Gold-linked trading demand has been climbing again, especially among traders who want a more defensive angle when markets turn uncertain. In crypto, that demand often shows up in tokenized gold markets, and XAUT has become one of the most active places for traders who want gold exposure inside a crypto-native workflow.

But there is a reality most traders run into fast: leveraged trading is not only about leverage. It is also about how much size a market can support cleanly.

On many gold-linked markets, leveraged traders face limits that have nothing to do with strategy quality. The issue is often position capacity and liquidity depth. When supported size is tight, even a well-planned trade turns into a work-around. You split entries, manage more order tickets than you want, and accept that execution can vary more than it should.

That is the problem Bitunix targeted with its latest infrastructure update. The goal was simple: make XAUT leveraged trading more usable at real trading scale, while keeping the existing leverage structure and risk framework intact.

[ez-toc]

XAUT sits at the intersection of two strong trading narratives.

First, it is tied to a defensive asset class that traders often turn to when they want a different risk profile from major crypto pairs. Second, it is actively traded, which makes it relevant to both short-term traders and those running more structured strategies.

However, leveraged trading on gold-linked assets is often constrained by two practical issues:

If you trade with levels, you already know why this matters. Strategy-driven trading depends on execution. When you have to fragment a trade, you introduce more variables: different fills, different average prices, and more manual management. Over time, that friction adds up.

Bitunix’s update is built to reduce that friction specifically by expanding the supported trading size within each leverage tier.

Bitunix enhanced its leveraged trading infrastructure by expanding the notional position capacity supported at each leverage tier.

Three points are important here because they explain exactly what changed and what did not:

This is a capacity upgrade, not a leverage change.

In practical terms, Bitunix strengthened the platform’s ability to support larger positions inside the same tier framework. That reflects improvements in liquidity depth and execution capability, so larger trades can be handled more effectively under the existing risk controls.

Traders do not need to learn a new leverage system. The structure stays familiar. What improves is the usable size you can execute within that structure.

