In 2025, futures trading remains one of the most powerful tools for traders looking to control risk, speculate on price movements, and navigate volatile global markets. Whether you’re trading crypto, commodities, or indices, building a structured strategy around futures trading is no longer optional — it’s essential.

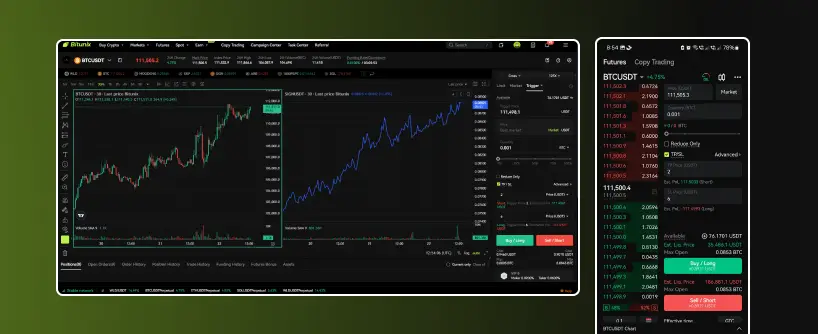

At Bitunix, we believe futures trading should be accessible to both professionals and beginners. That’s why our platform supports a full spectrum of futures trading strategies designed for real-world outcomes. This guide breaks down the most effective strategies in today’s market and how you can apply them directly through our futures trading platform.

[ez-toc]

What Is Futures Trading?

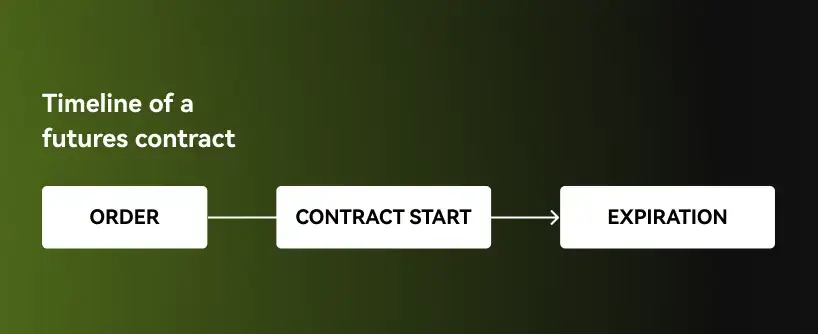

Futures trading involves buying or selling contracts that obligate you to transact an underlying asset at a set price on a future date. These standardized contracts are traded across global exchanges and cover everything from Bitcoin and Ethereum to crude oil, gold, and global indices.

Unlike spot trading, futures trading allows you to:

-

Leverage small capital to control larger positions

-

Go long or short based on market direction

-

Lock in pricing or hedge exposure

-

Access high liquidity across multiple asset classes

Core Futures Trading Strategies

1. Hedging with Futures Contracts

Hedging is a defensive futures trading strategy used to protect current holdings or business exposure. It’s widely used in bothtraditional and crypto markets.

Real Use Case (Crypto): If you’re holding 5 BTC in your Bitunix spot wallet, you can hedge against short-term downside by opening a short BTC/USDT futures contract. If BTC falls, your futures gains help offset spot losses.

Real Use Case (Commodities): A coffee distributor might buy futures to lock in current bean prices, protecting themselves from rising costs in the next quarter.

At Bitunix, hedging is easy with one-click SL/TP orders, reduce-only settings, and flexible margin modes.

-

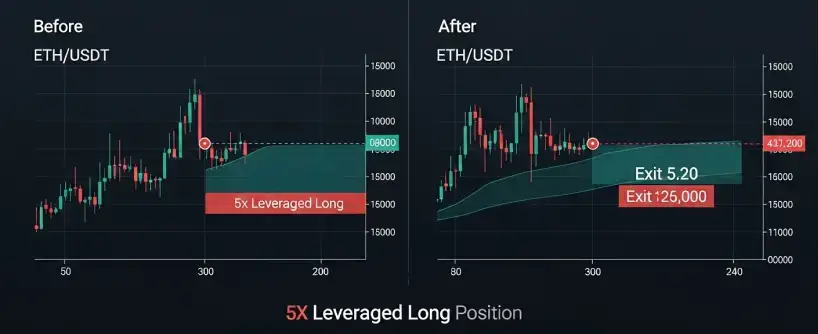

Long positions: Bet price will rise

-

Short positions: Bet price will fall

-

Leverage: Amplifies gains (and losses)

Example: You believe ETH will rise post-upgrade. You go long on ETH/USDT perpetual futures at 10x leverage. If ETH jumps 5%, your gain is 50% (minus funding/fees).

Bitunix supports this strategy through:

-

Real-time funding previews

-

Low-latency execution

-

Transparent PnL calculations

3. Spreading to Capture Inefficiencies

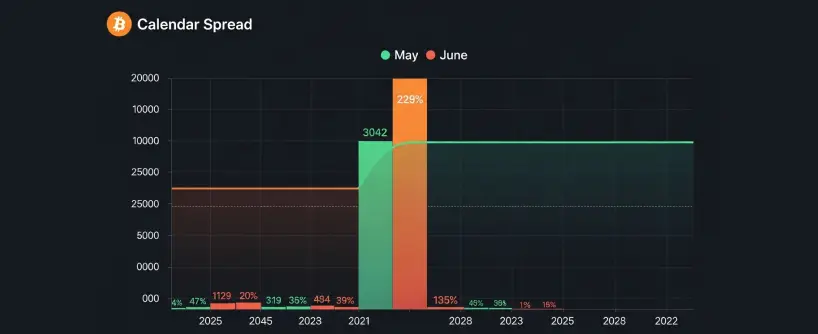

Spreading involves simultaneously buying and selling related futures contracts. The goal is to profit from pricing discrepancies, not direction.

Types of Spreads:

- Calendar Spreads: Long May BTC contract, short June BTC contract

- Inter-Commodity Spreads: Long gold, short silver

- Basis Spreads: Long BTC spot, short BTC futures (or vice versa)

Spreads are ideal for neutral positioning and are less sensitive to short-term volatility — perfect for futures trading in uncertain markets.

4. Scalping: Profiting from Small Moves

Scalping is a high-frequency futures trading strategy that involves taking multiple small trades over short timeframes.

Requirements:

- Tight spreads

- Fast execution

- High liquidity

- SL/TP automation

-

Mobile-ready interfaces

-

Market and limit order flexibility

-

Cross and isolated margin tools

Example: A scalper might open 20 trades per day on BTC/USDT, targeting 0.2% moves using 5–10x leverage.

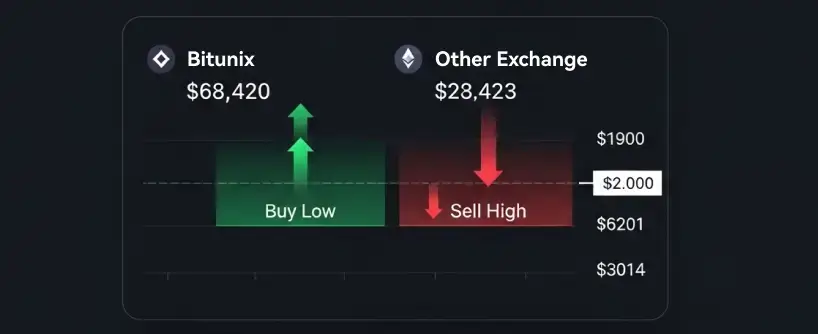

5. Arbitrage: Riskless Profit from Price Gaps

Arbitrage is a technique where traders exploit price differences across platforms or instruments.

Example:

-

BTC/USDT on Bitunix = $65,000

-

BTC/USDT on another exchange = $65,300

-

Long on Bitunix, short on other exchange

-

Close both positions when prices align for a net profit

Futures trading arbitrage can also occur between spot and perpetual contracts or during high volatility events.

6. Position Trading: Long-Term Trend Riding

Position trading is about holding futures contracts for weeks or even months to benefit from macro trends.

Use Cases:

-

Anticipating ETH approval for spot ETF

-

Trading inflation-sensitive commodities like oil

-

Taking advantage of election-cycle market volatility

-

Quarterly and perpetual contracts

-

Clear fee and funding structure

Advanced Futures Trading Techniques

As you grow, so should your system. Here are three advanced strategies used in 2025:

🔹 Futures Options Combinations

Combine options and futures for complex setups like synthetic longs or gamma scalps.

🔹 Triangular Arbitrage in Crypto

Exploit inefficiencies across BTC/ETH, ETH/USDT, and BTC/USDT pairs.

🔹 Quant-Based Algorithmic Spreads

Automated trades that analyze futures curves and volatility.

Bitunix APIs and order customization allow advanced traders to build and execute these strategies at scale.

How to Build a Futures Trading Plan

Success in futures trading starts with a defined approach. Your trading plan should include:

- Asset Focus: Crypto? Commodities? Indices?

- Strategy Type: Hedge, speculate, or spread

- Capital Allocation: How much per trade?

- Risk Controls: Max loss per day/trade

- Trade Review Schedule: Daily, weekly, or per trade?

Bitunix provides traders with data dashboards, funding calculators, and historical logs to fine-tune plans.

Risk Management in Futures Trading

More leverage = more risk.

To protect yourself:

-

Use stop-losses

-

Avoid overexposure

-

Diversify assets

-

Set alert levels for funding rate spikes

-

Scale into trades instead of going all-in

Our futures trading platform features automatic margin alerts, liquidation risk displays, and reduce-only modes — so you’re always in control.

Futures Trading for Beginners: Bitunix Tools

Just starting out?

We recommend:

- Start with 2x–5x leverage

- Use demo trading to test strategies

- Watch for real-time funding rate changes

- Stick to major pairs like BTC/USDT and ETH/USDT

Our UI is designed to walk new users through every contract type — from placing a market order to reviewing PnL after closing.

Why Choose Bitunix for Futures Trading?

-

SL/TP on order setup

-

Adjustable margin settings

-

App + web parity

-

24/7 multilingual support

-

Mobile trade editing

-

Perpetual + dated contracts

-

Transparency in fees and liquidations

Whether you’re learning how to trade futures or executing a 100-contract macro hedge, Bitunix is built to perform.

Final Thoughts: Futures Trading in 2025

Markets in 2025 are faster, smarter, and more unpredictable than ever. But futures trading, when approached with structure and backed by the right platform, remains one of the most powerful strategies for wealth building and capital preservation.

There is no “one-size-fits-all” futures strategy. Some traders hedge. Some speculate. Some spread. What matters is knowing your risk, defining your plan, and executing with precision.

If you’re ready to step up your futures game — Bitunix is the partner that helps you do it with speed, clarity, and control.

2 replies on “Futures Trading Strategies: Proven Approaches for Crypto and Market Success in 2025”

Great article! This was super useful. Can’t wait to read

more. If anyone’s interested, check outNV Casino na sprzedaż.

Keep it up!

Keep this going please, great job!