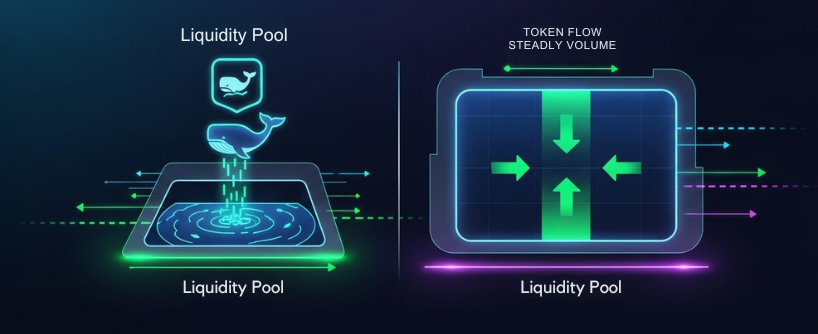

Decentralized finance allows anyone with a wallet to trade, lend, borrow, and earn yield without banks or brokers. Liquidity pools are the mechanism that makes decentralized exchanges work. A liquidity pool is a smart contract holding two or more assets of equal value, which enables decentralized trading on DeFi platforms. DeFi protocols are built on these pools and form a core part of the DeFi ecosystem, enabling decentralized trading, lending, and yield generation. A pool is a smart contract that holds two or more crypto assets and quotes prices using an automated formula. Traders perform token swaps and other trading activities in and out of the pool, and the liquidity provider who supplied the deposited assets earns a share of the trading fees generated.

The model is efficient, but it is not risk free. Providing liquidity exposes deposited assets to impermanent loss risk, smart contract vulnerabilities, and potential losses due to price fluctuations and price divergence. Many users focus on headline yields and ignore structural risks that can erase months of returns in a single volatile day. Others deposit into pools with weak security or thin liquidity and learn too late that the warning signs were visible from the start.

Yield farming and high volume pools can offer potential earnings through trading fees generated and additional incentives, but it is important to understand the overall value and risks involved. Stablecoin pools are often used to avoid impermanent loss.

[ez-toc]

Red Flag 1: High Impermanent Loss Exposure

Impermanent loss is the difference between the value of your position if you had simply held the tokens and the value after providing those tokens to an automated market maker. Impermanent loss occurs when the prices of pooled assets diverge, which is a key risk for liquidity providers. This difference represents the opportunity cost of not just holding your assets. Automated market makers such as Uniswap v2 and many forks use a constant product formula, often written as x times y equals k, to determine the exchange rate and maintain the price ratio between assets. The impermanent loss formula is used to calculate impermanent loss by quantifying the potential loss liquidity providers may face when asset prices diverge. When one asset rises quickly, arbitrage traders exploit differences between the pool’s price ratio and external

Red Flag 2: Unsustainable APY or Reward Design

Very high yields often come from token emissions rather than genuine trading demand. A protocol mints a governance token and distributes it to liquidity providers. Many protocols use yield farming to attract liquidity providers by distributing native tokens as rewards, often offering high APYs and additional incentives. If the token has weak utility or unlimited issuance, the extra supply pushes the price down. Investors who entered for a 400 percent APY discover that the token they earned fell 90 percent, so their real return is far lower than the headline figure.

Signals that yield is not sustainable

- Rewards are almost entirely paid in the native token of a new project with little utility or governance value.

- Emission schedules are front loaded, and the APY drops sharply every week.

- Liquidity is thin and most of the pool volume appears to come from wash trading rather than genuine users.

Practical mitigations

- Separate fee yield from incentive yield in your analysis. Fee yield comes from real trading and tends to be more durable.

- Read the tokenomics. Look for capped supply, a declining emission curve, and credible sinks for the token such as fee reductions or staking that locks supply.

- Plan for reward conversion. If you farm a token, decide in advance what percentage to harvest into stablecoins or the base pair to reduce volatility.

Red Flag 3: Weak Smart Contract Security and Missing Audits

Smart contracts control deposits and withdrawals, calculate fees, and enforce rules. A single bug can drain an entire pool. The most common attack classes include reentrancy, unchecked external calls, price oracle manipulation, and arithmetic mistakes. Smart contract vulnerabilities are a major risk factor in DeFi investments, as flaws in the underlying code can expose liquidity and assets to significant threats. Bridges and cross chain messaging contracts add an additional layer of complexity and risk.

What to check

- Publish dates and authors of external audits from reputable firms. Read the reports instead of just trusting a logo on a website. Confirm that high severity issues were remediated and that a follow up review was completed.

- Existence of a live bug bounty with meaningful rewards. Bounties attract skilled researchers who can find issues before attackers do.

- Clear upgrade permissions. If an admin key can unilaterally upgrade the pool logic or move funds, you must trust that key holder completely. Strong projects use multi signature wallets, timelocks, and on chain governance.

User level protections

- Prefer protocols with long operating histories and high total value locked because the code has been battle tested by real usage.

- Use a hardware wallet and sign only the minimum approvals. Revoke approvals for tokens you no longer use.

- Consider smart contract insurance when available, especially for positions that represent a large share of your portfolio.

Red Flag 4: Centralized Control or Anonymous Teams With Poor Transparency

Decentralization does not mean the absence of responsibility. On the contrary, it means clear rules that restrict unilateral action by any single party. A project that is operated by an anonymous team with full control over upgrade keys or treasury funds can disappear overnight.

Indicators of poor governance

- No public roadmap, no financial disclosures, and no regular community calls or written updates.

- Admin wallets that can pause, upgrade, or drain the pool without a timelock.

- Concentrated token ownership that allows a small group to pass proposals without community input.

Better practices to look for

- A documented governance process with forums, temperature checks, and on chain voting.

- Multi signature control of upgrades with well known signers and a timelock that gives users time to withdraw if they disagree with a proposed change.

- Transparency around treasury spending and a published security policy.

Red Flag 5: Low Liquidity, Poor Market Depth, or Thin Volume

Liquidity is the source of trading fees and also the buffer that protects prices from manipulation. A pool with two hundred thousand dollars of liquidity can be moved by a single trader. Slippage increases, arbitrage removes value from the pool, and the risk of a pump and dump rises. High volume pools are especially attractive to liquidity providers because the trading fees generated in these pools can be substantial, offering higher potential returns.

Why thin markets matter

- High slippage reduces volume because traders search for better execution elsewhere. Fee income drops and your APY falls.

- Large players can move prices, causing your position to rebalance into the weaker asset.

- Thin markets often reflect weak community engagement and a short life cycle for the project.

Risk controls

- Target pools with deep liquidity and consistent daily volume. A stablecoin pool with tens of millions of dollars and sustained volume is usually safer than a volatile pair with a small pool.

- Check whether arbitrage volume is dominating real user activity. Healthy pools have organic order flow from many independent traders.

- Avoid new tokens without established demand or listings on reputable venues.

Best Practices for Safer Liquidity Provision

Knowing the red flags is step one. Step two is building a process that you can repeat for every pool. The following playbook is structured so that each step adds a layer of protection. Following these steps helps investors make informed decisions and manage risk more effectively. Adopt as many as possible to turn liquidity provision from speculation into a managed investment activity.

Create a written thesis

Decide why you want exposure to a specific pool. A thesis could be simple, for example, earn stable fees on a USDC and DAI pool, or more advanced, such as provide liquidity to an ETH and stETH pool to capture staking yield while earning trading fees. A written thesis prevents impulsive moves driven by fear of missing out.

Define risk budgets

Allocate a maximum percentage of your portfolio to liquidity strategies, then set position limits per pool. Many professionals cap a single pool at five to ten percent of portfolio value and keep at least one third of assets in low volatility holdings such as stablecoin pools or short duration treasuries on chain.

Run an impermanent loss scenario analysis

Quantify how your position behaves under different price paths. Model a 20 percent move, a 40 percent move, and a 60 percent move in either direction. For each scenario, calculate impermanent loss by using an impermanent loss calculator—input the current prices of the assets to estimate your potential losses. For each scenario, estimate fee revenue based on historical volume. If fees do not cover the modeled divergence, either reduce the position or choose a different pair.

Choose the right AMM model

- Constant product AMMs are simple and work well for volatile assets.

- Stableswap AMMs such as Curve use a different curve that reduces slippage for like assets.

- Concentrated liquidity AMMs allow you to place liquidity within a range. Do this only if you can monitor and rebalance, because out of range liquidity earns nothing.

Verify oracle design and price inputs

If a pool relies on external prices to set incentives or calculate rewards, confirm the oracle is decentralized and resistant to manipulation. Protocols often use time weighted average prices to mitigate short term spikes. Understand the lookback window and how it affects liquidation or penalty logic.

Review audits like a security analyst

Read the executive summary and the unresolved issues section of each audit. Check the repository commit hash that was audited to ensure the deployed code matches the reviewed code. Confirm that critical issues were fixed and that the auditors validated the fixes. Search community forums for post audit discoveries.

Map administrative powers

List every privileged function that can affect your funds. Common examples include pause, unpause, change fee parameters, whitelist tokens, or upgrade the logic. If a single externally owned address can perform these actions, your risk is higher. Favor multi signature control with public signers and a clear emergency playbook.

Confirm fee structure and revenue share

Calculate the base trading fee for the pool and the share that accrues to liquidity providers after protocol fees and any partner splits. Some pools display a blended APY that includes rewards from multiple sources. Separate these components and verify what you will actually receive.

Stress test with a small deposit

Before committing size, deposit a small amount and observe how the pool behaves during a volatile market session. Watch how often your range goes out of bounds if you use concentrated liquidity. Measure gas costs for rebalancing and for removing liquidity. These operational insights prevent surprises.

Build an exit strategy

Plan when you will reduce or exit the position. Triggers might include a sustained drop in daily volume, a change in fee tier, a loss of a stablecoin peg, or a governance proposal that alters risk. Document your plan so that you act calmly when markets are noisy.

Use portfolio and risk monitoring

Adopt one or two dashboards that show position value, accrued fees, impermanent loss estimates, and approvals. Tools such as DeBank, Zerion, and Dune community dashboards provide visibility. Set calendar reminders to review positions at a consistent cadence, for example every Monday and Thursday.

Rebalance and harvest on a schedule

Decide how often you will claim and convert rewards. A common approach is to harvest weekly and convert a portion into stablecoins to lock gains while reinvesting the remainder into the base pair. Scheduled actions reduce the temptation to chase short term moves.

Protect approvals and manage keys

Approve only the amount required for the next transaction rather than granting unlimited approval. Revoke lingering approvals periodically using a trusted revocation tool. Store keys on a hardware wallet. If you manage a fund or a team wallet, use a multi signature wallet with clear signer policies.

Consider insurance selectively

Smart contract risk is real. Third party insurers offer coverage for specific protocols and pools. Review exclusions carefully, such as oracle failure or governance risk, and compare premiums with expected yield. Insurance can make sense for positions that would be financially painful to replace.

Understand tax and accounting treatment

In many jurisdictions, fees earned from liquidity provision are taxable income. Swaps triggered by pool rebalancing may also have tax consequences because your token composition changes. Keep accurate records and consult a professional who understands digital asset taxation.

Diversify across chains without ignoring bridge risk

Layer 2 networks and alternative chains often provide lower fees and attractive yields. If you cross chains, evaluate bridge security and decide how much exposure you are willing to take to a single bridge. Use native bridges when possible and avoid chasing yield that depends on an unproven cross chain link.

Watch for sandwich attacks and miner extracted value

Front running and sandwich attacks increase slippage and reduce fee capture. Pools with strong order flow protection or private mempool options can mitigate the effect. If you provide liquidity through a strategy contract, verify that it routes transactions through trusted relays when appropriate.

Maintain a personal incident response plan

Write down what you will do if the protocol pauses, if a stablecoin depegs, or if a critical vulnerability is disclosed. Include contacts for project teams, links to governance forums, and a step by step removal process. Preparation reduces decision time when every minute matters.

Learn from historical blowups and successes

Study case studies. Curve’s stableswap design has supported large volumes with relatively low divergence. By contrast, several small farms in prior cycles offered extreme APYs and later vanished. Patterns repeat. The best defense is a memory.

Keep learning

DeFi evolves quickly. New AMM designs, oracle methods, and risk controls appear every quarter. Dedicate time each month to read technical posts, join community calls, and experiment on test networks. A consistent learning habit is the most durable edge you can build.

Frequently Asked Questions

What is the single most important metric to check before I provide liquidity?

There is no single magic metric, but a practical starting point is the relationship among daily volume, total value locked, and fee tier. A healthy pool has enough volume relative to its size to generate meaningful fees. For example, a daily volume to TVL ratio of 5 percent at a 0.3 percent fee tier indicates solid fee potential. Combine that with deep liquidity and good security practices and you have a stronger candidate.

How do I estimate whether fees will offset impermanent loss?

Model historical daily volume and apply the fee tier to estimate daily fee income. Compare that to an impermanent loss estimate for a few plausible price paths. Online calculators help. If a 30 percent price move produces more divergence than a month of fees, you need either higher volume or a different pair.

Are audited protocols safe enough to trust with large deposits?

