Ready To Place Your

Next Trade?

Choose a market, set your order, and manage risk in one place.

Real estate has always been one of the most stable and profitable asset classes, offering rental income, long-term appreciation, and portfolio diversification. However, traditional real estate investment has long been limited by high capital requirements, geographic restrictions, complicated paperwork, and slow transactions. These barriers mean that direct participation in lucrative property markets is often reserved for wealthy individuals or institutions.

In 2025, blockchain is disrupting this status quo through real estate tokenization. By turning property ownership into digital tokens, investors worldwide can buy fractions of real estate quickly, securely, and with far fewer barriers. This new model is democratizing access to property markets while improving liquidity and transparency.

This article explains what real estate tokenization is, how it works, the benefits it offers, the risks involved, and how investors can start exploring opportunities in tokenized property.

Real estate tokenization is the process of converting property ownership rights into digital tokens that are recorded on a blockchain. Each token represents a fraction of the property, meaning investors can purchase smaller units rather than committing large amounts of capital to buy an entire building or land parcel.

For example, a $20 million commercial tower could be divided into 2 million tokens, each priced at $10. Investors who hold these tokens share ownership rights, which could include receiving rental income or benefiting from property appreciation.

Smart contracts automated codes on the blockchain govern these tokens. They handle functions such as transferring ownership, distributing income, or enforcing restrictions, all without manual intervention.

| Feature | Traditional Real Estate | Tokenized Real Estate |

| Entry Barriers | Requires high upfront capital | Fractional ownership at lower amounts |

| Settlement | Weeks or months with brokers and banks | Near-instant transactions via blockchain |

| Liquidity | Illiquid, resale may take months or years | Tradable on secondary digital markets |

| Transparency | Ownership records often opaque | Transparent, blockchain-based records |

| Accessibility | Limited to accredited or local investors | Global participation enabled |

| Income Distribution | Manual collection and distribution | Automated via smart contracts |

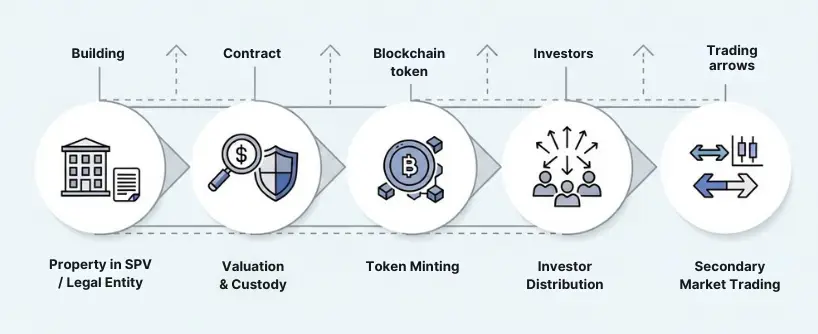

The property is placed in a legal entity, such as a Special Purpose Vehicle (SPV), which ensures tokens are legally tied to the real estate. This step provides investors with enforceable claims.

Independent appraisals are conducted to determine the property’s value. Custodians or trustees then manage the asset to ensure its legal rights remain intact and aligned with token issuance.

Tokens are minted on a blockchain platform, such as Ethereum, Polygon, or Avalanche. Each token represents a portion of the asset, and smart contracts define ownership rights, governance rules, and income distribution.

The tokens are distributed through tokenization platforms or digital marketplaces. Depending on regulations, investors may purchase tokens using fiat currency or cryptocurrencies.

After purchase, tokens can be traded on secondary markets, making traditionally illiquid assets more liquid. Smart contracts manage ongoing functions, including rental income distribution and compliance reporting.

Fractional ownership means retail investors can now participate in property markets that were once only open to institutions or ultra-wealthy buyers.

Tokenized real estate can be traded on secondary markets, reducing the time it takes to enter or exit an investment.

Blockchain records provide a clear, auditable history of transactions and ownership, reducing fraud and increasing trust.

Intermediaries such as brokers and custodians are reduced, lowering transaction costs and accelerating processes.

Investors can buy fractional shares across multiple properties in different geographies and sectors, building diversified portfolios at relatively low cost.

Real estate tokenization is moving from concept to practice across global markets:

These cases demonstrate how blockchain is already reshaping real estate ownership and investment models.

Despite its advantages, tokenized real estate comes with challenges investors must carefully evaluate:

Investing in tokenized property requires careful planning. Here are the key steps:

Real estate tokenization combines two traditionally separate worlds, property investment and blockchain technology. For many investors, navigating this new landscape requires both financial and technical knowledge.

Bitunix Academy addresses this by offering tailored educational resources on real estate tokenization. Investors can learn how fractional property ownership works, how to analyze tokenized rental yields, and how legal structures such as SPVs protect investor rights. The Academy also covers practical topics like evaluating tokenization platforms, understanding smart contracts in real estate, and strategies for diversifying across tokenized property markets.

This makes Bitunix Academy a bridge between traditional real estate expertise and blockchain innovation, giving investors the confidence to participate in tokenized property opportunities.

How does real estate tokenization benefit small investors?

Tokenization enables fractional ownership, allowing small investors to buy shares of high-value properties such as luxury apartments or commercial buildings with relatively low capital.

Do tokenized real estate tokens give me ownership of the property?

It depends on the token structure. Some tokens represent direct equity ownership, while others may represent debt obligations or rights to income distributions like rental yields. Always review the legal framework before investing.

Is tokenized real estate legal worldwide?

Regulation varies by jurisdiction. Some regions, like Singapore and Switzerland, have clearer frameworks for tokenized real estate, while others are still developing guidelines. Investors should check local regulations before participating.

How do investors earn returns from tokenized real estate?

Returns may come from rental income distributions managed through smart contracts or from appreciation in the property’s token value. Some projects also offer voting rights on property management.

What are the risks of investing in tokenized property?

Risks include regulatory uncertainty, market volatility, limited secondary market liquidity, and technical risks associated with blockchain platforms. Conducting research on the platform and property is essential.

Real estate tokenization is transforming property investment by lowering barriers, increasing liquidity, and creating transparency. Through fractional ownership, blockchain allows investors from around the world to participate in markets that were once exclusive to a privileged few.

Challenges remain, particularly around regulation, custody, and secondary market depth. However, the long-term trajectory is clear. Tokenized real estate offers flexibility, accessibility, and diversification that traditional property ownership cannot match.

By leveraging resources like Bitunix Academy, investors can gain the technical and financial knowledge to explore this new frontier in real estate. Those who adapt early to tokenized property investing will be well positioned to take advantage of the trillion-dollar opportunities unfolding in global property markets.

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.