Ethereum has transformed the blockchain space by introducing programmable tokens that represent far more than currency. ERC20, ERC721, and ERC1155 are examples of ethereum based tokens, each following a specific technical standard that defines their behavior and interoperability. Unlike Bitcoin, which was primarily designed as a digital form of money, Ethereum allows developers to create tokens with diverse purposes such as digital currencies, governance rights, collectibles, gaming assets, or real estate deeds. Digital currency is a key use case, and these tokens can be traded on a crypto exchange, expanding their utility in the blockchain ecosystem. The creation and token creation process is enabled by Ethereum’s smart contracts, allowing for standardized development and management of various blockchain assets. These tokens are made possible by Ethereum token standards, which provide a framework for how tokens behave, how they interact with wallets, and how they are traded on exchanges.

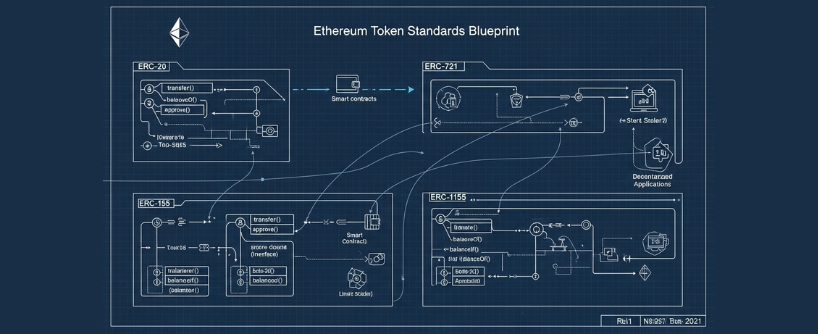

Three standards dominate the Ethereum ecosystem: ERC20, ERC721, and ERC1155. Each one defines unique characteristics that make it suitable for different use cases. ERC20 is the standard for fungible tokens such as stablecoins or governance assets. ERC721 introduced non-fungible tokens (NFTs), which power digital collectibles and art. ERC1155 combines the flexibility of both ERC20 and ERC721, enabling multiple types of tokens in a single contract, making it ideal for gaming and metaverse projects.

Selecting the right token standard is critical for developers and businesses. It determines not only the functionality of a token but also its integration with decentralized applications, exchanges, and wallets. In this guide, we will explore the differences between ERC20, ERC721, and ERC1155 tokens, explain their advantages and limitations, and help you decide which standard is best suited for your project.

[ez-toc]

What Are Ethereum Token Standards?

Ethereum token standards are rules and specifications written into smart contracts. Each ERC standard, where ERC stands for Ethereum Request for Comment, is defined in official technical documents that guide developers in creating tokens and smart contracts. They define how tokens should function, how they are transferred, and how they interact with other contracts or applications. Without these standards, every token would behave differently, requiring custom code for wallets, exchanges, and decentralized applications to handle them.

By following standards, developers ensure interoperability. For example, any ERC20 token can be added to a decentralized exchange like Uniswap without additional modifications. Similarly, any ERC721 token can be traded on NFT marketplaces like OpenSea. This consistency is what allows Ethereum to support thousands of tokens across diverse applications.

Why Standards Matter

The benefits of following token standards include:

- Interoperability – Tokens can interact with wallets, dApps, and exchanges seamlessly.

- Security – Standards define mandatory functions that prevent double spending and errors.

- Adoption – A standardized token is immediately compatible with the larger ecosystem.

- Efficiency – Developers save time by following a pre-defined framework rather than writing custom code.

ERC20: The Standard for Fungible Tokens

Overview

ERC20 was proposed in 2015 by Fabian Vogelsteller and Vitalik Buterin. It quickly became the most widely adopted Ethereum standard, providing a simple and universal framework for fungible tokens. ERC20 is the technical standard for a fungible token, where each token holds equal value and can be exchanged for another of the same value. Fungible means that every token is interchangeable with another token of the same type. Just as one U.S. dollar equals another, one ERC20 token equals another ERC20 token within the same contract, and this interchangeable nature means each token has the same value and can be easily exchanged.

ERC20 tokens have powered thousands of projects, from stablecoins to governance tokens. New tokens are created using the ERC20 standard, and tokens created in this way are widely adopted and traded. They form the backbone of decentralized finance (DeFi), representing significant value in the ecosystem. This makes them one of the most important innovations in blockchain history, as ERC20 tokens are created and exchanged on various platforms.