Audits reduce risk, but they do not guarantee safety. Attackers innovate and new bugs appear when contracts interact in unexpected ways. Treat audits as a filter, not a shield. Diversify, monitor, and size positions so that a worst case event would be survivable.

Should I use concentrated liquidity as a beginner?

Only after you understand how ranges work and how to manage them. Concentrated liquidity can increase fee capture because your liquidity is placed where trades occur. It also requires active management. If price moves outside your range you earn zero until you adjust. Beginners often prefer wide ranges or stableswap pools that require less attention.

Why is the team’s transparency so important?

Transparent teams publish audits, document how admin keys work, and explain how fees are split. They show their faces, host calls, and respond in public forums. If you cannot find that level of detail, assume higher governance risk. In DeFi, you choose the rules you are willing to live under. Choose rules you can see.

How often should I harvest rewards?

It depends on gas costs, reward volatility, and your compounding plan. Many investors harvest weekly to balance gas efficiency with risk reduction. If a reward token is volatile, harvesting more frequently and converting a portion to stablecoins can reduce drawdowns.

What tools help me track risk in real time?

Use a portfolio dashboard to see position values, accrued fees, and token approvals. Add block explorer alerts for transactions from admin wallets or the pool contract. Follow the project’s official channels and subscribe to security feed services that publish incident notifications.

Can stablecoin pools still be risky?

Yes. Stablecoins can break their peg during stress events. A depeg can trap a pool with mostly the weaker stablecoin. Review reserve attestations and historical behavior under stress. Diversify across more than one stablecoin issuer rather than relying on a single peg.

What is the best way to learn without risking real money?

Use test networks and small amounts on production networks. Many protocols operate faucets or educational sandboxes. Treat early experiments as tuition and record what you learn in a notebook so that each action improves your process.

How do taxes usually work for liquidity providers?

Rules vary by jurisdiction, but in many places, fees are treated as income when claimed, and swaps inside the pool can create taxable events when you withdraw because your token composition changed. Keep detailed records and consult a professional who understands digital assets.

What signs suggest I should exit a pool quickly?

Emergency signs include a disclosed critical vulnerability, a governance proposal that grants sweeping powers to a single wallet, an unexplained drop in TVL, a stablecoin losing its peg, or a credible report of oracle manipulation. When in doubt, reduce exposure first and investigate after.

Can I eliminate risk altogether by using only the largest pools?

Large pools reduce some risks but cannot eliminate them. Smart contract bugs, oracle failures, and depegs can still occur. Treat size as one input, not a guarantee.

How do liquidity pools work?

Liquidity pools work by enabling trading without traditional order books. Instead, they use automated market makers (AMMs) to set prices and facilitate trades, which is fundamental to many DeFi applications.

Glossary

Automated Market Maker: A smart contract system that quotes prices and executes trades using a mathematical formula rather than an order book.

Concentrated Liquidity: A method that allows a provider to place liquidity within a chosen price range to improve capital efficiency.

Depegging: Loss of the intended one to one value of a stablecoin relative to its reference asset.

Impermanent Loss The shortfall that occurs when the price of pooled assets diverges compared to simply holding them.

Liquidity Mining: Distribution of tokens to users who provide liquidity, often used to bootstrap a new protocol.

Multi Signature Wallet: A wallet that requires multiple approvals to execute a transaction, used for safer administration.

Oracle: A service that supplies off-chain data such as prices to smart contracts.

Slippage: The difference between expected and executed prices due to market impact and liquidity depth.

Stableswap: An AMM design optimized for assets that trade near the same price, which reduces slippage.

Total Value Locked: The amount of assets deposited in a protocol, often used as a proxy for adoption and trust.

Conclusion

Earning yield from liquidity pools is a legitimate strategy when it is supported by careful analysis and disciplined risk management. The major red flags are clear. Watch for high impermanent loss exposure, do not chase yields that depend on inflationary emissions, avoid unaudited or weakly governed contracts, be cautious with teams that hide from accountability, and be selective with pools that lack depth and real volume.

Apply the best practices in this guide as a checklist. Write a thesis, set risk budgets, model scenarios, read audits with a critical mindset, verify oracles and admin powers, run small live tests, and monitor positions with professional tools. Harvest and rebalance on a schedule, protect your approvals, consider insurance where it makes sense, and keep learning.

DeFi rewards patient operators who respect risk and build process. If you approach liquidity provision with that mindset, you can capture fees and incentives while protecting capital through changing market cycles.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.