Futures trading has become the go-to approach for many traders aiming to take advantage of market volatility in 2025. Whether it’s Bitcoin or traditional commodities, including stocks one thing is clear: your choice of broker matters more than ever.

The trading space is crowded now. While that might seem like a good thing, the truth is, not all brokers are created equal. Some offer flashy interfaces but fall short when it comes to speed, fees, and real control. Choosing a futures trading broker is less about branding and more about raw performance under pressure, especially for futures traders .

In this guide, we’ll walk through what experienced traders actually care about when selecting a futures platform. No fluff — just the key traits that separate reliable brokers from the rest.

Key Takeaways in Futures Trading

- Don’t underestimate how much your broker affects trade outcomes

- Look for full transparency — fees, funding, risk

- Avoid default max leverage, and always test SL/TP on mobile

- Bitunix gives control, not surprises — especially when it counts

- If you’re serious about futures trading in 2025, start with a broker that’s built for it

Futures markets are dynamic platforms where traders can buy and sell futures contracts, which are agreements to purchase or sell an underlying asset at a set price on a future date. To trade futures effectively, investors must grasp the fundamentals of futures contracts and the inherent risks. Trading futures demands a significant initial investment and a deep understanding of market dynamics. Futures traders employ various strategies, such as hedging to protect against price fluctuations and speculating to profit from market movements. Whether you’re an investor looking to hedge your portfolio or a trader aiming to capitalize on market trends, understanding the intricacies of futures markets is crucial.

Why Does Your Futures Trading Broker Matter?

The broker you pick influences almost every aspect of how you trade — from how fast your orders get filled to how transparent your liquidation alerts are. Maintaining futures accounts is crucial for conducting trades, as these accounts come with specific futures margin requirements and conditions that must be met. Margin, leverage, fees, tools — all of it is defined by your broker’s infrastructure. A solid setup gives you an edge. A weak one? That’s how good trades go bad.

Understanding Futures Contracts

A futures contract is a legally binding agreement to buy or sell an underlying asset, such as commodities, currencies, or stocks, including physical delivery option at a predetermined price on a specific future date. These contracts are standardized and traded on futures trading platforms, ensuring transparency and liquidity. Each futures contract specifies the quantity, quality, and delivery date of the underlying asset. The notional value of a futures contract represents the total value of the underlying asset, while the performance bond, or margin, is the minimum amount required to enter into a futures contract. This margin is set by the exchange and serves as a safeguard against potential losses. Traders must maintain a minimum amount of funds in their futures account to avoid an account drop, ensuring they can meet the minimum regulatory requirements and continue trading without interruptions.

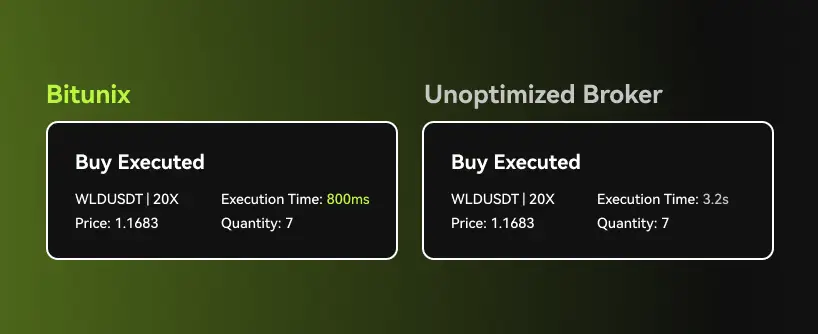

Execution Speed & Trade Accuracy

If your trade doesn’t go through when you hit the button, you’re already in trouble. Speed matters, especially in fast-moving markets. The best brokers route your orders quickly and don’t lag when the charts start spiking. No trader should be guessing if their position was filled or not.

Some platforms freeze during volatility, leaving you stuck. That’s unacceptable in futures trading, where seconds can define your gains or losses. Millisecond-level performance isn’t a luxury anymore — it’s table stakes.

