If you are new to cryptocurrency, one of the first questions you may have is what is the difference between a token and a coin. There are fundamental differences between tokens and coins that are important to understand. These two terms are often used interchangeably in online discussions, but they do not mean the same thing. Understanding the distinction is essential for anyone who wants to invest, trade, or build in the blockchain ecosystem.

Coins like Bitcoin and Ethereum serve as the native currency of their respective blockchains. Tokens, on the other hand, are built on top of existing blockchains and usually serve a specific function, such as powering decentralized applications or representing digital assets.

In this article, we will explore the meaning of coins and tokens, highlight their differences, discuss real-world use cases, and explain why these distinctions matter within the broader cryptocurrency space.

[ez-toc]

A coin is a cryptocurrency that operates on its own independent blockchain. Coins function as digital money that can be used for payments, trading, or storing value. Coins like Bitcoin and Ethereum serve as the native currency of their respective blockchains. These are considered native coins or native tokens of their blockchain networks. Each coin has its own infrastructure, consensus mechanism, and native utility.

Coins exist on their own blockchain. For example, Bitcoin runs on the Bitcoin blockchain, and Ether exists on the Ethereum blockchain.

Coins are mainly used for payments, value transfer, and securing the blockchain. For instance, Bitcoin is primarily a peer-to-peer payment system, while Ether powers transactions and smart contracts on Ethereum.

Coins are usually generated through mining or staking. Bitcoin miners validate transactions, while Ethereum validators stake ETH to secure the network.

Coins form the backbone of blockchain ecosystems. They are typically accepted by exchanges, wallets, and merchants as a store of value or payment method.

A token is a cryptocurrency that does not have its own blockchain. A crypto token is a type of digital asset built on existing blockchain networks. Instead, it exists on top of another blockchain, such as Ethereum, Solana, or Binance Smart Chain. Tokens are created through smart contracts and can represent almost anything: digital assets, governance rights, or access to a platform. Crypto tokens are issued via smart contracts, and new tokens can be created for different purposes.

Tokens are launched using established blockchain networks. For example, ERC20 tokens like USDT (Tether) and UNI (Uniswap) exist on the Ethereum blockchain.

Tokens are generated using code that defines supply, distribution, and functionality. Developers do not need to build a new blockchain to launch a token.

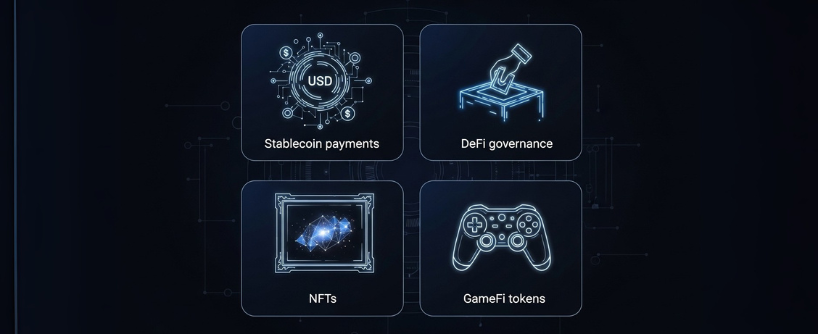

Tokens can represent:

Examples of Tokens

Tokens expand the possibilities of blockchain by enabling decentralized finance, gaming, collectibles, and more.

There are key differences and major differences between coins and tokens that set them apart in the cryptocurrency ecosystem.

| Feature | Coins | Tokens |

| Blockchain | Native blockchain (BTC, ETH) | Built on existing blockchain (ERC20, BEP20) |

| Creation | Mining or staking | Smart contracts |

| Use Case | Payments, security, gas fees | Utility, governance, NFTs, stablecoins |

| Examples | Bitcoin, Ethereum, Litecoin | Tether, Uniswap, Chainlink, Decentraland |

| Supply Model | Often capped (BTC 21M) | Varies depending on project |

The technological underpinnings of coins and tokens are fundamentally different: coins operate on their own blockchain infrastructure, while tokens are created and function on top of existing blockchains. This major difference impacts how they are created, used, and valued.

Simply put, coins are the foundation, while tokens are the applications built on top.

Understanding whether you are buying a coin or token helps you assess risks. Coins like Bitcoin often serve as long-term stores of value. Tokens may carry higher risks but also offer exposure to innovation. Understanding the distinction between coins and tokens is crucial for navigating the cryptocurrency market, as each plays a different role in decentralized finance and blockchain applications.

Coins focus on core blockchain functions. Tokens can represent assets, governance rights, or services. Knowing this distinction allows you to understand what you are holding.

Coins are secured by their own blockchain. Tokens rely on the security of the underlying network. If the base blockchain has vulnerabilities, all tokens built on it are exposed.

Coins like Bitcoin are often viewed as commodities, while some tokens may be considered securities depending on their design. Some tokens are also regulated as financial instruments, depending on their use case and structure. Understanding this difference helps navigate compliance risks.

