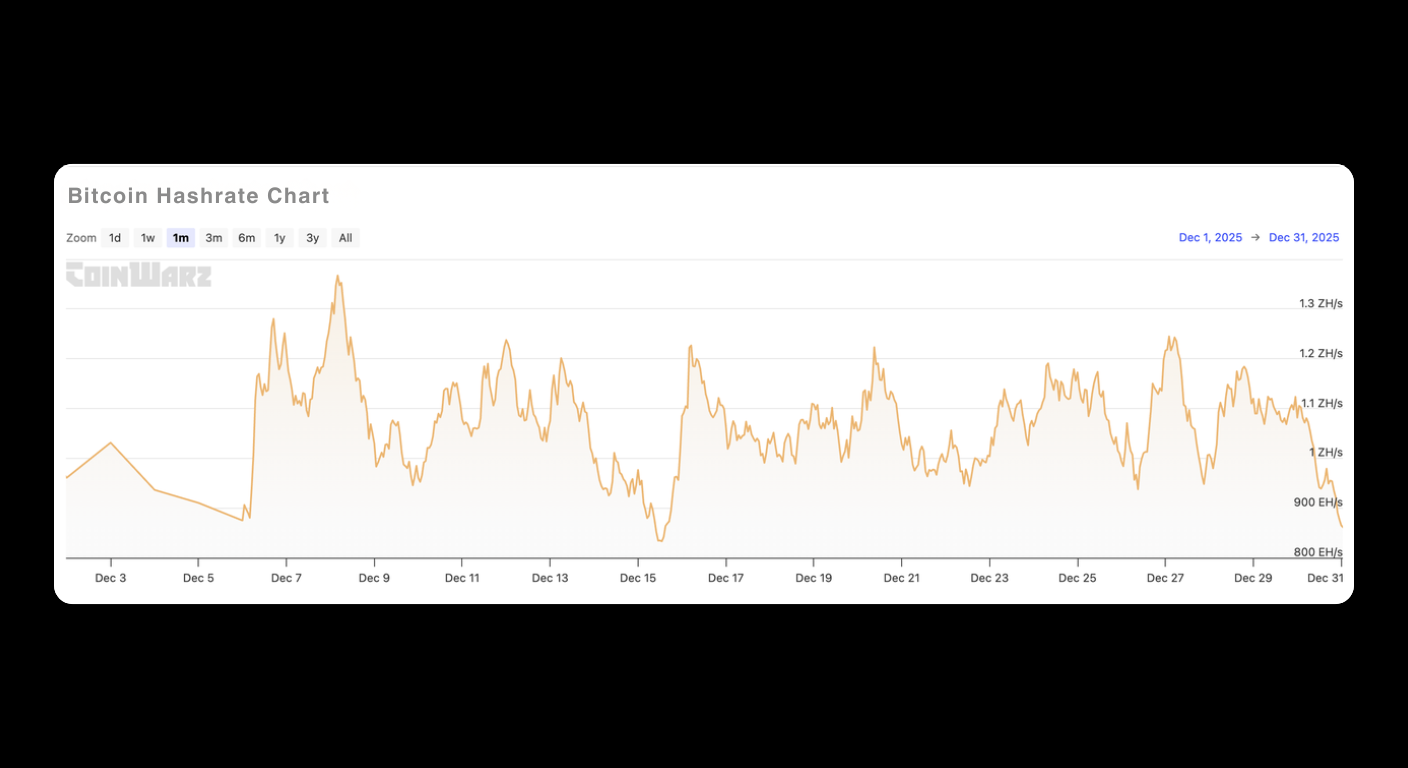

In December, Bitcoin network hashrate fluctuated between 900 EH/s and 1,200 EH/s, staying near historical highs overall. VanEck’s crypto research lead Matt Sigel and senior investment analyst Patrick Bush noted that since 2014, when hashrate declines during the period from November 23 to December 23, the linear correlation with Bitcoin’s 90-day forward returns is about 65%.

Even as BTC pulled back, spot prices were still around $88,000, down nearly 30% from the October 6 all-time high of $126,080. At the same time, improvements in the hashrate mix and energy efficiency helped ease mining cost pressure. The breakeven electricity price for the Bitmain S19 XP was cited as improving from about $0.12/kWh in December 2024 to about $0.077/kWh, indicating miner-side cost stress had moderated.

Compared with BTC, ETH showed stronger resilience during December’s consolidation. Data shows BTC gained about 2.16% in December, while ETH fell about 0.66% over the same period. Although ETH underperformed BTC, it remained one of the more resilient major assets. During the month, ETH repeatedly attempted to reclaim $3,000, but each rebound struggled to hold, often slipping back below $3,000 in the short term. This highlighted $3,000 as a key near-term support and resistance zone.

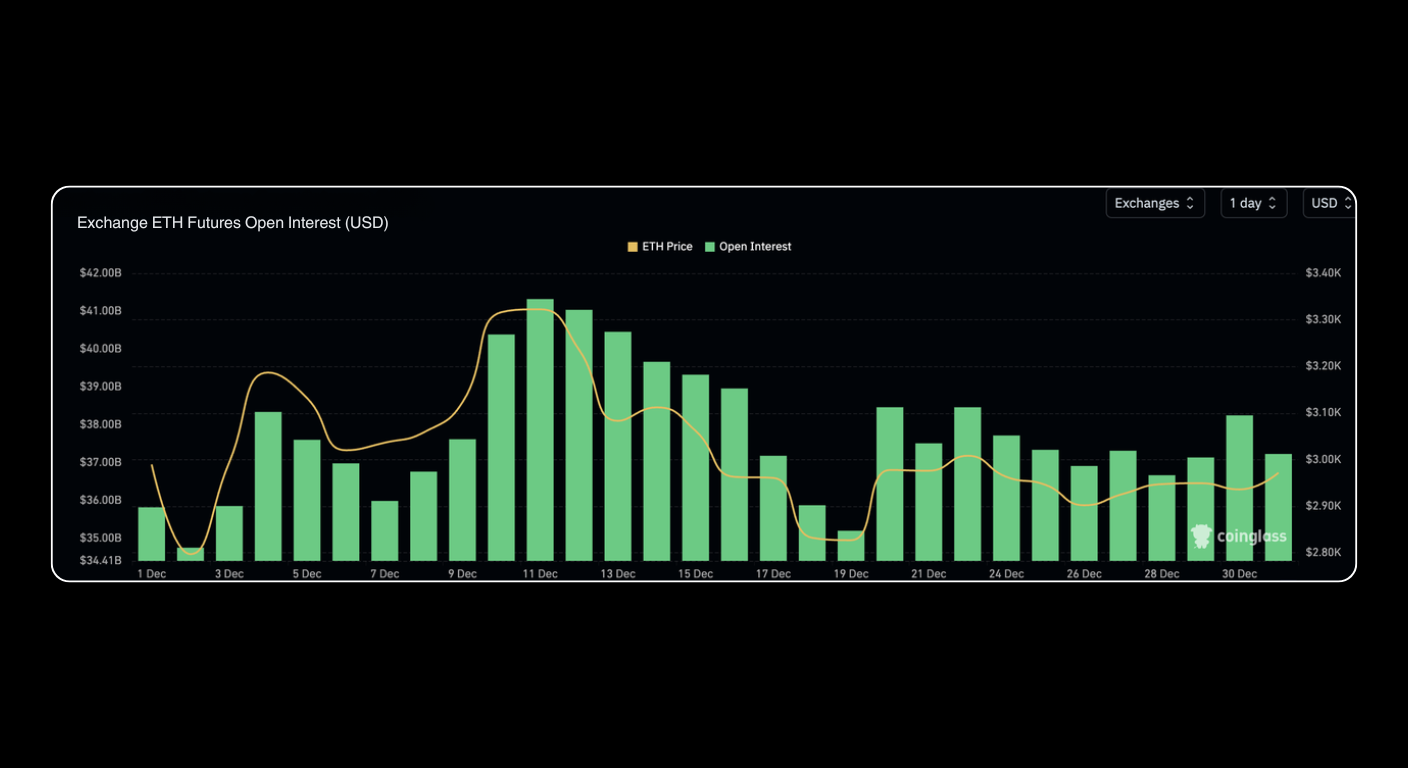

In December, ETH futures open interest did not show major swings. Data shows total ETH futures open interest was about $35.8 billion at the start of the month and rose to about $37.2 billion by month end, a modest increase of roughly $1.4 billion. Relative to BTC futures open interest in December, this pattern suggests some market participants saw more room for short positioning in ETH as a hedging tool, and as a result, some portfolios favored using ETH for partial allocation and risk management.

