Ready To Place Your

Next Trade?

Choose a market, set your order, and manage risk in one place.

XAUT is a tokenized gold asset that gives traders a way to follow gold price movements in a crypto-native format. Instead of managing physical storage, settlement delays, or traditional brokerage steps, traders can access gold-linked exposure through a market like XAUT/USDT and execute with familiar order types and risk tools.

This guide explains what XAUT is, why traders use it, and how to trade it with a clean, beginner-friendly process on Bitunix. You will also see when spot makes sense, when futures can be useful, and how to structure risk so your first XAUT trades feel controlled rather than emotional.

[ez-toc]

XAUT is a token designed to represent exposure to physical gold through a digital asset structure. It is commonly referred to as tokenized gold. The key idea is simple: the token’s value is intended to track gold, so traders can express a gold view inside a crypto trading account.

Before trading any tokenized commodity, it is important to understand one practical point: tokenized gold products are not all identical. The issuer’s backing model, custody arrangement, and redemption rules can differ. If your goal is purely trading price movement, you will typically focus on liquidity, spreads, and execution quality. If your goal includes redemption rights, read the issuer documentation carefully.

XAUT tends to attract two types of traders: those who want a gold-linked position without leaving crypto infrastructure, and those who want a calmer instrument when the broader market feels unstable.

Here are the most common reasons traders add XAUT to their watchlist.

Many traders already understand gold as a macro asset. XAUT lets you express that idea in a pair like XAUT/USDT, using the same workflows you use for other markets.

Crypto markets can be fast and emotionally demanding. A gold-linked instrument can help diversify decision-making. It is not a guaranteed hedge, but it can be a useful option when you want exposure that often behaves differently than high-volatility coins.

Because XAUT is linked to a widely followed traditional asset, traders often find it easier to build a thesis, define levels, and stick to a plan. This is especially helpful for beginners learning disciplined execution.

Most traders interact with XAUT through XAUT/USDT, which simply means XAUT priced in USDT. For beginners, this is a practical starting point because it is easy to calculate position size and PnL in stablecoin terms.

When you open the XAUT/USDT market on Bitunix, focus on three things before placing any order:

Bitunix offers both spot and futures access depending on product availability. Beginners should choose the simplest product that matches their goal.

Spot is straightforward: you buy and sell XAUT directly. If you are learning market structure, entries, exits, and position sizing, spot keeps the mechanics clean.

This is the best fit for:

Perpetual futures are derivatives contracts that track the underlying market price and do not expire. They can be useful for active trading, hedging, and strategies that require margin efficiency.

This is a better fit for:

If you trade XAUT via futures, treat risk controls as mandatory, not optional.

If you want consistency, keep your process boring and repeatable. Use this checklist every time.

This approach reduces impulsive trading and makes your results easier to review and improve.

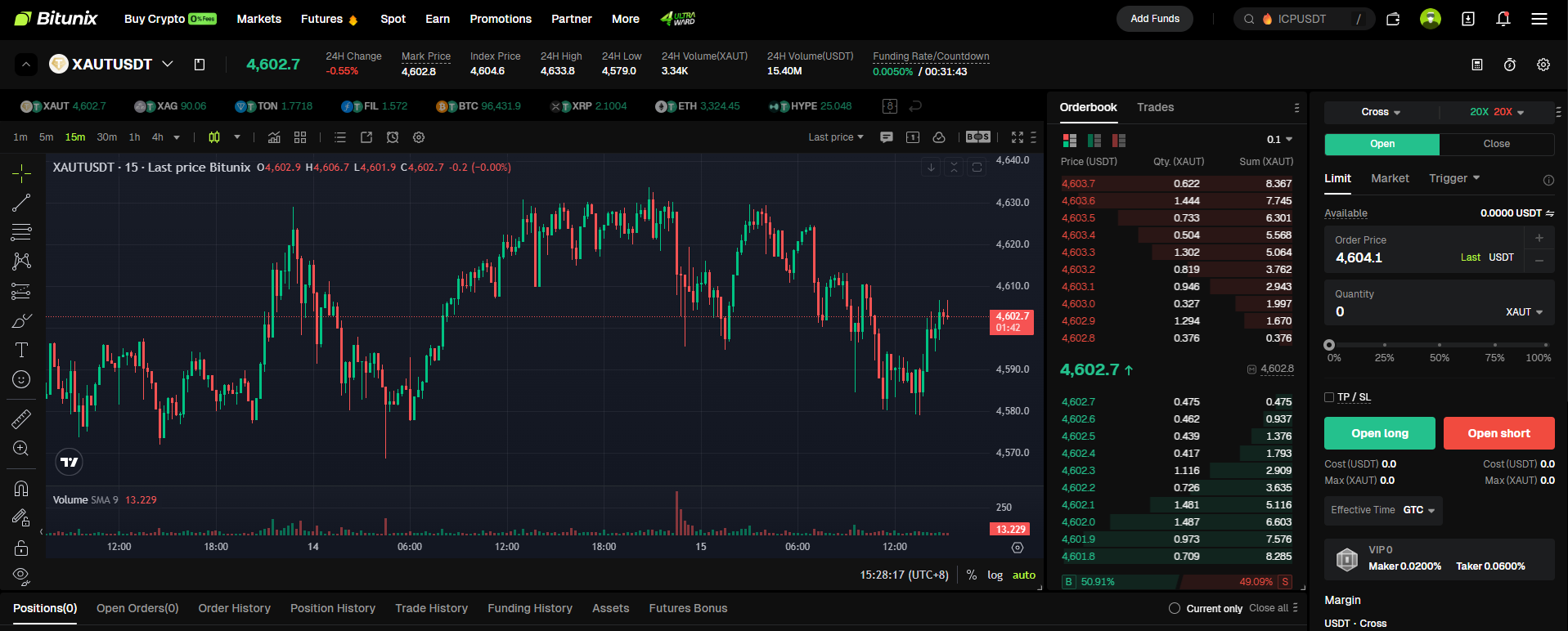

Bitunix trading platform showing the XAUT/USDT

Below is a clean workflow used by many traders on Bitunix exchange.

Before funding, set strong security. Use a strong password and enable two-factor authentication.

Most traders fund with USDT. This makes it easy to trade XAUT/USDT in spot, and it also supports USDT-margined futures where available.

Search for XAUT/USDT and open the market page. Take a moment to observe:

This helps you decide whether a limit order is more appropriate than a market order.

Use the order type that matches your plan.

If you are learning, limit orders plus a clear stop-loss process is usually the best starting structure.

Risk tools turn a trade into a plan. Before you confirm, make sure you have:

In futures, use reduce-only where available to avoid accidentally increasing exposure.

Leverage can magnify results, but it also reduces the distance to liquidation. For XAUT futures, Bitunix offers up to 75x leverage on XAUT/USDT, where supported. Beginners typically benefit from using much lower leverage while learning, because a small mistake becomes expensive very quickly at higher leverage.

A disciplined beginner approach for XAUT futures looks like this:

If you are not placing a stop-loss, leverage is not the problem. The process is.

XAUT is designed to track gold-linked pricing behavior, so its movements often reflect the same broad themes traders watch for gold.

Common drivers include:

Even if you do not trade macro, these drivers matter because they can create faster moves than beginners expect. That is why your stop-loss and size discipline still matter in a gold-linked market.

If you want a practical starting point, use a simple structure that encourages discipline.

The goal is not to “win big.” The goal is to build consistent execution and avoid preventable errors.

XAUT is a tokenized structure intended to represent gold-linked exposure. Whether it offers direct redemption rights depends on the issuer rules and the product framework. Traders focused on price movement typically concentrate on market liquidity and execution.

XAUT/USDT is a common choice because it is easy to price, size, and manage in stablecoin terms.

Spot is usually the cleaner learning path. Futures can be useful, but only if you understand margin, liquidation, and you consistently use risk controls.

A sensible first goal is process quality: define invalidation, size correctly, place protection orders, and execute the same way every time.

Bitunix: A cryptocurrency trading platform that provides spot and futures markets, depending on product availability.

Bitunix exchange: The Bitunix trading environment where users access markets, charts, and order placement.

Bitunix futures: Futures markets on Bitunix where traders use contracts rather than holding the underlying asset directly.

XAUT: A tokenized gold asset designed to represent gold-linked exposure through a digital token format.

XAUT/USDT: A trading pair where XAUT is priced in USDT.

Spot trading: Buying and selling the asset directly in the spot market.

Perpetual futures: Futures contracts with no expiry date that track the underlying market price through standard derivatives mechanics.

Isolated margin: A margin mode where the assigned margin is limited to a specific position, helping control risk per trade.

Leverage: A multiplier that increases exposure relative to margin, amplifying gains and losses.

Liquidation: Forced position closure when margin becomes insufficient to maintain the position.

Stop-loss: An order designed to limit losses by closing a position at a predefined level.

Limit order: An order to buy or sell at a specified price or better.

Market order: An order that executes immediately at the best available price, with potential slippage.

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. At Bitunix, we are committed to providing a transparent, compliant, and secure trading environment for every user. Our platform features a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, we prioritize user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.