Crypto trading continues to attract both beginners and professionals in 2025. Whether the market is bullish or bearish, futures contracts provide opportunities for profit by going long or short. When exploring crypto futures trading, two major types of contracts appear: USDT-M futures and COIN-M futures.

Understanding the difference between these futures is critical before trading, as the type of margin and settlement you use affects your risks, rewards, and strategy. In this guide, we will explain what each contract means, how they work, and which might be better suited for your trading goals on Bitunix.

What Are USDT-M Futures?

USDT-M futures are futures contracts that are margined and settled in USDT, the stablecoin Tether. This means you use USDT as collateral, and your profits or losses are also credited or deducted in USDT.

For example:

- If you open a BTC/USDT perpetual futures trade, you deposit USDT in your margin wallet.

- If Bitcoin’s price moves in your favor, your profit will be added in USDT.

- If the trade goes against you, your loss is deducted from the USDT balance.

This system provides stability because USDT maintains a 1:1 peg to the U.S. dollar, making it easier to calculate profits, manage risk, and measure overall portfolio value.

Key Features of USDT-M Futures:

- Collateral: USDT stablecoin.

- Settlement: Profits and losses in USDT.

- Simplicity: Easier to track in fiat terms.

- Lower liquidation risk: Collateral does not fluctuate in value.

What Are COIN-M Futures?

COIN-M futures are futures contracts that are margined and settled in the underlying cryptocurrency itself. For instance, if you trade a Bitcoin COIN-M futures contract, your collateral is Bitcoin, and your profits or losses are also paid in Bitcoin.

Example:

- You deposit BTC into your futures wallet.

- If you profit, you receive BTC.

- If you lose, BTC is deducted from your balance.

This type of futures appeals to traders who are long-term bullish on crypto and want to accumulate more coins directly. However, because the margin itself fluctuates in value with market price, there is higher volatility and higher liquidation risk.

Key Features of COIN-M Futures:

- Collateral: Underlying cryptocurrency (BTC, ETH, etc.).

- Settlement: Profits and losses in crypto.

- Dual exposure: Gain or lose from both futures position and asset price movement.

- Higher volatility: Collateral value changes with the market.

Side-by-Side Comparison: USDT-M vs COIN-M Futures

| Feature | USDT-M Futures | COIN-M Futures |

| Collateral | USDT stablecoin | Crypto asset (e.g., BTC, ETH) |

| Settlement | In USDT | In crypto |

| Risk Level | Lower (stable collateral) | Higher (volatile collateral) |

| Best For | Simplicity, risk control, fiat conversion | Long-term crypto holders, accumulation |

| Liquidity | Higher, more trading pairs | Lower, limited to major coins |

| Calculation | Easy to track in USD terms | Must account for crypto price swings |

Advantages of USDT-M Futures

- Simplicity and Stability Your balance is always in USDT, making it easier to track profits in fiat value. This is ideal for traders who want clarity in accounting.

- Lower Volatility Risk Since collateral is in USDT, it does not lose value if Bitcoin or Ethereum drops suddenly. This reduces the risk of margin calls and liquidation.

- Higher Liquidity USDT-M markets tend to have more trading pairs and deeper liquidity, which results in faster execution and tighter spreads.

Advantages of COIN-M Futures

- Potential for Dual Gains You can profit both from the futures position and from the appreciation of the underlying cryptocurrency.

- Accumulation of Crypto Profits are paid directly in coins, allowing traders to increase their holdings without converting back to USDT.

- Appeals to Long-Term Holders COIN-M contracts align with the philosophy of traders who want to stay exposed to Bitcoin or Ethereum while still speculating in futures markets.

Main Differences Between USDT-M and COIN-M Futures

One of the most significant differences lies in the underlying asset used for margin and settlement. USDT-M futures use USDT as collateral, meaning your profits and losses are realized in a stable currency.

Conversely, COIN-M futures use cryptocurrency itself (usually Ethereum or Bitcoin), which can lead to gains or losses in the underlying asset’s value, adding another layer of risk and reward.

The settlement process: USDT-M futures are settled in USDT, offering a straightforward, fiat-like settlement. COIN-M futures, however, are settled in cryptocurrency, which can either amplify your gains if cryptocurrency’s value increases or deepen your losses if it decreases.

Minimal margin: USDT-M futures typically require a lower margin, as USDT’s value is stable. This lower margin requirement can reduce the potential for liquidation, making it a safer option for risk-averse traders.

COIN-M futures, however, may require a higher margin due to the volatility of cryptocurrencies, and this higher risk could lead to significant gains or losses.

Risk management differs significantly between the two types. With USDT-M futures, your risk is primarily tied to the futures contract’s performance, as the value of USDT remains constant.

In contrast, COIN-M futures expose you to the risk of the underlying asset’s price movement in addition to the futures contract, necessitating more sophisticated risk management strategies.

Liquidity is generally higher in USDT-M futures markets due to the popularity and stability of USDT. COIN-M futures might have lower liquidity depending on the underlying cryptocurrency, potentially leading to wider spreads and less favorable execution prices.

Trading pairs: USDT-M futures offer a broader range of trading pairs, making them more versatile for traders looking to diversify their strategies across multiple assets. COIN-M futures are often limited to major cryptocurrencies like Bitcoin and Ethereum, which might restrict trading options.

Market volatility impacts both futures types but in different ways. USDT-M futures provide a buffer against extreme price swings because of stable collateral. COIN-M futures, on the other hand, can be highly volatile, reflecting both the futures contract and the underlying asset’s price movements, which could lead to more significant gains or losses.

Which Should You Choose?

The choice between USDT-M and COIN-M futures depends on your risk tolerance, strategy, and market outlook:

- Choose USDT-M futures if you want stability, predictable profits in stablecoin, and easier accounting. This is best for beginners and traders who measure returns in fiat.

- Choose COIN-M futures if you want to accumulate crypto directly and are comfortable with higher volatility. This is best for advanced traders with long-term conviction in Bitcoin or Ethereum.

On Bitunix, both options are available, giving you flexibility to design your trading strategy according to your preferences.

How to get started with USDT-M Trading on Bitunix?

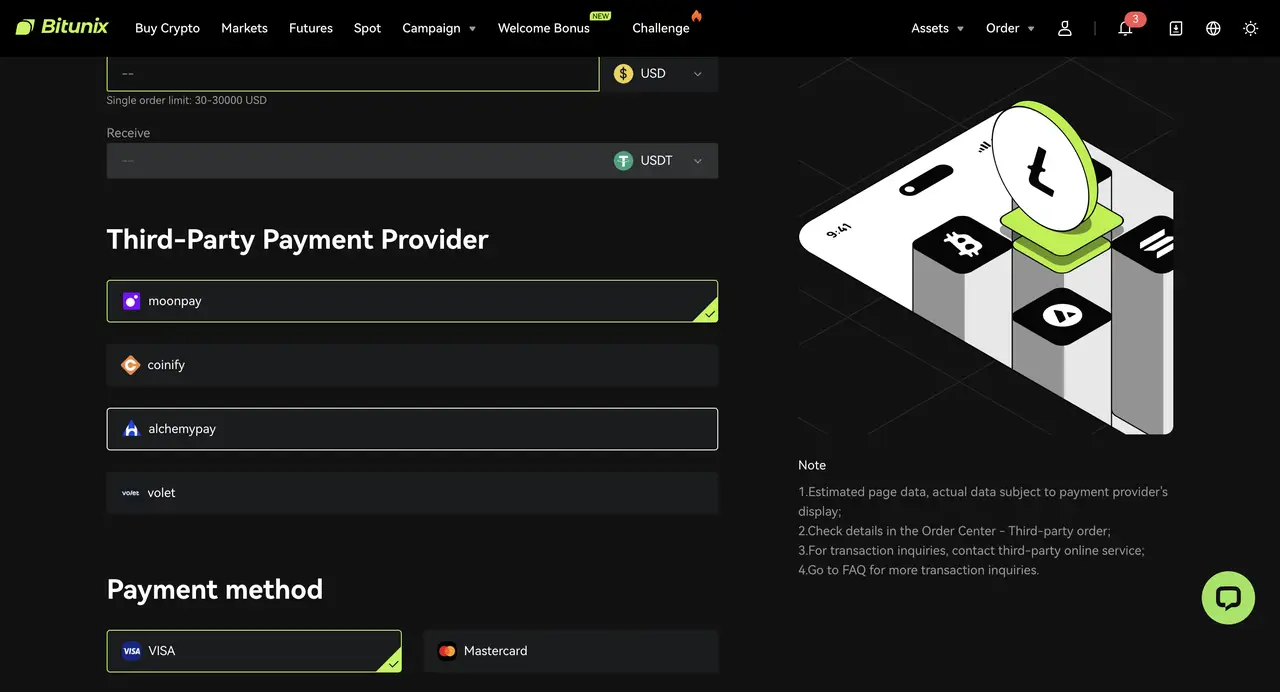

To get started with USDT-M futures trading, you need to create an account on Bitunix and complete your KYC. Once done, you can either fund your account with crypto by choosing deposit or you can buy crypto via Via Third-Party on Bitunix. We offer third party on-ramp crypto on Bitunix along with different choice of payment methods like credit and debit cards, Apple pay and bank transfer.

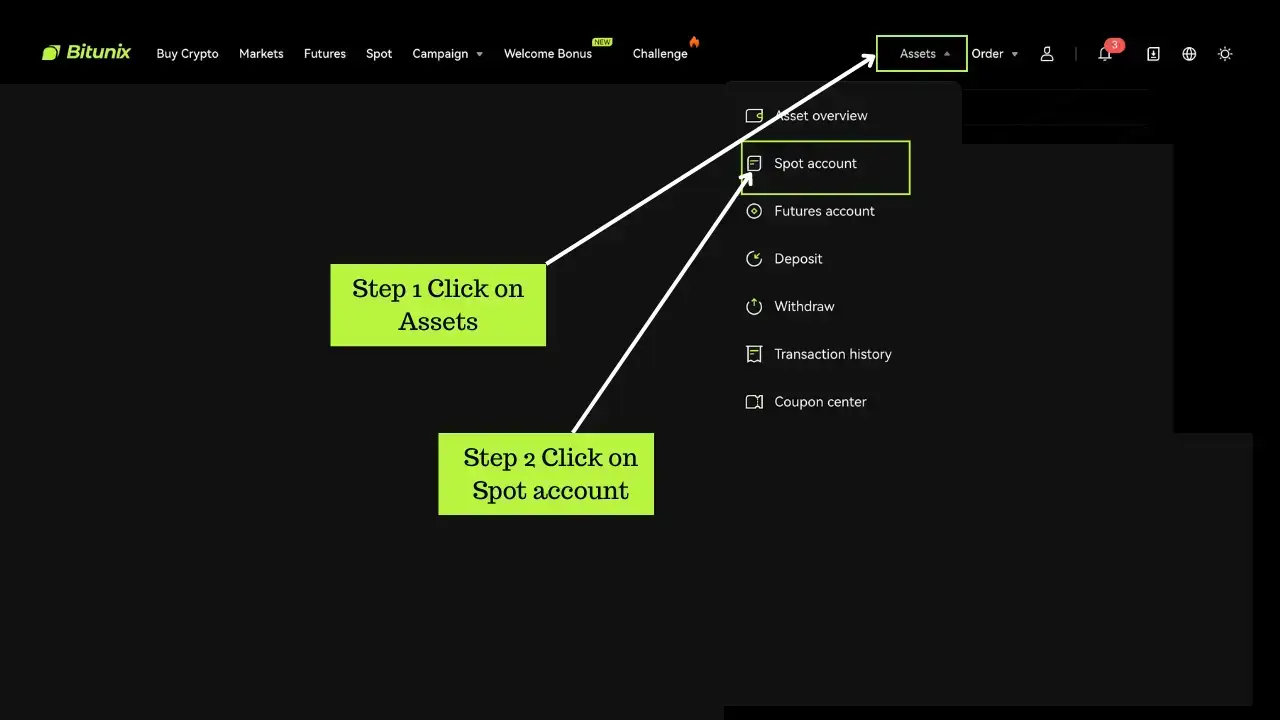

To deposit crypto in your Bitunix wallet, click on Assets from the navigation menu and click on spot account.

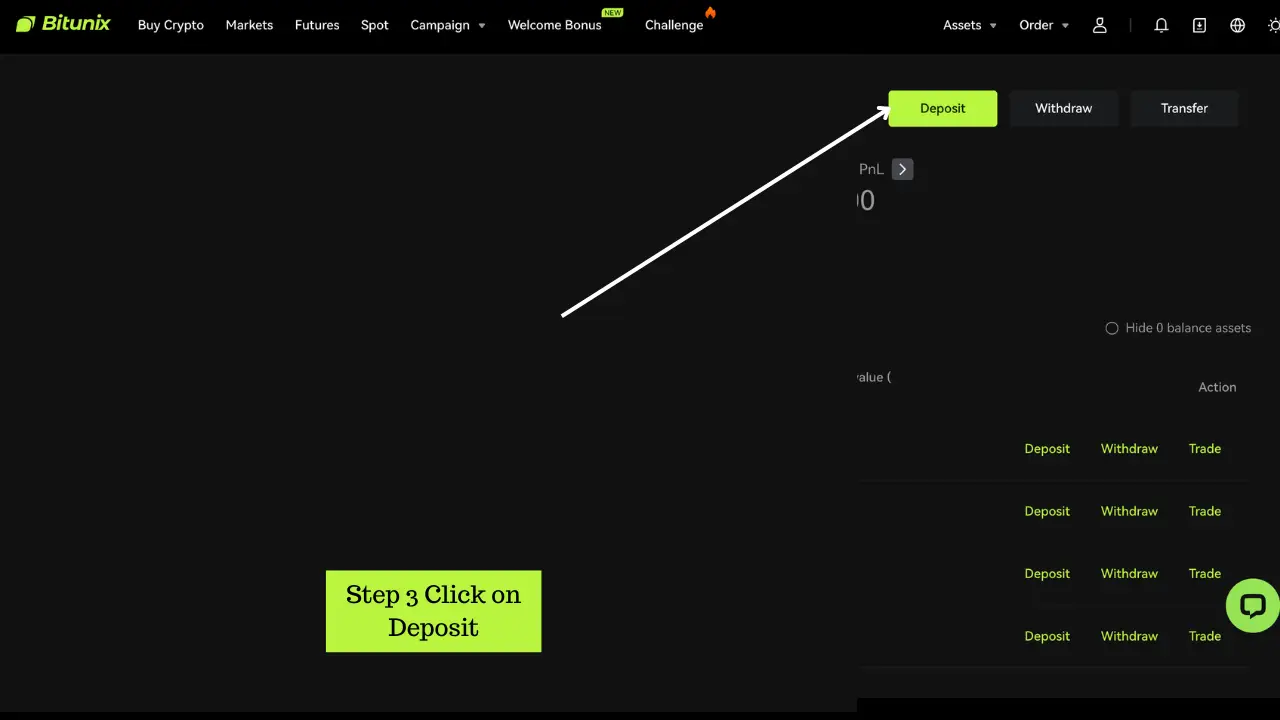

Next, click on deposit.

