Ready To Place Your

Next Trade?

Choose a market, set your order, and manage risk in one place.

Silver is one of the few markets that works for both macro traders and technical traders for the same reason. It can trend, it can mean-revert, and it can react sharply when sentiment shifts. If you want silver-linked exposure inside a crypto trading workflow, XAG/USDT gives you a direct way to plan and execute without leaving your exchange routine.

This guide explains what XAG represents in a trading context, why traders use it, and how to trade XAG/USDT perpetual futures on Bitunix using a clean, repeatable process.

[ez-toc]

XAG is the widely recognized market ticker used to refer to silver. In crypto, XAG/USDT refers to a silver-linked instrument priced in USDT, which lets traders express a view on silver price movement using familiar order tools.

One practical point matters. “Price-tracking” commodity instruments can differ by product design depending on the platform and structure. If your goal is trading price movement, focus on liquidity, spreads, execution, and risk controls. If your goal includes redemption rights or physical settlement, review the specific product description and issuer terms before committing significant capital.

XAG often appeals to traders who want a market with a different rhythm than high beta crypto. Silver can move quickly, but many traders approach it with a more structured thesis, which helps build discipline.

Common reasons traders choose XAG/USDT include:

Silver often reacts to interest rate expectations, inflation narratives, and changes in risk sentiment. That makes it useful when broader markets are driven by headlines and positioning.

If your watchlist is highly correlated, you can end up repeating the same trade idea across multiple assets. Adding a silver-linked market can reduce that loop and improve decision quality.

Many traders find it easier to define support, resistance, and invalidation levels on metals-linked instruments because major levels are widely watched. That does not guarantee performance, but it supports structured execution.

On Bitunix, XAG is offered via perpetual futures, meaning you are trading a contract that tracks the underlying price and does not expire.

This matters because futures trading adds mechanics that spot does not include:

Before placing any order, do a short pre-trade scan:

If you cannot define where your idea is wrong, you are not ready to enter.

Bitunix supports up to 20x leverage on XAG/USDT perpetual futures. Higher leverage reduces the distance to liquidation and leaves less room for normal volatility. For most traders, especially beginners, the highest leverage setting is not a target. It is a risk ceiling.

A disciplined approach for newer futures traders:

If you are not using a stop-loss, leverage is not the main issue. Process is.

A good trading process is not complex. It is consistent. Use this checklist every time.

This approach reduces impulsive trades and makes your decisions easier to review.

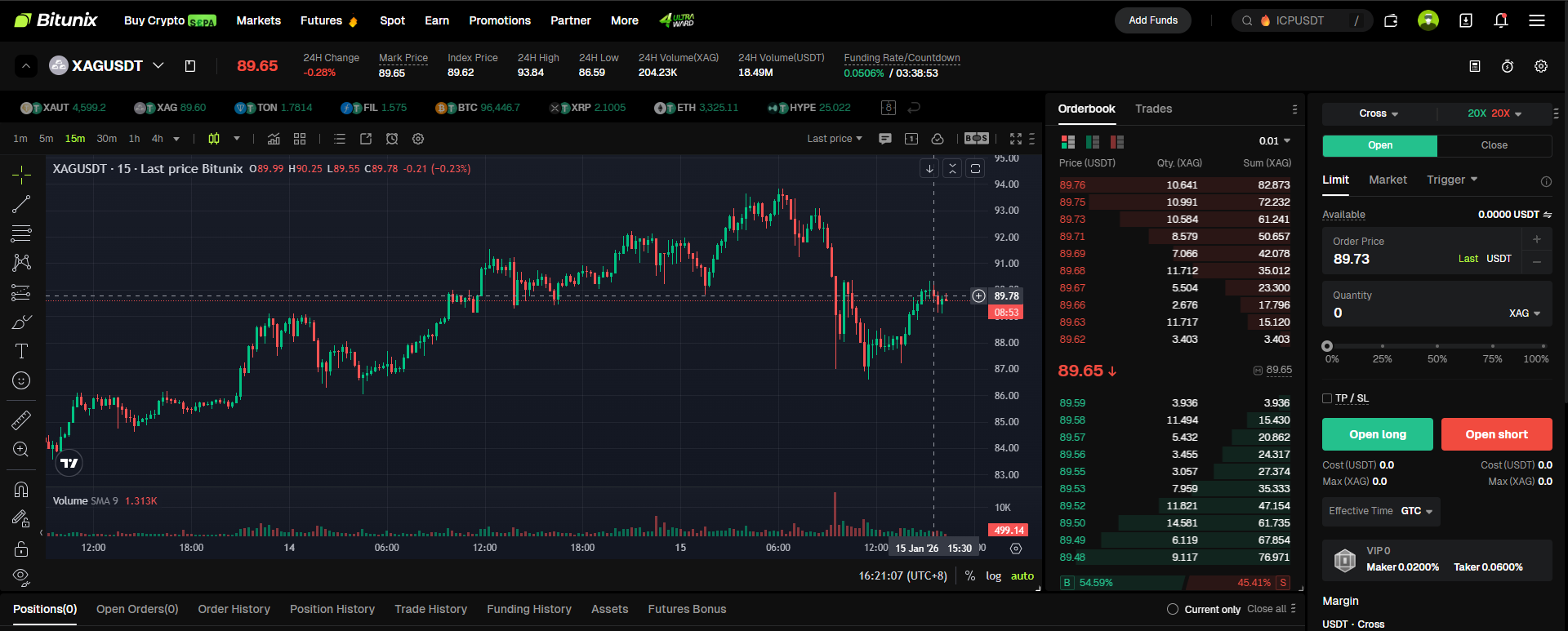

Bitunix trading dashboard for XAGUSDT

This workflow keeps execution clean and prevents avoidable mistakes.

Before funding, apply basic security. Use a strong password and enable two-factor authentication.

USDT funding keeps execution straightforward for USDT-margined futures and makes PnL tracking simple.

Search XAG/USDT and open the market page. Spend one minute reading the conditions:

This determines whether you should use a limit order or a market order.

If isolated margin is available, it is often the cleaner choice for controlled risk per position. Select leverage intentionally. If you are unsure, start lower and increase only when your process is consistent.

Pick the order type that supports discipline.

For many traders, limit orders are the cleaner default because they reduce rushed execution.

Your risk tools should be ready before the trade goes live.

Before you click confirm:

This habit prevents the most common beginner errors.

Silver-linked markets often react to a mix of macro and technical drivers:

You do not need to become a macro analyst to trade XAG/USDT, but you do need to respect that macro shifts can accelerate moves.

If you want a simple, practical starting point for XAG/USDT perpetual futures:

The goal is not a dramatic win. The goal is controlled execution you can repeat.

Is XAG the same as holding physical silver? XAG/USDT futures is typically used for silver-linked price exposure in a trading format. Whether a product includes redemption rights depends on the specific product design and issuer rules.

Should beginners trade XAG/USDT futures? Beginners can, but only if they use conservative leverage, isolate risk where possible, and consistently use risk controls.

What is the main benefit of trading XAG/USDT on Bitunix? It lets you express a silver view with stablecoin-based sizing and familiar futures order tools inside a crypto exchange workflow.

XAG: Standard market ticker reference for silver.

XAG/USDT: A market where XAG is priced in USDT.

Perpetual futures: Futures contracts with no expiry that track the underlying market price.

USDT-M futures: Futures contracts margined and settled in USDT.

Isolated margin: Margin mode that limits risk to the margin allocated to a single position.

Leverage: A multiplier that increases exposure relative to margin, magnifying gains and losses.

Liquidation: Forced closure of a futures position when margin becomes insufficient.

Stop-loss: An order designed to limit losses by closing a position at a predefined level.

Reduce-only: An order setting that helps ensure an order only reduces an existing position rather than increasing it.

Limit order: An order to buy or sell at a specified price or better.

Market order: An order that executes immediately at the best available price, with potential slippage.

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. At Bitunix, we are committed to providing a transparent, compliant, and secure trading environment for every user. Our platform features a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, we prioritize user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.