The debate between Ethereum vs Bitcoin has raged for years, but in 2025, the question remains: Is Ethereum better than Bitcoin? While Bitcoin stands as digital gold, Ethereum has evolved into a flexible blockchain powering everything from decentralized finance (DeFi) to smart contracts.

But which one is the superior investment? Does Ethereum’s dynamic ecosystem outweigh Bitcoin’s finite supply and store of value appeal? And how do institutional investors view these two giants in today’s crypto market?

Let’s dive into a detailed 2025 comparison, exploring their key differences, investment potential, and future outlook.

Key Takeaways

- Ethereum and Bitcoin are fundamentally different. Bitcoin focuses on store of value, while Ethereum powers decentralized apps and smart contracts.

- Bitcoin is more stable; Ethereum is more innovative.

- Institutional investors now treat them as distinct asset classes, not rivals.

- Ethereum’s transition to Proof of Stake and continued upgrades enhance scalability and environmental sustainability.

- Bitcoin’s simplicity and security make it a safe-haven asset.

- Both are essential to the future of digital finance.

The Core of the Debate: Ethereum vs Bitcoin

Let’s begin where most debates do – purpose.

In 2008, amidst a global financial crisis, a mysterious figure named Satoshi Nakamoto published a whitepaper outlining a radical idea: a decentralized digital currency called Bitcoin. It was a revolution against centralized banks and traditional currencies, offering a peer-to-peer system free from any central authority. By 2009, Bitcoin was born, announced as digital gold due to its fixed supply of 21 million coins, designed to act as a reserve asset and hedge against inflation.

Fast forward to 2013, when a young programmer named Vitalik Buterin envisioned something even grander. Inspired by Bitcoin but eager to expand its possibilities, he proposed Ethereum, a flexible blockchain platform that not only supports a digital currency (Ether) but also enables smart contracts and decentralized applications (dApps). Launched in 2015, Ethereum quickly became the backbone of the Ethereum ecosystem, powering innovations like decentralized finance (DeFi) and non-fungible tokens (NFTs).

Think of Bitcoin as digital gold. Ethereum? A global decentralized computer. So, what’s the key difference between Ethereum and Bitcoin? Bitcoin focuses on value storage and monetary policy. Ethereum powers a programmable world of decentralized finance (DeFi), apps, and tokenized assets.

Bitcoin vs. Ethereum: A Technical Showdown

To understand the Ethereum vs. Bitcoin debate, we need to look under the hood at their underlying technology. Both rely on blockchain technology, a decentralized ledger that records transactions across a network of computers to verify transactions securely. However, their approaches and goals diverge significantly.

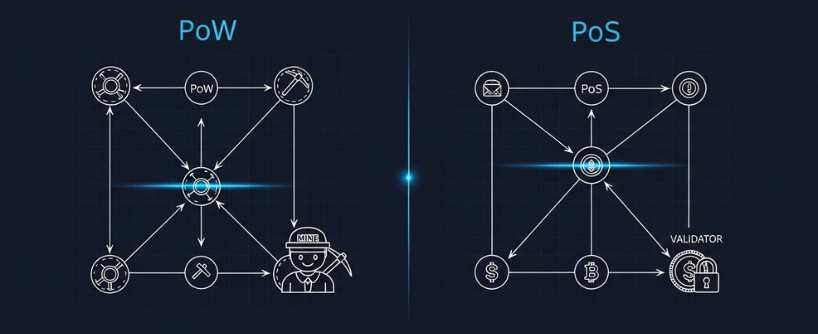

Bitcoin’s Simplicity: The Power of Proof of Work

Bitcoin relies on the Proof of Work (PoW) consensus mechanism, where miners compete to solve complex mathematical problems, allowing them to verify transactions and add new blocks to the Bitcoin blockchain. This process, while energy-intensive, ensures unparalleled security and decentralization. Transactions are added to the blockchain approximately every 10 minutes, making Bitcoin reliable but slower compared to modern payment systems like Visa, which processes thousands of transactions per second.

Bitcoin’s finite supply of 21 million coins is a cornerstone of its value proposition. This scarcity mimics precious metals like gold, earning it the nickname digital gold. Bitcoin’s emergence as a potential reserve asset is gaining traction, supported by institutional adoption and nation-level strategies. El Salvador continues to hold Bitcoin as part of its national treasury, and companies like MicroStrategy have treated it as a core treasury asset. In 2025, the U.S. government announced a Strategic Bitcoin Reserve funded by confiscated digital assets, signaling growing state-level interest, even if not yet reflected in traditional central bank reserves.

In fact, according to VanEck and BlackRock’s recent strategies, Bitcoin is now included in several mutual funds and ETFs, signaling confidence in its role as a digital currency reserve.

Ethereum’s Versatility: The Rise of Proof of Stake

Ethereum, on the other hand, is a programmable platform powered by the Ethereum Virtual Machine (EVM), which executes self-executing contracts and dApps. Unlike Bitcoin, Ethereum transitioned from PoW to a Proof of Stake (PoS) consensus mechanism with its 2022 Merge, making it more energy-efficient and scalable. In PoS, validators stake their Ether to verify transactions, reducing environmental impact and enabling faster transaction speeds – blocks are added roughly every 15 seconds.

Ethereum’s dynamic supply means there’s no hard cap like Bitcoin’s, but its supply can shrink or grow based on network usage. Recent upgrades, like the 2024 Dencun upgrade, have improved scalability and reduced transaction fees, boosting the adoption of layer-2 solutions and reinforcing Ethereum’s role as a core infrastructure for Web3 applications.

The Ethereum Foundation’s mission goes beyond currency; it’s about redefining the core infrastructure of the internet. It’s no wonder major investment companies registered under the Investment Company Act have started treating Ethereum not just as a coin, but as a platform.

Which blockchain’s approach is better? Bitcoin’s PoW offers unmatched security, while Ethereum’s PoS prioritizes sustainability and speed. The choice depends on what you value more in the crypto industry.

Use Cases: Bitcoin as Money, Ethereum as a Platform

Let’s explore how each cryptocurrency serves its users.

Bitcoin: The Store of Value

Bitcoin was designed as a digital currency to facilitate peer-to-peer transactions without intermediaries. Its primary use case is as a store of value, akin to gold, making it a hedge against inflation in global financial markets. With a market capitalization of $2.27 trillion as of August 2025, Bitcoin dominates the cryptocurrency market.

Bitcoin’s fixed supply and growing adoption by institutional investors, evidenced by the approval of spot Bitcoin ETFs in 2024, have solidified its status as a reserve asset. Tools like the Lightning Network have also enhanced its scalability, enabling faster, low-cost transactions for everyday use, such as cross-border payments or remittances in regions with unstable economies.

However, Bitcoin’s transaction speed remains a limitation, processing only about seven transactions per second, making it less practical for microtransactions compared to traditional payment systems. Still, its simplicity and widespread acceptance make it a cornerstone of crypto adoption.

Ethereum: The Engine of Innovation

Ethereum, with a market cap of $437.28 billion (August 6, 2025), is the second-largest cryptocurrency and the foundation of the Ethereum ecosystem. It’s smart contracts enable a wide range of applications, from decentralized finance platforms like Uniswap to NFT marketplaces and blockchain-based gaming. Ether (ETH) is used to pay for these transactions, fueling the network’s operations.

Ethereum’s versatility extends to tokenized assets, such as stablecoins (e.g., USDC) and tokenized real-world assets like bonds, which institutions are increasingly exploring. The Ethereum Foundation and its vast developer community continuously drive technical improvements, positioning Ethereum as a leader in decentralized applications and Web3 infrastructure.

But Ethereum isn’t without challenges. Its transaction fees can be higher than Bitcoin’s due to the complexity of smart contracts, and its dynamic supply raises concerns about potential inflation. Despite these hurdles, Ethereum’s ability to enable smart contracts and support a vibrant ecosystem makes it a powerhouse in the crypto industry.

Which use case resonates with you? Are you drawn to Bitcoin’s stability or Ethereum’s innovation? The answer could shape your investment decisions.

Ethereum vs Bitcoin Investment: Which is Better in 2025?

Let’s talk money. And more importantly, investment strategy. In 2024, Bitcoin soared from $44,162 (start of the year) to a peak of $103,332 on December 4th, 2024, driven by institutional interest and its narrative as a hedge against inflation. Ethereum, while not reaching Bitcoin’s heights, rallied impressively, with analysts predicting a potential climb to $4,000 if it breaks the $3,000 resistance.

Choosing between Ethereum and Bitcoin isn’t just about technology; it’s about your investment objectives. If you’re looking for:

- Stability, long-term preservation of value, and a hedge against global market volatility → Bitcoin may be your go-to.

- Growth, exposure to innovation, and participation in the evolving crypto economy → Ethereum offers more upside.

But here’s the twist in 2025: You no longer have to choose. In today’s maturing cryptocurrency market, many portfolios include both Bitcoin and Ethereum. Financial advisors, mutual funds, and hedge funds are integrating crypto exposure through tokenized portfolios and even retirement plans.

- Bitcoin is seen as a macro-hedge, a replacement or complement to gold in uncertain global markets.

- Ethereum is seen as a growth asset, a bet on the future of decentralized applications and digital ownership.

Both assets are now held by major investment companies that’ve adapted to meet regulatory requirements around digital currency exposure.

Key Differences: Bitcoin vs Ethereum

| Feature | Bitcoin | Ethereum |

| Launch Year | 2009 | 2015 |

| Primary Purpose | Digital money/store of value | Smart contracts / dApps platform |

| Consensus Mechanism | Proof of Work (PoW) | Proof of Stake (PoS) |

| Supply | Fixed (21 million) | Dynamic (burning & minting mechanisms) |

| Speed | ~7 TPS | 15-45+ TPS (and scaling upgrades) |

| Blockchain Use | Currency transfers | Programmable apps + DeFi |

| Energy Use | High | Reduced post-Merge |

| Institutional Interest | High as digital gold | Growing in DeFi and app infrastructure |

| Regulation | Treated as a commodity | In flux — tech platform considerations |

What About Regulation in 2025?

Regulators in 2025 are clearer about how they view them:

- Bitcoin is now widely treated as a commodity, governed under frameworks like the Commodity Exchange Act.

- Ethereum operates in a more nuanced space, part utility platform, part financial instrument, depending on how it’s used.

Both are subject to tax implications, with investors urged to seek tax advice and consider the same regulatory requirements as traditional asset classes.

The Future: Where Do Bitcoin and Ethereum Stand?

Looking ahead, both Bitcoin and Ethereum blockchains are poised to shape global markets. Bitcoin’s finite supply and growing adoption as a reserve asset suggest it will remain a cornerstone of the crypto market. Its consensus mechanism ensures security, but its transaction speed may limit its use as digital money unless solutions like the Lightning Network gain traction.

Ethereum’s future events are equally promising. Its Ethereum Virtual Machine and smart contracts position it as the core infrastructure for DeFi, NFTs, and Web3. The Ethereum Foundation continues to drive innovation, with upgrades like sharding expected to enhance scalability further. Posts on X suggest Ethereum could see “orders of magnitude” value increases as Wall Street embraces DeFi.

To sum up:

- Ethereum’s upgrades like Danksharding and further scaling solutions may finally make it accessible to billions.

- Bitcoin’s potential integration into central bank reserves could mark a new era of adoption.

- Tokenized assets on both chains might revolutionize everything from stock trading to real estate.

But the crypto market is unpredictable. Future events like regulatory changes or technological breakthroughs could sway the balance. Bitcoin stands as a symbol of financial independence, while Ethereum powers a decentralized internet. Both have attracted significant attention, but neither is without risks.

Conclusion: Is Ethereum Better Than Bitcoin?

It’s not a matter of better, but different purposes.

Bitcoin is digital gold – a hedge, a sanctuary, a stable force in turbulent markets. Ethereum is a platform for innovation, a canvas for reimagining how finance, law, and even art can work.

In your investment decisions, you’ll need to weigh what matters more: stability or innovation, scarcity or flexibility, store of value or world computer.

But in truth, both Bitcoin and Ethereum are winning in 2025. They offer distinct paths forward. And in a crypto market increasingly shaped by choice, freedom, and decentralization, that’s exactly the point.

Want to explore more blockchain comparisons? Check out our in-depth Solana vs Ethereum breakdown.

FAQs

What is the difference between the Bitcoin and Ethereum networks?

The Bitcoin network is built for secure, peer-to-peer value transfers and is often called digital gold. The Ethereum network, however, was designed for programmability, allowing developers to build smart contracts and decentralized apps.

How do Bitcoin and Ethereum validate transactions?

Bitcoin uses Proof of Work, requiring miners to secure the network. Ethereum transitioned to Proof of Stake, improving transaction speed, scalability, and energy efficiency.

What types of digital assets can Ethereum enable?

Ethereum enables a wide range of digital assets, including tokens for DeFi, NFTs, and tokenized real-world assets, thanks to its flexible, programmable blockchain.

Why does Ethereum offer distinct advantages?

Ethereum offers distinct advantages through its support for smart contracts, which enable secure, automated processes without intermediaries, ideal for decentralized finance and digital applications.

Do Ethereum and Bitcoin share any similarities?

Yes, Ethereum and Bitcoin share a commitment to decentralization and innovation in the digital assets space, but they serve very different purposes within the crypto industry.

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.

Leave a Reply