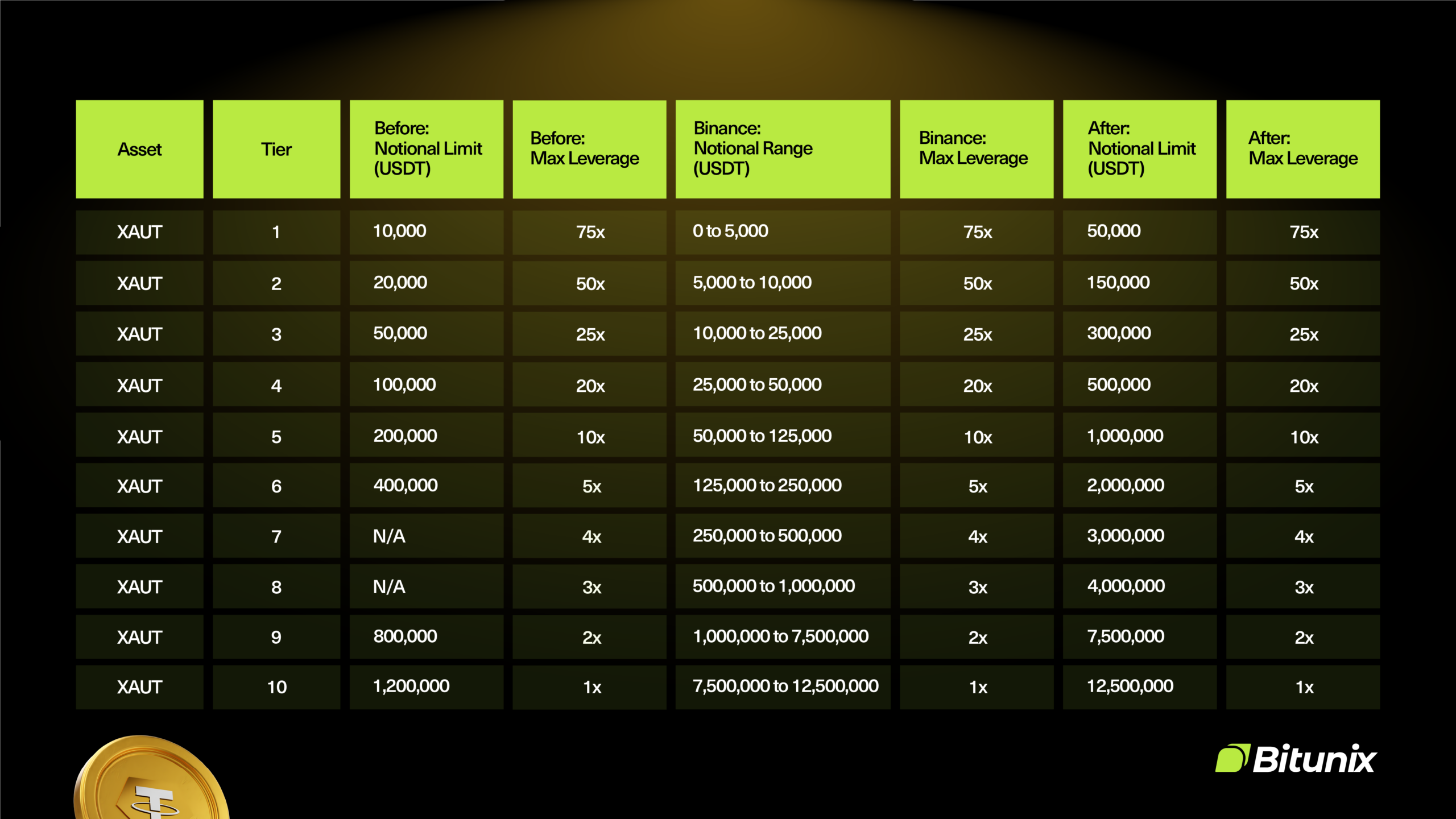

A table showing XAUT asset tiers, with notional limits and maximum leverage values before, during, and after specified ranges, alongside the Bitunix logo and a gold coin icon in the lower corners.

XAUT is the first market where this upgraded leveraged trading framework has been fully implemented. It is the proof market because it demonstrates what expanded capacity looks like in real usage, not in theory.

Here is the clearest example of what the upgrade enables on XAUT:

That is a meaningful improvement for traders who operate with larger notional sizes and want the flexibility of higher leverage tiers, while still expecting stable execution.

It is also important that this update is not only about high leverage. Bitunix has expanded supported size across leverage tiers, including mid- and low-leverage levels. That matters because many traders intentionally choose lower leverage for more room in liquidation distance, steadier risk control, and cleaner position management.

In other words, the upgrade is designed to support real-world trading styles across different risk preferences.

This upgrade changes the trading experience in practical ways that strategy-driven traders will notice immediately.

When supported capacity is larger within each tier, traders can deploy capital more efficiently. You are less likely to hit limits early and less likely to restructure a trade just to fit within constraints.

Splitting one intended position into several smaller orders adds manual work and complicates execution. With more supported size per tier, traders can place cleaner positions with fewer split orders.

That can help with:

Many trading strategies rely on repeatability. Entries, exits, and sizing are not random. They are defined.

When execution becomes inconsistent due to capacity constraints, strategies can drift from their intended design. Expanding supported size helps reduce that drift by making it easier to execute the position you actually planned.

Professional traders and high-volume users care about a specific set of things: capacity, depth, and execution stability. When those are strong, leverage becomes a tool. When those are weak, leverage becomes a limitation.

By expanding the supported trading size within each tier on XAUT, Bitunix makes tokenized gold trading more practical for traders who operate at scale.

It is worth calling out why Bitunix kept the leverage structure unchanged.

Changing leverage tiers is easy to announce, but it can also change user behavior and risk dynamics in ways that are not always beneficial. This update takes a more disciplined approach: keep the structure and risk controls intact, while improving the market’s ability to support larger trades inside that structure.

That is a trader-first improvement because it focuses on execution quality and usability, not just headline numbers.

Bitunix is building toward a clear standard: leveraged trading should be usable at real scale, with the liquidity depth and execution capability to support serious strategies.

This capacity upgrade reflects that direction. The leverage structure remains unchanged. Risk controls and tiered limits remain intact. What improves is the supported trading size within each tier, starting with XAUT as the first proof market.

XAUT is just the beginning. Trade it now!

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. The platform is committed to providing a transparent, compliant, and secure trading environment for every user. Bitunix offers a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, Bitunix prioritizes user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium