A portfolio only compounds when each holding earns its place. Research is the filter that protects capital. Strong projects solve a clear problem for a defined user, show usage that you can verify on chain, and connect that usage to token demand through transparent rules. Weak projects borrow narratives, publish vague roadmaps, and depend on incentives that fade once the campaign ends. You will learn how to read a whitepaper with intent, how to test claims inside the product, how to connect metrics to economics, how to judge security and governance without being a security engineer, and how to turn findings into position sizes and exit rules.

[ez-toc]

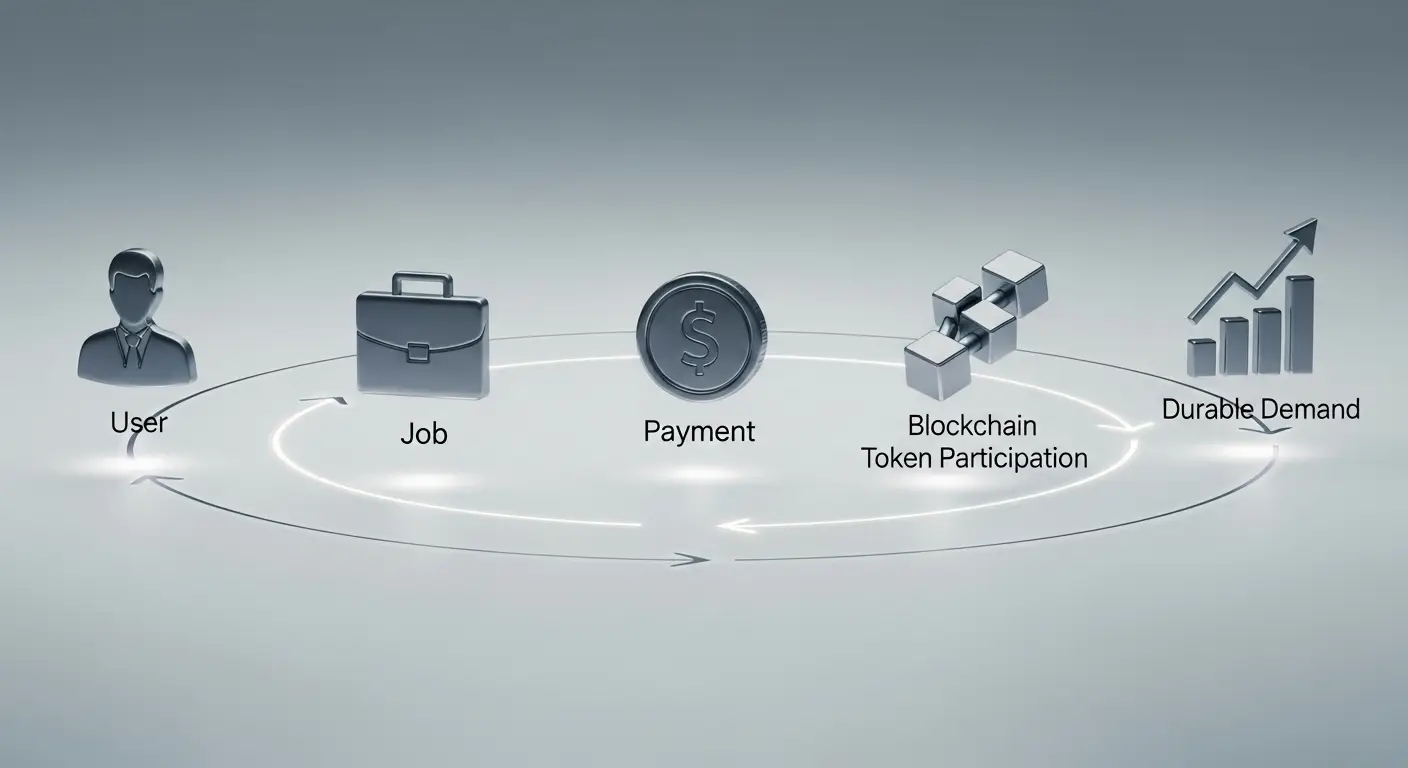

A circular flowchart with icons representing User, Job, Payment, Blockchain Token Participation, and Durable Demand, connected by arrows indicating a continuous process.

Fundamental analysis in crypto studies the real economy of a network or protocol. You identify the user, the job that the system performs, and the cash flows or cost savings that the user is willing to pay for. You then ask a simple question. Does the token participate in that economy in a way that creates durable demand. This is different from scanning a chart or following social accounts. It is closer to product management and risk control than it is to trading. The process is slower than chasing headlines, yet it delivers a portfolio that you can explain to a stakeholder in plain language, which is the true test of conviction.

A flowchart with four glowing squares labeled: Screen (computer icon), Validate (checkmark icon), Harden (shield icon), and Decide (lightbulb icon), connected by arrows on a dark background.

Start with clarity. Write one sentence that names the user, one sentence that states the problem, and one sentence that describes the action that creates value. If you cannot do this, step away. A project you cannot explain will be hard to size, hard to monitor, and hard to defend when markets become loud. During the screen stage, collect only the minimum set of facts. What chain it lives on, whether contracts are live, where the code is, and whether a token exists. The goal is not depth. The goal is to avoid wasting time.

Move from claims to evidence. Open the application and perform the core action yourself, even with a tiny amount. Swap a token, post collateral, bridge a small transfer, mint a receipt, claim a reward. Keep the transaction hash and any contract addresses you touched. Now look at the public metrics that should change if the product is real. Daily activity, gas paid, fees charged, or a change in balances. The point is not to build a full data warehouse. The point is to confirm that the story aligns with something that happened on chain. During validation, also identify how the token fits into the process. If the usage you observed does not require the token in any meaningful way, the asset may be a poor long term hold even if the product is decent.

This is the stage where many losses are avoided. Read security documents and audits, not for code details, but for scope, severity, and upgrade paths. Look for timelocks that delay privileged changes, for public postmortems after incidents, and for a bug bounty that invites outside review. Find out who can pause contracts, who can change fee parameters, and who can change oracle sources. Review treasury addresses, asset composition, and expected runway. A project that cannot fund operations, audits, or incident response will fail at the first long outage. Harden also covers bridges, wrapped assets, and any cross-chain dependency. Route design determines how fast you can exit during a problem, so you size to the weakest link.

Turn research into a number. Decide whether the project belongs in your portfolio, and if so, how large the first tranche should be. Write your position limits by category, your maximum loss for a single position, and the conditions that trigger a reduction or exit. Store a one page thesis that lists the user, the mechanism, the metrics you will monitor, and the specific reasons why the token should benefit. When you revisit the note in six weeks, you will immediately know whether reality matched your expectations.

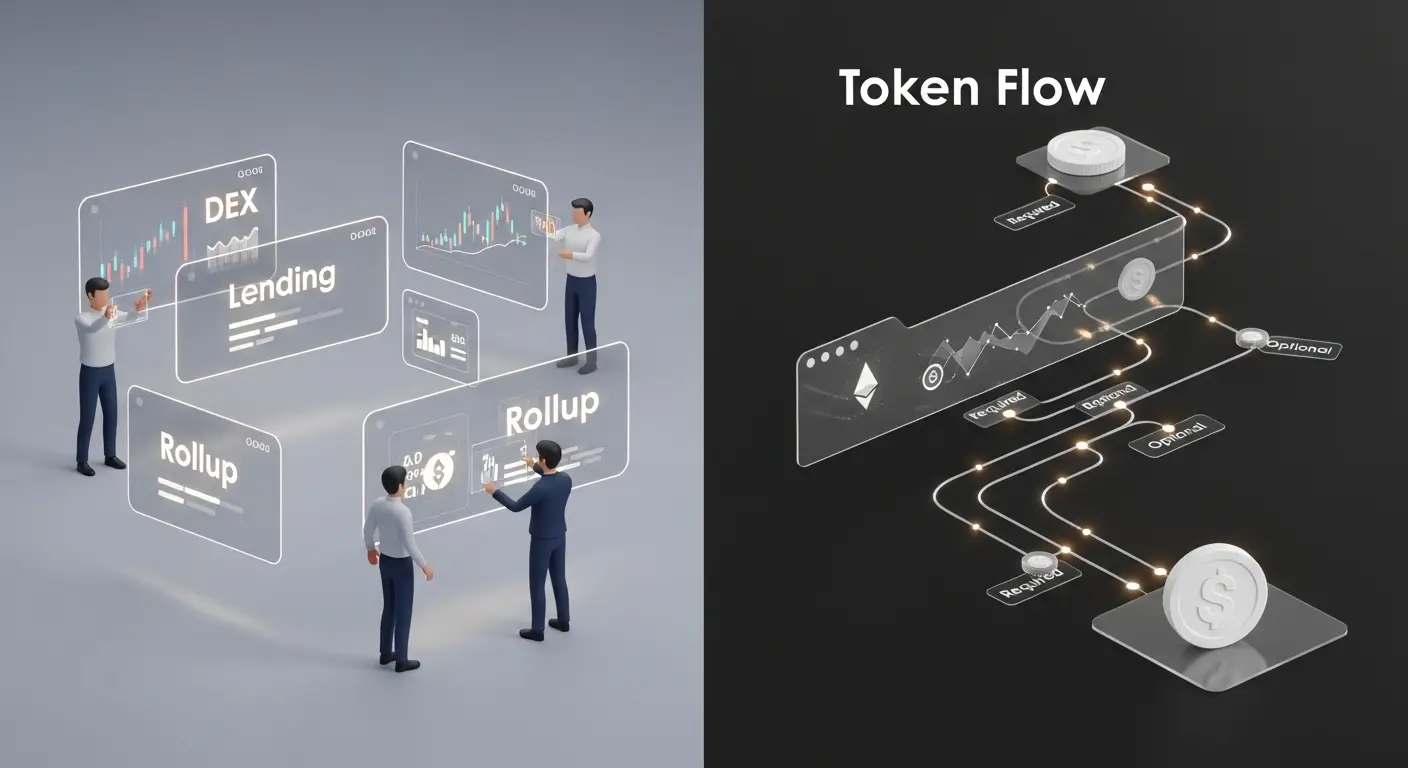

Four people interact with floating virtual screens labeled DEX, Lending, and Rollup on the left; on the right, a diagram labeled Token Flow shows tokens moving through blockchain icons and financial platforms.

Every credible project can state its user and job in plain words. A decentralized exchange serves traders who need low slippage swaps with custody control. A lender serves borrowers who want credit against volatile collateral with predictable liquidation rules. A data availability network serves rollups that need inclusion guarantees at a known cost. If the user is “everyone,” or the job is “all finance,” there is no focus. You will see that lack of focus later in fragmented metrics and weak retention.

Draw a simple diagram or write a short paragraph that names inputs and outputs. For a DEX you have token A and token B coming into the pool, a swap that pays a fee, and liquidity providers that earn the fee. For a rollup you have transactions entering a sequencer, batches posted to an L1, and a cost structure that includes execution and data. The map forces you to confront where value enters, who pays it, and who receives it. Later, when you evaluate token design, you will compare the fee path and the token path. If they never meet, token holders may not benefit from growth.

A polished interface is a feature. Deep liquidity that lowers trading cost is an advantage. A bridge that delivers native assets across chains with predictable finality is an advantage. A toolchain that cuts developer time in half is an advantage. Write the specific property that makes the project hard to replace. If you can replace it with a fork and a marketing budget, treat the token as a trade, not a core holding.

A digital dashboard displays claims with evidence sources and status labels: Verified (red), Pending (yellow), and Disputed (gray). Claims include document, email, and database verification evidence. Notes are on the left.

Skim for claims that you can test. Throughput, finality, oracle quality, fee splits, emissions, security assumptions. Place each claim in a small table with a destination for evidence. The evidence can be a contract address, a block explorer view, a governance forum excerpt, or an audit page. This method turns a long document into a checklist of verifications that you can complete in a single session.

Every system sits on assumptions. Oracles are timely and hard to manipulate. Validators remain online. Liquidity is present when liquidations occur. Write each assumption and imagine it failing. What happens if an oracle lags for thirty minutes. What happens if gas spikes on the settlement chain and the fast path pauses. Stress tests expose single points of failure that do not appear in a happy path.

List the token roles and mark which are required. Payment for gas is required. Staking to secure a validator set is required. Posting the token as collateral in order to borrow the network’s stablecoin can be required, if that is the design. Governance is useful, but governance without economic weight rarely supports price. If the token can be removed with no effect on users or operators, you have learned something important.

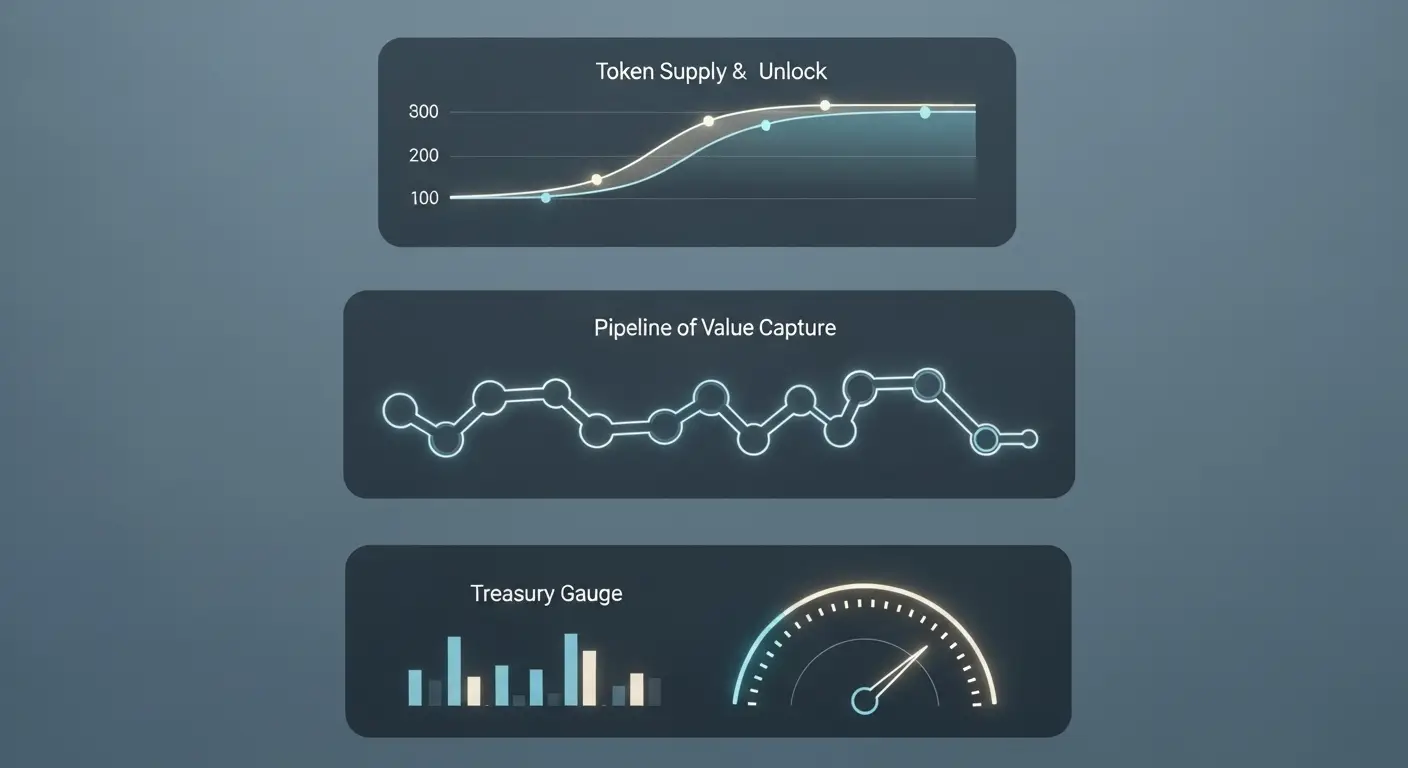

Three dashboard widgets: a line chart labeled Token Supply & Unlock, a dotted line chart labeled Pipeline of Value Capture, and a section with a bar graph and a gauge labeled Treasury Gauge.

Write current circulating supply, total supply if capped, and the schedule by cohort. Translate any cliffs into dates on a calendar. Ask what happens if a major team or investor unlock coincides with a bear month. Markets can absorb flow when demand is deep, but supply shocks often overpower thin books. If you like the product, but the unlock schedule is heavy, start with a smaller tranche and wait for the overhang to clear.

Describe the steps that connect usage to token demand. A portion of fees may buy and burn the token. Stakers may receive revenue after supplying security. Tokens used as core collateral remove supply from circulation. If the business model pays a separate operating company while the token floats independently, adoption can rise while the token drifts. When value capture is missing, you can still use the product, yet you should avoid the token.

Find treasury addresses on the explorer or in public docs. Record balances by asset and estimate months of runway at current spend. Healthy treasuries keep liquid reserves, reveal spending categories, and avoid holding only their own token. This is not a moral judgment. It is survival analysis. Teams that can pay for audits, bug bounties, and engineers will fix problems faster than teams that cannot.

Check order book depth near the mid price and the availability of pairs across venues. A token that trades thinly will be hard to rebalance and easy to push around. Wait for listings to broaden, or size the position so that you can exit through your own liquidity without moving the market.

A digital dashboard displays two line graphs labeled User Activity and Protocol Fees, showing data trends over time with smooth, colorful lines and a stability icon in the top right corner.

Pull a three month view of active addresses, transactions, and contracts interacting with the system. You can use public explorers and dashboards for this step. Do not look for fireworks. Look for steady usage, a slow rise that matches product releases, or stability through market volatility. A campaign that creates a spike and a collapse is a red flag for speculative activity.

Collect numbers for fees paid by users and revenue that the protocol retains after paying suppliers. For an exchange, you have volume multiplied by fee tiers, less the share sent to liquidity providers. For a rollup, you have gas for execution and data, and a policy for where the surplus goes. For a lender, you have interest collected, interest distributed, and realized bad debt. Economic proof is the difference between a crowded booth and a business.

If you can, follow new user cohorts and see whether they return after one month and three months. Strong products create habits. If a cohort returns with meaningful activity, you have a truthful signal that discounts noise from campaigns.

A floating dashboard displays an audit scope checklist with four items: Timelock, Bug bounty, Key management, and Bridge type, each marked with a green checkmark indicating completion.

Read audits for scope, severity, and resolution. Critical items should be fixed or mitigated with clear justification. If contracts are upgradeable, there must be a delay between approval and execution. That delay, known as a timelock, gives users time to react. Also check whether the project runs a public bug bounty. A bounty invites diverse review and often catches issues that audits miss.