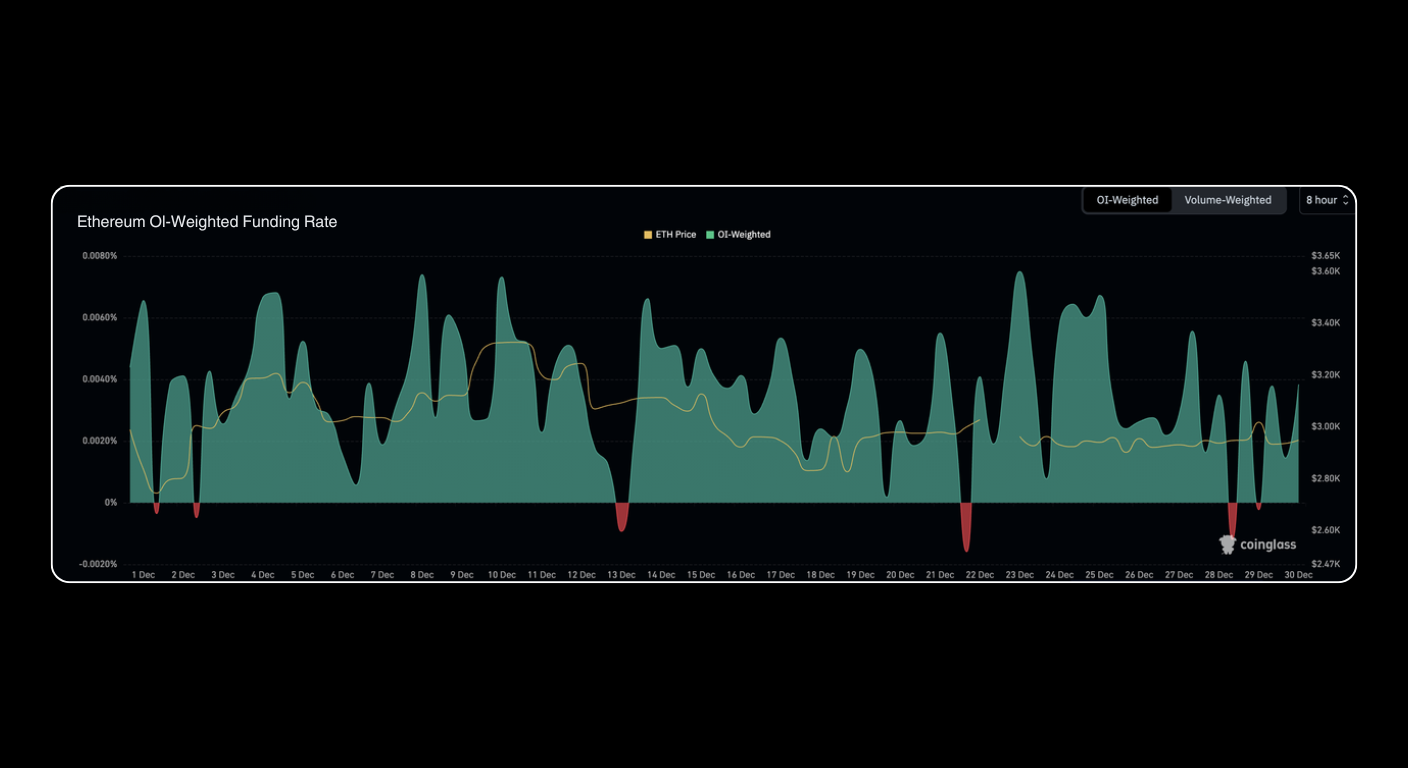

From the perspective of perpetual funding, ETH funding rates showed weaker long bias than BTC in the latter half of the month. ETH funding turned negative six times during December, indicating that shorts briefly gained the upper hand during certain windows. Overall, however, ETH funding stayed within a tight range and did not show extreme sentiment or sharp volatility.

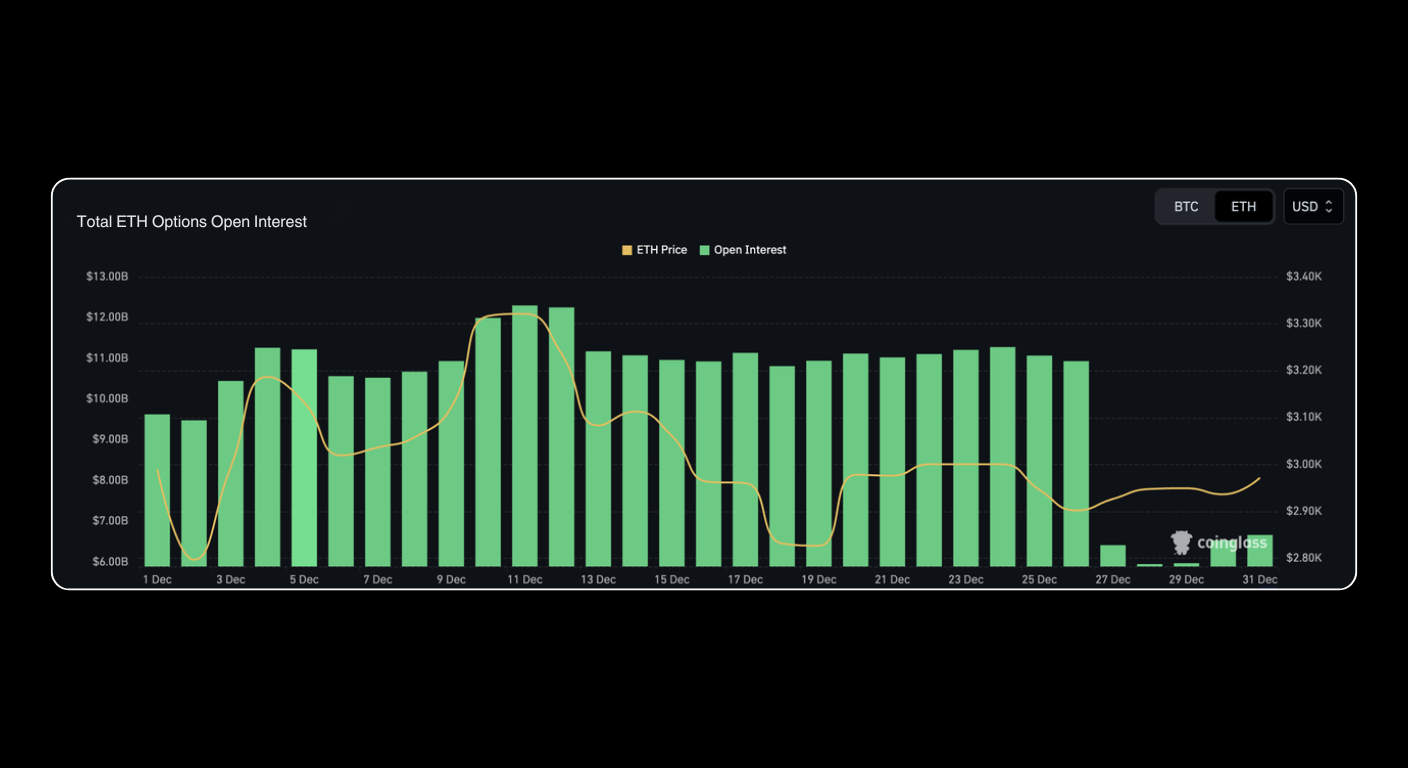

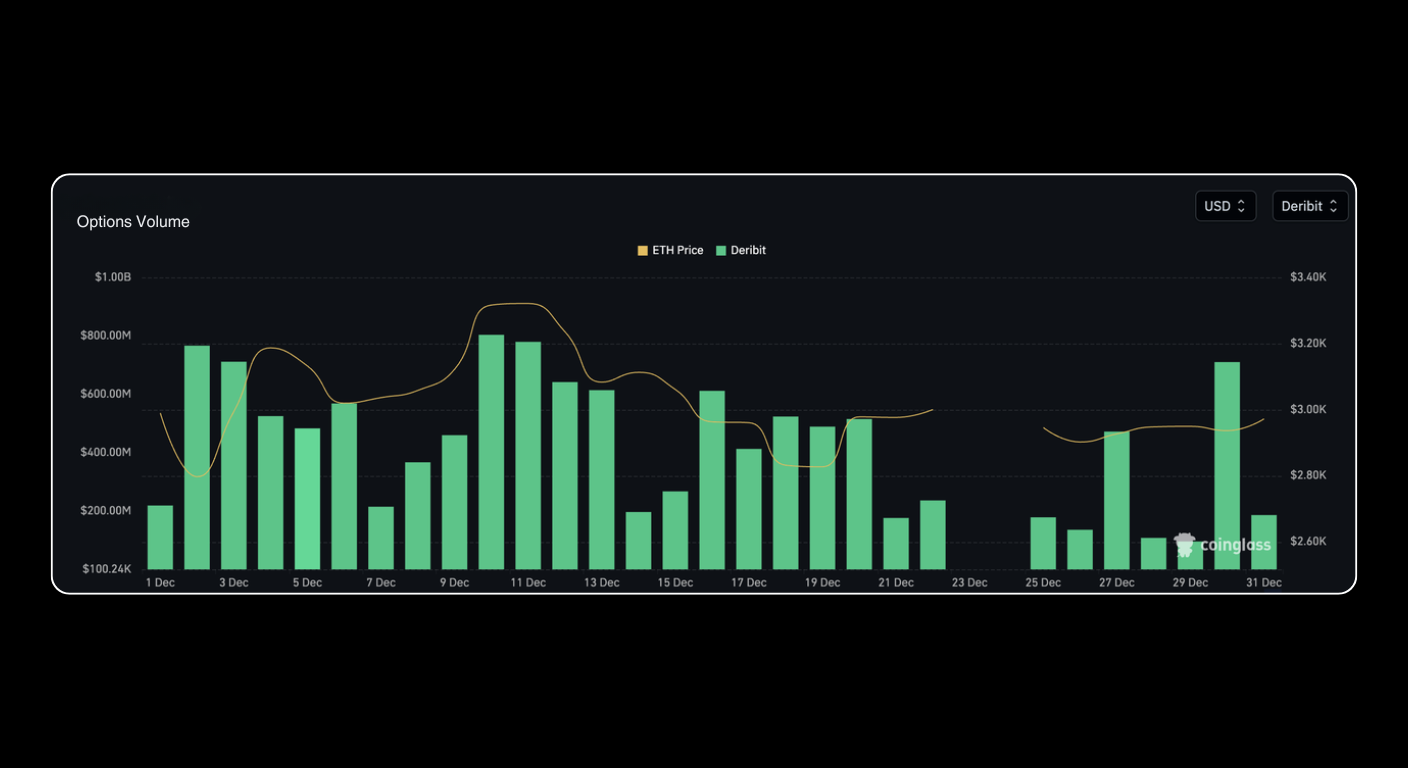

Compared with the much larger BTC options market, ETH options remained relatively limited. Total ETH options open interest held near $10 billion, roughly 20% of BTC options open interest. On December 26, ETH options saw a concentrated expiry, with more than $4 billion expiring in a single day. After settlement, ETH options open interest fell from about $10 billion to about $6 billion.

In addition, with overall crypto market volatility staying relatively muted in December, ETH options trading activity also cooled. Data shows Deribit’s average daily ETH options volume during December generally stayed in the $500 million to $800 million range. Activity remained relatively steady overall, but it had clearly cooled from earlier peak levels.

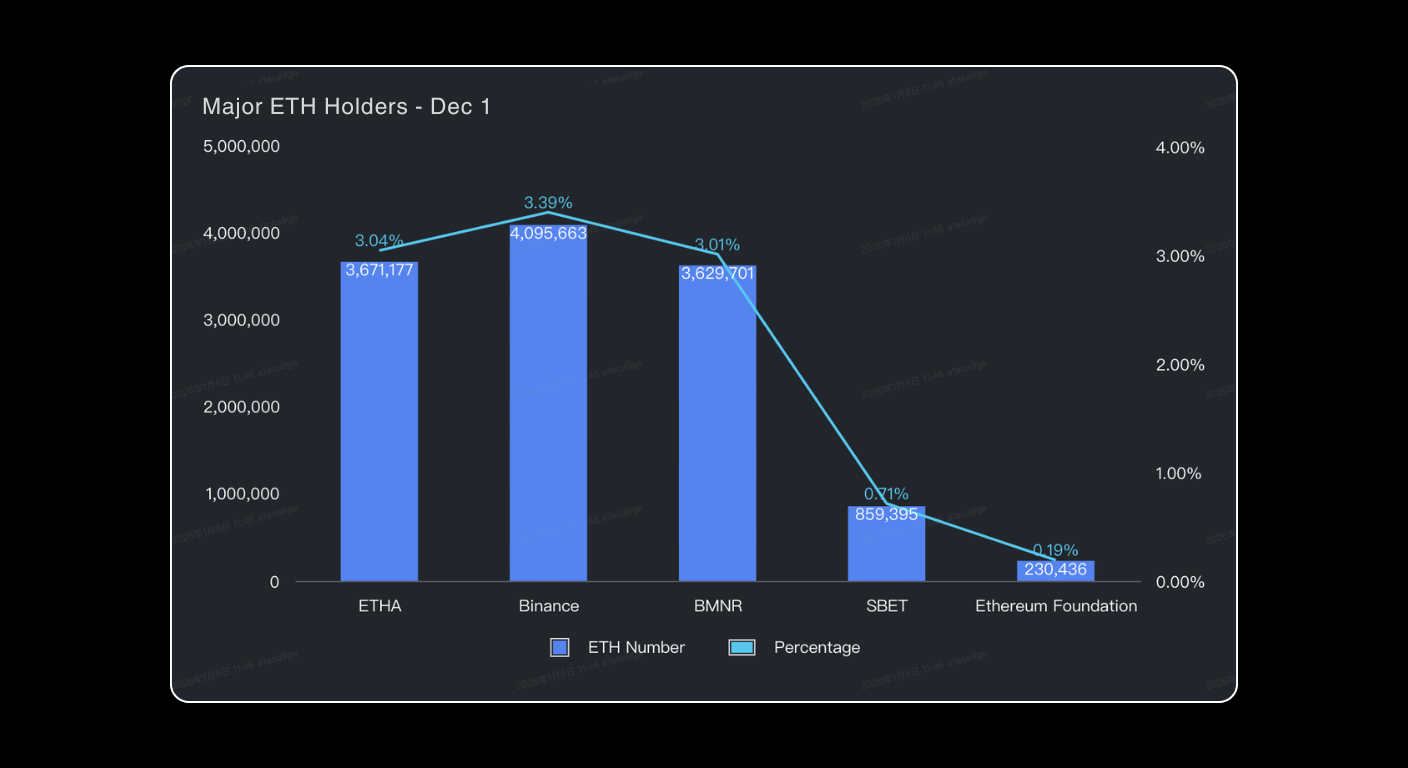

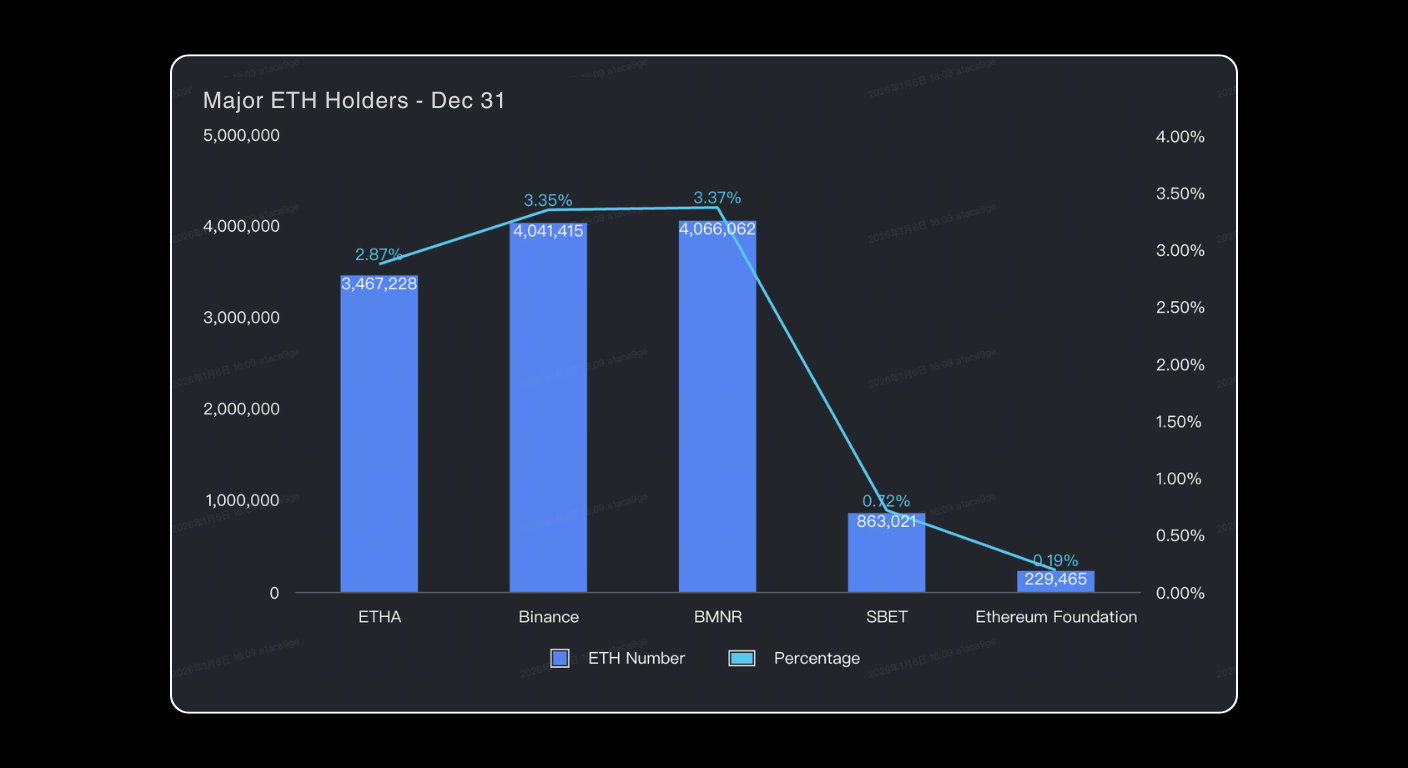

In December, institutional ETH holdings also showed a clear structural shift. On December 1, Binance, the ETHA fund, and the public company BMNR ranked first, second, and third by ETH holdings. As markets moved into a choppy consolidation phase, BMNR continued to add ETH, buying a cumulative 436,000 ETH during the month. In contrast, ETHA and Binance reduced holdings by about 203,000 ETH and 54,000 ETH, respectively.

Against this backdrop, BMNR became the largest ETH holder globally for the first time, with its share rising from 3.01% to 3.37%. By comparison, ETHA’s share of ETH holdings fell to 2.87%.

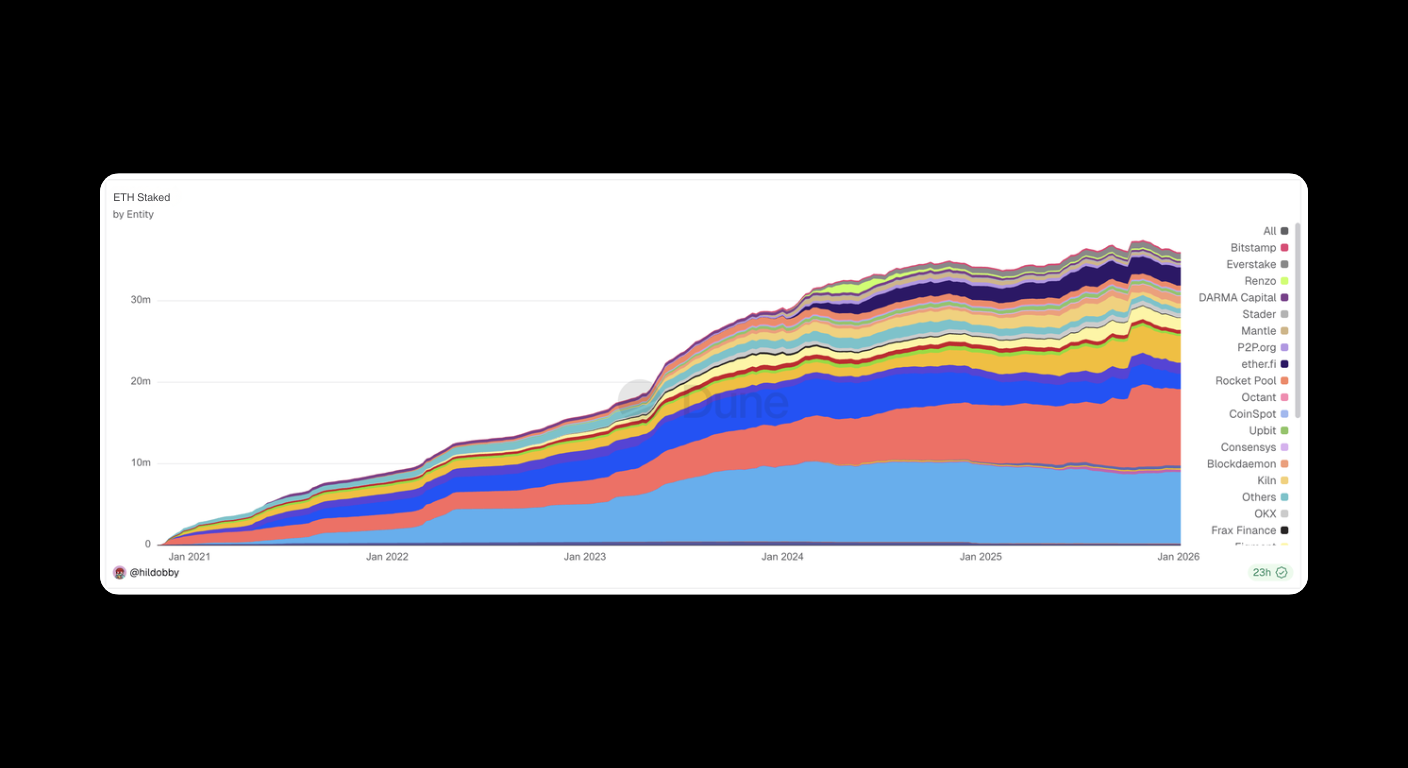

By the end of December 2025, total ETH staked across the Ethereum network fell to about 35.97 million ETH, down roughly 390,000 ETH from the start of the month. Total staked ETH has continued trending lower since October. Despite the decline in total staking, leading staking platforms grew. As the leading liquid staking provider, Lido increased its staked ETH from about 8.66 million ETH to about 8.77 million ETH in December. Overall, staking continued to concentrate toward top platforms, and that concentration trend strengthened further.

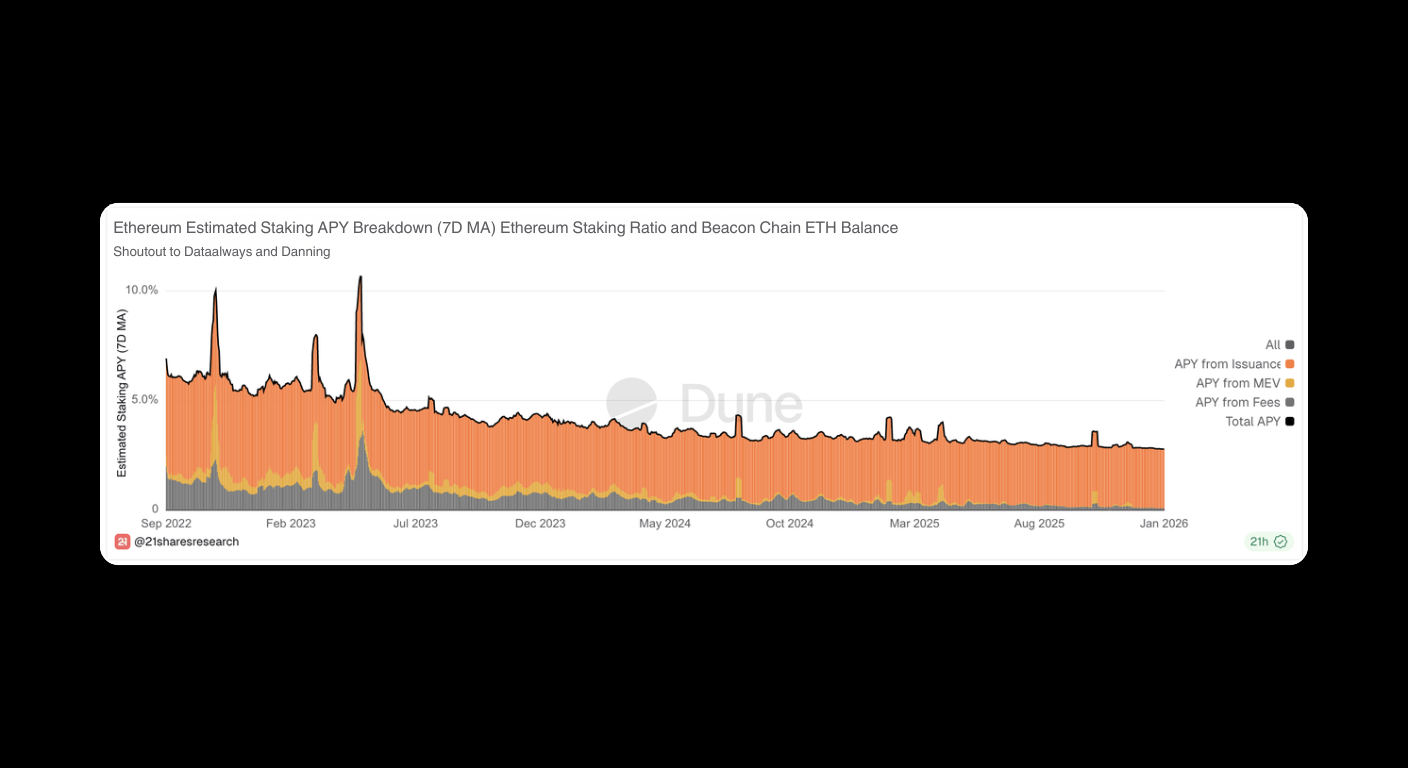

During December, ETH staking yields remained broadly stable, with annualized returns staying in the 2.79% to 2.85% range. Across the three components of staking yield, the contributions from tips and MEV (maximal extractable value) both fell below 0.1%, and their shares continued to decline. The sustained drop in MEV and tip income suggests on-chain activity became more rational, arbitrage opportunities decreased, and the network is moving toward a more stable, lower-volatility fee and yield structure.

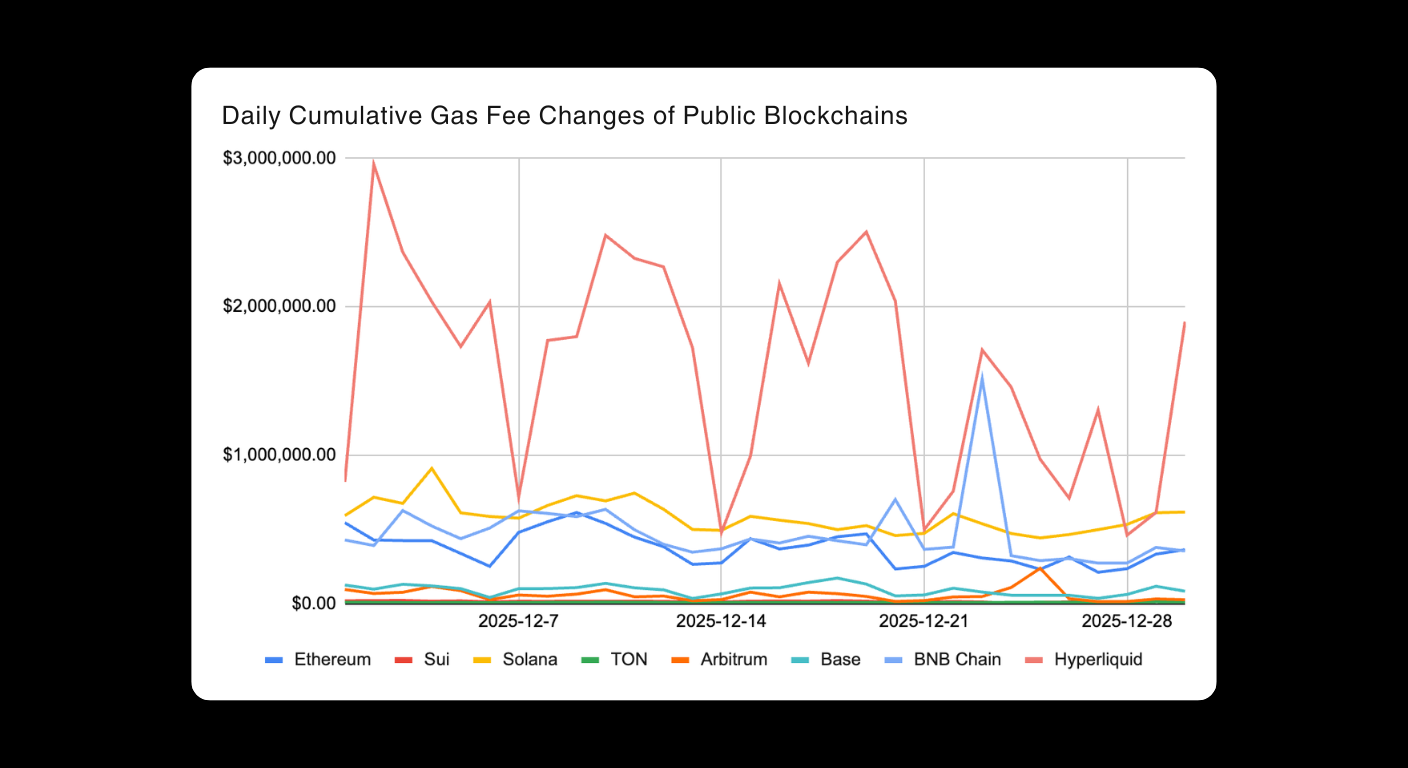

In December 2025, activity across major public blockchains remained broadly steady, with no major changes in daily transaction counts. Solana continued to lead with an average of about 71 million transactions per day, although that was slightly lower than November’s roughly 77 million. Even with the pullback, Solana’s throughput still meaningfully outpaced other networks. Base and BNB Chain remained firmly in second and third place.

