The battle for dominance in the spot trading market is heating up in 2025. On one side, traditional finance is stepping further into the crypto world with institutional products like GBTC and Bitcoin ETFs. On the other side, meme coins like Trump Coin and Shiba Inu continue to capture attention, liquidity, and explosive growth.

Is this a passing trend or a structural shift? In this article, we examine how institutions and meme coins are shaping the future of crypto spot markets.

Meme Coins Are Reshaping Retail Demand

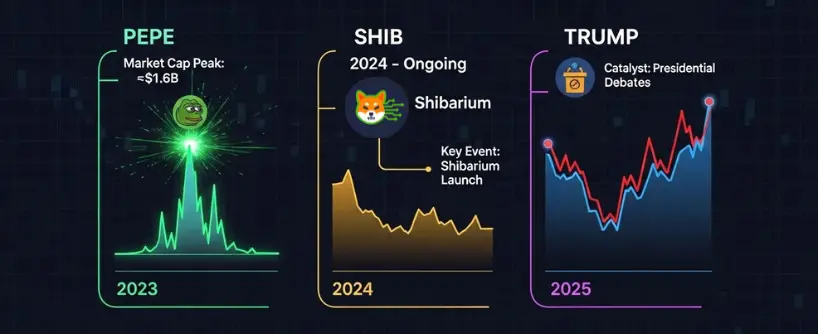

The explosion of Trump meme coin in Q1 2025 reminded everyone that crypto is not just about fundamentals. It is also driven by narrative, emotion, and community. Trump Coin’s market cap soared past $1.3 billion in under two months, backed by political news cycles, social media hype, and support from public figures.

The coin’s rise mirrored earlier meme surges like Dogecoin in 2021 or PEPE in 2023, but with a new element: political relevance. For many retail traders, meme coins have become the entry point into crypto, offering fast price movements and relatable branding.

Shiba Inu coin price also remains a top search in 2025. Despite volatility, the SHIB community continues to drive demand through token burns, new DEX listings, and Shibarium Layer-2 development.

These tokens may lack traditional value models, but they represent a powerful new market force — a fusion of speculation, community, and pop culture.

GBTC, ETFs, and Spot Stock Bridges

While meme coins dominate headlines, institutional money is quietly building deeper roots. The GBTC stock narrative shifted in late 2024 after its conversion to a spot Bitcoin ETF was approved. Since then, Grayscale’s flows have turned positive, with institutional investors treating GBTC as a gateway to crypto.

Spot stock products are also gaining traction. Platforms now allow users to trade tokenized versions of stocks like Tesla and Apple on-chain, bridging traditional equity trading with crypto markets. These tokenized stocks are often backed one-to-one by real shares, held in custody by regulated entities.

This growth in spot stock trading indicates that crypto is not just about digital assets anymore. It is merging with traditional finance in a way that provides broader access and increased liquidity.

Trading Pairs Reflect the Shift

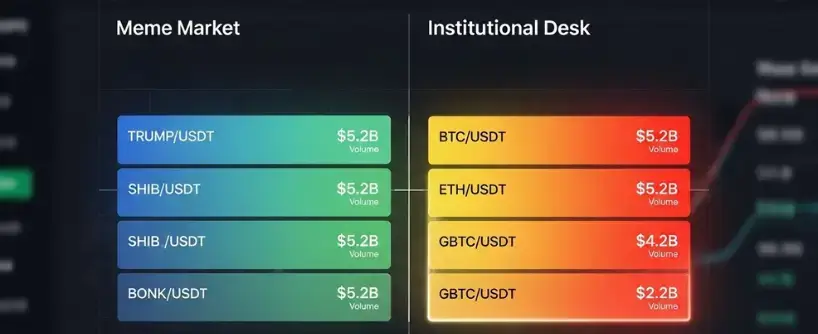

In 2025, trading pairs tell the real story of market sentiment. Pairs like TRUMP/USDT and SHIB/USDT have recorded some of the highest volumes on exchanges like Bitunix, especially during political events and token airdrops.

On the other hand, BTC/USDT and ETH/USDT remain the base pairs of institutional interest, with high-volume inflows following ETF announcements or macroeconomic data releases.

Altcoin and meme coin traders are increasingly rotating between narrative-driven assets, while institutions are building long-term exposure via spot products and yield strategies.

The Case for Meme Coins

Why are meme coins still so effective in a market increasingly dominated by institutions?

- Accessibility: Meme coins usually have low unit prices, which psychologically encourages new investors to buy in bulk.

- Community Momentum: Tokens like Trump Coin and Shiba Inu have massive, engaged communities that drive constant social media presence.

- Exchange Listings: Centralized exchanges are responding to demand by listing these coins early, giving them immediate access to liquidity.

- Cross-Platform Promotion: From Reddit to TikTok to Telegram, meme tokens enjoy an organic form of multi-platform virality that institutional assets rarely match.

This movement is no longer just a novelty. Meme coins have become a valid sector within crypto, even if they carry significantly more risk and volatility.

The Institutional Angle

Institutions prefer structure, regulation, and risk control. Their growth in the spot market is being driven by:

- ETF access: Bitcoin and Ethereum ETFs are available on major U.S. stock exchanges.

- Custodial services: Institutional-grade custodians now support altcoins and tokenized assets.

- Liquidity aggregation: Professional trading desks use tools like smart order routing and slippage control to operate at scale.

- Compliance-ready exchanges: Platforms like Bitunix support KYC, tax reporting, and regulatory alignment to attract institutional capital.

This segment is less visible than meme coin communities, but it is much larger in terms of capital base and long-term impact.

The Emerging Hybrid: Meme Coins with Real Use Cases

A new trend in 2025 is the development of meme coins that combine viral appeal with functional ecosystems. These include:

- Token burns linked to usage

- Governance rights in meme DAOs

- DeFi features like staking and yield farming

This shift brings a layer of utility to what were once purely speculative assets. It blurs the line between serious altcoins and cultural tokens, attracting both retail traders and speculative funds.

Bitunix: Bridging the Gap Between Retail and Institutions

Bitunix is one of the few exchanges actively catering to both sides of this evolving market. On Bitunix, users can:

- Trade high-volume meme coins like SHIB, TRUMP, and BONK

- Access top institutional-grade spot pairs like BTC/USDT and ETH/USDT

- Monitor liquidity flows across sectors with real-time market data

- Use low-latency APIs for both retail and institutional trading strategies

The platform supports both types of traders by offering deep liquidity, secure storage, and mobile-friendly interfaces, making it a powerful bridge between two very different user groups.

What Does the Future Hold?

In 2025 and beyond, the spot trading landscape will not be a zero-sum game between institutions and meme traders. Instead, it will likely evolve into a layered ecosystem:

- Institutions will dominate with volume and infrastructure

- Retail traders will drive market sentiment and narrative cycles

- Hybrid tokens will emerge that mix both elements, appealing across the board

The rise of spot stock products, tokenized assets, and on-chain analytics is making crypto markets more complex, but also more transparent and inclusive.

FAQs

Are meme coins still profitable in 2025?

Yes, meme coins like Trump and Shiba Inu continue to produce fast, volatile gains. However, they require careful timing and strong risk management.

What is GBTC and why is it important?

GBTC is Grayscale’s Bitcoin Trust, now converted into a spot ETF. It allows institutions to gain Bitcoin exposure through traditional brokerage accounts.

Can meme coins coexist with institutional products?

Absolutely. Both attract different user types. Meme coins serve retail speculation, while institutional products bring long-term capital and structure.

What platform supports both meme coins and institutional trading?

Bitunix supports a wide range of spot pairs, including meme coins and high-volume institutional tokens, with advanced trading tools.

What are spot stocks in crypto?

Spot stocks are tokenized shares of real companies, traded on blockchain platforms and backed by custodial assets.

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.