Fee Transparency

Futures trading isn’t just about entry and exit — it’s also about knowing exactly what you’re paying. Maker/taker fees, funding rates, potential withdrawal charges — it should all be visible upfront. If it’s buried in fine print, that’s a red flag. Additionally, the absence of a monthly fee is a significant advantage for users, as it allows them to pay only for their trades without incurring additional charges.

The best brokers show:

- A fee preview before order confirmation

- Real-time funding rate estimates

- Detailed trade histories with cost breakdowns

This information isn’t extra — it’s essential.

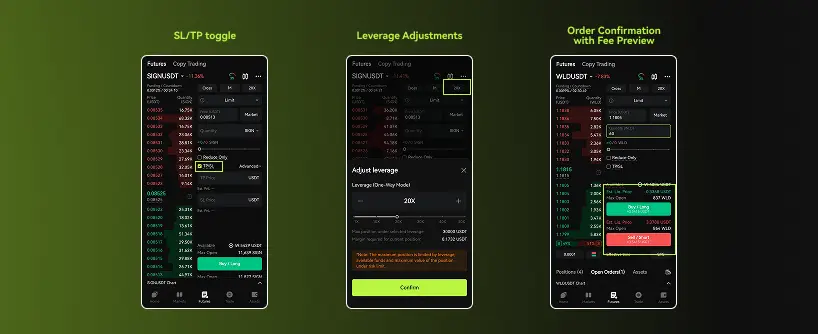

Mobile-First Matters

These days, most futures trades happen from mobile. And that means your broker’s app isn’t a side tool — it’s your primary trading station. It needs full feature parity: live charts, leverage controls, SL/TP setup, and fast editing. Anything less puts you at a disadvantage.

If your app can’t:

- Execute a close order in under 3 taps

- Edit leverage on an open trade

- Display real-time liquidation risk

— then it’s time to rethink the platform.

Bitunix, as an example, has prioritized mobile parity — ensuring traders aren’t chained to a desktop just to manage risk.

Built-In Risk Management

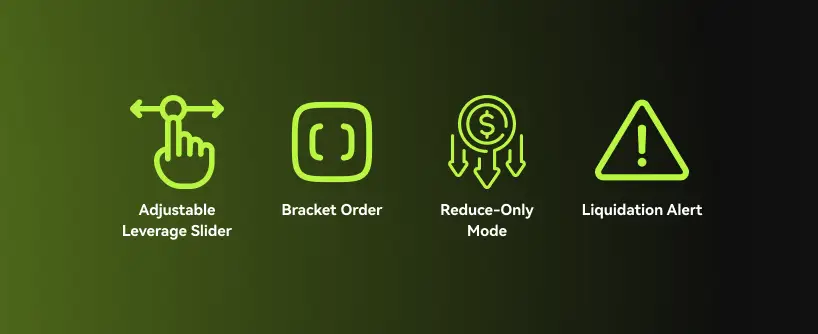

Serious platforms build risk tools into their core. Look for:

- Bracket orders (SL + TP together)

- Reduce-only mode

- Auto-margin call alerts

- Adjustable leverage by position

Without these tools, you’re flying blind. Advanced features like sophisticated tools for order management, automation, and analytics are crucial for enhancing the trading experience and accommodating complex trading needs. Futures trading carries real risk — and if your broker doesn’t help you manage that in real time, it’s not designed for traders. Tools should work before a position turns red, not after.

Clarity on Custody and Regions

You should always know where your assets are kept and what jurisdictions your broker operates in. Hot vs. cold wallet storage, supported countries, and how they handle sudden liquidation events — this transparency is part of what makes a broker trustworthy.

Platforms that are vague on these details usually have something to hide. Don’t wait for an issue to find out how your funds are handled.

Mistakes to Avoid When Picking a Broker

Even experienced traders can fall into common traps:

- Defaulting to high leverage. Some brokers pre-set 50x or even 100x to make things look profitable. It’s a trap. Traders can experience significant losses beyond what they initially invested, stressing the importance of understanding the financial implications of trading futures contracts.

