Crypto copy trading is popular for a simple reason: it turns trading from a constant decision loop into a structured process. Instead of staring at charts all day, you select a lead trader and allow the system to mirror their actions in your account, using rules you choose in advance.

That sounds easy, but the outcomes depend on the details. In this guide, you will learn what copy trading is in plain terms, how Bitunix copy trading works on the Bitunix exchange, and what you should understand about execution, risk, and performance tracking before committing meaningful capital.

[ez-toc]

What Is Copy Trading in Crypto?

Copy trading in crypto is a feature that allows a follower to mirror a lead trader’s positions automatically. When the lead trader opens, adds to, reduces, or closes a position, the system attempts to replicate that activity for the follower based on the follower’s copy configuration.

In other words, crypto copy trading is not “advice.” It is automated trade replication.

Key Roles: Lead Trader and Follower

Lead trader

The strategy provider whose trades can be copied by others. Lead traders usually aim to build a track record, attract followers, and earn profit sharing when followers make money.

Follower

The user who copies the lead trader. Followers control their own allocation, copy sizing method, and limits. Even though execution is automated, the follower remains responsible for risk.

Copy Trading Crypto Is Not the Same as Signals

Signals tell you what someone might do. You still place the trade yourself.

Copy trading crypto aims to place the trade for you. That automation can be a benefit, but it also means you need clear rules, because trades may trigger when you are not actively watching the market.

Why Copy Trading Is Usually Futures-Based

In practice, copy trading systems often operate through derivatives, which is why many users experience copy trading as crypto futures copy trading.

Futures-based copying has two implications:

- Risk can change quickly. Futures positions can experience rapid swings in profit and loss, especially in volatile markets.

- Execution quality matters. If the market moves between the lead trader’s action and the follower’s copied execution, the follower may enter or exit at a different price.

This is not a flaw. It is the reality of copying live trades in live markets.

How Copy Trading Works on the Bitunix Exchange

On the Bitunix exchange, the copy workflow can be understood as a sequence of decisions and checks. You choose who to copy, define how you want copying to behave, then monitor whether the system and the trader perform as expected.

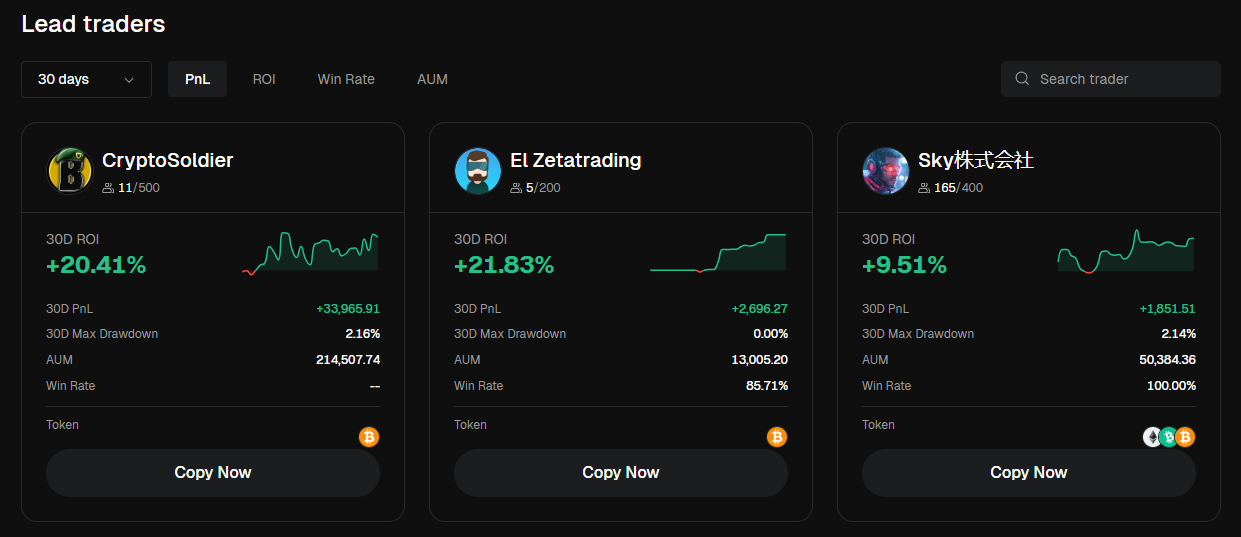

Step 1: Choose a Lead Trader

Start by selecting a trader whose style you can tolerate, not just someone with the highest short-term results.