Technical Details

ERC20 defines six mandatory functions and three optional ones, which are the essential functions required for ERC20 token operation. These functions enable basic operations such as checking balances, transferring tokens, and approving spending allowances.

Key Functions:

- totalSupply(): Returns the total supply of tokens.

- balanceOf(address): Displays the balance of a given account.

- transfer(address, amount): Sends tokens to another address.

- approve(address, amount): Approves a third party to spend tokens on behalf of the owner.

- transferFrom(address, address, amount): Transfers tokens using approved allowance.

- allowance(address, spender): Shows how many tokens a spender is allowed to use.

Example Use Cases

- Stablecoins: Tokens like USDT, USDC, and DAI use ERC20 to provide digital currencies pegged to fiat values.

- Governance Tokens: UNI from Uniswap and COMP from Compound enable users to vote on protocol changes.

- Utility Tokens: Basic Attention Token (BAT) allows payments for digital advertising within the Brave browser.

- Other Assets: ERC20 tokens can also represent other assets, such as tokenized stocks or commodities, enabling the management and transfer of real-world properties on the blockchain.

Advantages

- Simplicity: Easy for developers to implement.

- High Liquidity: Supported by nearly all exchanges and wallets.

- Strong Integration: Widely used in DeFi platforms such as lending, staking, and liquidity pools.

- Easy Access: ERC20 tokens provide easy access to a wide range of decentralized applications and exchanges.

Limitations

- Only Fungible: Cannot represent unique assets.

- Batch Transfers Missing: Each transaction can only handle one transfer, making bulk operations costly.

- Allowance Risks: Poorly managed approvals may lead to vulnerabilities.

ERC721: The Standard for Non-Fungible Tokens

Overview

ERC721 introduced the concept of non-fungible tokens (NFTs). ERC721 is the original non fungible token standard, also known as erc 721, which formalized the creation of unique digital assets on the Ethereum blockchain. Unlike ERC20, each ERC721 token is unique, with its own identifier and metadata, highlighting the key difference: ERC20 tokens are fungible, while ERC721 tokens are non-fungible and represent individual tokens. This uniqueness makes ERC721 the standard for digital art, collectibles, real estate, and in-game assets.

NFTs gained mainstream attention in 2020 and 2021. Popular NFTs such as CryptoPunks and digital cats from CryptoKitties, created by larva labs, exemplify the impact of the non-fungible token standard, with contributors like Jacob Evans playing a significant role in the development of the ERC721 standard. The standard remains the cornerstone of the NFT industry.

Technical Details

ERC721 tokens rely on unique identifiers known as token IDs. Each ID corresponds to a specific asset. In addition to token IDs, the ERC721 standard also requires a symbol to uniquely identify the token within a contract, alongside the token’s name and contract address. Metadata stored within or linked to the token can describe its properties, such as an image, description, or traits.

Key Functions:

- ownerOf(tokenId): Returns the address of the token’s owner.

- transferFrom(address, address, tokenId): Transfers a unique token.

- tokenURI(tokenId): Provides metadata about the token, often linking to external storage like IPFS.

Example Use Cases

- Digital Collectibles: CryptoPunks and Bored Ape Yacht Club represent unique profile picture NFTs.

- Virtual Real Estate: Platforms like Decentraland and The Sandbox tokenize land ownership.

- Certification: ERC721 tokens can represent academic certificates, identity, or ownership rights.

Advantages

- Uniqueness: Each token is one of a kind.

- Metadata Support: Allows attaching digital art, music, or property documents.

- Widespread Adoption: Supported by NFT marketplaces and wallets.

Limitations

- Gas Costs: Each transfer involves a separate transaction, leading to high fees.

- Lack of Batch Operations: Cannot transfer multiple NFTs in one transaction.

- Scalability: High demand may cause congest networks.

ERC1155: The Multi-Token Standard

Overview

ERC1155 was introduced by Enjin in 2018 to solve the inefficiencies of ERC20 and ERC721. Known as the multi-token standard, ERC1155 allows developers to create fungible, non-fungible, and even semi-fungible tokens within a single contract, enabling management of various assets within a single smart contract for increased efficiency.

This innovation makes ERC1155 particularly useful for gaming, where a player may own fungible in-game currency, unique weapons, and collectible items all in one system.

Technical Details

ERC1155 introduces batch operations that allow multiple token types to be transferred in a single transaction. Tokens are identified by IDs, similar to ERC721, but they can represent fungible or non-fungible assets.

Key Functions:

- safeBatchTransferFrom(): Enables efficient multi-token transfers.

- balanceOfBatch(): Checks balances of multiple accounts simultaneously.

- supportsInterface(): Ensures compatibility with wallets and dApps.

ERC1155 also utilizes events to log token transfers and other important actions, enhancing transparency.

Example Use Cases

- Gaming Assets: Enjin and Gods Unchained use ERC1155 for in-game items.

- Metaverse Platforms: The Sandbox issues assets like land, items, and avatars.

- Hybrid Assets: Event tickets are a practical example of semi-fungible tokens. These tickets can be traded as fungible assets before the event, such as general admission tickets exchanged among users. After the event ends, they become unique collectibles, representing a transition from fungible to non-fungible assets.

Advantages

- Gas Efficiency: Batch transfers reduce transaction costs.

- Flexibility: Handles both fungible and non-fungible assets.

- Future-Oriented: Ideal for large-scale ecosystems.

- Supports Blockchain Applications: ERC1155 is well-suited for complex blockchain applications that require managing multiple asset types within a single contract.

Limitations

- Complexity: Harder to implement compared to ERC20 or ERC721.

- Adoption: Not as widely integrated into exchanges or wallets.

- Learning Curve: Developers need advanced knowledge.

Comparison of ERC20, ERC721, and ERC1155

| Feature | ERC20 | ERC721 | ERC1155 |

| Token Type | Fungible | Non-fungible | Multi-token (fungible + non-fungible) |

| Best Use Case | Currencies, governance | NFTs, collectibles | Gaming, metaverse, hybrid assets |

| Batch Transfers | No | No | Yes |

| Gas Efficiency | Moderate | Low | High |

| Metadata Support | Limited | Extensive | Strong |

| Adoption Level | Highest | High | Growing |

| Developer Complexity | Low | Medium | High |

Note: Native tokens like Ether (ETH) are the primary cryptocurrencies of their respective blockchains and are distinct from tokens created using ERC standards. ERC20, ERC721, and ERC1155 are designed for different types of assets and use cases, while the native token serves as the blockchain’s internal currency.

Fungible vs Non-Fungible Tokens

- Fungible Tokens (ERC20): ERC20 is the standard for fungible tokens, which are identical and interchangeable. Common examples include USDC and in-game currencies used in Web3 gaming, where these tokens facilitate in-game transactions and economies.

- Non-Fungible Tokens (ERC721): Each token is unique and non-interchangeable. Example: Bored Ape NFTs.

- Hybrid Tokens (ERC1155): Combines both. Example: Gaming currencies with unique in-game items.

Security Considerations

- ERC20 Risks: Approval mismanagement can allow exploits.

- ERC721 Risks: Metadata often stored off-chain may create vulnerabilities.

- ERC1155 Risks: Complexity introduces broader attack surfaces.

Best Practices:

- Use audited libraries like OpenZeppelin and follow secure coding practices.

- Limit approvals to avoid infinite spending risks.

- Store metadata on secure, decentralized storage such as IPFS.

- Use secure storage solutions for private keys and sensitive data.

When to Use Each Standard

- ERC20: Ideal for stablecoins, governance tokens, and fungible assets. Developers can create their own tokens with custom rules and features to suit their project’s needs.

- ERC721: Best for collectibles, art, property, or unique certifications. Also allows developers to design their own tokens for unique digital assets.

- ERC1155: Perfect for gaming, metaverse, and ecosystems combining multiple asset types, enabling the creation of your own tokens with flexible standards.

Future of Ethereum Token Standards

Ethereum 2.0 and Layer 2 scaling solutions such as Optimism, Arbitrum, and zkSync are expected to reduce gas fees and improve efficiency. This will benefit ERC721 and ERC1155 adoption, which currently face high transaction costs.

Cross-chain interoperability is also a growing trend. Standards like BEP-2 and BEP-20 on Binance Smart Chain are designed to be compatible with ERC standards on the Ethereum network and ethereum blockchain, enabling broader asset transfer and token creation. Projects may use ERC1155 tokens across multiple blockchains, creating a new era of portable gaming assets and collectibles. Real-world asset tokenization, such as real estate and intellectual property, may also expand using ERC721 and ERC1155.

Frequently Asked Questions

Are ERC20 tokens only for cryptocurrencies?

No, ERC20 tokens go beyond acting as cryptocurrencies. While many ERC20 tokens are used as digital currencies, they also serve as governance tokens, allowing holders to vote on protocol changes in decentralized organizations. Others are utility tokens used within applications, such as paying fees, accessing premium features, or rewarding participation. Some ERC20 tokens also function as staking assets in DeFi protocols, where users lock tokens to secure networks or earn yield. This makes ERC20 a versatile standard that supports both financial and non-financial use cases.

Can ERC721 tokens store images directly?

No, ERC721 tokens cannot store images directly on the blockchain because it would be inefficient and expensive to do so. Instead, they store metadata that links to digital files, which are usually hosted on decentralized storage networks like IPFS (InterPlanetary File System). This metadata often contains information such as image URLs, descriptions, traits, and attributes, ensuring the NFT retains its uniqueness. While the actual image exists off-chain, the blockchain record guarantees authenticity and ownership, which is the key value driver of ERC721 tokens.

Why is ERC1155 more efficient?

ERC1155 is more efficient because it was designed to reduce the redundancy found in ERC20 and ERC721 contracts. By allowing batch transfers, ERC1155 can send multiple tokens in a single transaction, saving significant gas fees compared to handling each transfer individually. It also enables developers to manage fungible, non-fungible, and semi-fungible tokens under a single contract, avoiding the need to deploy separate contracts for each asset type. This streamlined approach is particularly valuable in gaming ecosystems, where players own a mix of currencies, weapons, and collectibles.

Can ERC20 tokens be turned into NFTs?

Not directly, because ERC20 tokens are fungible while NFTs are unique by design. However, wrapping mechanisms or bridging contracts can be used to create NFT representations of ERC20 tokens. For example, a protocol could lock a specific number of ERC20 tokens in a smart contract and issue an NFT that represents ownership of that locked asset. This wrapped NFT could then be traded as a unique token while still tied to the fungible value of the original ERC20. Such systems are rare but demonstrate the adaptability of Ethereum standards when combined creatively.

Which token standard is best for games?

ERC1155 is widely considered the best choice for blockchain-based games. Gaming ecosystems often require multiple types of tokens: fungible currencies like gold or gems, non-fungible items like unique swords or rare skins, and semi-fungible assets like limited-edition event items. ERC1155 handles all of these in a single contract, allowing for efficient transactions and lower gas fees. This flexibility makes it ideal for developers who want to build immersive and scalable gaming economies that mirror real-world complexities.

Do all wallets support ERC1155?

Not all wallets currently support ERC1155 tokens, but adoption is steadily improving. Popular wallets like MetaMask and Trust Wallet have integrated ERC1155 compatibility, while others are gradually following as demand grows from gaming and metaverse projects. Because ERC1155 is newer than ERC20 and ERC721, its integration into the ecosystem is still evolving. Developers and users often choose platforms that actively support the standard to ensure smooth token management and transfers. In the near future, widespread adoption of ERC1155 is expected as its use cases expand.

What does fungible vs non-fungible mean?

Fungible means that each unit of a token is interchangeable with another of the same type. For example, one USDC is always equal to another USDC, just like fiat currencies. Non-fungible means that each token is unique and cannot be exchanged on a one-to-one basis with another token. For instance, one NFT may represent a rare artwork, while another represents a concert ticket, and their values are not equal. This distinction is at the core of why Ethereum needed separate standards for ERC20 and ERC721 tokens.

Is ERC20 outdated?

No, ERC20 is not outdated despite being the oldest Ethereum token standard. It remains the backbone of decentralized finance, powering stablecoins, governance systems, and liquidity pools. Its simplicity and universal compatibility make it extremely reliable and widely used. While ERC1155 offers more efficiency for certain use cases, ERC20 is still the preferred choice for fungible tokens where uniqueness is not required. Its dominance in the market ensures it will remain relevant for years to come.

Can ERC721 be used for tickets?

Yes, ERC721 tokens are an excellent choice for representing event tickets. Each ticket is unique and tied to a specific seat, date, or event, making it perfectly suited for a non-fungible token. Metadata can store details such as seat numbers, event location, and access privileges. By issuing tickets as NFTs, organizers can prevent counterfeiting, enable secondary trading in a transparent way, and even attach perks like VIP access. This use case demonstrates how ERC721 tokens can be applied to real-world industries beyond digital art.

Will ERC1155 replace ERC20 and ERC721?

No, ERC1155 is unlikely to replace ERC20 and ERC721, but it complements them by addressing specific limitations. ERC20 will remain the standard for fungible tokens because of its simplicity and widespread adoption. ERC721 will continue to dominate the NFT sector due to its cultural and technical influence. ERC1155 fills the gap by offering efficiency and flexibility, particularly for gaming and metaverse ecosystems. Rather than replacing earlier standards, ERC1155 expands the Ethereum toolkit, giving developers more options depending on their project’s goals.

How are ERC20 and ERC721 tokens used in trading?

ERC20 tokens dominate trading pairs on both centralized and decentralized exchanges. They allow users to trade cryptocurrencies, stablecoins, and governance assets seamlessly. ERC721 tokens, on the other hand, are primarily traded on NFT marketplaces like OpenSea, Rarible, and Blur. These marketplaces allow users to buy, sell, and bid on unique digital assets represented as NFTs. While ERC20 tokens provide liquidity and financial utility, ERC721 tokens provide ownership and uniqueness, which means their trading mechanics differ significantly. Both standards together represent the diversity of Ethereum’s digital economy.

Glossary

ERC (Ethereum Request for Comment): A technical proposal submitted to the Ethereum community that outlines standards for smart contracts, tokens, and protocols. ERCs are reviewed, debated, and refined before adoption, ensuring that tokens follow consistent rules across the ecosystem.

Fungible Tokens: Tokens where every unit is identical and interchangeable, such as ERC20-based stablecoins. They are ideal for currencies, governance tokens, and DeFi utilities where uniformity is critical.

Non-Fungible Tokens (NFTs): Unique digital assets that cannot be exchanged on a one-to-one basis. ERC721 introduced NFTs, allowing representation of art, collectibles, music, real estate, and tickets. Their uniqueness comes from metadata and token IDs.

Semi-Fungible Tokens: Tokens that start as fungible but later become unique. For example, a concert ticket may be fungible when first issued but becomes non-fungible after being tied to a specific seat or date. ERC1155 supports these hybrid cases.

Metadata: Supplementary information that describes a token. For NFTs, metadata may include images, descriptions, traits, or certificates stored on decentralized networks like IPFS. Metadata ensures uniqueness while the blockchain guarantees ownership.

Batch Transfers: A feature introduced by ERC1155 that allows multiple tokens to be transferred in a single transaction. This reduces gas fees and improves efficiency compared to ERC20 or ERC721, which handle transfers one by one.

Interoperability: The ability of tokens and contracts to function across different platforms, wallets, and applications. Interoperability is critical for liquidity and ecosystem growth, as it ensures tokens are not isolated in silos.

Programming Language: The formal coding language used to write smart contracts. Ethereum contracts are primarily written in Solidity, which supports the creation of token standards such as ERC20, ERC721, and ERC1155. Solidity enables developers to define token behavior, ownership, and interactions.

Tokenomics: The economic design of a token, including supply mechanisms, incentives, governance rules, and utility. Strong tokenomics ensures long-term sustainability and adoption of a project.

Security Audit: A professional review process where experts analyze smart contract code for vulnerabilities, logic errors, and compliance with best practices. Security audits are essential for both OpenZeppelin-based contracts and custom implementations.

Conclusion

Ethereum token standards have shaped the blockchain economy. ERC20 powers the world of fungible assets, ERC721 has built the foundation for NFTs, and ERC1155 represents the future of multi-asset ecosystems. Each has its strengths and weaknesses, and the right choice depends on the needs of your project.

If you are creating a fungible asset like a stablecoin or governance token, ERC20 remains the standard. If your goal is to represent unique digital ownership, ERC721 is the best option. If your project requires a flexible combination of currencies and collectibles, ERC1155 provides efficiency and scalability.

The future will likely see all three standards coexisting, with ERC1155 gaining traction in gaming and metaverse ecosystems, ERC721 continuing to dominate NFTs, and ERC20 powering the DeFi economy. By understanding their differences, you can make informed decisions that ensure your project thrives in the evolving blockchain landscape.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.