In futures grid trading, liquidity is not an optional feature. It is the foundation that determines whether a strategy performs as intended or struggles due to execution friction.

A well performing futures grid strategy relies on three execution outcomes: frequent fills, accurate fills, and predictable fills. These outcomes directly shape how a futures grid bot behaves in live markets. On the Bitunix exchange, liquidity plays a central role in supporting consistent grid execution across different market conditions.

This article explains how liquidity affects crypto futures grid bot performance, why it matters for grid strategies, and how Bitunix futures grid trading benefits from a high liquidity environment.

[ez-toc]

Before understanding the advantage, it helps to revisit what future grid trading is at a practical level.

Futures grid trading is an automated strategy where a futures grid trading bot places multiple buy and sell limit orders within a predefined price range for a perpetual futures pair. The bot executes a structured plan designed to capture repeated price movements rather than predicting a single trend.

Because this strategy depends on repeated execution, liquidity has a much larger impact than it does in standard discretionary trading.

A futures grid strategy typically follows this cycle:

Open position → Close position → Open position → Close position

Each cycle depends on smooth order execution. Weak liquidity can disrupt this process through slippage, delayed fills, or unstable pricing.

From an execution perspective, good liquidity usually appears in three measurable ways.

A tighter spread means the gap between the best bid and best ask is smaller.

For a futures grid bot, this results in:

In grid trading, wide spreads can cause each grid entry to start slightly below breakeven, which reduces overall grid efficiency over time.

A deep order book means there is sufficient volume available across multiple price levels.

This directly supports:

For Bitunix futures grid trading, deeper order books help ensure that one grid fill does not negatively affect the next.

Continuous fills mean limit orders are more likely to execute smoothly without long delays.

For grid strategies, this improves:

When liquidity is weak, grid orders may remain unfilled, delaying profit realization and reducing overall performance.

Because grid strategies execute frequently, futures grid trading bot performance is highly sensitive to execution quality.

When liquidity is insufficient:

These issues become more pronounced when leverage is applied, making futures grid leverage settings an important consideration alongside liquidity.

Liquidity translates into real, measurable improvements in grid performance.

Direct benefits for futures grid users:

This helps preserve the profitability of a futures grid strategy, especially when grid spacing is tighter.

Direct benefits:

For strategies placing many orders across a range, order book depth is critical to maintaining consistency.

Direct benefits:

Grid profit is only realized when a full cycle completes. Liquidity improves the likelihood that this happens smoothly.

Direct benefits:

This is particularly relevant for futures grid bot risk management, as unstable fills can trigger unwanted stop losses or pauses.

Liquidity works best when combined with thoughtful parameter selection.

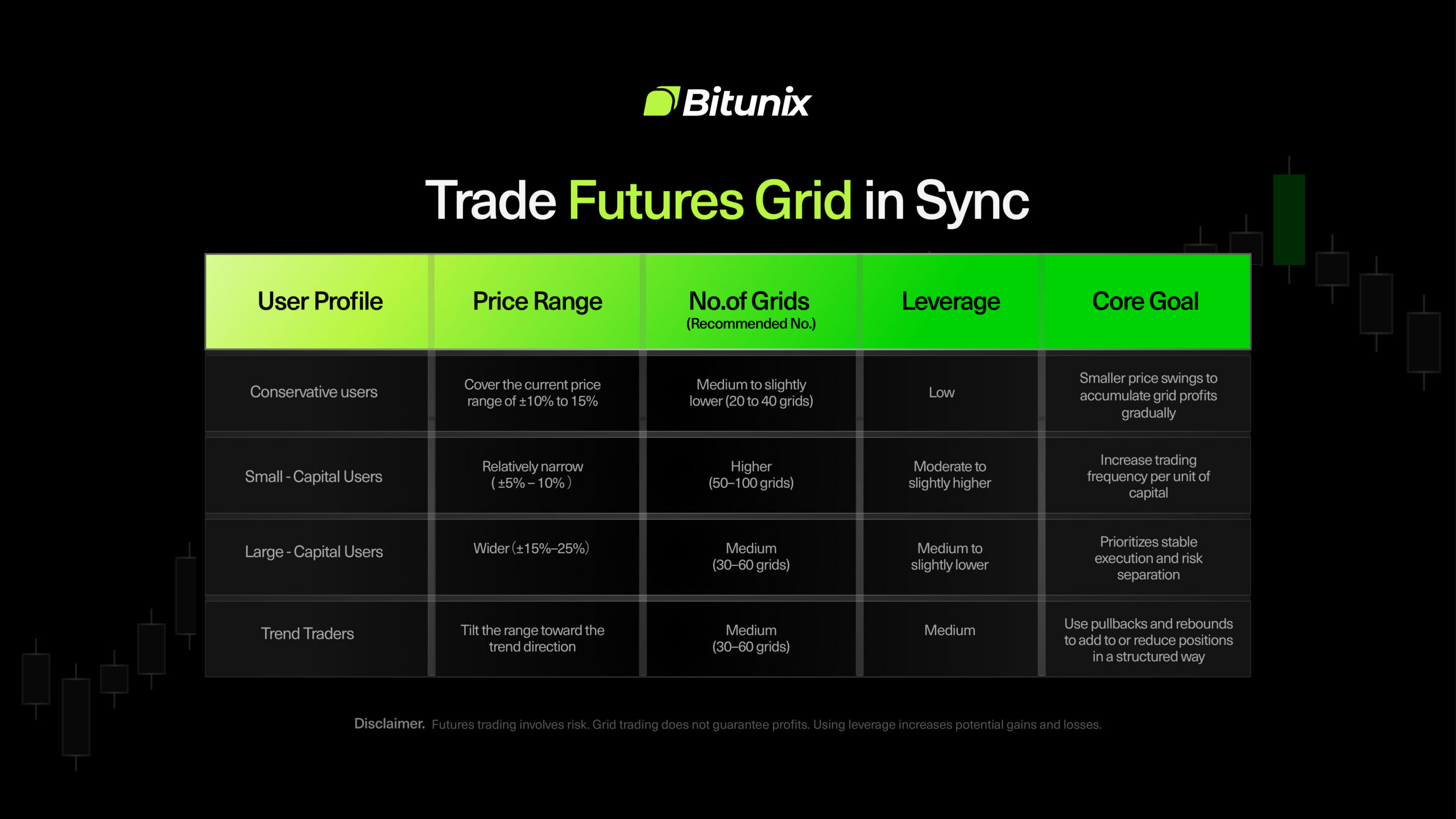

Understanding futures grid parameters explained helps users align their strategy with market conditions.

Choosing futures grid long vs short determines directional exposure.

Liquidity helps both configurations execute closer to intended levels, especially during active trading periods.

Leverage amplifies both outcomes and risks.

Strong liquidity helps ensure leverage outcomes are driven by price movement rather than execution friction.

Knowing how to use futures grid bot features effectively includes understanding the trading environment.

On Bitunix, each futures grid runs independently, with funds allocated from the Spot Account. This structure, combined with strong liquidity, helps strategies operate more predictably even when running multiple bots simultaneously.

On the Bitunix exchange, futures grid trading is supported by deep liquidity across major perpetual futures pairs with up to 200x.

This environment helps:

For users deploying a crypto futures grid bot, liquidity becomes a key differentiator between theoretical strategy design and real world execution.

No. Liquidity improves execution quality, not market direction. Strategy design and risk management remain critical.

Grid strategies execute far more trades than standard approaches. Small execution inefficiencies can compound over time.

Yes. Poor liquidity can cause abnormal fills or price spikes that increase drawdown and liquidation risk.

Partially. Wider ranges, fewer grids, and lower leverage can help, but liquidity remains a limiting factor.

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. The platform is committed to providing a transparent, compliant, and secure trading environment for every user. Bitunix offers a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, Bitunix prioritizes user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.