Perpetual futures are the most widely traded derivatives in the cryptocurrency market. Their design allows traders to hold positions indefinitely, but the unique feature that makes them different from traditional futures is the funding rate mechanism.

Funding rates can be either positive or negative, depending on market conditions. For hedgers, this mechanism directly affects the profitability of their strategies. Understanding how funding rates work and how they influence long and short positions is essential for effective risk management.

This article explores positive and negative funding rates, their impact on hedging profitability, and how traders on Bitunix can optimize their strategies around them.

What Are Funding Rates?

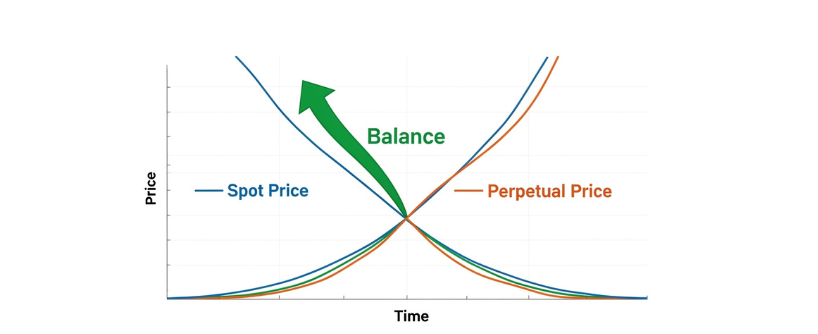

Funding rates are periodic payments exchanged between long and short traders in perpetual futures contracts. They are designed to keep the perpetual contract price close to the spot price.

- Positive funding rate: Long traders pay short traders.

- Negative funding rate: Short traders pay long traders.

On most exchanges, including Bitunix, funding is paid every 8 hours.

Why Do Funding Rates Exist?

Unlike traditional futures, perpetual contracts have no expiration date. Without settlement, contract prices could deviate significantly from spot prices. Funding rates solve this problem by incentivizing traders to restore balance.

- If perpetual prices trade above spot, funding turns positive. This discourages longs and rewards shorts.

- If perpetual prices trade below spot, funding turns negative. This discourages shorts and rewards longs.

Positive Funding Rates Explained

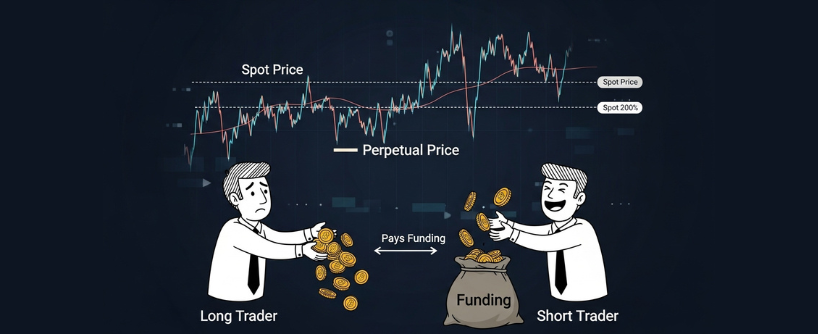

When the market is bullish, demand for long positions usually exceeds demand for shorts. This pushes the perpetual price above the spot price.

- In this case, funding rates become positive.

- Long traders pay funding to short traders.

- Shorts benefit by receiving payments, making short hedges more profitable.

Example

- Bitcoin spot: $40,000

- Perpetual price: $40,200

- Funding rate: +0.02%

- A trader shorting $100,000 worth of BTC perpetual futures would earn $20 in funding payments every 8 hours.

Negative Funding Rates Explained

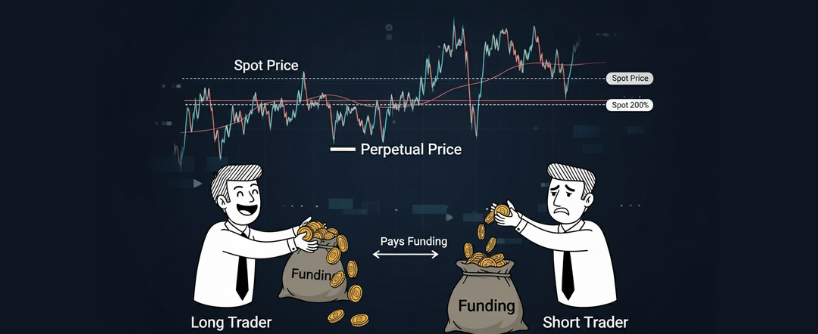

When the market is bearish, demand for short positions exceeds demand for longs. This pushes the perpetual price below the spot price.

- In this case, funding rates become negative.

- Short traders pay funding to long traders.

- Long hedges become more profitable because traders receive payments.

Example

- Ethereum spot: $3,000

- Perpetual price: $2,950

- Funding rate: -0.01%

- A trader long $50,000 worth of ETH perpetual futures would receive $5 in funding every 8 hours.

Impact on Hedging Strategies

Short Hedge and Positive Funding

- A Bitcoin holder using a short hedge during bullish conditions benefits from positive funding.

- The hedge not only protects the portfolio from declines but also generates income from funding.

Long Hedge and Negative Funding

- A stablecoin holder using a long hedge during bearish conditions benefits from negative funding.

- The hedge provides upside exposure and generates additional income through funding payments.

Neutral Impact

- In sideways markets, funding rates tend to stay close to zero, minimizing impact on hedging profitability.

Funding Rate Volatility

Funding rates are not fixed and can change rapidly:

- During extreme bull runs, positive funding can reach several percent per day.

- During sharp sell-offs, negative funding can persist for extended periods.

Traders must monitor funding closely, as it can turn a hedge into a profitable or costly position.

Benefits of Understanding Funding Rates

- Optimized hedging: Choose long or short hedges based on expected funding conditions.

- Income generation: Earn funding payments while maintaining portfolio protection.

- Market sentiment gauge: Funding rates reflect trader positioning and can signal potential reversals.

Risks of Funding Rates

- Costs of long-term hedging: Positive funding can make long hedges expensive over time.

- Unexpected shifts: Sudden market sentiment changes can flip funding from positive to negative.

- Funding arbitrage risks: Some traders attempt to exploit funding but face liquidity and volatility risks.

Real-World Examples

- Bitcoin bull market 2021: Positive funding rates surged as traders piled into longs. Short hedges became highly profitable due to funding payments.

- Crypto bear market 2022: Negative funding dominated as shorts outnumbered longs. Long hedges not only provided exposure but also generated extra income.

- Altcoin volatility 2023: Funding flipped frequently, rewarding traders who actively monitored and adjusted hedge positions.

How Bitunix Helps Traders Manage Funding Rates

Bitunix provides tools that help traders monitor and act on funding rates effectively:

- Transparent funding rate display: Funding rates are updated in real time on every perpetual contract.

- Futures calculators: Estimate potential funding costs or income before opening a position.

- Customizable leverage: Control exposure to balance funding income with liquidation risk.

- Advanced order types: Automate hedge management with stop and conditional orders.

- Copy trading: Follow professionals who actively manage funding rate opportunities.

- Mobile app: Track funding rates and adjust positions on the go.

With these features, Bitunix ensures traders can optimize hedging profitability under both positive and negative funding conditions.

FAQ

Do funding rates always favor one side?

No. Funding rates shift based on market conditions. Longs pay shorts during bullish conditions, and shorts pay longs during bearish conditions.

How often are funding payments made on Bitunix?

Every 8 hours, funding is exchanged between long and short traders.

Can funding rates make hedges profitable even without price movement?

Yes. Receiving funding payments can turn a hedge into a net positive position even if the price does not change.

Are funding rates predictable?

Funding rates are influenced by supply and demand. While not fully predictable, trends can often be anticipated during strong bullish or bearish phases.

How does Bitunix help traders manage funding risks?

Bitunix provides real-time funding data, futures calculators, leverage control, and automated order types to manage exposure effectively.

Conclusion

Funding rates are one of the most important mechanics in perpetual futures. Positive rates reward shorts, while negative rates reward longs. For hedgers, funding can significantly impact profitability, turning risk management strategies into income-generating opportunities.

By understanding funding rate dynamics, traders can optimize hedge positions for both bullish and bearish conditions. On Bitunix, transparent funding rate displays, calculators, leverage customization, and futures copy trading make it easier to manage funding risks and maximize profitability.

Mastering the balance between positive and negative funding rates is essential for traders who want to turn perpetual futures hedging into a strategic advantage.

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.