Write who can upgrade contracts, who can pause markets, and how keys are stored. Hardware security modules, well described rotation procedures, and narrow emergency powers are good signals. A single hot wallet with broad authority is not.

If the protocol needs prices, read how those prices are built. Quality oracles aggregate multiple sources, use time windows, and have rules that ignore outliers. For lenders, liquidation incentives should be clear, and large positions should be liquidated in chunks that the market can absorb. If prices come from a thin pool that the project itself controls, treat the position as speculative.

If the token relies on cross-chain movement, identify the bridge category. Canonical bridges favor strong verification and predictable redemption. Liquidity network bridges favor speed and rely on operator honesty and inventory. Custodial bridges concentrate risk in a set of keys. Position size should reflect the weakest part of the route.

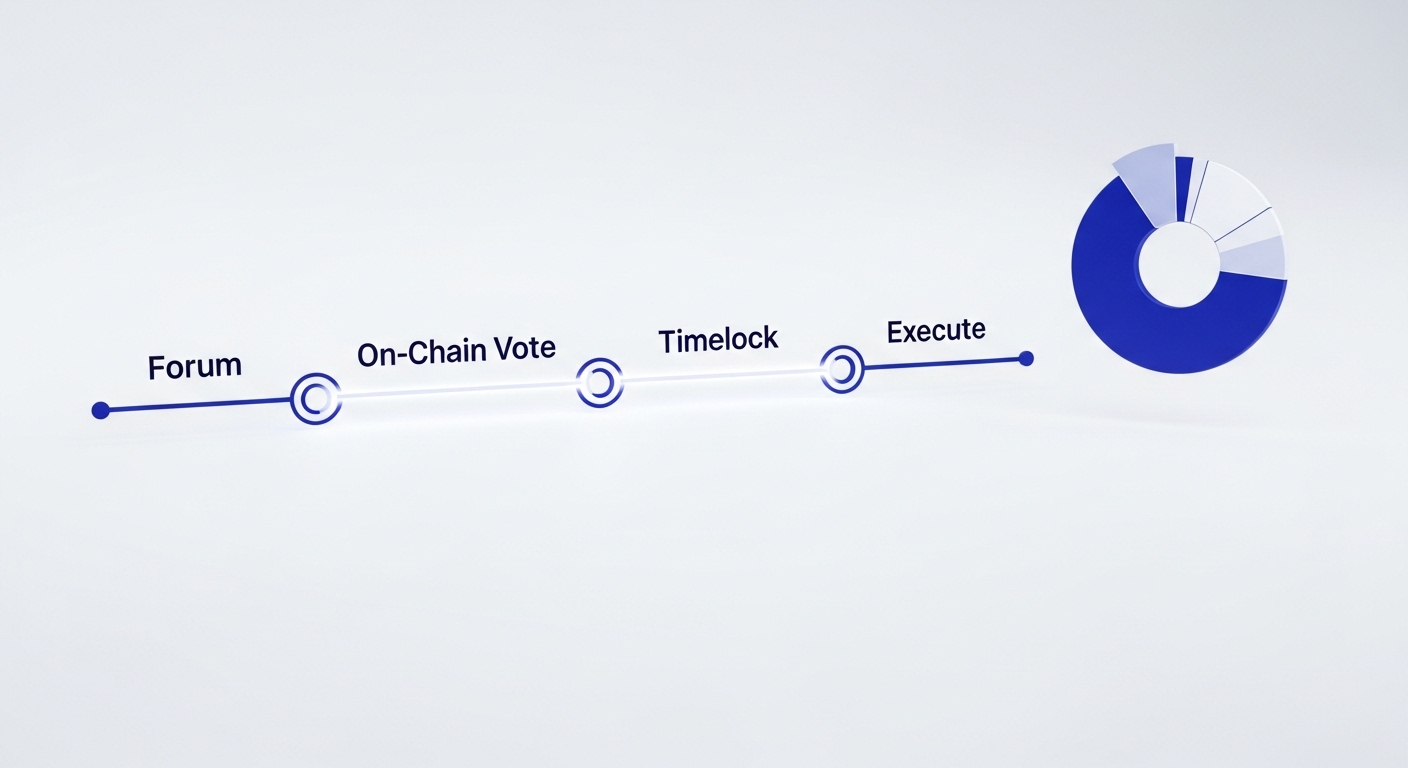

A visual diagram showing four stages labeled Forum, On-Chain Vote, Timelock, and Execute, connected in a line, with a blue and white circular chart on the right.

Record who can change fees, adjust risk parameters, or upgrade core logic. Write the quorum, threshold, and delay for execution. Good governance looks like a clear forum, documented proposals, on-chain voting, and a delay that allows users to respond. Poor governance looks like a single multisig that can change rules instantly.

Open the voter list for several proposals. If one address or a small cluster controls the outcome, governance is cosmetic. Token holders without influence cannot defend their interests. In that case, reduce size or treat the asset as a trading instrument, not a long term hold.

Healthy projects ship changelogs, publish incident reports, and maintain a weekly or monthly rhythm. The cadence signals operational maturity. Long silences after incidents usually predict more trouble.

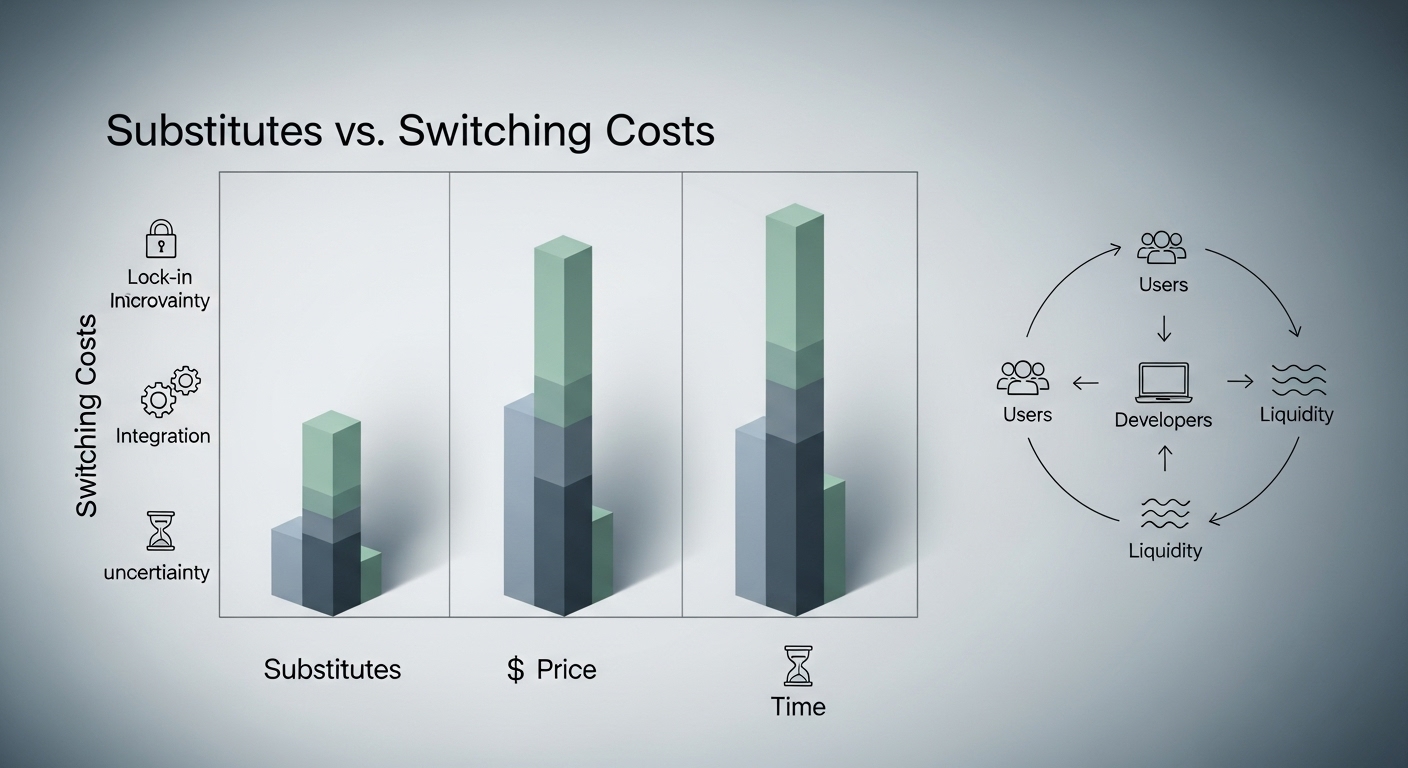

A chart compares substitutes, price, and time against switching costs, with icons for uncertainty, integration, and lock-in. On the right, a circular diagram shows users, developers, and liquidity in a network flow.

Name the practical alternatives for the user. A trader can move to another DEX or a centralized exchange for certain pairs. A borrower can use a competing lender or can sell collateral and exit. A developer can deploy on another chain where fees and tooling fit better. When alternatives are abundant and switching is easy, the project must win on price and incentives, which is expensive and hard to sustain.

List the integrations that would make leaving painful. For a DEX it might be deep liquidity in core pairs, routing through aggregators, and a stable pool of market makers. For a rollup it might be a toolchain, a data availability partner, and a set of wallets that work cleanly. Integrations and habits are silent moats.

Write the loop that strengthens with use. Traders bring liquidity, liquidity lowers slippage, lower slippage brings more traders. Developers bring apps, apps bring users, users pay fees that fund more tooling. If there is no loop, you will likely rely on paid incentives to maintain activity.

Turn findings into limits that keep your portfolio safe. Set a cap per asset, a cap per protocol, a cap per chain, and a cap per risk class. A balanced investor might allow a new position to start at one to three percent of portfolio value, then add only after milestones are met. Caps create natural profit taking when a holding rallies, and they protect you when a project disappoints.

Split entries into tranches. Take a starter position once your research file is complete. Add after a successful upgrade, an audit follow-up, a governance improvement, or two quarters of consistent fees. Staging keeps emotions in check and gives the project time to prove durability.

Write exit rules that do not depend on mood. Examples include removal of timelocks, a change in fee policy that redirects value away from token holders, a sustained oracle failure, or a major exploit with unclear remediation. For trading sleeves you can add price based stops. For long term sleeves, focus on fundamentals that break your original thesis.

Scores above thirty four indicate candidates for core sleeve positions at modest size. Scores between twenty seven and thirty three belong in a research sleeve with strict caps. Scores below twenty seven move to a watchlist.

Consider a lending market that focuses on large cap collateral. The user is a borrower who wants predictable credit against ETH, and a lender who wants conservative income on stablecoins. The mechanism is simple. Borrowers post ETH, lenders supply stablecoins, the protocol mediates interest and liquidations, and an oracle provides prices. Token utility comes from staking to a risk module that backstops losses and receives a fixed share of net interest. Contracts are live on a major L2, two independent audits name versions and list resolved findings, and a timelock governs upgrades. Over the last quarter, the number of borrowers grew steadily, utilization moved within a healthy band, and fees increased without outsized incentives. The treasury holds liquid reserves equal to twelve months of spend. Governance happens on a public forum with on-chain votes and a two day delay before execution. Competitors exist, yet the market differentiates with lower liquidation penalties and a conservative collateral set. The decision is to initiate a two percent position, add only if revenue grows while incentives decline, and cut if oracle diversity is reduced or if upgrade rights are centralized.

Create one document per project and complete the following items. Write in full sentences so that a teammate can understand your logic months later.

How long should a complete research cycle take, and how do I keep it efficient?

A thorough initial pass usually fits into two or three focused sessions within one week. The first session screens and validates with a small on-chain action. The second session covers token design, audits, and governance. The third session writes the thesis and sets size. Efficiency comes from using the same template every time, saving links to dashboards, and refusing to expand scope once a decision is good enough for the current tranche.

Do charts belong in fundamental research, or do they bias decisions?

Charts are useful as context when they are paired with fundamentals. A rising price during flat fees can signal speculative flow that you should fade. A falling price during rising fees can create a patient entry. Treat charts as a timing aid inside an allowed window, not as a substitute for the file you just wrote.

What if the product is strong, but the token does not capture value?

Separate the two. You can use the protocol while holding no exposure to the token. Many investors conflate product quality with token quality. If fees flow to an operating company, or if governance has no weight, owning the token may not help you even when the application grows. In that case, trade events if you must, yet avoid long term positions.

How do I size a new position without guessing?

Tie size to risk budget rather than emotion. Start small, for example one to three percent of portfolio value for a balanced sleeve. Add only after explicit milestones, such as a clean post-upgrade audit, two quarters of consistent fees, or a governance change that strengthens controls. Keep hard caps per asset, per protocol, per chain, and per risk class. Caps convert good intentions into rules.

What is the single most common research mistake?

Ignoring unlock calendars and upgrade rights. A beautiful interface and a helpful community can hide a supply shock or a central switch that changes rules overnight. Always paste the unlock schedule into your note, and always write who can upgrade contracts, how, and when. If you cannot find these answers, the position does not qualify for size.

How do I avoid buying into hype during a strong market?

Write a cooling rule. After finishing a file, wait forty eight hours before funding the first tranche. Limit yourself to a fixed number of new positions per month. Allocate any extra enthusiasm to your stablecoin buffer or to dollar cost averaging in existing positions. A cooling rule protects you from urgency and creates consistency across cycles.

Can I earn yield on research positions without creating stacked risk?

Yes, if you choose conservative methods. Native staking on established networks is the first choice. Conservative lending of large caps and stablecoins on well audited markets is the second choice. Avoid layering derivatives, leverage, and cross-chain wrappers on top of early positions. The goal is to let an idea prove itself without adding complexity that can fail for unrelated reasons.

How do I measure whether my research process is working?

Track the hit rate of your theses. After three months and six months, write whether each position met the usage and revenue conditions you set. Record the size you started with, the adds you made, and the exits you executed. A process that delivers fewer positions with higher survival and cleaner exits is working, even if you passed on a few winners. Consistency wins over time.

Address: A public identifier on a blockchain that can receive and send assets or interact with contracts.

Audits: Independent reviews of smart contracts that document scope, severity of findings, and remediation status.

Bug bounty: A standing program that pays external researchers for responsibly disclosing vulnerabilities.

Canonical bridge: The official bridge endorsed by a network, typically favoring strong verification and predictable redemption.

Collateral: Assets pledged to support borrowing or risk backstops inside a protocol.

Cohort: A group of new users tracked from the same start period to measure return usage and retention.

Decision rights: The specific powers to change code, fees, or risk parameters, usually defined in governance documents.

Emissions: Scheduled token releases that expand circulating supply or fund incentives.

Exit rules: Prewritten conditions that trigger a reduction or full exit from a position when fundamentals change.

Fees: Payments made by users for services such as swaps, lending, execution, or data posting.

Finality: The point at which a transaction or block is considered irreversible under network rules.

Governance: The process that proposes, votes on, and executes protocol changes, often with timelocks and recorded quorums.

Key management: The operational practice for storing, rotating, and protecting keys that control upgrades and privileged actions.

Liquidity: The depth available to enter or exit positions without large price impact.

Liquidity network bridge: A bridge that pays users from destination pools first and rebalances inventory later.

Market structure: The trading environment for a token, including venues, order book depth, funding, and borrow availability.

Mechanism: The concrete process by which a protocol creates value for its users, for example matching trades or settling rollup batches.

Network effects: Self-reinforcing loops where additional users improve service quality, which attracts more users.

On-chain evidence: Verifiable activity recorded on a blockchain such as transactions, gas paid, and contract interactions.

Oracle: A system that delivers external data, most often prices, to smart contracts with rules to resist manipulation.

Order book depth: Tradable size near the mid price that indicates how much volume markets can absorb.

Position size: The amount of capital allocated to a single asset, set by written limits rather than emotion.

Postmortem: A public report explaining an incident, its cause, impact, and corrective actions.

Product–market fit: A condition where a protocol consistently serves a user need that is visible in repeat activity and fees.

Protocol revenue: The share of fees or interest that remains with the protocol after paying supply side participants.

Quorum: The minimum voting participation required for a governance proposal to be valid.

Relayer: An off-chain operator that observes events and submits messages or proofs between chains.

Research sleeve: A bounded allocation for earlier stage positions that require stricter caps and closer monitoring.

Retention: The share of users who return and continue activity after their first session or month.

Rollup: A scaling system that executes transactions off the main chain and posts data or proofs to a base layer.

Runway: The number of months a treasury can fund operations at current spend.

Scope (audit): The exact contracts, commits, and components that an audit reviewed.

Sequencer: The component that orders transactions for a rollup and submits batches to the base layer.

Slippage: The price movement between order submission and execution caused by limited depth or volatility.

Smart contract: Code deployed on a blockchain that executes rules for swaps, lending, staking, or governance.

Staged entry: A plan to build a position through tranches tied to milestones such as clean audits or sustained revenue.

Supply and unlocks: The amount of circulating tokens and the schedule that releases locked allocations into the market.

Threshold: The approval level a governance vote must reach to pass, often a supermajority for sensitive changes.

Thesis: A one-page statement of why a position belongs in the portfolio, how it should benefit, and what will invalidate it.

Timelock: A delay between governance approval and execution that gives users time to react to changes.

Token utility: The concrete roles a token plays in the system such as paying fees, staking for security, or receiving revenue share.

Tranche: A discrete slice of a planned allocation used in staged entries or exits.

Treasury: The on-chain reserves that fund audits, development, incentives, and operations.

Unlock calendar: A dated schedule showing when large token allocations become transferable.

Upgrade rights: The privileges and pathways that allow contracts to change logic, ideally controlled and delayed by governance.

User and job to be done: The target participant and the specific problem the protocol solves for that participant.

Value capture: The explicit path that connects product usage to token demand or protocol revenue.

Validator: An operator that proposes or attests blocks in a proof of stake network.

Voter concentration: The share of voting power held by top addresses, used to judge how dispersed governance really is.

Whitepaper: A project’s technical and economic specification that should contain testable claims rather than marketing language.

Good research is practical, repeatable, and written in plain language. Start with the user and the job to be done. Verify usage on chain. Connect economics to token demand. Demand security controls that you can explain. Judge governance by who can change what, and when. Map competitors honestly. Then convert the file into a position size, a staged entry, and exit rules that you will follow when markets are noisy. Work this way and your portfolio becomes a collection of decisions you can defend, not a collection of headlines you chased.

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. At Bitunix, we are committed to providing a transparent, compliant, and secure trading environment for every user. Our platform features a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, we prioritize user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 125x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.