The global financial system is on the verge of a major transformation in 2025. At the center of this change is the tokenization of Real World Assets (RWA), which is reshaping how people and institutions invest, trade, and unlock value. While traditional assets have long been the backbone of global markets, they are being challenged by tokenized models that deliver speed, transparency, and access at a scale never seen before.

As tokenization continues to disrupt financial markets, this article previews the potential benefits it offers, including increased efficiency, liquidity, and accessibility that are driving its adoption and changing the landscape of global finance.

This article explores why tokenization is outpacing traditional systems, what advantages it brings, and how it is fueling a digital asset transformation that investors cannot afford to ignore.

[ez-toc]

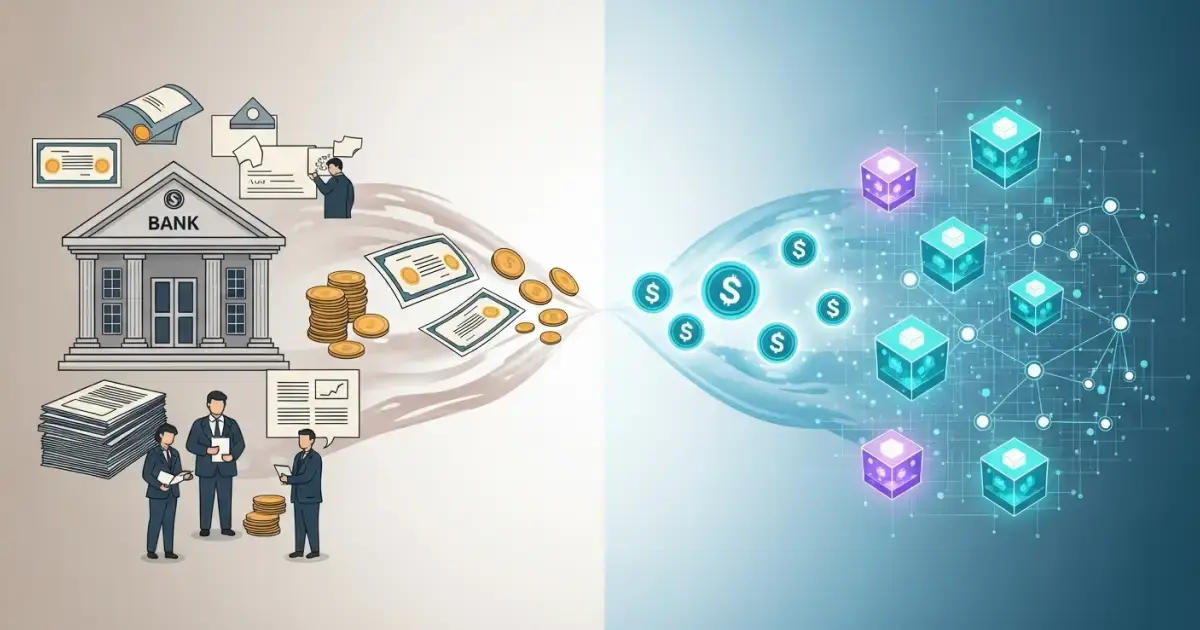

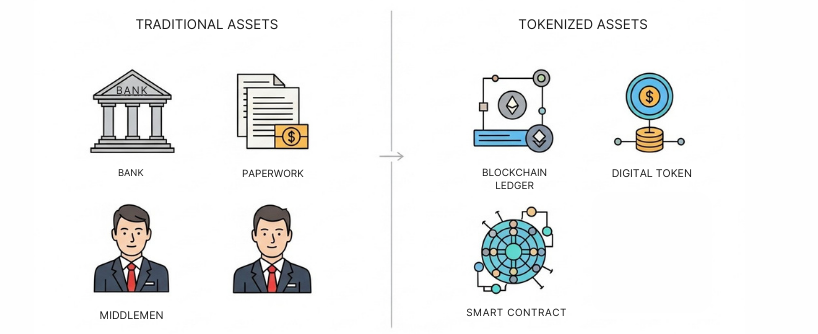

Tokenization vs Traditional Assets Explained

Traditional assets are physical or paper-based representations of ownership, such as stock certificates, real estate deeds, or bond notes. In traditional financial systems, there are multiple intermediaries involved—such as financial institutions, brokers, custodians, and clearing houses—which increases costs and complexity in asset management. These systems, while trusted, are costly and slow. Traditional assets often include physical assets like real estate and commodities.

Tokenization, by contrast, converts ownership rights into digital tokens on a blockchain. This process uses distributed ledger technology and blockchain technology to secure and record transactions. These tokens can represent real estate, equities, commodities, or even luxury items. Ownership is secured on a decentralized ledger, which means settlement is near-instant and records are immutable. Tokenization eliminates intermediaries, streamlining asset management and reducing costs. Tokenized assets can represent a wide range of asset classes, and this process is transforming traditional financial systems.

Comparison Table: Tokenization vs Traditional Assets

| Feature | Traditional Assets | Tokenized Assets |

| Settlement | Days to weeks | Near-instant |

| Accessibility | Limited | Greater accessibility and fractional ownership opportunities |

| Transparency | Opaque, requires intermediaries | Public, blockchain-based |

| Liquidity | Restricted | Greater liquidity |

| Transaction Costs | High | Lower transaction costs and cost savings |

| Costs | High due to multiple middlemen | Reduced with blockchain efficiency |

Key Advantages of Tokenization

Liquidity Through Fractionalization

A luxury property worth $10 million is a prime example of a high value asset that may only be accessible to elite investors in traditional markets. Tokenization creates fractional ownership opportunities by splitting such assets into thousands of affordable units, making them accessible to smaller investors worldwide. This process increases liquidity in the market.

