Bitunix has expanded its derivatives offering with the introduction of Coin-M Perpetual Futures, a new product category that allows traders to use cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and other supported coins as both margin and settlement.

Coin-M contracts are designed for traders who prefer to manage their entire exposure in crypto rather than in stablecoins. With Coin-M Perpetual Futures, both the margin and the profit and loss (PnL) are denominated in the underlying coin instead of USDT.

The addition of these contracts gives Bitunix users a broader set of tools to hedge, speculate, and manage portfolios, complementing the existing USDT-M Perpetual Futures on the platform.

A Coin-M Perpetual Futures contract is a type of crypto derivative that tracks the price of an underlying asset, such as BTC or ETH, without an expiry date. Unlike traditional quarterly futures, perpetual contracts remain open as long as margin requirements are met.

The unique feature of Coin-M contracts is their margin and settlement structure. Instead of using a stablecoin such as USDT for collateral, traders use the coin itself. For example, in a BTCUSD Coin-M contract, the trader deposits BTC as margin, and the resulting gains or losses are also settled in BTC.

This structure suits long-term holders and those who measure portfolio performance directly in crypto assets. It also provides a natural hedge for users whose exposure and risk appetite are denominated in Bitcoin or other cryptocurrencies.

Coin-M contracts operate on the same perpetual mechanism familiar to USDT-M traders. The contracts have no expiry date, and a funding rate system ensures that the contract price remains close to the spot market price.

Funding payments occur periodically between long and short positions. When the futures price trades above spot, long traders pay funding to short traders, and vice versa. This continuous adjustment keeps the futures market aligned with real-time spot prices.

By using the underlying cryptocurrency as both margin and settlement, traders can avoid converting holdings into stablecoins. This reduces exposure to fiat-pegged assets and can help advanced users optimize their capital utilization in a fully crypto-denominated structure.

Bitunix has launched multiple Coin-M Perpetual Futures contracts at the initial stage, covering major crypto assets:

These contracts are accessible under the Futures section of the Bitunix trading platform. More trading pairs will be added progressively based on liquidity, demand, and community feedback.

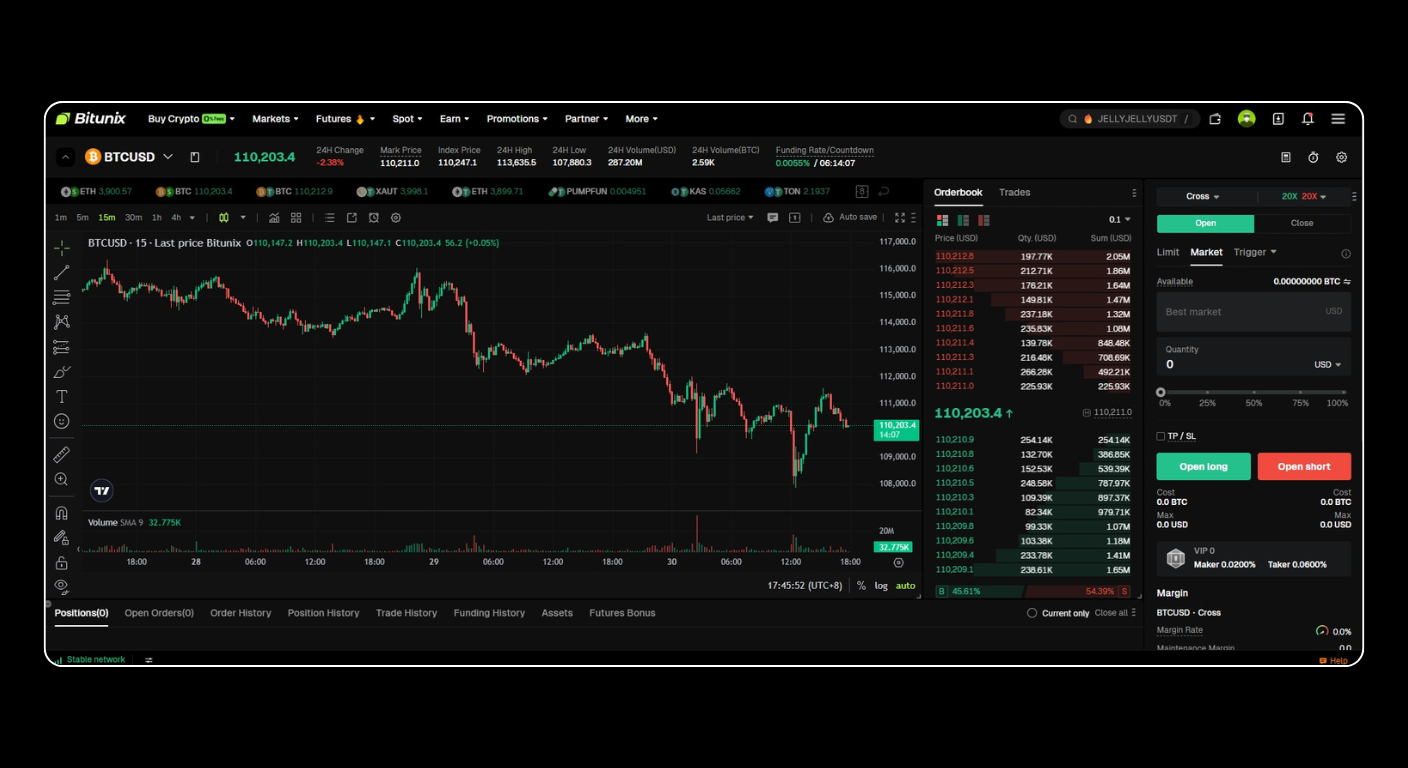

Each Coin-M contract supports professional-grade trading tools, including real-time charts, funding rate information, and depth data.

Traders can use BTC, ETH, and other supported coins as margin. PnL is settled in the same asset, allowing users to accumulate more of their preferred cryptocurrency through profitable trades.

For instance, when trading BTCUSD Coin-M Futures, both profits and losses are realized in BTC. This provides a seamless way to build Bitcoin holdings without stablecoin conversion.

Coin-M Perpetual Futures have no expiration date. Traders can maintain positions indefinitely as long as margin requirements are met.

Funding rate adjustments occur regularly to keep the perpetual price close to the spot price. This structure creates an efficient and fair pricing environment, minimizing long-term basis deviations.

The Bitunix Futures platform integrates essential trading tools into a single interface. Users can access:

This combination supports both short-term and long-term strategies while offering granular control over risk and exposure.

The Coin-M trading environment mirrors the simplicity of the existing USDT-M interface. Traders can view real-time K-line charts, order book depth, open positions, and funding rate information all in one place.

The unified layout is designed to reduce friction during high-volatility periods, allowing traders to manage orders efficiently without switching between pages.

Different contracts may have varying leverage limits and maintenance margin requirements. Bitunix adjusts these parameters dynamically to balance risk and market stability.

This flexibility enables traders to fine-tune their leverage levels according to strategy and market volatility.

The introduction of Coin-M contracts provides several practical advantages for active traders and long-term crypto holders.

This product type aligns closely with the needs of traders who operate primarily in cryptocurrency terms and wish to maintain consistent exposure to the underlying coin.

Bitunix now supports both Coin-M and USDT-M contract types. The choice depends on whether a trader prefers stability or crypto-based growth.

| Feature | Coin-M Perpetual Futures | USDT-M Perpetual Futures |

|---|---|---|

| Collateral Type | Cryptocurrency (BTC, ETH, etc.) | Stablecoin (USDT) |

| PnL Settlement | In the same coin | In USDT |

| Volatility Exposure | Higher, since PnL fluctuates with coin price | Lower, as USDT value is stable |

| Ideal Use Case | For holders who want to increase crypto assets | For traders who prefer stable profit measurement |

| Hedging Suitability | Natural fit for long-term coin holders | Better for short-term trades seeking consistent USD value |

The dual system lets traders choose how they want to manage capital. Many professional traders use both types of contracts to diversify exposure and control risk.

Coin-M contracts are particularly useful for long-term investors who hold assets such as BTC or ETH. By shorting the same coin’s futures contract, a trader can hedge temporary price drops while keeping spot holdings intact.

Day traders and swing traders can use Coin-M contracts to speculate on short-term movements while maintaining coin-based balances. Profits remain in crypto, aligning with their market exposure.

Institutional or high-volume traders may combine Coin-M and USDT-M contracts to fine-tune portfolio sensitivity to volatility. This hybrid approach helps balance risk while maintaining flexibility in capital allocation.

Bitunix plans to expand Coin-M Perpetual Futures with additional trading pairs and analytics tools. Future updates will include:

These developments aim to make Coin-M trading more transparent and data-driven, supporting both new and experienced traders in the derivatives market.

The introduction of Coin-M contracts reflects a broader industry trend toward multi-margin trading ecosystems. Leading derivatives exchanges are increasingly offering both coin- and stablecoin-margined products to meet the preferences of different user segments.

Coin-M Perpetual Futures provide an option that aligns directly with crypto-native portfolios. They allow traders to stay within the ecosystem of their chosen coin while benefiting from perpetual leverage, hedging, and high-frequency trading opportunities.

As the market matures, coin-denominated contracts are likely to become an essential part of professional derivatives strategies, particularly for those seeking to compound returns in crypto terms rather than in stablecoins.

The launch of Coin-M Perpetual Futures on Bitunix represents an important addition to the platform’s product suite. By supporting coin-based margin and settlement, Bitunix now offers a more flexible and comprehensive trading environment for a wide range of users.

Coin-M contracts give traders the ability to manage exposure, hedge risk, and grow holdings directly in cryptocurrency. The combination of professional tools, unified trading interfaces, and expanding asset support makes this a significant advancement for Bitunix users.

As Coin-M trading expands, it will continue to play a central role in how both retail and institutional traders engage with crypto derivatives. Bitunix remains committed to supporting innovation and building an ecosystem that reflects the evolving needs of modern digital-asset markets.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.