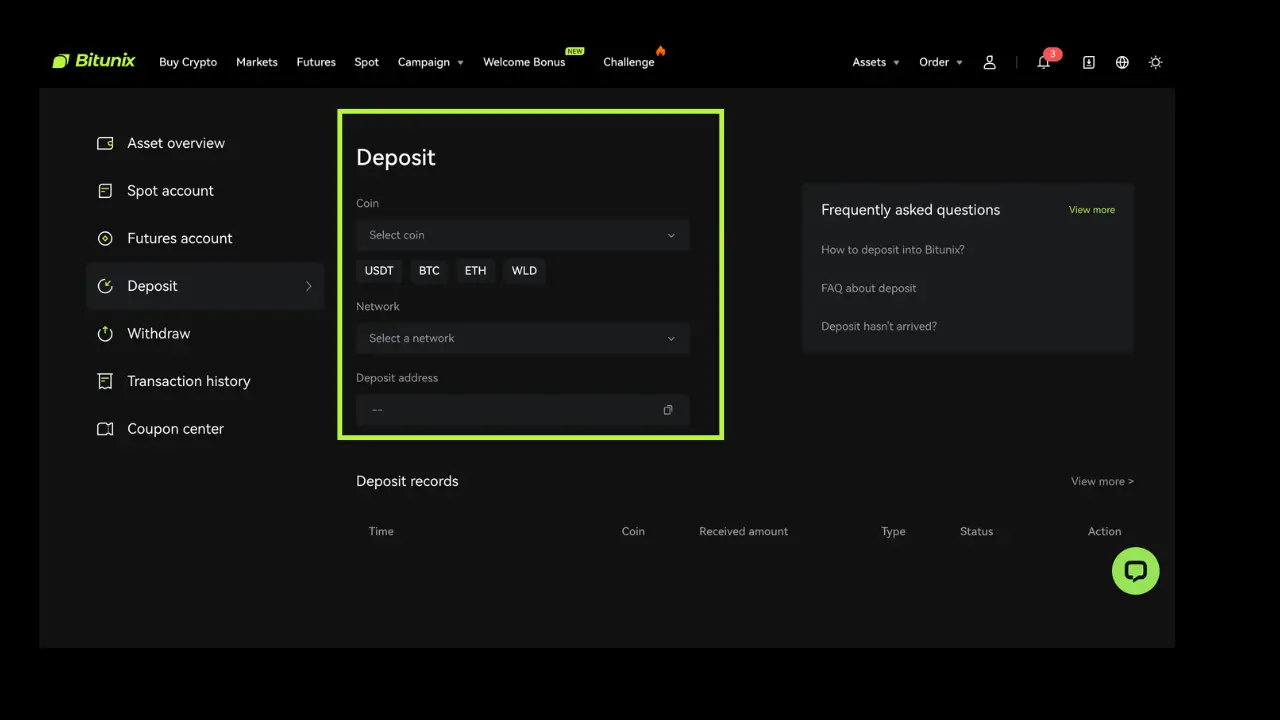

Then choose the cryptocurrency you want to deposit and the network. (Choose the network carefully. If you choose the wrong network, your crypto funds may get lost forever)

- Once you have chosen the currency and the network you need to copy the deposit address. Next, head over to the wallet where you have your funds. Click on send and paste the address you just copied and click send.Now, you are ready to start trading in USDT-M futures.

Conclusion

Both USDT-M and COIN-M futures are powerful tools for crypto traders, but they cater to different strategies. USDT-M futures provide stability and predictable profits in USDT, making them ideal for risk-averse traders. COIN-M futures, on the other hand, allow direct exposure and accumulation of cryptocurrencies, but carry higher volatility.

On Bitunix, you can access both USDT-M and COIN-M contracts with advanced trading features, competitive fees, and a secure trading environment. By understanding the differences, you can align your futures strategy with your financial goals in 2025.

FAQs

1. What is the difference between USDT-M and COIN-M futures?

USDT-M futures use USDT as margin and settlement, while COIN-M futures use cryptocurrency as margin and settlement.

2. What is the meaning of USDT-M futures?

USDT-M futures are stablecoin-margined contracts where profits and losses are settled in USDT.

3. What is the meaning of Coin-M futures?

COIN-M futures are coin-margined contracts where collateral and settlement occur in the underlying asset, such as BTC or ETH.

4. Which is safer, USDT-M or COIN-M futures?

USDT-M is generally safer due to stable collateral, while COIN-M carries higher risk because crypto collateral fluctuates.

5. Is USDT a coin or a token?

USDT is a stablecoin token, issued on multiple blockchains like Ethereum and Tron, pegged to the U.S. dollar.

6. Is stablecoin a coin or token?

Most stablecoins, including USDT, are tokens built on top of blockchains rather than native coins.

7. What is the difference between a coin and a token?

- A coin operates on its own blockchain (e.g., Bitcoin, Ethereum).

- A token is built on an existing blockchain (e.g., USDT on Ethereum).

8. Which is better: USDT-M or COIN-M futures?

Neither is universally better. USDT-M suits traders who prioritize fiat-equivalent profits, while COIN-M suits those seeking direct crypto accumulation.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | MediumDisclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.