Faster and Cheaper Transactions

With blockchain networks, trading, settlement, and custody happen in one ecosystem, enabling faster settlement and lower transaction costs. The use of blockchain networks results in significant cost savings compared to traditional systems. This efficiency reduces transaction costs and accelerates the flow of capital across borders due to the streamlined processes provided by blockchain technology.

Transparency and Security

Blockchain technology and distributed ledger technology are used to record every transaction immutably. Each digital token serves as a digital representation of ownership on the blockchain, enabling secure and transparent asset management. Investors can verify ownership and transfer history without relying on opaque third parties.

Broader Investor Participation

Tokenization provides greater accessibility for retail investors. It provides investors with global access to new investment opportunities and easier asset ownership through blockchain-based digital tokens.

Tokenization democratizes markets by enabling participation with small capital commitments. Assets like commercial real estate, private equity, or even fine art become available to everyday investors.

Market Growth and Real-World Momentum

The tokenization market is expanding at an unprecedented rate. Analysts project the global tokenized asset market to exceed $2 trillion by 2025 and grow to more than $13 trillion by 2030. Already, tokenized assets surpass $50 billion in value, ranging from real estate to government bonds. The rapid growth of tokenized real world assets is driving blockchain adoption across financial markets and asset classes, enabling broader access and efficiency.

Notable real-world use cases include:

- The Hong Kong government issuing a $750 million blockchain bond with a one-day settlement.

- BlackRock entering tokenized funds to unlock new investor pools.

- Robinhood’s launch of tokenized stocks and ETFs in Europe.

- State Street partnering with Swiss firm Taurus to tokenize traditional financial products.

- Industry leaders are leveraging blockchain platforms to innovate and expand the reach of tokenized assets across diverse asset classes.

These examples highlight the unstoppable momentum behind tokenization.

The Bigger Picture: Digital Asset Transformation

Tokenization is not just about digitizing existing assets. Digitizing assets through asset tokenization enables the creation of new financial instruments and digital representations of ownership, transforming how assets are managed and traded. It is a gateway to a fully digital financial system. By integrating programmable ownership rights, tokenized assets can interact with decentralized finance (DeFi), lending protocols, and cross-chain ecosystems.

Intellectual property and non fungible tokens (NFTs) are examples of assets that can be managed and traded in this new digital ecosystem, expanding the scope of asset management beyond traditional boundaries.

This creates entirely new possibilities:

- Tokenized real estate collateral for DeFi loans.

- Bonds automatically paying interest through smart contracts.

- Global markets operating 24/7 without traditional bottlenecks.

Challenges That Remain

Despite its promise, tokenization faces hurdles that need resolution:

- Regulation: Regulatory barriers and differences based on geographical location complicate cross-border adoption of tokenized real world assets, as jurisdictions lack uniform standards, creating uncertainty.

- Liquidity Depth: While fractionalization boosts access, certain asset classes remain less liquid due to market volatility and limited secondary markets.

- Custody Risks: Integration with blockchain networks and blockchain platforms presents technical and administrative overhead challenges, as linking off-chain assets with on-chain tokens securely requires robust infrastructure.

- Institutional Adoption: Cultural resistance and technical complexity slow down large-scale acceptance.

Why RWA is Revolutionary in 2025

Tokenization is revolutionizing finance by bridging the gap between traditional markets and blockchain efficiency. By enabling the tokenization of real world assets such as real estate property, blockchain technology transforms asset ownership, allowing for fractional ownership, increased liquidity, and easier transfer of rights compared to traditional finance and traditional financial systems. In conventional models, asset managers and central banks play key roles in managing investments and influencing returns, but tokenization introduces new approaches to risk management and market volatility, offering greater transparency and accessibility.

Both retail and institutional investors are recognizing that tokenization offers more than efficiency—it creates entirely new opportunities for wealth creation and market innovation.

Comprehensive Crypto Education Platform

Bitunix Academy provides comprehensive guides on the fundamentals of real world assets and tokenization. For readers who are just beginning to explore this space, the Academy offers accessible courses on blockchain basics, the mechanics of asset tokenization, and how tokenized assets compare to traditional investments. This makes it a starting point for investors and professionals seeking to understand the digital asset transformation at a foundational level.

FAQ

What is the main difference between tokenized assets and traditional assets?

Traditional assets rely on intermediaries such as brokers, banks, and custodians, which makes them slower and more expensive to trade. Tokenized assets, on the other hand, are represented as digital tokens on a blockchain, enabling near-instant settlement, transparency, and fractional ownership.

Why are Real World Assets (RWA) important in 2025?

RWA are gaining momentum because they bridge traditional finance and blockchain technology. Tokenization unlocks liquidity, reduces transaction costs, and expands global access to asset classes that were once exclusive.

Can small investors benefit from tokenization?

Yes. Fractional ownership allows retail investors to participate in markets such as real estate, commodities, or private equity by purchasing small portions of tokenized assets instead of large upfront investments.

What challenges does tokenization still face?

The main challenges include regulatory uncertainty, limited liquidity in secondary markets, and the need for secure custody solutions to link physical assets with their digital counterparts.

How can I learn more about tokenization and RWA?

Educational resources like Bitunix Academy provide structured guides on tokenization, blockchain fundamentals, and investment strategies for both beginners and advanced professionals.

Conclusion

The debate of tokenization versus traditional assets is no longer theoretical. Tokenization is proving itself as a more efficient, transparent, and inclusive model that is reshaping global finance.

While regulatory clarity and market depth are still evolving, the long-term trajectory is undeniable. Investors, institutions, and innovators who embrace tokenization today position themselves at the forefront of a trillion-dollar opportunity.

As part of this journey, Bitunix Academy stand ready to equip readers with the knowledge and strategies needed to thrive in the new digital financial era.

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.