On the fee side, Hyperliquid continued to rank first among public chains by value capture, generating about $1.57 million per day on average. Solana and BNB Chain also ranked in the top tier, highlighting structural differences across networks in both usage frequency and fee-based value capture.

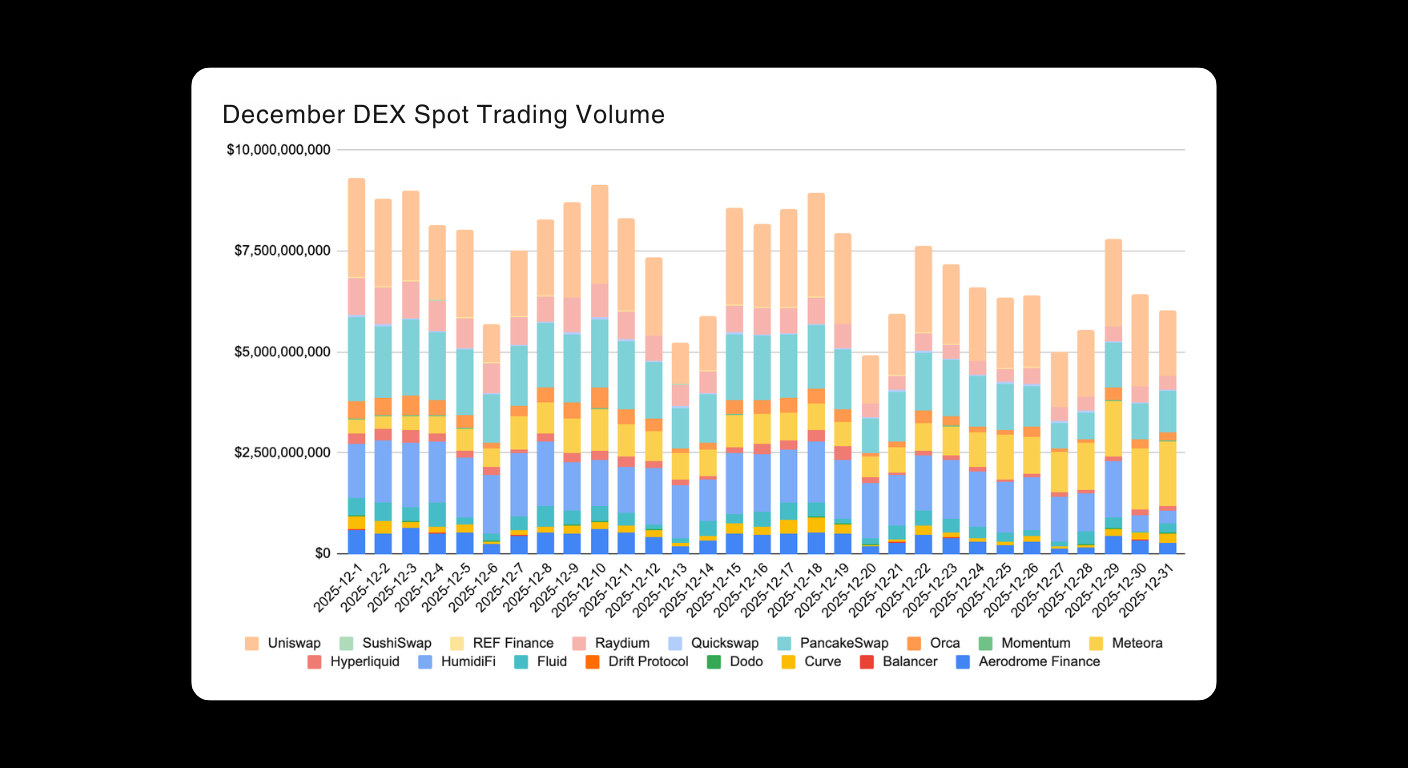

In December, DEX spot trading remained concentrated among the leaders. Uniswap held the top position with average daily spot volume of about $1.92 billion, but that figure was down roughly 23% month over month versus November. PancakeSwap and HumidiFi ranked second and third, with average daily spot volume of about $1.63 billion and $1.28 billion, respectively.

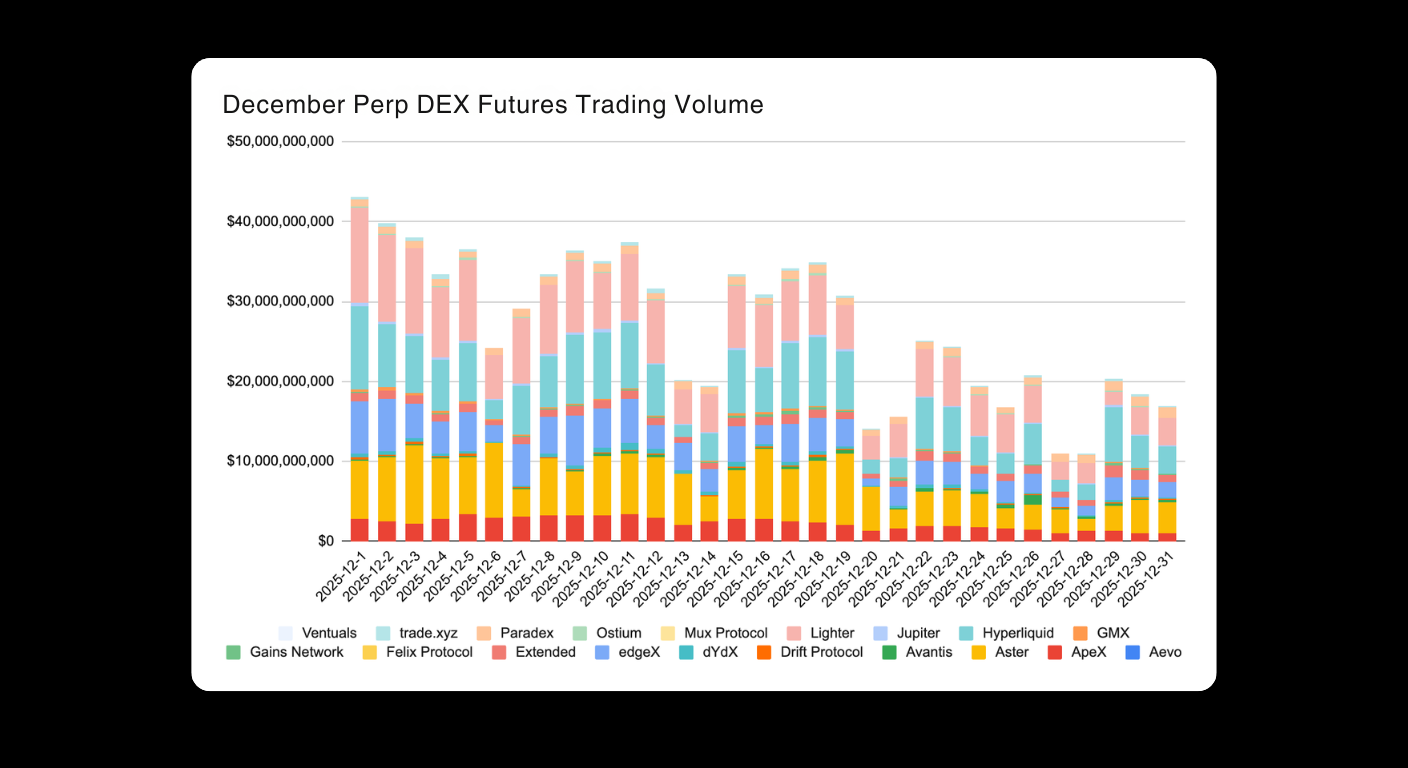

In perpetual DEX markets, competition remained highly tight. After Lighter completed its first multi-signature TGE in late December, activity accelerated quickly and average daily volume jumped to about $6.3 billion, making it the standout mover. Aster and Hyperliquid followed close behind, with December average daily volume of about $5.72 billion and $5.56 billion, respectively.

Prediction markets were not only a major focus area for crypto in Q4 2025, they are also widely viewed as a narrative traders may prioritize in 2026. The leading platforms remain Kalshi, Opinion, and Polymarket, and the competitive landscape stayed relatively balanced with no clear runaway leader.

Data shows December cumulative trading volume of about $7.46 billion for Kalshi, $6.69 billion for Opinion, and $5.31 billion for Polymarket. Kalshi held a slight lead based on total volume.

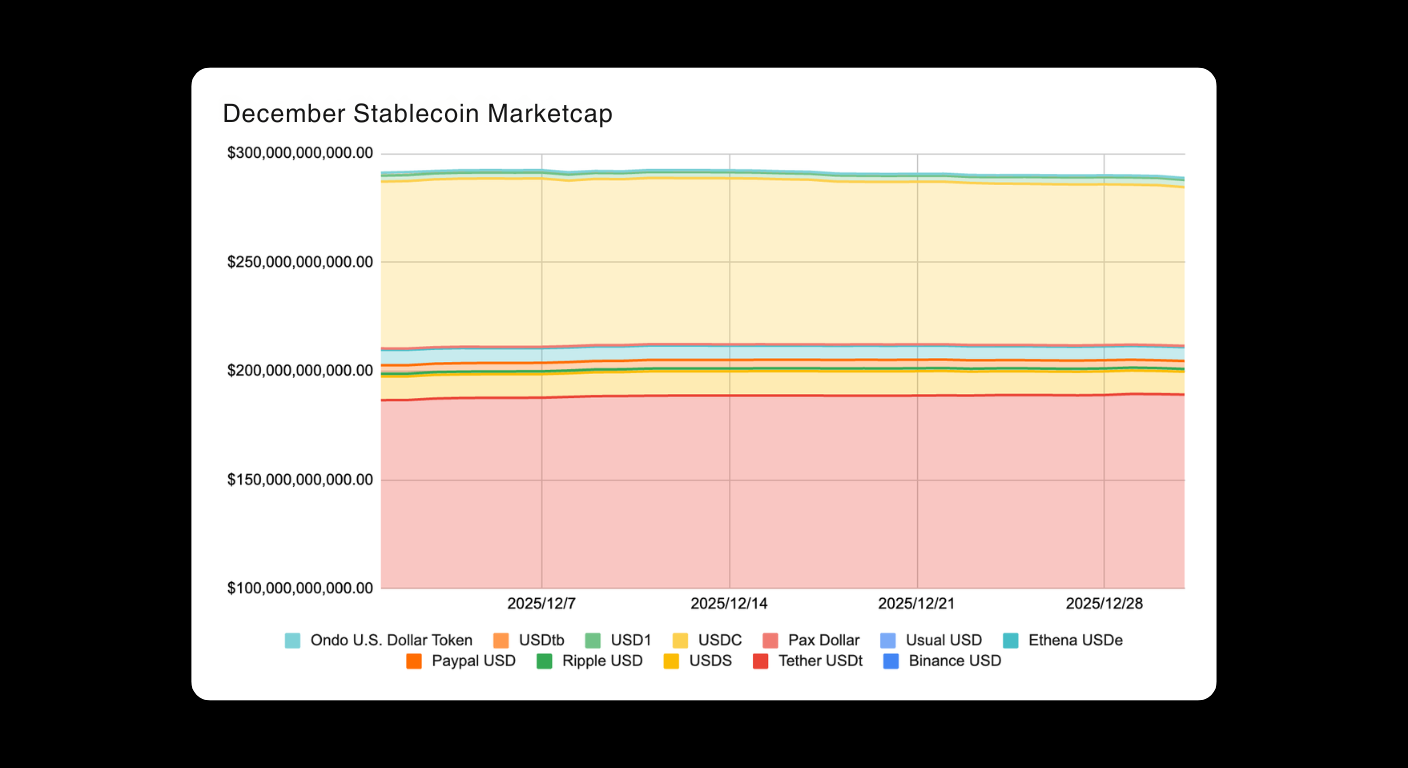

RWA was one of the fastest-growing segments in crypto during 2025. Stablecoins expanded meaningfully, with market size rising from about $200 billion to $300 billion in roughly one year. By comparison, the move from $100 billion to $200 billion took more than three years. Overall, stablecoins were the largest source of incremental growth within RWA in 2025. By issuance scale, Tether, Circle, and MakerDAO ranked top three at approximately $189.1 billion, $72.9 billion, and $10.5 billion, respectively.

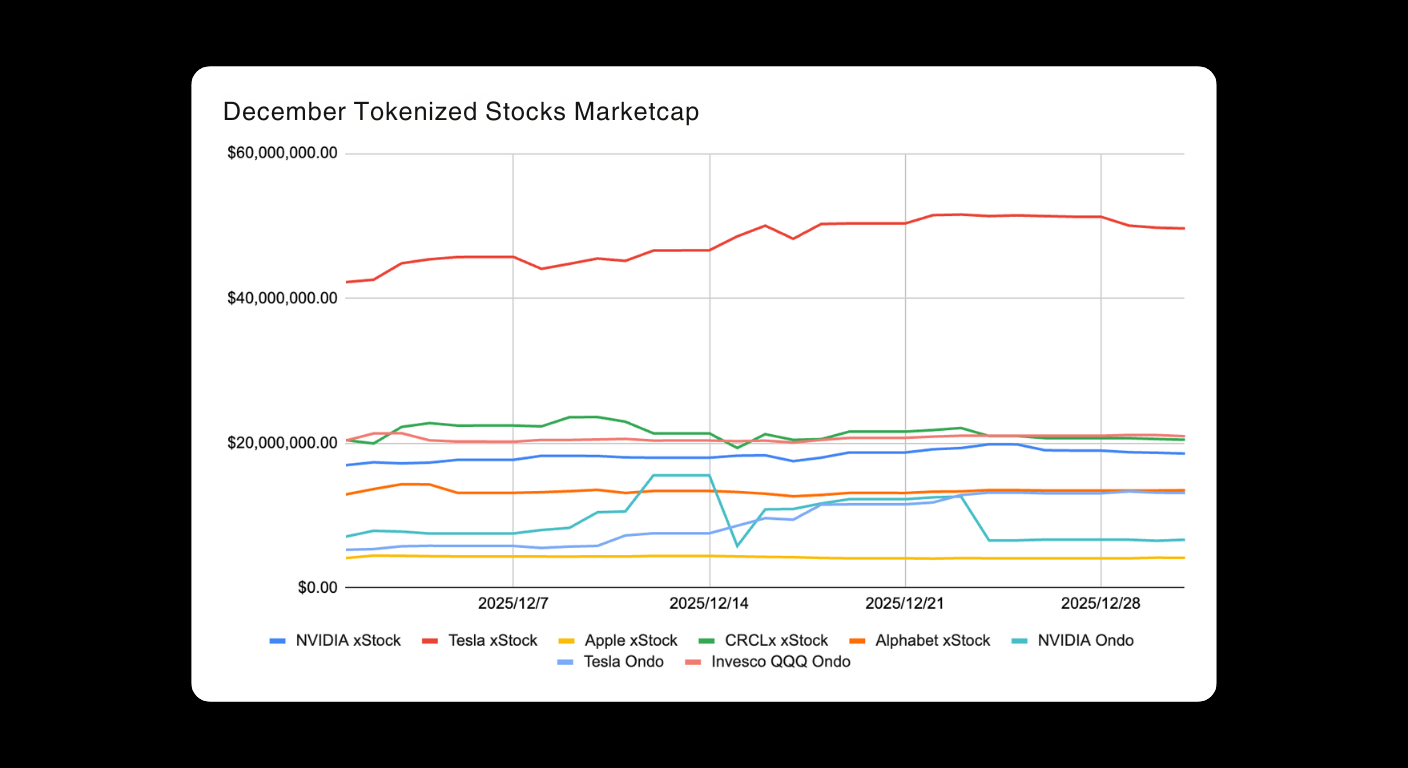

Tokenized equities became the fastest-growing subcategory by market size growth within RWA. Market size increased from about $291 million in January 2025 to about $738 million by December 2025, a full-year increase of 153%. On the issuer side, Backed Asset and Ondo Finance led the sector with issuance scale of about $391 million and $195 million, respectively.

Ethereum is expected to undergo two hard forks in 2026: Glamsterdam and Heze-Bogota. The Glamsterdam hard fork is projected for mid-2026. Key items include block access lists and native proposer-builder separation. EIP-7928 is designed to enable parallel processing within blocks, shifting Ethereum from a single-threaded execution model toward a multi-threaded approach, improving throughput and addressing read bottlenecks tied to fragmented database access. ePBS is intended to move builder and proposal workflows into the consensus layer, aiming to reduce MEV centralization risk and give validators more time to verify ZK proofs.

On scalability, Ethereum’s L1 gas limit is expected to rise meaningfully in 2026. Gary Schulte, a Besu client engineer, expects the gas limit to move quickly toward 100 million. Tomasz Stańczak, Executive Director at the Ethereum Foundation, has indicated that after ePBS is implemented, the gas limit could double to 200 million, and potentially reach 300 million by year end. In addition, the number of data blobs per block could increase to 72 or more, supporting Layer 2 systems that process hundreds of thousands of transactions per second. The Heze-Bogota hard fork expected toward the end of 2026 is set to introduce fork-choice enforced inclusion lists, aiming to strengthen censorship resistance by forcing inclusion of specific transactions.

In December, Uniswap’s proposal to activate the fee switch passed the final governance vote. After the governance timelock period, the Uniswap v2 and v3 fee switches are set to be enabled on mainnet, triggering UNI token burns. The proposal includes burning 100 million UNI from the Uniswap Foundation treasury and introduces protocol fee discounts and an auction mechanism designed to improve liquidity provider returns.

On December 28 at 4:30 a.m., Uniswap’s treasury completed the burn of 100 million UNI, valued at $596 million. Under the approved framework, future fees collected by Uniswap are also expected to be used for additional UNI burns.

On December 26, Meteora posted on X that DAMM V2 now supports market-cap-based trading fees. This feature is designed to reduce trading fees progressively as a project grows, supporting long-term sustainability and helping deter sniping behavior. Meteora added that creators, deployers, and launch platforms can now customize a market-cap-based fee curve to match each stage of a token’s lifecycle.

Meteora is a decentralized liquidity protocol in the Solana ecosystem focused on delivering efficient, low-slippage liquidity for long-tail assets and newly issued tokens. Its core product, DAMM, dynamically adjusts liquidity and fee mechanisms to address issues seen in traditional AMMs, including sniping during a token’s early trading phase. In recent years, Meteora has become one of Solana’s more important token issuance and liquidity infrastructure components.

According to official information, Tether released QVAC Genesis II, a synthetic educational dataset designed for AI pretraining. QVAC Genesis II adds 107 billion labeled tokens on top of Genesis I, bringing the total size of the public synthetic education dataset to 148 billion tokens. It covers 19 educational subject areas, significantly expanding the scale, depth, and reasoning quality of open AI training data.

The new version expands coverage into 10 additional domains, including chemistry, computer science, statistics, machine learning, astronomy, geography, econometrics, and electrical engineering. It also uses improved methods to regenerate university-level physics content.

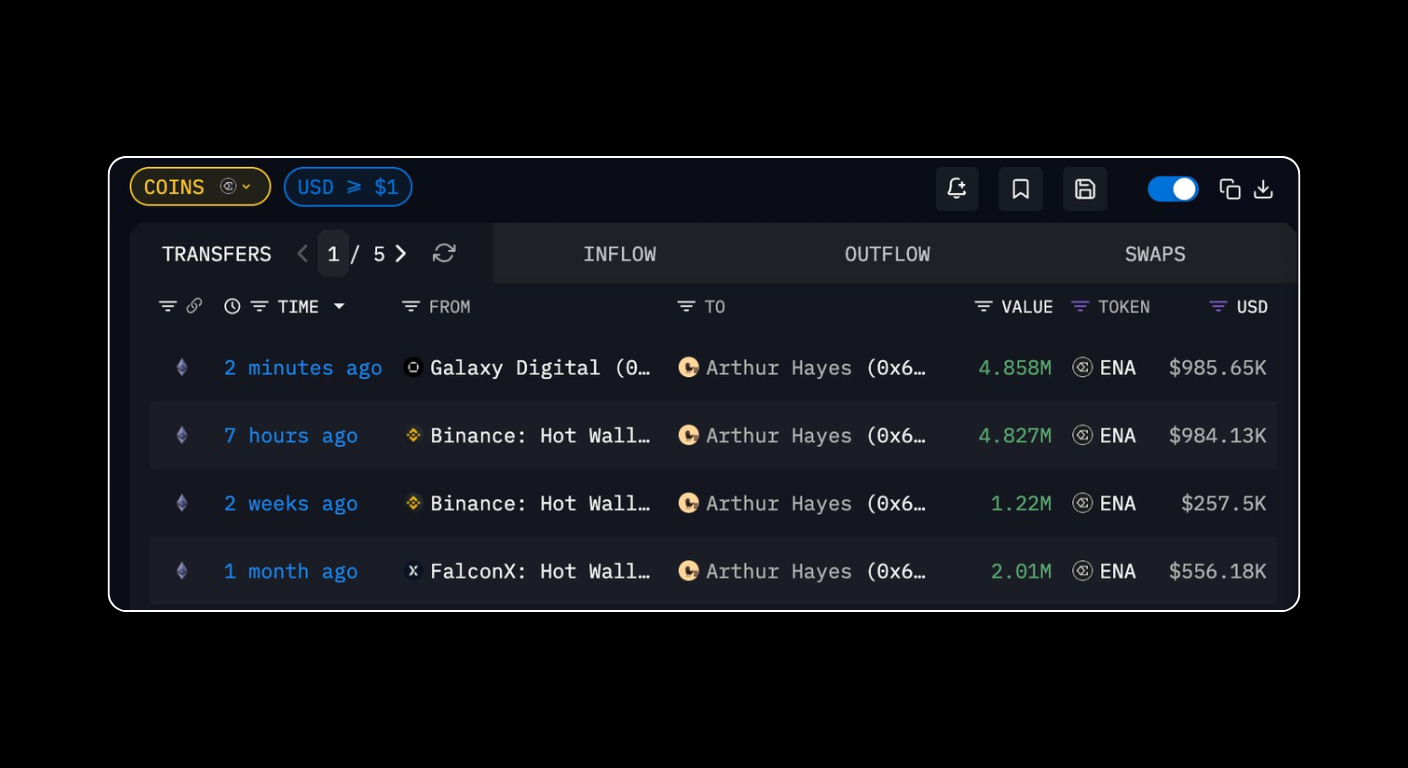

On-chain analyst Ai Yi reported that, on Dec 31, BitMEX co-founder Arthur Hayes (0x534…624) received approximately 4.85 million ENA (about $985,000) and 697,000 ETHFI (about $484,000) from Galaxy Digital. Since Dec 20, Hayes has accumulated a total of 10.905 million ENA, with a combined cost basis of about $2.227 million, at an average entry price of roughly $0.2042.

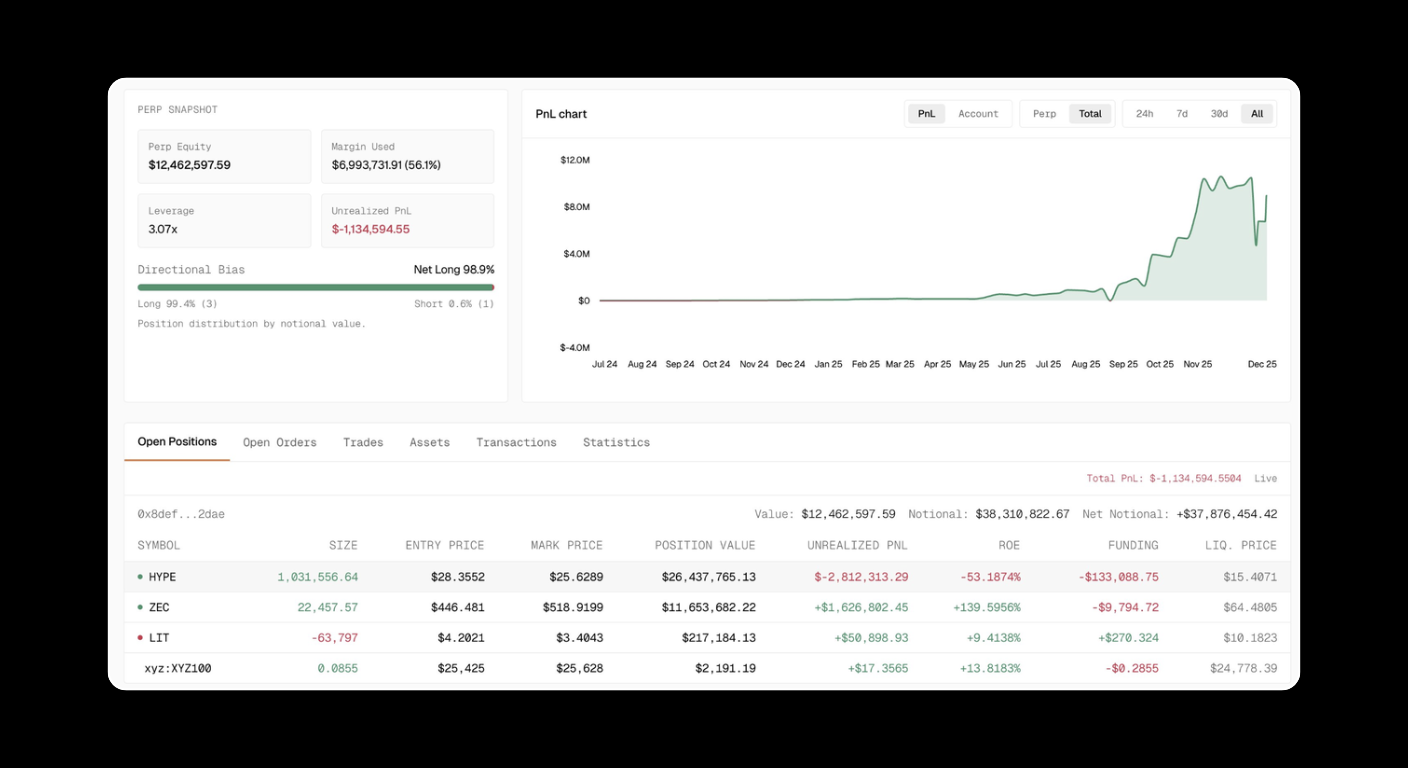

Ai Yi reported that the No. 2 ZEC perpetual position on Hyperliquid (address 0x8de…2dae) opened a 10x leveraged ZEC long using $4.4648 million in margin. The wallet currently holds 2,457.57 ZEC, with a position value of about $11.65 million. As ZEC broke above $510, the position’s unrealized profit reached about $1.62 million. The address also holds a HYPE long, with a more conservative position showing about $2.81 million in unrealized profit.

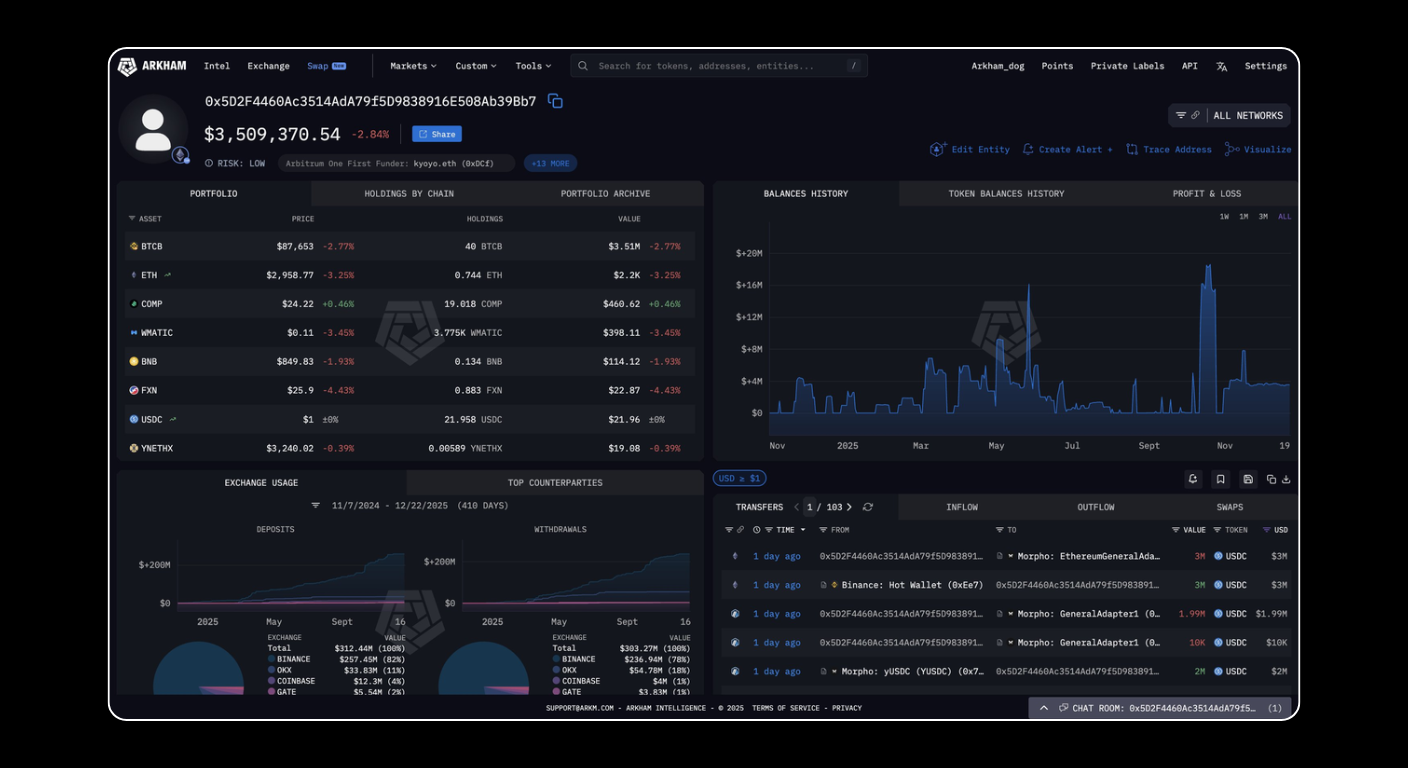

Arkham monitoring data shows that on Dec 23, address 0x5d2 (nicknamed the “sickle short whale”) generated about $12.5 million in realized PnL from a two-month Bitcoin short strategy, with no remaining unrealized profit at period end. The trading activity began in late October, with the short position size reaching about $63.6 million. The account also earned about $9.6 million in funding payments during the trade and continues to hold about $3.5 million worth of BTCB (Bitcoin on BNB Chain).

According to the latest Fed meeting minutes, the FOMC reached consensus at the December meeting but held detailed discussions on risks facing the U.S. economy. The minutes note that even some officials who supported a rate cut acknowledged the decision reflected a balancing of risks, and that they might not have supported leaving the target rate range unchanged. Some participants said that based on their economic projections, the decision at this meeting could imply keeping the target range unchanged for a period of time. The minutes also suggest that if inflation continues to decline as expected, most officials believe taking a further step would be appropriate. Overall, the minutes highlight internal divergence and underscore the difficulty of recent decision-making.

The UK plans to bring crypto assets under financial services regulation by October 2027. In December 2025, HM Treasury submitted to Parliament the Financial Services and Markets Act 2000 (Cryptoassets) Order 2025, which would formally bring activities such as operating trading venues, custody, and crypto lending and borrowing into the regulated perimeter. The FCA is expected to publish consultation papers detailing requirements, including disclosures, market abuse prevention, and capital and prudential standards. Separately, the UK government launched an independent review focused on how bringing crypto regulation into scope could affect domestic political and financial risks, with the report expected by March 2026.

Cryptonews reported that Japan is considering a 2026 tax reform plan that would cut crypto capital gains tax to a flat 20%. Japan currently applies progressive tax treatment that can reach 55%, among the highest globally. The proposal would move crypto gains into a separate 20% framework similar to equities and investment trusts. However, it would apply only to “specified cryptoassets” handled by companies registered under Japan’s Financial Instruments and Exchange Act. Major assets such as Bitcoin and Ethereum may qualify, but the business requirements remain unclear.

Hong Kong’s insurance regulator proposed new rules to guide insurance capital into crypto assets and infrastructure investment. A Dec 4 consultation document indicated the regulator is considering maintaining a 100% risk capital requirement for crypto assets, while infrastructure investment risk capital requirements would follow Hong Kong’s statutory capital standards. The regulator stated it completed a review of the risk capital regime this year, with the goal of supporting the insurance sector and broader economic development. Public consultation is expected to run from February to April next year, followed by submission for legislation. The proposal also addresses infrastructure investment and encourages insurers to invest in Hong Kong and mainland projects, including initiatives such as the Northern Metropolis, supported by potential tax incentives to align with government infrastructure plans.

In December, the crypto industry recorded 17 security incidents, with total losses of about $22.5 million, a sharp decline compared with October. One of the month’s key security stories involved risk in the Trust Wallet browser extension. According to SlowMist analysis, the incident stemmed from a malicious modification to Trust Wallet’s internal codebase (analytics service link) rather than a compromised third-party dependency. As of December 31, the incident was confirmed to have impacted 2,520 wallet addresses, with total losses estimated at about $8.5 million.

In addition, Unleash Protocol suffered an unauthorized contract upgrade, which was then used to maliciously transfer user assets. Estimated losses were about $3.9 million.

| Date | Project | Estimated Loss | Incident Summary |

| Dec 4 | USPD | $1.0M | USPD stated it was hit via on-chain exploit activity, resulting in about $1.0M in losses. The attacker minted tokens without authorization and drained liquidity. Users were urged to revoke all token approvals granted to the USPD contract. |

| Dec 14 | Aevo | $2.7M | Aevo stated that a vulnerability introduced during a smart contract update led to an attack on the Ribbon DOV vault on Dec 12, with losses of about $2.7M. |

| Dec 17 | Futureswap | $0.83M | SlowMist security monitoring detected suspicious activity linked to @futureswapx. Analysis indicated the attacker created a malicious proposal and used a flash loan to push governance voting, resulting in about $0.83M in losses. |

| Dec 27 | Flow | $3.9M | The Flow Foundation stated the attacker exploited a vulnerability in the Flow execution layer and moved about $3.9M in assets off-network before validators could complete coordinated shutdown actions. |

| Dec 26 | Trust Wallet | $8.5M | Trust Wallet confirmed security risk in browser extension version 2.68. The attacker tampered with the application’s own code and used a legitimate PostHog package to redirect analytics data to a malicious server. |

| Dec 30 | Unleash Protocol | $3.9M | Unleash Protocol experienced an unauthorized contract upgrade and malicious user-asset transfers. The attacker used control over multi-sig governance permissions to execute the upgrade, leading to theft and cross-chain transfers to external addresses. Confirmed losses were about $3.9M. |

Overall, the number of security incidents across the blockchain industry in 2025 remained elevated, but total loss size has shown a clear phase of compression from earlier peaks. Security risk is expanding beyond single-contract vulnerabilities into deeper, more systemic areas, including wallet endpoints, code supply chains, and multi-sig permission design. Multiple incidents suggest attackers increasingly exploit permission gaps inside legitimate processes rather than relying only on technical flaws. Going forward, security focus cannot stop at smart contract audits. It also needs full coverage across release pipelines, governance design, and user-side protection.

| Date | Event | Why it matters |

| Jan 5 | Global Web3 Ecosystem Innovation and Application Summit | Held at Cyberport in Hong Kong on Jan 5, 2026. The summit focuses on “ecosystem innovation” and “real-world applications,” bringing together global regulators to discuss blockchain compliance and industry use cases. |

| Jan 6 | CES 2026 (Web3 and blockchain track) | The world’s largest consumer tech show, covering frontier trends such as AI, IoT, and robotics. Blockchain use cases often surface in areas like digital identity and select consumer applications. |

| Jan 8 | Ethereum global developer discussion on the Heogota upgrade | Focused on Heogota upgrade technical details and consensus changes. Outcomes may influence Ethereum scalability, security, roadmap expectations, and developer adoption. |

| Jan 14 | Crypto Finance Conference | Covers the latest trends in digital asset markets, capital flows, and technical development. A key forum for Web3, DeFi, and blockchain investors, founders, and operators to share views and build connections. |

| Jan 19 | Web3 Hub Davos | A Web3-focused program held during the World Economic Forum in Davos, featuring invite-only talks and executive-level discussions on decentralized tech, digital assets, and the global economy. |

| Jan 22 | ECB releases minutes from its December monetary policy meeting | Provides insight into Eurozone policy direction and inflation views. Markets often use this to assess how shifts in European funding costs and risk appetite could influence crypto price action and volatility. |

| Jan 27 | FOMC meeting | A core macro catalyst for global liquidity and risk assets. In crypto, the decision often drives capital inflows and outflows. Hawkish signals can pressure risk assets, while a more dovish tone can support crypto in the short term. |

Entering 2026, the blockchain and crypto industry continues advancing across three parallel tracks: technology, regulation, and macro conditions. From Hong Kong’s global Web3 summit to CES 2026, Web3 is increasingly integrating into mainstream tech narratives. High-density developer discussions will keep attention on the Ethereum Heogota upgrade, shaping base-layer performance, developer confidence, and ecosystem direction. At the same time, global capital, market structure, and policy conversations are heating up at events like Crypto Finance Conference and Web3 Hub Davos. On the macro side, policy signals from the ECB and the Fed are still positioned to steer early-year crypto risk appetite and capital flows.

Looking back on December 2025, the crypto market closed the year with a mix of high-level consolidation and structural divergence. With no clear macro or policy catalyst, BTC remained range-bound, and leverage across derivatives stayed relatively restrained, keeping overall risk appetite neutral to slightly constructive. By contrast, ETH showed stronger resilience in both price behavior and allocation trends, with institutional positioning shifting further toward longer-term capital.

Meanwhile, key sub-sectors such as public chains, DEXs, RWAs, and prediction markets continued pushing product and mechanism innovation, building momentum for a new narrative cycle in 2026. As regulation becomes more defined and technical roadmaps continue to evolve, the market is moving from short-term trading toward a phase that places greater weight on fundamentals and medium-to-long-term value.

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. At Bitunix, we are committed to providing a transparent, compliant, and secure trading environment for every user. Our platform features a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, we prioritize user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium