President Donald Trump announced on Friday the decision to impose a 100 tariff on China, marking one of the sharpest and most coordinated selloffs in the cryptocurrency market this year. Trump’s announcement of the 100 tariff on China set off a global wave of risk aversion that affected equities, bonds, commodities, and digital assets simultaneously.

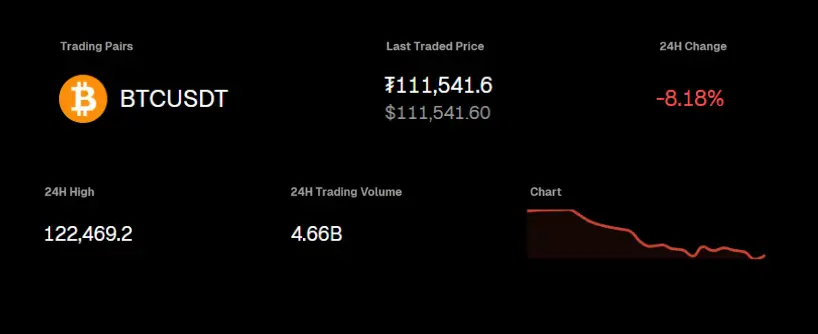

Bitcoin fell more than eight percent within hours, briefly touching a low near 109,900 before stabilizing above 110,000. This sharp decline in Bitcoin and other major cryptocurrencies followed the imposition of the 100 tariff on China. Ethereum declined over eleven percent to trade near 3,850. Solana, BNB, and XRP also suffered steep declines. According to data from Coinglass, roughly seven billion dollars of leveraged crypto positions were liquidated within one hour. More than five and a half billion dollars of those were long positions, indicating how aggressively traders had positioned for further gains ahead of the weekend.

The abrupt move revived memories of past macro shocks such as the 2020 pandemic crash and the 2022 tightening cycle. It demonstrated again how sensitive the crypto market remains to global liquidity, macroeconomic sentiment, and sudden changes in trade policy.

[ez-toc]

Policy Shift and Global Backdrop

In a social media post, President Donald Trump accused China of adopting an “extraordinarily aggressive position” and an “extraordinarily hostile” trade stance following Beijing’s announcement of new export restrictions. Trade tensions between the US and China escalated rapidly after this announcement, with both nations taking steps that impacted the entire world. Beijing revealed that China imposed large scale export controls on rare earth minerals and critical software, targeting virtually every product in these categories. These new export controls, announced in Oct 2025, were described as a violation of “international fairness” and a moral disgrace by some analysts. President Trump, in official statements from the White House in Washington, vowed to retaliate by applying a 100 percent tariff on all Chinese imports effective November 1, 2025. Trump said that the US would increase tariffs on Chinese goods, and Trump’s threat to impose export controls and tariffs led to a massive increase in trade tensions. Trump wrote that these measures were necessary to protect US interests, while the Chinese government sent an extremely hostile letter in response, threatening potentially painful consequences for the global economy.

The announcement represents a dramatic escalation in trade policy and caught many investors by surprise. Previous warnings from the administration had focused on specific sectors such as semiconductors and electric vehicles, but the confirmation that the tariff would apply broadly to virtually all goods immediately shifted market expectations for global growth and inflation. The scope of China’s actions was also unprecedented, as China imposed export controls on virtually every product they manufacture, affecting international trade and supply chains across nations and the world. The ongoing China trade dispute has had a profound impact on international trade, with countries around the globe reassessing their economic strategies in response to these developments.

President Xi Jinping and Chinese President Xi Jinping have emerged as key figures in the trade dispute, with the possibility to cancel a planned summit between the US and China being discussed amid the heightened tensions. The aggressive moves by both sides have threatened to destabilize not only bilateral relations but also the broader international trading system.

Economists described the policy as a supply-side shock that could raise costs for consumers and manufacturers alike. Equity markets reacted with sharp declines, Treasury yields moved lower as investors sought safety, and the dollar gained modestly as a refuge asset.

The timing also matters. The announcement arrived during a period of cautious optimism in financial markets after the Federal Reserve signaled readiness to hold policy steady into year-end. Traders had increased exposure to risk assets, expecting stable rates and improving liquidity. The tariff shock reversed that tone within minutes.

For our readers, understanding these international trade developments is crucial, as the actions taken by one country can have far-reaching effects on nations and the world economy.

Market Reaction Across Assets

The impact was broad and immediate. The S&P 500 futures contract fell more than three percent in after-hours trading, and major tech shares were heavily sold in Asian and European sessions that followed. Oil initially rose on concerns about supply-chain disruption but later reversed as global demand expectations weakened. Gold climbed toward 2,400 dollars an ounce, reflecting renewed safe-haven demand.

In digital assets, the effect was amplified by leverage. Crypto markets experienced heightened volatility, with major cryptocurrencies like Bitcoin and Ethereum leading the declines. Bitcoin’s drop below the psychological 110,000 level triggered automatic liquidations across multiple exchanges. Ethereum and Solana experienced even sharper percentage declines. Altcoins with smaller liquidity pools saw extreme volatility as automated bots struggled to maintain price discovery.

The total market capitalization of all cryptocurrencies fell by roughly 220 billion dollars within a single trading session. Stablecoin flows showed investors moving temporarily into dollar-linked assets as they sought to reduce exposure to volatile tokens.

Liquidity Crunch and Exchange Stress

Binance, the largest trading platform by volume, confirmed that its systems experienced “high load” due to heavy traffic and volatility. Users reported intermittent delays and temporary display issues. The company issued a statement assuring customers that “funds are SAFU,” repeating the reassurance it uses during episodes of market stress.

Other major exchanges also observed surges in activity. Bitunix, OKX, and Coinbase saw trading volumes rise significantly as both retail and institutional clients attempted to close or hedge positions. Market depth across order books fell sharply, widening bid-ask spreads and creating a temporary liquidity vacuum.

Data from Kaiko indicated that during the most volatile hour of trading, average spreads on Bitcoin-USD pairs widened by more than 120 percent. Similar behavior occurred during prior global shocks, including the 2022 rate-hike panic and the 2024 regulatory crackdown episodes. The pattern once again demonstrated how crypto liquidity remains thinner than traditional financial markets despite growing institutional participation.

The Mechanics Behind the Selloff

Leverage and funding dynamics explain much of the magnitude of the move. In the days before the announcement, perpetual futures funding rates had turned strongly positive across major venues. That indicated a market dominated by long positions betting on upside continuation. When the tariff news hit, those positions were forced to unwind.

Liquidation engines across exchanges triggered a chain reaction. Long traders faced forced selling as margin thresholds were breached, creating downward momentum that spilled into spot markets. Short positions also saw significant activity as traders bet on further declines, with sudden price movements impacting those positions as well. Once liquidations exceeded five billion dollars, short-term volatility jumped to levels last seen during the March 2023 flash crash.

This pattern is not new in crypto. Leverage often accelerates market moves that would otherwise remain moderate. In this case, macro uncertainty served as the catalyst for a mechanical cascade that erased days of accumulated positioning in under an hour.

Cross Asset Relationships and Dollar Behavior

The dollar’s reaction was modest but telling. Initially, the U.S. currency strengthened against both the euro and the yuan, reflecting global demand for safety. However, as the session progressed, Treasury yields declined, suggesting expectations for slower growth. The result was a mixed pattern in which the dollar held steady but failed to extend gains.

For cryptocurrencies, a firm dollar usually creates headwinds. Bitcoin’s correlation with the DXY index has remained negative through most of 2025. When the dollar rises on risk aversion rather than monetary tightening, crypto tends to weaken further because it competes with cash as a store of value.

In this case, the dollar bid coincided with a collapse in crypto leverage, amplifying pressure. The result was a synchronized de-risking across global portfolios. Analysts at Bitunix Research noted that this type of macro correlation event often precedes short-term volatility clusters that last for several sessions.

Policy Implications for Inflation and Growth

The policy itself carries significant macroeconomic implications. A 100 percent tariff on Chinese goods effectively doubles the cost of imports for many U.S. companies. The measure covers electronics, machinery, textiles, and consumer products. Economists estimate that such a tariff could raise the Consumer Price Index by 0.6 to 0.8 percentage points over the next quarter if fully implemented.

This presents a challenge for the Federal Reserve, which has been attempting to stabilize inflation near its two percent target while supporting a slowing labor market. The new tariffs complicate that balance by raising import prices even as demand weakens. Some analysts already suggest that the Fed may pause any easing plans until the inflation impact becomes clearer.

For global markets, this means renewed uncertainty over growth. European and Asian equity futures traded lower following the news, and commodity-sensitive currencies such as the Australian dollar and Malaysian ringgit weakened.

Technical Structure of Bitcoin

From a technical perspective, Bitcoin remains within a broad range defined by resistance near 116,000 and layered supports between 108,000 and 104,000. The overnight low near 109,900 tested the upper edge of that support zone.

Traders now view 116,000 as the first key resistance level. A sustained daily close above that area would be required to confirm a breakout and signal that buyers have regained control. Until that occurs, price behavior suggests a consolidating market with downward bias.

Volume profiles show heavy trading around 110,000, suggesting it is a high-volume node where participants continue to transact. If price loses that level on strong volume, the next logical target becomes the 106,000 shelf, followed by potential overshoot to 104,000.

Spot-futures relationships remain an important gauge. During the crash, spot volumes briefly outpaced futures for the first time in weeks, indicating that real selling rather than purely derivative unwinds contributed to the move.

Ethereum and Major Altcoins

Ethereum mirrored Bitcoin’s pattern but with slightly higher beta. The drop below 3,900 marked a 12 percent decline from its weekly high. Traders observed liquidation clusters near 3,850 and 3,700, levels that have acted as major pivots in previous corrections.

The ETH to BTC ratio remains near recent lows, reflecting weaker relative performance. A sustained rebound in that ratio would typically signal renewed risk appetite within crypto. Until that occurs, Ethereum is likely to remain range bound with quick reversals tied to Bitcoin’s direction.

Solana and BNB both faced heavy selling as liquidity fragmented. Their intraday declines exceeded 15 percent before stabilizing. Analysts attribute the sharper drawdown to thinner market depth and higher speculative leverage in altcoin derivatives.

Positioning, Funding, and Sentiment

Data from derivatives platforms show that funding rates turned deeply negative across Bitcoin and Ethereum perpetual futures. This reflects traders paying to hold short exposure and implies that leverage has flipped from long to defensive positioning.

Open interest fell by more than ten percent in twenty-four hours, indicating that forced liquidations removed a significant portion of speculative capital. While this kind of reset can appear painful, it often sets the stage for stabilization once excess leverage clears.

On social sentiment trackers, crypto fear and greed indices plunged from neutral to extreme fear readings. Mentions of “liquidation,” “tariff,” and “Trump policy” spiked across major platforms. Historically, such sentiment collapses tend to precede technical bounces once funding normalizes.

Institutional Flows and Derivatives Behavior

Institutional data from CME and major crypto ETFs reveal significant outflows on October 10 and 11. Bitcoin futures volume on CME increased by more than 60 percent, the largest single-day jump since mid-2023.

ETF products tracking spot Bitcoin saw redemptions as investors reduced risk. However, long-term holders remained relatively stable. On-chain data show that coins held for over one year moved very little, suggesting that the selloff was driven by short-term traders rather than structural holders.

In derivatives markets, options skew shifted toward puts, signaling rising demand for downside protection. Implied volatility across one-week Bitcoin options jumped to nearly 80 percent annualized, while one-month tenors rose to 67 percent. The volatility surface remains steep, indicating that traders expect near-term turbulence followed by gradual stabilization.

Broader Policy and Valuation Context

The new tariff environment raises complex questions about global growth and valuation. Equity markets had been trading near cycle highs, and many analysts argued that risk assets had priced in a soft landing scenario. The shock of a renewed trade war changes that calculus. Market analysis now focuses on the interplay between trade policy and asset valuations.

Historically, tariffs of this magnitude tend to produce near-term inflation but long-term disinflation if they slow global trade. The key issue will be how China responds. If Beijing introduces countermeasures or reduces export quotas further, supply chain costs could climb.

Crypto investors often frame such scenarios through liquidity and psychology rather than trade mechanics. A prolonged trade standoff could tighten global credit conditions and reduce speculative flows into digital assets. Conversely, if tariffs weaken the dollar or prompt new monetary easing, crypto could benefit over the medium term.

Tactical Outlook and Scenario Planning

Analysts at Bitunix Research outline three plausible paths for the weeks ahead.

