[ez-toc]

Ethereum did not just follow Bitcoin lower. It fell harder.

During the crypto crash 2026, ETH experienced heavier selling pressure than BTC as traders reduced exposure to higher-risk assets. When markets turn defensive, capital usually exits altcoins first, and Ethereum, despite its size, is still treated as an altcoin by many institutional and derivatives traders.

The result was a faster and deeper drop compared with Bitcoin.

Ethereum’s price decline during the crash was significant and rapid.

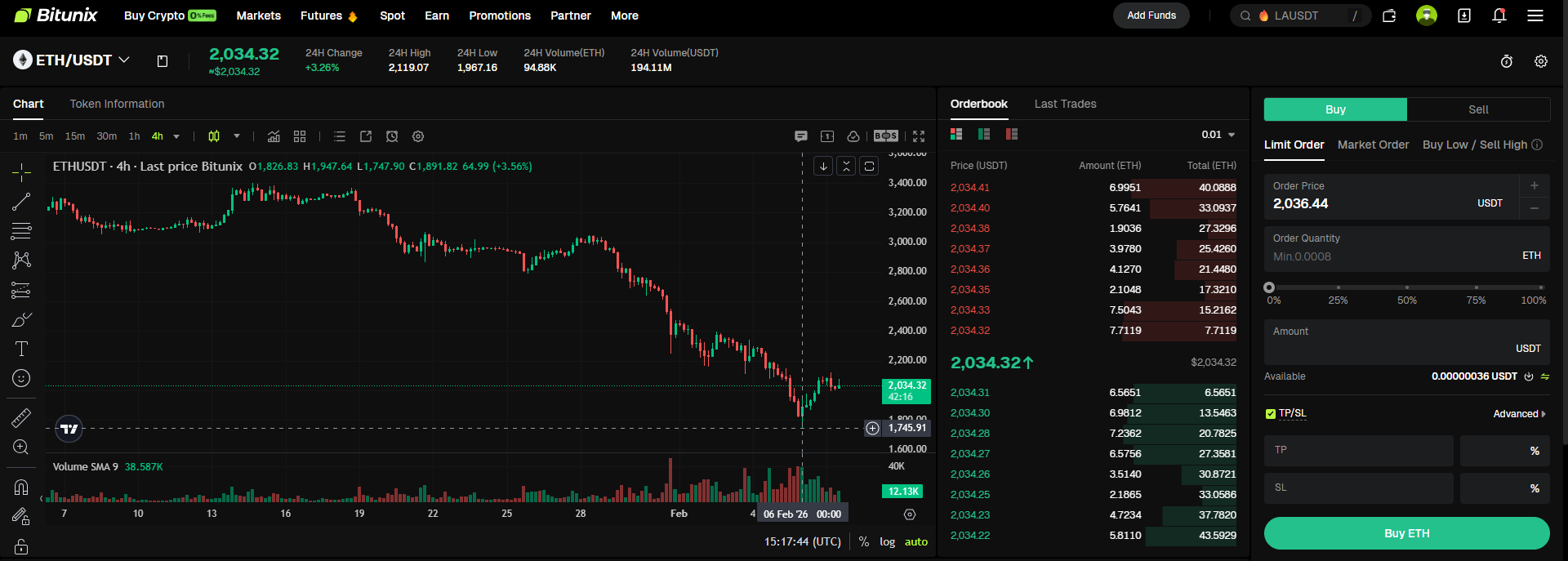

Market data from early February 2026:

After reaching these levels, ETH entered a volatile consolidation phase. While price stabilized temporarily, volatility remained elevated and liquidity stayed thin.

The main reason Ethereum crashed harder than Bitcoin was risk positioning.

Bitcoin is widely viewed as the lowest-risk crypto asset. Ethereum, while foundational to the ecosystem, still carries additional risk due to:

When markets de-risk, ETH tends to be sold aggressively as traders rotate into cash or Bitcoin.

Ethereum derivatives markets were heavily leveraged leading into the crash.

As ETH price began to fall:

This created a liquidation cascade, where each forced close pushed ETH lower and triggered more liquidations. Unlike Bitcoin, ETH liquidity thins faster during stress, which magnified the effect.

Ethereum normally trades with strong liquidity, but during the crash that liquidity evaporated quickly.

As volatility spiked:

Once liquidity disappeared, price discovery became inefficient. ETH moved down in sharp steps rather than smooth trends, increasing panic and accelerating selling.

Sentiment around Ethereum deteriorated faster than Bitcoin.

Concerns about DeFi exposure, liquidation risk, and broader altcoin weakness fed into market fear. As ETH dropped, traders rushed to reduce exposure, often selling at market rather than waiting for price stabilization.

Discussions around exchange stability and withdrawal access also contributed to anxiety, even when those issues were temporary or unrelated to Ethereum itself.

Ethereum’s crash was not caused by a technical failure.

The decline was entirely market-driven.

Why did Ethereum crash harder than Bitcoin in 2026?

Ethereum carries higher risk and leverage exposure than Bitcoin. During risk-off events, traders exit ETH more aggressively, leading to larger percentage declines.

How low did ETH go during the crash?

Ethereum fell from above 3,500 to trade in the 2,000 to 2,400 range during the most volatile period.

Did liquidation play a role in the ETH crash? Y

es. Forced liquidations in ETH derivatives markets significantly amplified selling pressure and accelerated the decline.

Was Ethereum fundamentally damaged by the crash?

No. The Ethereum network remained secure and operational throughout the event.

Is this kind of volatility normal for ETH?

Yes. Historically, Ethereum has experienced larger drawdowns than Bitcoin during market crashes due to higher beta and leverage exposure.

ETH crash: A rapid decline in Ethereum price driven by market structure and risk rotation.

Altcoin sell-off: Capital exiting higher-risk crypto assets during market stress.

Forced liquidations: Automatic closure of leveraged positions when margin requirements are breached.

Liquidation cascade: A chain reaction where liquidations trigger further price drops.

Liquidity stress: Reduced market depth that amplifies price movement.

Ethereum crashed in 2026 because markets turned defensive and leverage unwound rapidly. As liquidity thinned and liquidations accelerated, ETH fell faster than Bitcoin, even though its underlying network remained strong.

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. The platform is committed to providing a transparent, compliant, and secure trading environment for every user. Bitunix offers a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, Bitunix prioritizes user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Crypto trading and investing involve significant risk, including the potential loss of principal. This article is for informational purposes only and does not constitute financial advice.