[ez-toc]

Bitcoin’s recent crash did not happen out of nowhere. It unfolded quickly, but the conditions behind it had been building for weeks.

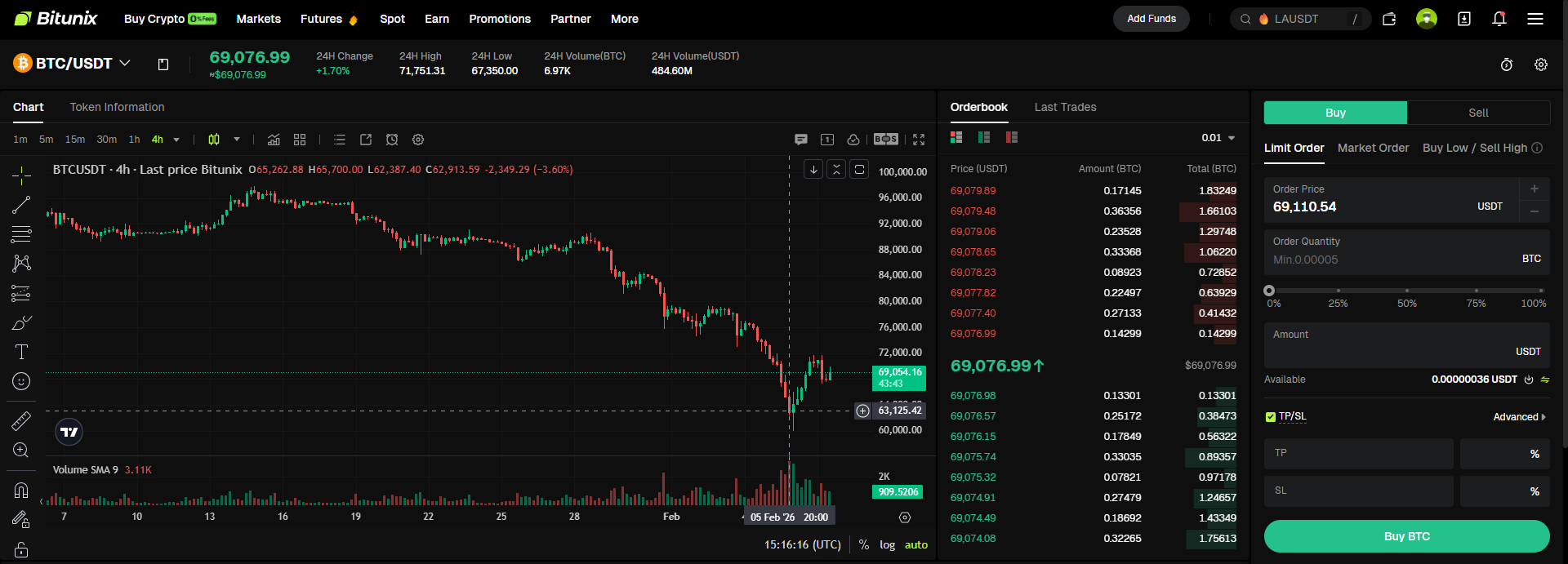

In early February 2026, Bitcoin led the broader crypto market lower as selling pressure intensified across global risk assets. What started as a pullback quickly turned into a full crypto market crash, with Bitcoin acting as the primary liquidity exit for traders and institutions.

This was not a Bitcoin-specific failure. It was a market event driven by positioning, leverage, and fear.

At the height of the sell-off, Bitcoin experienced one of its sharpest short-term declines in recent years.

Based on widely reported market data:

After hitting these levels, Bitcoin entered a period of consolidation. Price stabilized temporarily, but trading conditions remained sensitive and reactive.

The biggest structural reason Bitcoin crashed was leverage.

Leading into the sell-off, futures and perpetual markets showed elevated open interest. Many traders were positioned to continue higher, using borrowed capital. When price began to fall, those positions quickly became vulnerable.

As margin thresholds were breached:

This created a classic liquidation cascade. The selling was mechanical, not emotional. Once it started, it fed on itself.

Another important factor was Bitcoin ETF outflows.

During the crash period, spot Bitcoin ETFs recorded net outflows as institutional investors reduced exposure. These flows matter because ETF redemptions often result in real selling in the underlying market.

ETF outflows did not cause the crash on their own, but they added steady pressure at a time when liquidity was already weakening. This made it harder for price to recover once selling began.

In normal conditions, Bitcoin has deep liquidity. During the crash, that liquidity thinned quickly.

As volatility increased:

This liquidity stress meant that even moderate sell volume could cause sharp price moves. Once fear set in, buyers stepped back and waited, allowing price to fall faster.

Market psychology played a major role.

As Bitcoin dropped, social media and trading communities filled with panic. Discussions around withdrawals paused, exchange restrictions, and system stress spread quickly, even when many of those issues were isolated or temporary.

Fear does not need to be rational to affect price. Once confidence weakens, traders prioritize capital preservation over opportunity.

It is important to be clear about what this crash was not.

This was a market-driven crash, not a technological one.

Why did Bitcoin crash in 2026?

Bitcoin crashed due to a combination of leverage unwinding, forced liquidations, ETF outflows, and a broader risk-off shift across global markets.

How low did Bitcoin go during the crash?

Bitcoin fell from above 80,000 to trade in the 60,000 to 64,000 range during the most volatile period.

Did Bitcoin ETFs contribute to the sell-off?

Yes. Bitcoin ETF outflows added sustained selling pressure during a time of reduced liquidity.

Was Bitcoin fundamentally damaged by the crash?

No. The Bitcoin network remained secure and operational throughout the event.

Is this type of crash unusual for Bitcoin?

No. Bitcoin has experienced similar drawdowns in past cycles, especially during periods of excessive leverage.

Bitcoin crash: A rapid decline in Bitcoin price driven by market structure and liquidity conditions.

Crypto market crash: A broad sell-off across digital assets, often led by Bitcoin.

Forced liquidations: Automatic closure of leveraged positions when margin requirements are breached.

Liquidation cascade: A chain reaction where liquidations trigger further price declines.

Bitcoin ETF outflows: Capital leaving Bitcoin exchange-traded funds, adding selling pressure.

Bitcoin crashed in 2026 not because it failed, but because markets were overleveraged and unprepared for a sudden shift in sentiment. Once selling began, liquidations, ETF outflows, and liquidity stress accelerated the decline.

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. The platform is committed to providing a transparent, compliant, and secure trading environment for every user. Bitunix offers a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, Bitunix prioritizes user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Crypto trading and investing involve significant risk, including the potential loss of principal. This article is for informational purposes only and does not constitute financial advice.