Coins and tokens are foundational to the digital economy, supporting its ongoing evolution and the development of new financial systems.

Security is one of the most important considerations in the crypto world, whether you are dealing with coins or tokens. Both coins and tokens are digital assets, but their security depends on different factors tied to the underlying blockchain technology and how these assets are managed.

Coins, such as Bitcoin or Ethereum, operate on their own independent blockchain. This means they have native security protocols built directly into their respective networks. The security of these cryptocurrency coins is maintained by network participants—miners or validators—who verify transactions and help protect the blockchain from attacks. Because coins have their own blockchains, they can implement custom security features and consensus mechanisms, making them generally more robust against certain threats.

Tokens, on the other hand, are created on existing blockchain networks like the Ethereum blockchain. Their security is closely linked to the strength and reliability of the underlying blockchain. For example, most tokens on Ethereum benefit from the network security provided by thousands of validators and the established infrastructure of the Ethereum network. However, tokens also rely on smart contracts—self-executing code that defines how the token operates. Well-audited smart contracts can add extra layers of protection, such as multi-signature wallets or time-locked transfers, which help prevent unauthorized access or movement of digital assets.

Network security is a shared responsibility in the crypto ecosystem. Whether you are using coins or tokens, the collective efforts of network participants are crucial for maintaining the integrity of blockchain networks. These participants are incentivized with rewards in the form of coins or tokens, which helps keep the network secure and operational.

In addition to technical safeguards, many blockchain projects implement extra security checks, such as know-your-customer (KYC) and anti-money-laundering (AML) protocols. These measures help ensure that coins and tokens are not used for illicit activities and add another layer of trust for users and regulators.

Bitcoin is a good example of a native coin operating on its own blockchain and has a capped supply of 21 million coins. It is the original coin and remains the benchmark of the crypto industry.

Ethereum is a good example of a blockchain that supports both a native coin and a wide variety of tokens. Ethereum is a coin, but it also enables thousands of tokens via smart contracts. Tokens like USDT, UNI, and AAVE depend on the Ethereum network for security and transactions.

BNB is a good example of a token that became a coin after migrating to its own blockchain. BNB started as an ERC20 token before moving to its own chain. Today, BNB is a coin, and thousands of tokens exist on Binance Smart Chain.

What is the main difference between a coin and a token?

A coin has its own blockchain, while a token is built on top of an existing blockchain. Coins are mainly used for payments and network security. Tokens represent assets, services, or governance rights within applications.

Can a token become a coin?

Yes. A project can start as a token and later launch its own blockchain. Binance Coin (BNB) is a famous example. It began as an ERC20 token on Ethereum before migrating to its own blockchain.

Are tokens riskier than coins?

Generally, tokens can carry more risks since they depend on the base blockchain for security. However, coins are not risk-free either, as their value depends on adoption and network stability.

Why are tokens easier to create?

Tokens are created through smart contracts. Developers do not need to build a blockchain from scratch, making tokens faster and cheaper to launch compared to coins. Tokens issued via smart contracts can be created quickly and can have various functionalities, rules, and conditions.

What are stablecoins and why are they important?

Stablecoins are tokens pegged to stable assets like the US dollar. They are important because they allow traders to move money quickly in and out of volatile markets without relying on traditional banks. Stablecoins are just one type among many different tokens, which can include security, utility, equity, and payment tokens.

Do I need to use coins to buy tokens?

Yes, in most cases. Tokens are purchased using coins like ETH or BNB as the base currency. This is because tokens exist on those blockchains and require coins for gas fees.

Can NFTs be considered tokens?

Yes. NFTs are a type of non-fungible token. Each NFT is unique and cannot be exchanged one-to-one like coins or fungible tokens.

Why is Ethereum both a coin and a token platform?

Ethereum is a coin (ETH) that powers its blockchain. At the same time, Ethereum supports thousands of tokens built using ERC20, ERC721, and ERC1155 standards.

Are coins always more valuable than tokens?

Not necessarily. While coins like Bitcoin have higher market caps, some tokens like USDT or USDC are crucial for market stability. Token value depends on use case, demand, and adoption, and some tokens are also significant in terms of value and market presence.

How do regulations treat coins and tokens differently?

Coins like Bitcoin are often treated as commodities. Tokens may be classified as securities if they represent investment contracts. This distinction is important for compliance and investor protection.

Can coins and tokens be used together in DeFi?

Yes. In decentralized finance, coins provide liquidity while tokens power lending, borrowing, and governance. For example, ETH is used for gas fees, while tokens like USDT or DAI are used for stable trading pairs.

Which is better for beginners to invest in, coins or tokens?

Beginners often start with coins like Bitcoin and Ethereum because they are more established. Tokens can provide higher rewards but also higher risks. The best choice depends on your risk tolerance and goals.

Altcoin: Any cryptocurrency that is not Bitcoin. Altcoins often introduce new features such as faster transactions, different consensus mechanisms, or unique use cases.

Base Layer (Layer 1): The primary blockchain where coins operate, such as Bitcoin or Ethereum. These blockchains provide the foundation for building applications and tokens.

Bridge: A blockchain protocol that allows tokens to move across different networks. Bridges improve interoperability by letting assets flow from Ethereum to Binance Smart Chain, Polygon, and other ecosystems.

Burning: The process of permanently removing tokens from circulation by sending them to an inaccessible address. Burning helps reduce supply and can increase scarcity over time.

Circulating Supply: The number of coins or tokens that are currently available to the public. This figure excludes locked or reserved tokens.

Coin: A cryptocurrency that operates on its own blockchain. Examples include Bitcoin, Ethereum, and Litecoin. Coins are often used for payments and as a store of value.

Collateralized Token: A token backed by real assets such as fiat currency, commodities, or cryptocurrencies. Stablecoins like USDC are collateralized with US dollars to maintain stability.

Consensus Mechanism: The system a blockchain uses to validate transactions and secure the network. Common examples include Proof of Work and Proof of Stake.

Cryptocurrency Exchange: A platform where users can buy, sell, and trade coins and tokens. Exchanges may be centralized, like Coinbase, or decentralized, like Uniswap.

DAO (Decentralized Autonomous Organization): An organization governed by smart contracts and token holders rather than a central authority. Decisions are made through community voting.

ERC20 Standard: A technical standard on Ethereum for creating fungible tokens. ERC20 tokens can be easily traded and integrated into wallets and decentralized applications.

ERC721 Standard: A standard for creating non-fungible tokens (NFTs) on Ethereum. Each ERC721 token is unique and cannot be exchanged one-to-one with another token.

ERC1155 Standard: A multi-token standard on Ethereum that supports both fungible and non-fungible tokens. It is widely used in blockchain games and digital collectibles.

Fiat-backed Stablecoin: A cryptocurrency pegged to traditional currencies such as the US dollar or euro. These tokens aim to maintain price stability and are used widely in trading.

Fungible Token: A type of token that is interchangeable with others of the same kind. Each unit holds the same value, just like one dollar is equal to another dollar.

Gas Fees: Transaction fees paid on blockchains such as Ethereum. Users pay gas fees in the network’s native coin, such as Ether, to process transactions and run smart contracts.

Governance Token: A token that allows holders to vote on protocol changes and platform decisions. For example, UNI holders vote on proposals for the Uniswap platform.

Liquidity Pool: A pool of cryptocurrency assets locked in a smart contract to provide liquidity for decentralized exchanges. Liquidity pools enable users to trade without traditional order books.

Market Capitalization: The total market value of a cryptocurrency, calculated by multiplying the price per unit by the circulating supply. It is a common metric to measure project size.

Migration: The process of moving a token from an existing blockchain to a new, independent blockchain. When this occurs, the token effectively becomes a coin.

NFT (Non-Fungible Token): A type of token that represents ownership of unique digital or physical assets. NFTs are often used for artwork, music, gaming assets, and collectibles.

Security Token: A blockchain-based token that represents ownership in an asset, company, or revenue stream. Security tokens are often subject to financial regulations.

Smart Contract: A self-executing piece of code stored on a blockchain. Smart contracts automatically carry out transactions when specific conditions are met.

Stablecoin: A cryptocurrency designed to maintain a stable value, often pegged to fiat currencies such as the US dollar. Stablecoins are widely used in payments and DeFi.

Staking: The act of locking coins in a proof-of-stake blockchain to support network security and earn rewards. Stakers often receive interest-like returns.

Token: A digital asset built on an existing blockchain, such as Ethereum. Tokens can represent utility, governance, or assets like stablecoins and NFTs.

Tokenomics: The economic system behind a cryptocurrency project. Tokenomics includes supply, distribution, incentives, and mechanisms to create value.

Utility Token: A token that provides access to products or services within a blockchain ecosystem. For instance, MANA is used in Decentraland to buy virtual land.

Wallet: A software application or hardware device that stores cryptocurrencies securely. Wallets allow users to send, receive, and manage coins and tokens.

Wrapped Token: A tokenized version of a cryptocurrency that can be used on another blockchain. Wrapped Bitcoin (WBTC), for example, allows Bitcoin to be used on Ethereum.

Coins and tokens both play critical roles in the cryptocurrency ecosystem. Coins like Bitcoin and Ethereum provide the infrastructure and security of blockchains, while tokens expand possibilities by enabling stablecoins, DeFi, governance, and NFTs.

For beginners, understanding the difference between token vs coin is essential for making smart investment and usage decisions. While coins offer stability and long-term value, tokens provide innovation and diverse opportunities. Together, they form the foundation and future of blockchain technology.

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.