Scenario One – Reflexive Rebound

If price holds above the 108,000 to 106,000 zone and funding remains negative, a short squeeze could develop. This would push Bitcoin back toward 113,000 or 116,000 as traders rebalance. For confirmation, analysts want to see spot demand lead futures and open interest rebuild on neutral funding.

Scenario Two – Deeper Correction

If volatility persists and macro headlines worsen, Bitcoin could break 106,000 and test the 104,000 cluster. This area contains concentrated liquidation levels from March and May, making it a magnet during stress. If that level fails, technical targets extend toward the high 90,000s where longer-term moving averages converge.

Scenario Three – Range Continuation

If global markets stabilize and the tariff policy remains only a future risk rather than an immediate shock, Bitcoin may consolidate between 109,000 and 116,000. Range trading strategies with tight stops and reduced leverage would suit this environment.

Policy Outlook and Fiscal Interactions

Beyond market mechanics, the tariff policy introduces uncertainty for fiscal and monetary coordination. The administration signaled it is willing to accept short-term market pain in exchange for strategic leverage over China. The Federal Reserve may face new pressure to balance inflationary effects with financial stability.

Should inflation expectations rise due to higher import prices, policymakers might delay further rate cuts. Conversely, if equity and credit markets tighten sharply, the Fed could interpret it as a demand shock requiring offsetting support. Either scenario creates volatile feedback loops for global investors.

Crypto tends to trade as a high-beta expression of those feedback loops. Periods of policy friction often translate directly into intraday swings as traders digest each headline.

Trader Behavior and Microstructure

Microstructure data highlight how traders responded in real time. During the selloff, market depth dropped by more than 40 percent across major pairs. Short-term traders widened spreads to reduce exposure, while long-term market makers maintained baseline liquidity but reduced order size.

Funding normalized within twenty-four hours, and open interest began to rebuild modestly. This suggests that liquidation pressure has eased but sentiment remains cautious.

Analysts emphasize that volatility events like this reset positioning and can create opportunity for disciplined traders. Those with predefined risk parameters and clear entry zones often find value when forced selling pushes price below intrinsic levels.

Comparative Analysis with Past Shocks

The October 2025 tariff shock ranks among the largest single-hour liquidation events in crypto history. The seven billion dollar total rivals the March 2023 flash crash and the May 2021 China mining ban reaction. In all those cases, forced leverage unwinds were followed by stabilization and gradual recovery.

What differentiates the current episode is its macro origin. This is the first major crypto selloff triggered directly by trade policy rather than monetary policy or internal market issues. It underscores how digital assets have become integrated into the global risk landscape.

The magnitude of response confirms that crypto is now a mainstream asset class. When macro policy shifts affect sentiment, digital markets react in tandem with equities and commodities.

Broader Lessons for Market Participants

Episodes like this highlight how global policy shifts can rapidly influence digital assets. Traders increasingly must combine macroeconomic awareness with on-chain and technical analysis. The dividing line between traditional and crypto finance continues to fade.

Understanding the interaction between trade policy, inflation expectations, and liquidity conditions has become essential. The same headline that moves Treasury yields or the dollar now moves Bitcoin and Ethereum in parallel.

For long-term participants, the focus remains on structural adoption. Short-term volatility may unsettle markets, but each stress test strengthens infrastructure and transparency. Exchanges, custodians, and clearing systems now operate under higher standards than in prior years.

Conclusion

President Trump’s 100 percent tariff on China represents more than a trade dispute. It is a signal that geopolitical risk can still eclipse monetary policy as a driver of market behavior. The immediate reaction in crypto showed how deeply intertwined digital assets are with global sentiment.

Bitcoin’s drop below 110,000 reflected not only mechanical liquidations but also broader uncertainty about growth, inflation, and policy direction. Yet within that volatility lies evidence of progress. The market absorbed record liquidations without systemic failure, and liquidity returned quickly once forced selling ended.

For traders, the lesson is clear. Macro policy shocks will continue to generate opportunity and risk in equal measure. The key is preparation, discipline, and the ability to navigate uncertainty without emotion. As 2025 moves toward its final quarter, crypto investors face a new environment shaped by politics as much as by technology.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.

One reply on “Trump 100% Tariff On China Sparks Massive Crypto Market Selloff”

It’s crazy how much leverage was involved here—over $7 billion liquidated in such a short time. It’s a reminder of the risks traders face in the volatile crypto space.