Bitcoin is king, but the altcoin market offers thousands of chances to innovate and grow. Ready to explore? In 2025, traders look beyond BTC for a few core reasons: ecosystem expansion with new L1s and scaling solutions, a maturing DeFi stack plus tokens tied to AI and real-world assets, capital rotation through liquidity cycles, and the search for specific utility such as fast payments, privacy, gaming, infrastructure, and data.

The idea is that while Bitcoin preserves value and liquidity, altcoins compete on utility and how quickly teams ship useful features, creating room for big wins even with small positions. Diversifying crypto holdings this year is not a fad. It is risk management with upside ambition. Serious projects show public roadmaps, measurable user bases, and tokenomics that align incentives.

At the same time, volatility, smart contract risks, and uneven liquidity demand a methodical approach. This guide walks you end-to-end through how to research and filter projects, how to read utility and supply, and how to make your first purchase safely on a trusted platform like Bitunix.

By the end, you will have practical criteria to spot opportunities and execute with discipline, from the first deposit to a market or limit order, with a clear view of costs, risks, and best practices. If your question is how to buy altcoins safely in 2025, you are in the right place.

[ez-toc]

What Are Altcoins?

An altcoin is any cryptocurrency that is not Bitcoin. That is the simple definition, but there are many categories.

- Layer 1s (L1) are base blockchains that compete on speed, cost, and security, for example, Ethereum and Solana.

- Meme coins are driven by narrative and community, for example, Dogecoin, and tend to be highly speculative.

- DeFi tokens power decentralized finance protocols such as DEXs, lending, derivatives, and oracles, for example, UNI, AAVE, and LINK.

- GameFi and the metaverse include tokens tied to games, NFTs, and virtual experiences, for example, AXS and SAND.

Altcoins generally carry higher risk, including volatility, technical failures, thin liquidity, and execution risk on the roadmap. That is also why they can offer higher potential returns when they combine a real product, user traction, and well-designed incentives. The key is to evaluate utility, tokenomics, security, and adoption before you click buy.

Step 1: How to Research Altcoins Before You Buy

It all starts with the whitepaper. Read with a focus on technology to check consensus, throughput, EVM compatibility, and audits; use case to see who uses it, why now, and what clear edge it has over competitors; and tokenomics to verify total and max supply, emissions, unlock schedules, and the token’s real utility. If there is no clarity across those three layers, treat it as a warning sign.

Look up the developers on GitHub and LinkedIn. Check delivery history, open-source contributions, and prior projects. Founders with a consistent shipping record and relevant advisors reduce execution risk. It does not eliminate it, but it helps.

Organic activity matters too. Review the cadence of commits, discussions in Discord and Telegram, developer updates, AMAs, and grants. On X, separate noise from signal. Check real engagement metrics, not just follower counts. Strong communities support liquidity and product stickiness.

Applying the checklist to a live project (GhostwareOS):

- Whitepaper & Technology: GHOST has a full whitepaper outlining its plan to serve as a privacy layer for Solana, with the $GHOST (SPL) token used for routing and incentives. The materials describe the stack and how it aims to enable default confidential payments while preserving network performance. The tokenomics section details total and max supply, emissions, the unlock schedule, and the token’s real utility across the ecosystem.

- Use Case & Differentiators: Focus on private payments and confidential transactions within the Solana ecosystem, with native integration to the network’s throughput and a user experience similar to normal usage (low latency and costs). The edge is default transactional privacy on a high-performance L1.

- Team & Track Record: The presence of advisors who are relevant to the Solana ecosystem reduces execution risk.

- Organic Activity & Community: There is an active community, which tends to support liquidity and product stickiness.

For market cap and tokenomics, value projects by stage. Track FDV and circulating market cap, vesting schedules, wallet concentration, and market-maker incentives. A simple reference formula is FDV = price × total supply. Circulating market cap uses the circulating supply. Prefer predictable emission curves and token utility tied to protocol usage.

Within the Bitunix ecosystem, you can follow project spotlights, market overviews, and pair pages such as BTC/USDT, ETH/USDT, and SOL/USDT to see order book depth, history, and fees in real time. These materials help filter short-term narratives and execute your thesis with discipline, which is essential if your question is how to buy altcoins responsibly.

Step 2: Choosing a Secure and Reliable Crypto Exchange

There is a lot to evaluate before trusting a platform with your money. Early security signals include a verifiable proof of reserves, cold storage, strong account protection such as 2FA, and a Protection Fund. Competitive maker and taker fees and clear deposit and withdrawal costs also matter.

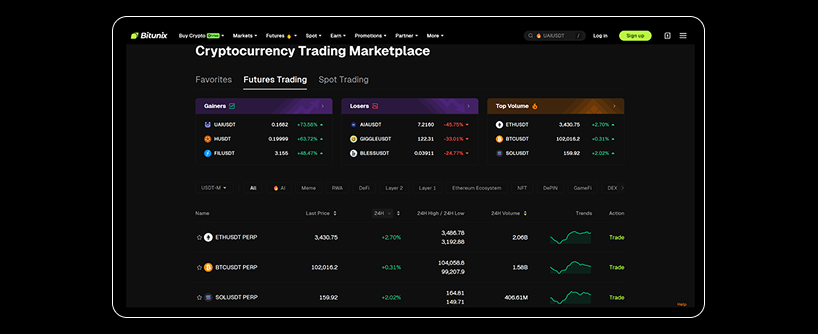

For listings, you want breadth across altcoins and pairs in both spot and futures, beyond the most famous names. The experience should be smooth, with a stable app, clean interface, and One Chart that brings orders, SL, TP, and P&L into one place. If something goes wrong, support should offer 24/7 channels and a straightforward help center.

Why Bitunix Is Great for Altcoins

Bitunix offers hundreds of spot and derivatives markets, including the most-traded pairs. You will find everything from L1s to DeFi and GameFi on a single crypto exchange. Bitunix provides live Proof of Reserves and a Protection Fund to reinforce user trust. Its fee structure is competitive for spot and crypto futures trading, benefiting dollar-cost averaging and frequent rotation.

Onboarding is simple, with quick sign-up, user-friendly verification required only for fiat, and an intuitive layout with One Chart that serves both beginners and advanced traders.

With hundreds of altcoins available, Bitunix is your gateway to the broader crypto market. Open your account today and turn your research into execution with safety and efficiency. The first practical step is knowing how to buy altcoins in 2025.

Step 3: How to Buy Altcoins on Bitunix (Step-by-Step)

With an intuitive interface, buying ETH and other altcoins on Bitunix is straightforward.

Create and Verify Your Bitunix Account

Go to the website or app, tap Sign Up, enter your email or phone, and create a strong password (enable 2FA right after). Verification is quick. If you choose a fiat on-ramp, some additional KYC steps may be required. For crypto-to-crypto, you can start exploring the Bitunix crypto exchange app right away.

Deposit Funds

You have two ways to make a deposit:

- Fiat → Crypto: choose your preferred method and buy USDT in seconds. When available in your country, you can buy crypto with a debit card or credit card to convert local currency into stablecoins.

- Crypto Deposit: Transfer crypto from another wallet or exchange to your Bitunix Spot Wallet, then use it directly to buy altcoins on spot markets (for example, deposit USDT, BTC, or ETH and trade the relevant pairs).

Find Your Altcoin

In Markets or via the search bar, type the ticker (for example, SOL, ARB, AVAX). Open the pair page, such as SOL/USDT or ARB/USDT, and review the order book, price history, and the asset info tab. If this is your first purchase, use the Spot tab. For tracking, pin your favorites.

Place Your Order

A market order executes at the current market price, ideal for quick entries on liquid pairs. With a limit order, you set the price and the order waits in the book until filled. In both cases, review the estimated fee and final quantity before confirming.

Tip: If you plan to trade crypto futures later, get familiar with One Chart now. The panel puts the chart, order ticket, positions, P&L, and risk metrics in one view. Start with crypto spot trading first.

Secure Your Altcoins

After execution, your coins settle in your Spot Wallet. You can keep them on the exchange for convenience (trading, staking where available, or swapping between pairs) or transfer to a private wallet (hardware or software) for long-term holding. If you want to realize gains in local currency, Bitunix streamlines crypto-to-fiat through the routes supported in your region.

Popular Altcoins to Watch in 2025 (Examples)

The crypto market is vast, and there are many paths to explore. Some segments are in focus in 2025 and deserve attention.

Layer-1 Giants – Ethereum (ETH), Solana (SOL), and Avalanche (AVAX) offer high throughput and strong developer bases. They are daily liquidity benchmarks and often the first exposures beyond BTC.

Promising Layer-2s – Arbitrum (ARB) and Polygon (MATIC) focus on scalability, lower fees, and integration with popular dApps. They help you monitor where activity flows.

DeFi Leaders – Tokens of established protocols, such as UNI, AAVE, and LINK, often have clear utilities (governance, staking, oracle fees) and liquid pairs. If your thesis includes yield, understand smart contract risk and volatility before you buy and sell crypto in these segments.

This is not financial advice. Always DYOR: evaluate utility, tokenomics, liquidity, and protocol risks before investing.

Common Mistakes to Avoid When Buying Altcoins

FOMO (Fear of Missing Out). Jumping in at the top of the hype without validating the utility, roadmap, and liquidity. Use a checklist: whitepaper, team, tokenomics, market cap, and FDV, and a liquid trading pair.

Ignoring Tokenomics. Not understanding total supply, unlocks, and inflation skews your target price. Check the vesting calendar, wallet allocations, and the token’s real utility.

Weak Security. Reused passwords, 2FA turned off, and unprotected email leave your account exposed. Enable 2FA, use a password manager, and switch on login alerts.

Betting More Than You Can Afford to Lose. The golden rule is to define position size, a mental stop, and your time horizon. Diversify across blue chips and targeted theses, and always keep cash for the unexpected.

Why Trade With Leverage on Bitunix?

- Fast registration and friendly verification get you into the market in minutes.

- Bitunix operates with global compliance and a Protection Fund, providing a trading environment that truly puts users first.

- One Chart unifies orders, P&L, SL/TP, and risk in one place, ideal for beginners, with leading liquidity to execute strategies efficiently.

Try it in practice. Create your Bitunix account today and see how the platform streamlines your journey in crypto derivatives.

FAQs

What Is the Easiest Way to Buy Altcoins?

Create an account, deposit USDT or fiat, search for the pair (for example, SOL/USDT), and place a market order. On mobile, the best app to buy crypto simplifies everything in a few taps, which is why many start with the Bitunix app.

Can I Buy Altcoins With a Credit Card on Bitunix?

Yes, when available in your region. You can buy crypto with a credit card or debit card to acquire USDT, then convert it to your target altcoin on the corresponding spot pair.

What Is the Difference Between an Altcoin and a Token?

Altcoin refers to any cryptocurrency that is not BTC. Token usually describes assets issued on an existing network (for example, ERC-20 on Ethereum). In practice, every token can be an altcoin, but not every altcoin is a token, Layer 1 blockchains have a native coin.

How Many Altcoins Should I Have in My Portfolio?

It depends on your risk tolerance and account size. Many prefer a BTC/ETH core plus 3 to 7 thematic bets (L1, DeFi, GameFi). Start small and scale positions as your thesis proves out.

Which Altcoins Have the Most Potential for 2025?

Projects with real utility, active developer bases, and liquidity tend to stand out (for example, ETH, SOL, AVAX, L2s like ARB/MATIC, and DeFi blue chips like UNI/AAVE/LINK). Use Bitunix’s where to buy crypto to locate liquid pairs and execute with predictable costs.

How Do I Know If an Altcoin Is a Scam?

Check for a clear whitepaper, a verifiable team, tokenomics without abusive emissions, public audits, an active community, and consistent liquidity. If transparency is missing, avoid it.

What Are the Fees for Buying Altcoins on Bitunix?

Bitunix uses a competitive maker and taker structure. Your exact rate depends on your tier and volume. Review the crypto exchange fees table and also account for withdrawal and network costs before trading.

Do I Need To Buy a Whole Coin, or Can I Buy a Fraction?

You can buy fractions. On pairs like BTC/USDT or ETH/USDT, enter the amount in USDT you want to invest, and the platform calculates the fraction automatically. This is useful for smaller tickets.

How Do I Sell My Altcoins on Bitunix?

Open the same pair (for example, XRP/USDT) and select Sell. Use a market order for immediate exit or a limit order to set your price. If you want to convert to local currency, use the supported sell crypto routes in your region.

Where Should I Store My Altcoins After Buying Them?

For convenience, trading and rotations, the exchange Spot Wallet is practical. For long-term holding, consider a private wallet (hardware or software). If you plan to trade actively, the Bitunix ecosystem as a crypto exchange streamlines execution and tracking.

Glossary

Altcoin: Any cryptocurrency that isn’t Bitcoin; spans L1s, L2s, DeFi, memecoins, GameFi, infrastructure, data, and more.

Layer-1 (L1): A base blockchain (e.g., Ethereum, Solana, Avalanche) that finalizes its own transactions and secures the network.

Layer-2 (L2): A scaling network that processes transactions off-chain (often rollups) and settles to an L1 for security and finality.

DeFi (Decentralized Finance): On-chain financial apps such as DEXs, lending, derivatives, and oracles operating without intermediaries.

DEX (Decentralized Exchange): A permissionless venue to swap tokens on-chain; can be AMM-based or order-book-based.

AMM (Automated Market Maker): A DEX design that prices trades from liquidity pools instead of matching individual bids and asks.

Order Book: A list of live bids and asks; used by order-book DEXs and centralized exchanges to match buyers and sellers.

Market Order: An order that fills immediately at the best available price; prioritizes execution over price.

Limit Order: An order set at a specific price; fills only when the market reaches that level; prioritizes price over immediate execution.

Maker/Taker Fees: Exchange fees charged to orders that add liquidity (maker) or remove liquidity (taker) from the book.

Spread: The gap between the best bid and best ask; tighter spreads usually indicate deeper liquidity.

Slippage: The difference between the expected execution price and the actual fill price, often higher in thin markets or large orders.

Tokenomics: The economic design of a token, utility, emissions, supply caps, vesting, unlocks, and incentive alignment.

Circulating Market Cap: Price × circulating supply; a snapshot of current float valuation.

FDV (Fully Diluted Valuation): Price × total (max) supply; estimates valuation assuming all tokens are issued.

Emissions / Inflation: The rate at which new tokens are created and distributed to participants (e.g., validators, liquidity providers).

Vesting / Unlock Schedule: Timetable that releases locked tokens (team, investors, ecosystem) into circulation; a key supply overhang risk.

Wallet Concentration: Share of supply held by large addresses; higher concentration can increase volatility and governance risk.

Whitepaper: A project’s technical and economic blueprint; should detail the problem, architecture, roadmap, audits, and token utility.

Roadmap: A public plan of milestones and deliveries; helps assess execution risk and time-to-utility.

Audit (Smart Contracts): An independent code review for vulnerabilities and correctness; multiple, recent audits reduce risk but don’t eliminate it.

EVM Compatibility: Ability for a chain or L2 to run Ethereum-style smart contracts and tooling, easing developer onboarding.

Stablecoin (e.g., USDT, USDC): A crypto asset designed to track a fiat currency, commonly used as a base pair and settlement asset.

On-Ramp / Off-Ramp: Services that convert between fiat and crypto; on-ramps help you buy, off-ramps help you cash out.

2FA (Two-Factor Authentication): An extra login step (app or hardware code) that protects your account beyond passwords.

Hot Wallet vs. Cold Wallet: Hot wallets are connected to the internet (convenient, higher risk); cold wallets are offline (safer for long-term storage).

Hardware Wallet: A physical device that stores private keys offline; reduces the risk of remote compromise.

Custody: Where and how your assets are held, self-custody (you hold keys) or custodial (a third party holds keys).

DYOR (Do Your Own Research): The standard reminder to verify claims, repos, audits, and on-chain data before investing.

FOMO / FUD: Fear of Missing Out and Fear, Uncertainty, and Doubt, emotional drivers that can distort decisions.

DCA (Dollar-Cost Averaging): Investing fixed amounts at intervals to reduce timing risk in volatile markets.

Perpetual Futures (Perps): Derivatives with no expiry used to gain long/short exposure; prices align to spot via funding payments.

Funding Rate: Periodic payments between longs and shorts in perps; positive funding means longs pay shorts, and vice versa.

Leverage: Borrowed exposure that magnifies gains and losses; requires strict risk controls and position sizing.

Isolated vs. Cross Margin: Isolated confines risk to one position’s margin; cross shares collateral across positions in the account.

PnL / TP / SL: Profit and Loss; Take-Profit orders to lock gains; Stop-Loss orders to cap downside.

Gas Fees: Network fees for executing transactions or smart-contract calls; vary by chain and congestion.

Bridges: Tools to move assets across chains; carry additional trust and technical risk.

Liquidity Mining / Staking Rewards: Token incentives for providing liquidity or securing networks; yields must be weighed against smart-contract and market risk.

Narratives / Rotations: Thematic flows (e.g., L2s, AI, RWAs, gaming) that drive capital rotation across sectors and tickers.

Proof-of-Stake (PoS): Consensus where validators stake native tokens to secure the network and earn rewards; misbehavior can be penalized (slashing).

Airdrop: Free token distribution to targeted users (e.g., early adopters); may create supply volatility after claim windows.

Conclusion: Building Your Altcoin Portfolio With Confidence

Buying altcoins methodically reduces risk and raises the odds of good results. That means research that validates technology, team, tokenomics, and liquidity, and choosing a platform that prioritizes security (PoR, 2FA, protection fund), clear fees, and usability.

Only then can you buy safely, always setting orders (market and limit), logging costs, and organizing custody (exchange or private wallet). Stay disciplined, record entries and exits, track liquid pairs, and keep improving your process. DYOR never ends.

For a simpler path than juggling multiple apps, wallets, and exchanges, Bitunix’s crypto exchange brings markets, tools, and 24/7 support together, useful both for buying crypto online and for rotating positions.

About Bitunix

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. At Bitunix, we are committed to providing a transparent, compliant, and secure trading environment for every user. Our platform features a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, we prioritize user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 125x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.