A practical way to evaluate traders is to consider:

- Consistency across weeks, not one exceptional week

- Drawdowns and recovery behavior

- Whether the trader trades liquid markets

- Whether the trade frequency matches your preference (fast versus slower)

If you cannot describe the trader’s style in one sentence, you are likely not ready to follow them with real size.

Step 2: Choose Your Copy Sizing Method

Copy sizing is the engine of your risk. On Bitunix copy trading, followers typically choose between two common sizing approaches:

Fixed Amount Mode

You define a fixed margin amount for each copied order. Each time the lead trader opens a new position, your account attempts to open a position using your fixed amount, subject to your available funds and any limits you set.

Why it often suits beginners:

- Predictable exposure per copied trade

- Easier to control losses while learning

- Less risk of sudden position size inflation

Fixed Ratio Mode

Your positions scale based on a ratio relationship between your account and the lead trader’s margin usage. This can mirror the lead trader’s sizing intent more closely, but it can also scale up quickly if the lead trader increases size aggressively.

Why it can be useful:

- Closer mirroring of lead trader scaling

- Can track a trader’s risk-on and risk-off behavior more directly

Why it can be dangerous without limits:

- A single high-risk scaling event can create exposure larger than you intended

Beginner rule: if you are unsure, fixed amount is usually the safer place to start.

Step 3: Set Allocation and Risk Limits

This is where followers separate themselves from gamblers. Before you copy:

- Set a maximum allocation per trader

- Keep a margin buffer so the system is less likely to skip trades due to insufficient funds

- Decide your personal “pause rule,” such as a maximum drawdown threshold that triggers review

- Limit how many traders you follow, even if the platform allows more

Your objective is not to copy more. Your objective is to copy well and survive normal drawdowns.

Step 4: Confirm, Then Monitor in Your Copy Dashboard

After you start copying, your job is not finished. You should monitor:

- Open positions and exposure size

- Realized profit and loss over time

- Trade frequency changes

- Any repeated pattern of skipped or failed copied orders

Copy trading is a living system. Traders can change behavior, and markets can shift regimes.

Step 5: Review on a Routine Schedule

Many copy trading systems use a weekly settlement rhythm for profit sharing. Even if you check daily, your main performance review should be weekly, because it reduces emotional decisions and aligns with how many copy programs calculate outcomes.

A good weekly review asks:

- Did the trader’s drawdown exceed my threshold?

- Did the trader’s position sizing behavior change?

- Do results still match the reason I started copying this trader?

- Were there repeated execution failures that might be affecting my outcomes?

Step 6: Stop Copying When It No Longer Fits Your Plan

Stopping is not a failure. It is a risk control.

If a lead trader starts taking larger risks than you are comfortable with, or if execution quality becomes consistently poor for the pairs they trade, the correct response is to pause and reassess.

Why Your Results Can Differ From the Lead Trader

A common beginner misunderstanding is assuming copy trading produces identical outcomes. In real markets, identical is not guaranteed.

Timing Differences

There is always a small delay between the lead trader’s action and the follower’s replication. In a fast move, that delay can affect entry or exit price.

Slippage and Liquidity

Even if the system copies instantly, liquidity conditions can change. This is why copy trading services typically include slippage protection, and why some copied orders may fail if price moves beyond acceptable bounds.

Account Differences

Followers have different balances, available margin, and allocation settings. Two followers can copy the same trader and still end up with different exposure profiles.

Existing Positions

If you start copying a trader after they already hold a position, your copied experience may not perfectly reflect their full position history. This is why timing and position lifecycle matter in crypto futures copy trading.

Common Issues in Crypto Copy Trading and How to Prevent Them

Most follower problems fall into a few predictable categories.

Issue 1: Copied Trade Skips Due to Insufficient Funds

If your available margin is too low at the moment the trade is copied, your order may not be placed.

Prevention:

- Maintain a margin buffer

- Avoid following too many traders with overlapping activity

- Reduce per-trade allocation

Issue 2: Copied Trade Fails During Volatility

If the market moves too quickly between the lead trader’s execution and your attempted execution, the copied order may fail.

Prevention:

- Prefer traders who focus on liquid, major markets

- Be cautious during major volatility windows

- Avoid traders whose strategy relies on extremely precise scalps

Issue 3: Overexposure From Poor Sizing Choices

Fixed ratio sizing without strict caps is a common cause of accidental overexposure.

Prevention:

- Use conservative caps

- Start with fixed amount sizing

- Add complexity only after you have several weeks of stable results

How to Use Bitunix Copy Trading More Safely

If your goal is sustainable learning, use a simple operating framework.

Start Small and Treat Month One as Training

Your first goal is not maximum return. It is execution confidence and process discipline.

Prefer Predictable Exposure

Beginners often do better with fixed amount sizing because it creates consistent per-trade risk.

Diversify Only When You Can Track Results

Following multiple traders can diversify, but only if you can review each one and understand why they are in your portfolio.

Use a Clear “Pause Rule”

Example pause rules followers use:

- Pause copying if weekly drawdown exceeds X percent

- Pause copying if trade frequency doubles without explanation

- Pause copying if copied order failures become frequent

Best Crypto Copy Trading Platform Checklist

If you are comparing platforms or trying to decide what the best crypto copy trading platform looks like for your needs, evaluate structure over marketing.

A strong platform should provide:

- Clear trader statistics and performance breakdowns

- Transparent copy sizing methods and easy-to-understand risk settings

- Monitoring tools that show positions, history, and profit and loss clearly

- Clear rules for settlement and profit sharing

- Execution transparency, including why copied trades can fail or skip

- Straightforward controls to stop copying quickly when needed

This checklist applies broadly, and it also helps you use Bitunix copy trading with a professional mindset.

Conclusion

If you were searching for what is copy trading in crypto, you now have a clear answer: it is automated trade mirroring that depends on your settings as much as the lead trader’s skill. On the Bitunix exchange, Bitunix copy trading follows a structured process: choose a trader, select a sizing method, set allocation and limits, monitor performance, and review routinely.

Used correctly, crypto copy trading can help you learn market behavior and participate with more structure. The safest path is to start small, choose predictable sizing, expect execution differences, and manage copying like a portfolio decision, not a gamble.

FAQ

What is copy trading in crypto?

It is a feature that automatically mirrors a lead trader’s positions in a follower’s account using the follower’s allocation and risk settings.

Is copy trading crypto beginner-friendly?

It can be, if you start with conservative sizing, choose stable traders, and treat copy trading as a risk-managed process rather than a shortcut.

What is crypto futures copy trading?

It is copy trading applied to futures contracts, where you copy derivative positions rather than buying the underlying cryptocurrency directly.

Why can my copy trading results differ from the lead trader?

Differences can occur due to timing delays, slippage, liquidity changes, and differences in account balance and copy settings.

What should I focus on first as a beginner?

Focus on sizing and limits, not trader hype. Predictable exposure and consistent review matter more than chasing the top leaderboard.

Glossary

- Crypto copy trading: Automatically mirroring a lead trader’s trades in your account.

- Copy mode: The rule that determines how your copied position size is calculated.

- Lead trader: The trader whose eligible positions followers can copy.

- Follower: The user who copies a lead trader using chosen settings.

- Fixed amount mode: Each copied trade uses a fixed margin amount you set.

- Fixed ratio mode: Position size scales based on a ratio to the lead trader.

- Margin: Collateral allocated to open and maintain a futures position.

- Leverage: Multiplier that increases exposure relative to your margin.

- Slippage: Difference between expected price and actual execution price.

- Profit sharing: Portion of follower profits allocated to the lead trader.

About Bitunix

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. At Bitunix, we are committed to providing a transparent, compliant, and secure trading environment for every user. Our platform features a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, we prioritize user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium