[ez-toc]

A candlestick chart shows the BTC/USDT price on Bitunix over October. The price fluctuates between 106,000 and 124,000, with volume bars below and a recent value of 111,569. Vertical and horizontal axes mark dates and prices.

At the beginning of October, the Bitcoin market followed a rally-then-correction pattern. From October 1 to October 7, Bitcoin moved in a steady uptrend on the daily chart, rising from $113,000 to $125,000. This represented an increase of more than 10 percent and set a new all-time high.

On October 10, geopolitical tensions triggered a rapid correction across the broader crypto market. Trading volume expanded sharply and Bitcoin sold off quickly, with the intraday low falling to $104,000. After forming a second bottom on October 17, Bitcoin entered a gradual recovery phase. By the end of October, the price had stabilized around $110,000.

Bar chart showing BTC price and open interest in USD from late September to late October. BTC price (yellow line) fluctuates, while open interest (green bars) varies, with peaks in early and mid-October.

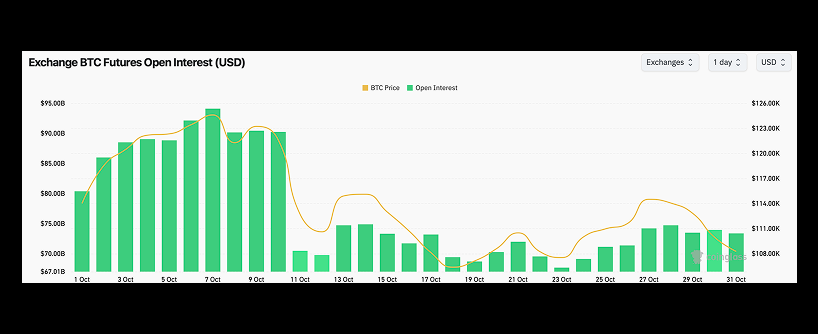

Bitcoin futures open interest fell sharply on October 10 as the market underwent a major selloff, triggering widespread liquidations. On October 1, total Bitcoin futures open interest stood at $78.1 billion. As Bitcoin’s price climbed steadily in the first week of October, open interest rose in tandem, reaching $94.0 billion by October 7 and $90.2 billion on October 9. When the correction hit on October 10, open interest fell abruptly to $70.4 billion, with daily liquidations reaching $19.8 billion. After this sharp deleveraging, market sentiment gradually improved. By the end of October, Bitcoin futures open interest had stabilized at around $73.5 billion.

Funding rates closely mirrored these shifts in price and sentiment. Early in the month, as Bitcoin continued to rise, the average funding rate increased from 0.005 percent to 0.01 percent, reflecting strong bullish positioning in perpetual futures. During the October 10 crash, the funding rate briefly turned negative, falling to between minus 0.004 percent and minus 0.005 percent. This indicated that short positioning dominated and that shorts were paying longs. In the second half of October, the funding rate recovered into a neutral-to-positive range, stabilizing between 0.002 percent and 0.009 percent, while overall sentiment remained cautiously bullish.

Bar and line graph showing major institutional Bitcoin holdings as of October 1st. IBIT, MSTR, and Binance have the highest BTC holdings, with percentages ranging from 0.76% (FBTC) to 3.22% (MSTR).

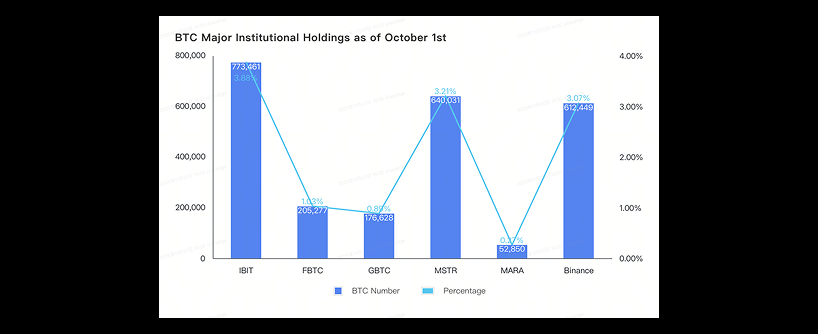

Institutional participation in Bitcoin remained strong in October, led by large asset managers, major exchanges, and corporate treasuries that continued to hold or accumulate Bitcoin for strategic and client-related allocations. Key institutional holders include BlackRock’s IBIT fund, a major centralized exchange, and Strategy, with each maintaining allocations above 3 percent in the report’s institutional holdings dataset.

Throughout October, the IBIT fund continued accumulating, purchasing 27,987 BTC during the month. In contrast, the major exchange posted the largest reduction in holdings, with reserves decreasing from 612,449 BTC to 606,356 BTC, representing a net reduction of 6,093 BTC. At the start of the month, major institutions collectively held hundreds of thousands of BTC, led by IBIT with 773,451 BTC (3.88 percent), Strategy with 640,031 BTC (3.21 percent), and the exchange with 612,449 BTC (3.07 percent).

Bar and line chart titled BTC Major Institutional Holdings as of October 31st showing IBIT, FBTC, GBTC, MSTR, MARA, and Binance with BTC numbers (bars) and percentages (line) held by each institution.

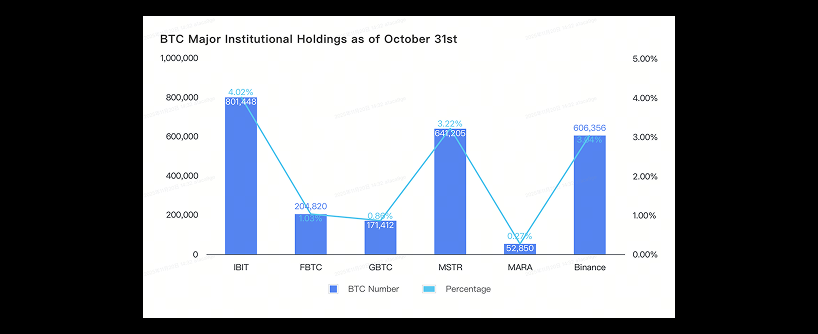

By October 31, IBIT’s holdings had risen to 801,448 BTC (4.02 percent), Strategy’s to 641,200 BTC (3.22 percent), while the exchange’s share declined to 606,356 BTC (3.06 percent). Overall, October reflected continued institutional accumulation led by regulated funds, despite brief market turbulence. This trend suggests sustained confidence among major participants in Bitcoin’s long-term outlook, even amid short-term corrections.

Line graph showing the Bitcoin hashrate from October 2 to October 25, 2015, with fluctuations between approximately 9,000 and 13,000 petahashes per second.

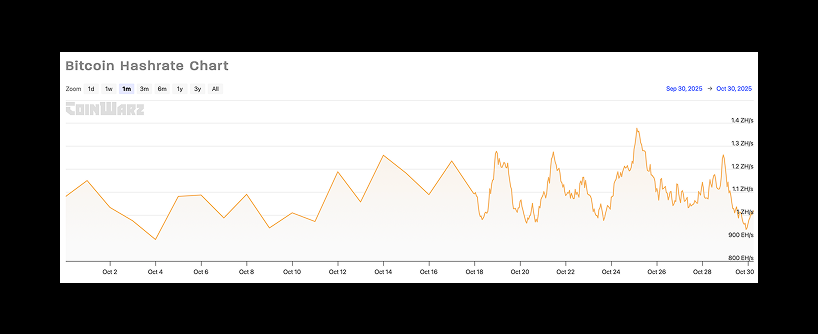

In October, Bitcoin network hashrate continued to trend higher, although it fluctuated throughout the month. The lowest reading was about 893 EH/s on October 4, while the hashrate peaked at around 1,362 EH/s on October 25. This level is close to a historical high for the network.

A rising hashrate suggests that miners remain confident in the longer-term outlook for Bitcoin mining and BTC price dynamics. Higher hashrate also strengthens Bitcoin’s security, since it becomes more expensive to attack the network. At the same time, rising hashpower increases competition, which can reduce the BTC earned per unit of hashpower for individual miners over time.

A candlestick chart shows the 4-hour price movements of ETH/USDT on Bitunix, with the price mostly fluctuating between 3,600 and 4,600 USDT. Volume bars are shown below the chart. Last price is 3,872.75 USDT.

Like Bitcoin, Ethereum was affected by macro and geopolitical risk in October, but its pullback was sharper. In mid-October, ETH declined from above $4,700 to around $3,400.

Toward the end of the month, ETH broadly converged with Bitcoin’s trend. After a brief rebound, ETH resumed a mild downtrend and closed October at approximately $3,872.

Bar chart showing ETH futures open interest (green bars) and ETH price (yellow line) in USD from October 1 to October 29. Open interest peaks near October 2, then declines, with ETH price fluctuating throughout the month.

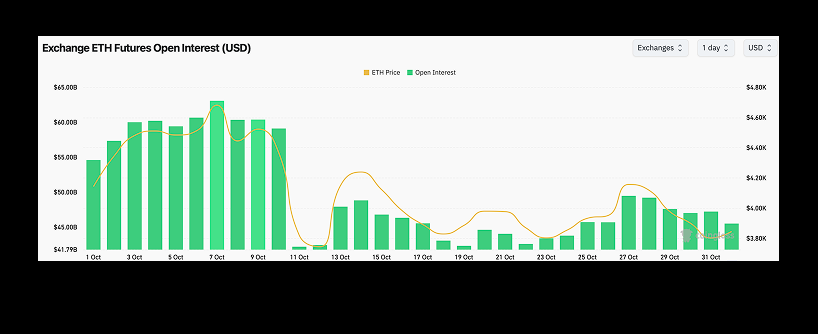

Ethereum futures open interest declined over the month. On October 1, ETH futures open interest was about $54.60 billion. By October 31, it had fallen to $47.20 billion, a decrease of $7.40 billion.

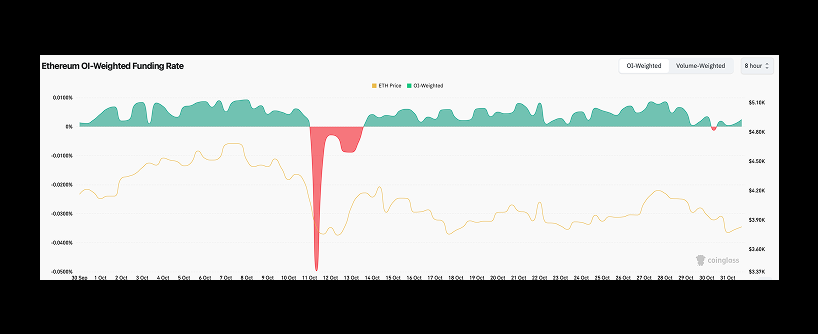

The largest single-day move occurred on October 10, when the market selloff led to heavy liquidations. On that day, total Ethereum futures liquidations reached $16.90 billion, second only to Bitcoin in notional liquidation size. Funding rates moved in line with price action. In early October, as sentiment remained bullish, the average funding rate stayed near 0.005 percent, signaling strong demand for long exposure in perpetual futures.

A chart showing the Ethereum open interest weighted funding rate with green and red areas above and below zero, alongside a yellow line graph tracking Ethereums price from $1.9K to $2.1K over time.

On October 10, during the sharp correction, the funding rate briefly plunged to around minus 0.049 percent, the lowest level in nearly six months. This indicated that short positioning dominated and that shorts were paying longs. As geopolitical pressures eased, sentiment gradually improved. In late October, the Ethereum funding rate moved back into positive territory, stabilizing at around 0.006 percent by month end.

Bar and line chart titled ETH Major Institutional Holdings as of October 1st comparing ETH holdings and percentages for ETHA, Binance, BMNR, 3BET, and Ethereum Foundation. Binance has the highest holdings and percentage.

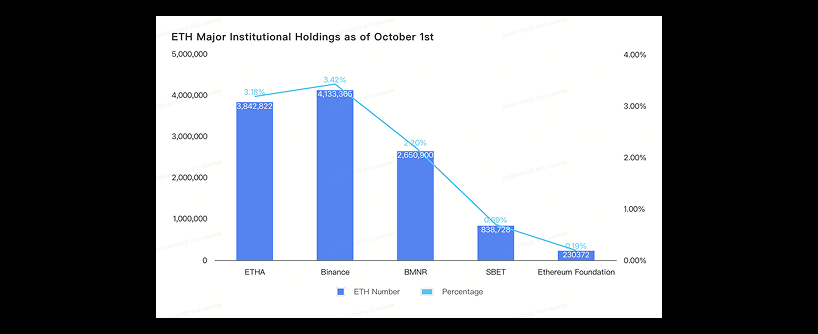

From an institutional holdings perspective, major Ethereum holders continued to include asset management firms, cryptocurrency exchanges, and digital asset treasury firms.

Among treasury institutions, Bitmine Immersion Tech held more than 3 million ETH, making it the largest Ethereum treasury holder in the dataset. During October, the company increased its position by more than 600,000 ETH, representing the largest net monthly ETH purchase among tracked institutions. A leading centralized exchange remained the single largest institutional ETH holder, but its share slipped slightly, falling from 3.42 percent to 3.39 percent in October, as it reduced holdings by roughly 37,000 ETH.

Overall, October data suggests resilient institutional demand for Ethereum. While some platforms trimmed exposure, longer-term allocators and treasury institutions continued to accumulate ETH, reinforcing Ethereum’s position as the second-largest crypto asset by market capitalization and derivatives activity.

A stacked area chart shows the growth of ETH staked by various entities from Jan 2021 to mid-2024. Lido, Coinbase, and Binance have the largest shares, represented by wide colored bands at the bottom.

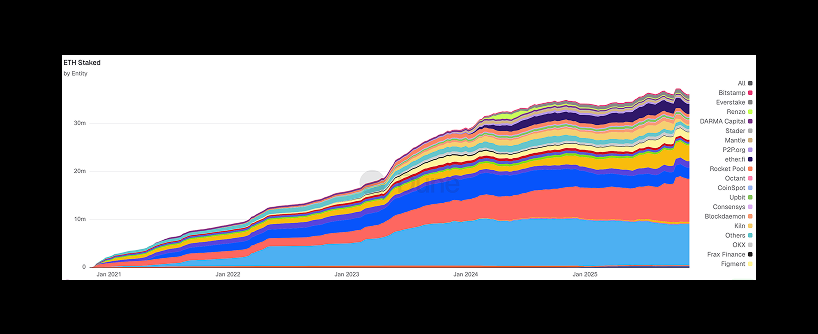

In October 2025, total ETH staked on the Ethereum network reached 36.8 million, up 1.9 percent from 36.11 million at the end of September. This put the staking ratio at 30.4 percent of total supply. Among staking platforms, Lido continued to lead the market with around 8.58 million ETH staked, accounting for 23.3 percent of all staked ETH. Two major centralized exchanges ranked second and third, with estimated staking balances of roughly 3.3 million ETH and 2.5 million ETH, respectively.

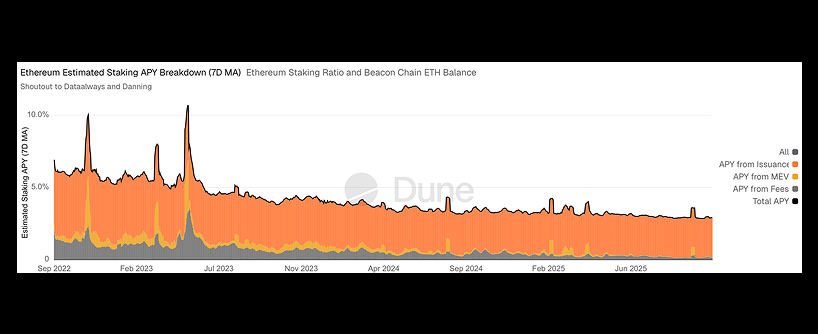

Stacked area chart showing Ethereum estimated staking APY breakdown from September 2022 to mid-2025. Total APY decreases over time, with contributions from issuance, MEV, and fees shown in different colors.

Throughout October, Ethereum staking yield remained broadly stable. Annualized yield was about 2.93 percent at the beginning of the month and 2.86 percent at the end. On October 10, extreme volatility drove a surge in on-chain activity. More users paid priority fees to accelerate transaction inclusion, and MEV activity increased. From October 10 to October 14, these factors lifted estimated ETH staking yield to roughly 3.60 percent. As ETH price action stabilized in the second half of the month, yields eased back toward early-month levels.

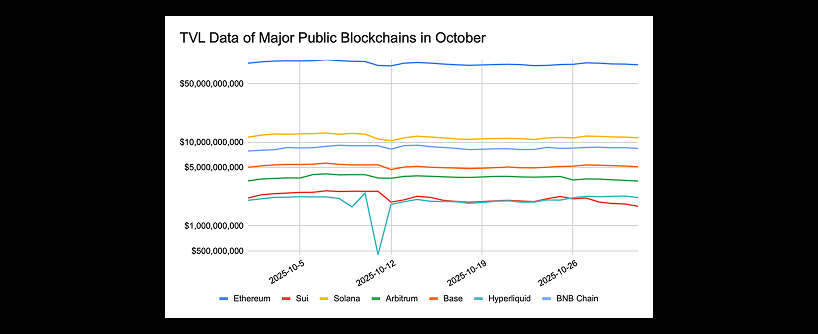

A line graph showing TVL (Total Value Locked) data for major public blockchains—Ethereum, Sui, Solana, Arbitrum, Base, Hyperliquid, and BNB Chain—throughout October, with values ranging from $500 million to $50 billion.

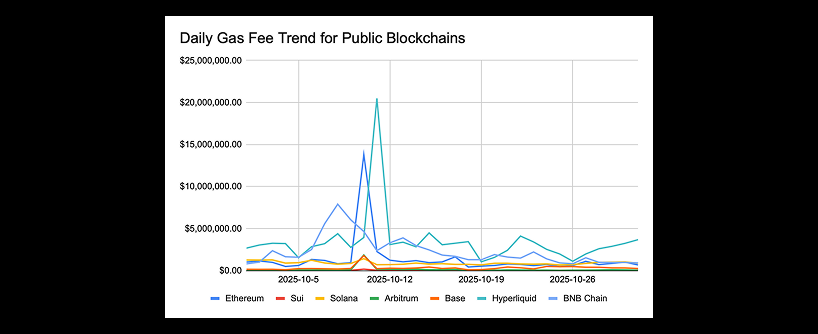

Line graph showing daily gas fee trends for public blockchains from 2025-10-05 to 2025-10-26. Ethereum peaks sharply around 2025-10-12; other blockchains like Sui, Solana, and Arbitrum remain much lower.

In October 2025, Ethereum remained the largest public blockchain by TVL, ending the month at $84.50 billion. Solana ranked second with $11.30 billion, followed by BNB Chain in third place at $8.40 billion.

Fee activity diverged from TVL rankings. Based on average daily network fees in October, Hyperliquid ranked first at $3.46 million per day, while BNB Chain and Ethereum ranked second and third at $2.28 million and $1.33 million, respectively.

Mid-month volatility reshaped on-chain behavior. On October 10, the market shock coincided with the sharpest single-day TVL decline on Ethereum, with TVL dropping by $9.65 billion. Over the same period, Hyperliquid’s TVL fell from $2.46 billion to $450 million. As risk sentiment worsened and activity surged, Hyperliquid’s daily network fees spiked to $20.40 million on October 11, far above its monthly average.

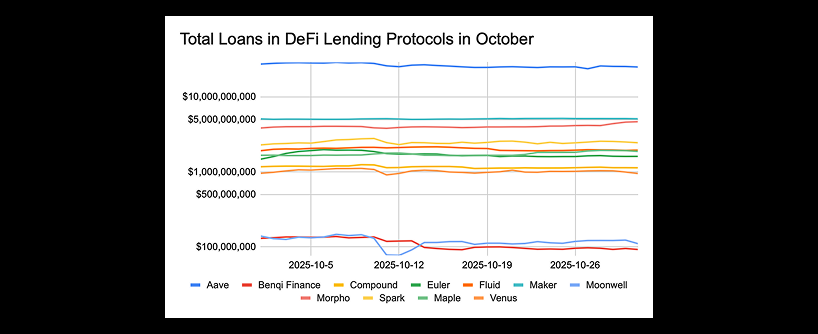

A line chart shows total loans in DeFi lending protocols for October 2025. Aave leads, followed by Compound and Maker. Other protocols, including Morpho, Spark, and Venus, have lower totals. Data trends run from 2025-10-05 to 2025-10-26.

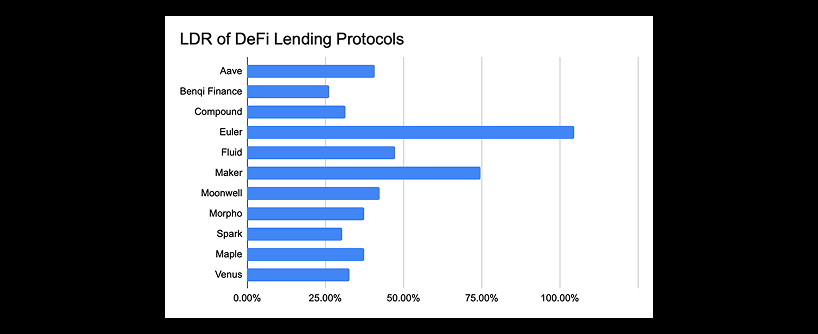

Bar chart showing Loan-to-Deposit Ratio (LDR) of DeFi lending protocols. Euler has the highest LDR around 100%, followed by Maker. Other protocols like Aave, Compound, and Venus have much lower LDRs.

In October 2025, Aave maintained its top position in DeFi lending, ending the month with $24.90 billion in total loans. This represented an 8.66 percent decline from $27.30 billion at the beginning of the month, signaling a moderate pullback in borrowing demand. Morpho recorded the fastest loan growth, with total loans increasing by 21.29 percent during October.

From a risk standpoint, the loan-to-deposit ratio (LDR) remained relatively conservative across major protocols at month end. Aave, Spark, Compound, and Morpho all posted LDR values below 50 percent, indicating deposits exceeded loans. Maker recorded an LDR of 75 percent, higher than peers.

Euler showed the strongest risk signal during the month. Its LDR exceeded 100 percent on October 6 and reached 112 percent on October 10, a level that typically indicates tighter liquidity conditions and increased vulnerability during rapid market moves.

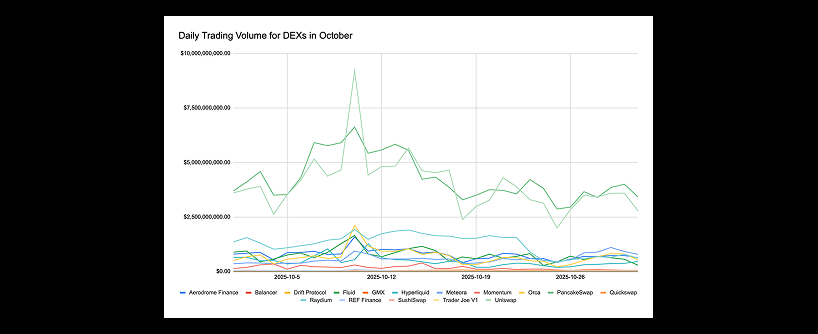

Line graph showing daily trading volume for various decentralized exchanges (DEXs) in October. Uniswap leads with the highest and most volatile volumes, while other DEXs have much lower, steadier volumes.

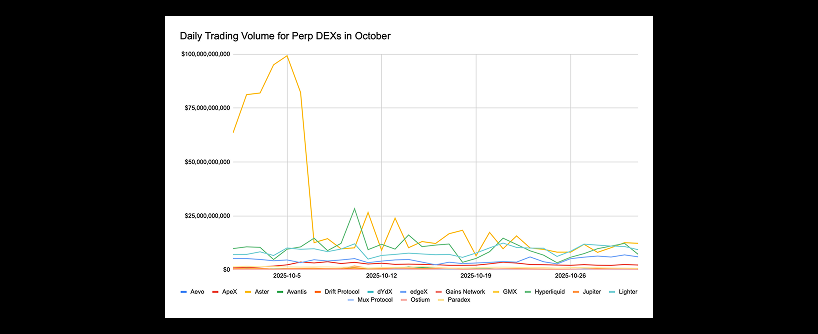

Line graph showing daily trading volumes for various Perp DEXs in October. Most DEXs have low, steady volumes, while dYdX (orange) peaks sharply above $100 million early in the month, then declines.

Spot DEX trading in October 2025 remained dominated by leading venues. PancakeSwap and Uniswap continued to alternate daily leadership. Their average daily spot DEX volumes were $4.27 billion for PancakeSwap and $3.97 billion for Uniswap, highlighting how concentrated liquidity remains in the spot DEX market.

Perpetual DEX volumes were more volatile. Following its launch, Aster recorded extreme fluctuations in early October, including a short-lived outlier spike near the top of the chart range before quickly reverting. After this initial burst, activity stabilized. By mid to late October, Aster’s daily perpetual volume settled around $10 billion, suggesting a transition from launch volatility to a more consistent trading range.

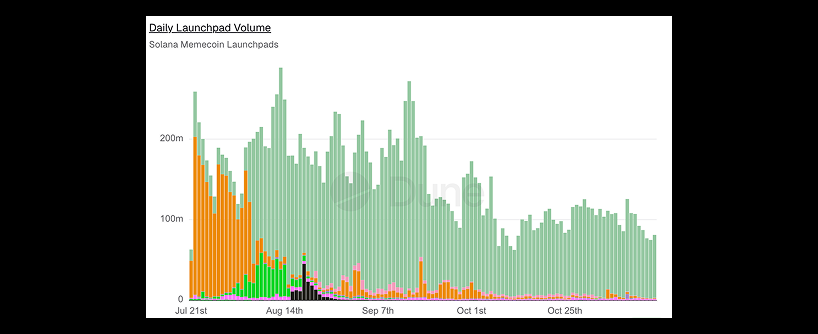

Bar chart showing daily launchpad volume for Solana memecoin launchpads from July 21st to late October. Volume is highest in August, represented mainly by green bars, and declines steadily through October.

The Solana memecoin narrative cooled significantly in October 2025, with both trading activity and launch throughput declining versus September. Pump.fun remained the leading launch platform, but its daily trading volume fell from $139 million in September to $108 million in October.

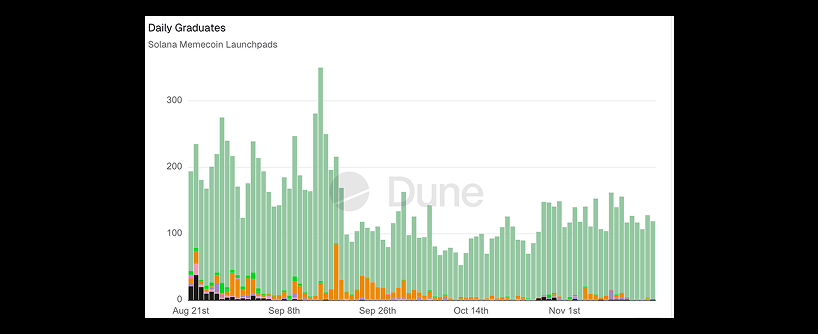

Bar chart showing Daily Graduates for Solana Memecoin Launchpads from August 21st to November 1st, with tall green bars peaking in September, and shorter orange, black, and other colored bars throughout.

This slowdown also appeared in DEX migrations. In this report, DEX migrations refer to tokens that reach a launchpad migration threshold and move to standard DEX liquidity pools for open-market trading. In October, daily DEX migrations from major launch platforms did not exceed 200, a clear decline versus September. Other platforms, including Letsbonk.fun, Moonshot, and Believe, also showed weaker momentum during the month.

A line graph showing the growth of various financial assets from 2023-10-02 to 2023-10-30. Private credit dominates, with smaller, steady lines for categories like stocks, bonds, and commodities. Stablecoins are excluded.

A stacked area chart showing stablecoin market size changes in October. USDT dominates in blue, followed by USDC in orange, with smaller bands for other stablecoins. The market size remains relatively stable throughout the month.

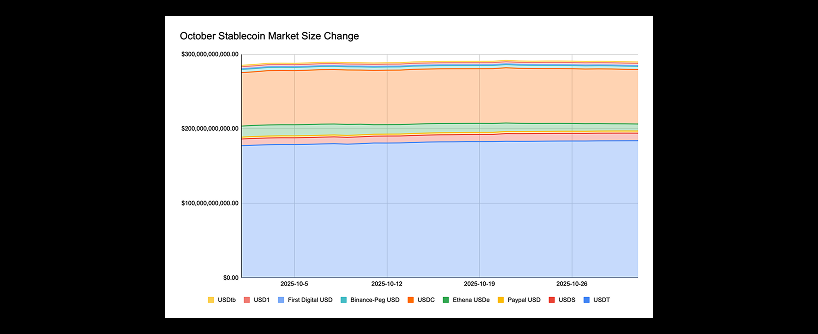

In October 2025, stablecoin market size remained broadly stable between $280 billion and $290 billion, indicating consistent demand for on-chain USD liquidity despite volatility. USDT remained the largest stablecoin by market size.

October also included a notable stress event. USDe (Ethena) experienced a sharp dislocation on October 10, when its price dropped to $0.62 during the market disturbance. Over the month, USDe’s overall size declined by 36 percent, falling to below $10 billion, highlighting how quickly certain stablecoin designs can contract under stress.

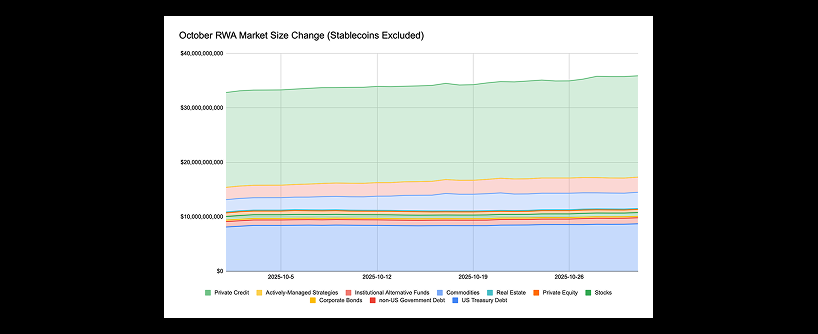

Outside stablecoins, RWA excluding stablecoins totaled $35.80 billion in October. Among tracked categories, Institutional Alternative Mutual Fund recorded the fastest growth during the month, reaching 22.86 percent.

Line graph showing average blob count per block from January 2024 to mid-2025. The Dencun upgrade set the target at 3; the Pectra upgrade raised the target to 6, with a maximum blob count of 9. Data points rise sharply after each upgrade.

In October 2025, Ethereum completed the final testnet phase of the Fusaka upgrade, the last major step before mainnet is expected to go live on December 3. Fusaka introduces a per-transaction gas limit cap of approximately 16.78 million gas units, aiming to improve execution efficiency, reduce denial-of-service risk, and strengthen the foundation for future scaling work, including parallel execution upgrades such as Glamsterdam.

Fusaka is positioned as the next major Ethereum upgrade after Pectra and includes optimizations across the stack. The name reflects the upgrade’s dual-layer focus, combining the execution layer upgrade Osaka with the consensus layer upgrade named after the Fulu star.

Ethereum Layer 2 usage continues to expand, and a larger L2 ecosystem increases the amount of data submitted to Ethereum. This makes blob capacity an increasingly important scaling lever. While PeerDAS has already enabled blob data expansion, the pace and parameters of blob scaling still need to evolve safely. Fusaka introduces a lightweight mechanism that allows blob parameters to be adjusted more flexibly without requiring a full network upgrade.

Blobs were introduced in the Dencun upgrade with a target of 3 per block. The target later increased to 6 in Pectra. After Fusaka, blob capacity can continue improving in a more incremental and sustainable way, better matching demand from Layer 2 networks.

Graphic for Circle’s Bridge Kit, with the text “Build crosschain apps faster.” Interface shows a token transfer from Avalanche to Ethereum and a message saying “Crosschain transfer complete.”.

On October 10, Circle announced Bridge Kit, a developer toolkit designed to simplify cross-chain transfer integrations. The initial release supports CCTP and USDC, packaging core CCTP V2 functions into a concise SDK approach.

Bridge Kit aims to reduce integration friction by providing step-by-step documentation, production-ready sample code, and built-in monetization logic to help developers benefit from cross-chain transfer flows. Circle stated that Bridge Kit can accelerate delivery whether teams are upgrading existing integrations or building new cross-chain products, shortening the path from prototype to production.

Hyperliquid plans to launch a major protocol upgrade, HIP-3, to support permissionless creation of perpetual futures markets. A Hyperliquid administrator stated on the protocol’s Discord channel that the network upgrade on October 13 will include enabling HIP-3. There are no immediate product changes for users at launch. Once developers meet the on-chain requirements, perpetual contracts can be deployed for trading.

According to previously disclosed documentation, HIP-3 supports perpetual contracts deployed by external developers, representing a step toward decentralizing the perpetual contract listing process. After HIP-3 is enabled, developers need to pledge 500,000 HYPE tokens to launch a perpetual contract DEX on HyperCore without permission. HIP-3 also integrates with HyperEVM to enable smart contract and governance functions and includes safeguards such as validator fines and position limits.

Graphic with the text Introducing Multichain Accounts beside icons representing Ethereum, Solana, and Bitcoin, along with a main logo featuring orange geometric shapes on a dark background.

In October 2025, MetaMask rolled out Multichain Accounts, upgrading its account model from “one account equals one address” to one account containing multiple addresses across networks. This change reduces friction for users managing assets across ecosystems by grouping addresses and balances into a single unified account view.

MetaMask began as an Ethereum-only wallet and later expanded to support Ethereum Layer 2 networks and other EVM chains. For non-EVM ecosystems, MetaMask previously relied primarily on Snaps, which allowed users to connect to additional networks through extensions. With Multichain Accounts and related architecture updates, MetaMask now supports native non-EVM experiences, beginning with Solana, while additional networks such as Bitcoin are positioned as future expansions.

The update also improves usability at the interface level. MetaMask states that Multichain Accounts simplify cross-chain navigation by reducing manual switching and consolidating how users view, swap, and bridge assets across networks. Third-party reporting also indicates the architecture change can improve portfolio and asset loading performance compared with the prior account structure.

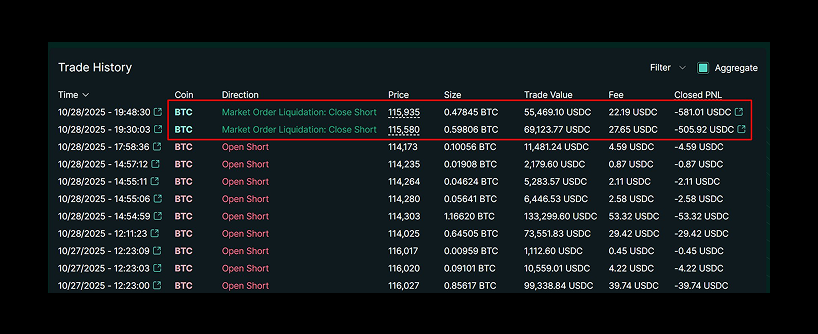

A cryptocurrency trading platforms trade history showing multiple BTC short trades, with two Market Order Liquidation: Close Short entries highlighted in red boxes, displaying time, size, trade value, and profit/loss details.

On October 28, on-chain monitoring from Onchain Lens reported that trader James Wynn’s 40x leveraged Bitcoin short position was partially liquidated as BTC price moved higher. The trade history screenshot shows multiple “market order liquidation: close short” entries, including closures around $115,935 and $115,500, with liquidated sizes of 0.47845 BTC and 0.59806 BTC.

From a market structure perspective, partial liquidations are typical during fast upside moves, when rising prices force high-leverage shorts to reduce exposure. If BTC strength persists, remaining high-leverage short positions may face additional liquidation risk, which can amplify volatility.

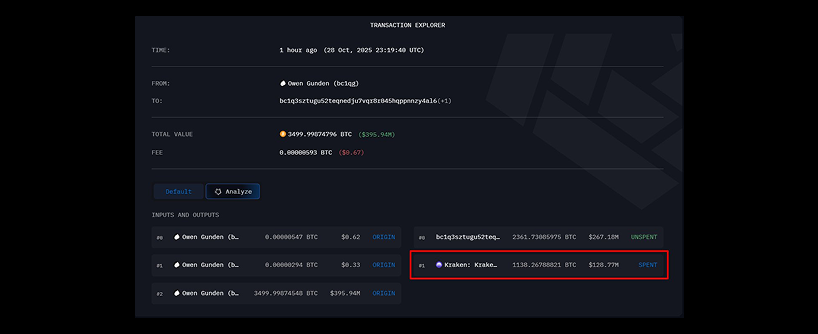

A cryptocurrency transaction explorer interface shows transaction details, including sender, receiver, amount, and status. A section labeled “Kizame: Kim…” is highlighted with a red box, indicating it as a spent output.

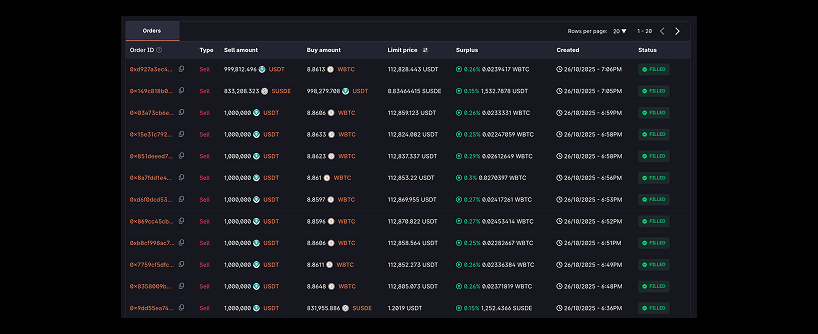

On October 26, tracking shared by on-chain analyst AiYi highlighted a “smart money” wallet (address shown as 0x6e1…90733) purchasing 88.6143 WBTC using 10,000,000 USDT at an average price of $112,846.

Including positions opened on October 21, the same wallet reportedly accumulated 271.73 WBTC (about $30 million) at an average cost of $110,403.69. The report notes that the current wave, starting October 21, had reached an estimated profit of $747,000 at the time of monitoring.

A cryptocurrency trading dashboard showing a list of buy and sell orders with details like order ID, type, amounts, limit price, time, and status, all using BTC and USDT pairs on a dark background.

On October 29, Onchain Lens monitoring reported that early Bitcoin holder Owen Gunden (@bitbitrage) deposited 1,447.56 BTC worth $163.19 million to a cryptocurrency exchange and transferred 2,361.73 BTC worth $266.20 million to a new wallet.

The transaction explorer screenshot also shows an exchange-tagged destination (displayed as Kraken in the view), reinforcing that a meaningful portion of the movement was exchange-related. Large exchange deposits are widely watched because they can signal potential liquidity preparation, hedging, or distribution. However, transfers alone do not confirm intent.

US SEC Chair Paul Atkins said the agency aims to establish an “innovation exemption” framework for companies operating in the United States across digital assets and other emerging technologies. He indicated the SEC is working to advance the policy as soon as possible, potentially by the end of the current quarter, but noted that the current US government shutdown has constrained the agency’s ability to move forward with rulemaking.

Despite these constraints, Atkins said the SEC still intends to initiate formal rulemaking before the end of 2025 or in Q1 2026 and expressed confidence that the agency can deliver within that window. During a Q&A, he described the proposed innovation exemption as a priority item he hopes to finalize quickly, positioning it as a step toward clearer crypto regulation in the US. He also praised Congressional efforts to advance crypto legislation, including the GENIUS Act, while noting that the SEC did not play a major role in that process.

Revolut is preparing to roll out expanded cryptocurrency services across the European Union after obtaining a license under the EU’s Markets in Crypto-Assets Regulation (MiCA). Revolut said it received a MiCA license from the Cyprus Securities and Exchange Commission, which enables the company to promote and offer crypto services across 30 countries in the European Economic Area.

The company linked this authorization to its upcoming “Crypto 2.0” launch and stated that the new service will offer access to more than 280 cryptocurrencies, zero-fee staking services, and zero-spread USD stablecoin conversions. The development reflects continued momentum behind regulated crypto expansion in Europe under MiCA.

Japanese startup JPYC announced the official launch of a stablecoin pegged to the Japanese yen at a 1:1 ratio. The token is backed by domestic savings and Japanese government bonds. Ryōzō Himino, Deputy Governor of the Bank of Japan, said stablecoins are expected to become an important part of the global payment system and may partially replace bank deposits over time.

JPYC also stated that transaction fees will be waived in the early stages of the project to support adoption. The project expects to generate income by holding interest-bearing Japanese government bonds. Tomoyuki Shimoda, a scholar at Rikkyo University and a former central bank executive, predicted that adoption of Japanese yen stablecoins in Japan could take approximately two to three years.

South Korea’s Financial Commission chair, Li Yiyuan, said during the National Assembly’s political supervision session on October 20 that payment stablecoins will not be allowed to generate interest payments from holding or using them. He said South Korea plans to align with key principles reflected in the US GENIUS Act and is exploring a bank-led alliance model for stablecoin issuance and oversight.

Li also noted that regulators plan to restrict fintech companies to a technology-partner role and prohibit virtual asset exchanges from issuing stablecoins on their own. He said the second-phase bill for virtual asset regulation is expected to be submitted within the year and is currently in the final coordination stage.

In addition, he highlighted strong non-China demand for stablecoins across crypto trading, payment settlement, and cross-border remittances, and said authorities plan to lay out relevant applications in advance to support compliant market development.

In October 2025, both the number of security incidents and the total loss amount declined compared with September. Even with the slowdown, October highlighted a recurring industry risk: attackers increasingly target operational weak points such as key management, oracle modules, and solver infrastructure, not only smart contracts.

The largest incident this month involved Garden Finance, which suffered a solver intrusion resulting in approximately $10.80 million in losses. The root cause was still under investigation at the time of reporting. Garden Finance’s founder, Jaz Gulati, stated that there was no loss of user principal and that the incident was limited to a single solver, with no impact on the protocol itself. Despite fewer headline events, the broader takeaway remains unchanged: users should remain vigilant about smart contract vulnerabilities, oracle risk, and operational security across DeFi and cross-chain infrastructure.

| Date (Oct 2025) | Project | Estimated Loss | Category | Event Summary |

| Oct 4 | Abracadabra | $1.8M | Smart contract exploit | Attackers exploited contract vulnerabilities to borrow or withdraw funds beyond collateral limits, resulting in stablecoin losses. |

| Oct 15 | Typus Finance | $3.4M | Oracle exploit | Attackers exploited a vulnerability in Typus Finance’s oracle module and drained funds from TLP related contracts. |

| Oct 20 | Sharwa.Finance | $0.14M | Leveraged lending + MEV | The attacker opened a margin account, used collateral to borrow additional assets via leveraged lending, then executed a sandwich style attack to extract value. |

| Oct 21 | DoodiPals | $0.17M | Private key compromise | A private key leak enabled attackers to access multiple wallets and swap or sell tokens into SOL. |

| Oct 21 | Garden Finance | $10.8M | Solver breach | Garden Finance suffered a solver intrusion. The attacker reportedly moved 501 BNB and 1,910 ETH to Tornado Cash, with root cause under investigation at the time of reporting. |

Despite heightened volatility triggered by geopolitical shocks, the crypto market in October 2025 showed resilience. Adjustments unfolded across multiple dimensions, including price action, derivatives positioning, on-chain activity, and institutional holdings. Across major narratives, from large-cap assets to key sectors such as DeFi, cross-chain infrastructure, and Layer 2 scaling, the month reflected ongoing structural development rather than a breakdown in long-term market direction.

Looking ahead, as core infrastructure continues to mature and regulatory frameworks advance gradually, the industry remains in a phase driven by technology upgrades, improved risk management, and evolving market structure. Short-term volatility remains likely, but it has not materially changed the broader long-term trajectory.

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. At Bitunix, we are committed to providing a transparent, compliant, and secure trading environment for every user. Our platform features a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, we prioritize user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 125x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.