- No stop-loss? No thanks. If SL/TP isn’t easy to find or set, your capital is at risk.

- Ignoring the mobile experience. If your app can’t adjust a trade in real-time, it’s not usable.

- Skipping the funding rate preview. Always check fees before entering a leveraged position.

Avoiding these mistakes is more important than picking a new indicator.

Bitunix — A Model That Works

Without turning this into a promo, Bitunix checks most of the boxes that pro traders expect:

- Orders execute quickly and reliably

- SL/TP setups are baked in from trade entry

- The app mirrors the desktop experience

- Funding and fee previews are transparent

- You can adjust leverage mid-trade — even on mobile

It doesn’t just look good — it performs where it matters. Customers benefit from extensive training materials, user-friendly interfaces, and various account features that enhance their trading experience, particularly for futures trading, providing them with the right money management tools .

A Real Scenario That Shows the Difference

Imagine this: you’re holding an ETH/USDT position at 10x. ETH jumps $200. You grab your phone to lock in profits — but your broker’s app is frozen, or worse, the SL button is missing.

You scramble to open the browser version. Too late. ETH dips. Most of your gain disappears. Not because you had a bad plan, but because your broker couldn’t keep up.

Now imagine the same trade using Bitunix. You tap “Close 50%,” fingerprint confirm, and you’re out in seconds. Understanding the current price is crucial to evaluate trading strategies and manage risks effectively. No stress. That’s what solid infrastructure gives you — control.

Digital Assets in Futures Trading

Digital assets, such as cryptocurrencies, are gaining traction in futures trading, offering new opportunities for traders to speculate on price swings or hedge against potential losses. Leading exchanges like the Chicago Mercantile Exchange (CME) and the Intercontinental Exchange (ICE) now offer futures contracts on digital assets, reflecting their growing importance in the financial markets. Trading digital assets in futures markets requires a thorough understanding of the underlying asset, market trends, and effective trading strategies.

Traders must be aware of the risks, including significant losses and price volatility. To trade digital assets, one must open a futures account with a registered futures trading platform and deposit the required initial margin, taking into account the prevailing interest rates . Trading hours for digital asset futures contracts vary by exchange, but most platforms offer trading six days a week. Understanding the tick size and margin requirements for these contracts is essential to avoid resulting debits to the account and to manage trades effectively.

By maintaining a consistent tone and style, these new sections seamlessly integrate into the existing article, providing valuable insights and information for traders looking to navigate the futures markets.

Interesting Facts of 2025

- 70%+ of crypto volume is now futures trading

- 60% of those trades happen via mobile

- 80% of trading-related user complaints in 2024 were about broker UX, not the market

Choosing the right broker matters more than ever. And in 2025, the gap between platforms is wider than it looks.

So What Makes the Best Futures Trading Broker?

It’s not just about who’s trending on Twitter. It’s about:

- Trade execution speed

- Mobile parity

- Built-in risk tools

- Transparent fees

- Real-world usability when things get volatile

Whether you’re managing five trades or fifty, your broker should make things smoother — not harder.

Final Word

If you’re looking to sharpen your edge in 2025, start with your foundation. That means your broker. And if you haven’t tried Bitunix yet, maybe it’s time to see how professional infrastructure from a reputable company really feels.

FAQ

Q1: What is a futures trading broker?

It’s a platform that allows users to open leveraged trades on assets they don’t own — speculating on price movement over time. Maintaining futures accounts is crucial for conducting these trades, as they have specific margin requirements and conditions.

Q2: How do I know if a broker is right for me?

Look at speed, fee transparency, mobile tools, and built-in risk controls. A good broker makes all of that seamless.

Q3: Why does mobile parity matter in 2025?

Because more than half of trades now happen via mobile. Weak apps are a liability.

Q4: Are brokers trading futures regulated?

Some are. Always check their terms, custody model, and region availability.

Q5: Is Bitunix one of the top brokers for futures trading?

It offers the tools and reliability that experienced traders demand, reflecting on their past performance — and it’s designed to perform under pressure.