Ready To Place Your

Next Trade?

Choose a market, set your order, and manage risk in one place.

Have you ever wondered how professional traders consistently extract profits from volatile crypto markets? The secret lies not in luck but in meticulously designed trading systems that adapt to market dynamics. In 2025, building a robust futures trading system has become more accessible than ever, yet paradoxically requires greater sophistication.

What if you could transform market uncertainty into calculated opportunity? What if market volatility became your ally rather than your enemy?

This guide will walk you through building, testing, and optimizing a futures trading system specifically designed for today’s crypto markets. Whether you’re a newcomer curious about futures trading for beginners or a seasoned trader looking to refine your approach with advanced futures trading strategies, you’ll discover actionable insights to elevate your trading performance.

Crypto futures are contracts to buy or sell a cryptocurrency, like Bitcoin or Ethereum, at a set price on a future date. Unlike spot trading, where you own the asset outright, futures let you speculate on price changes without holding the underlying asset. This opens doors to leverage, letting you control larger positions with less capital, and hedging, which can protect your portfolio from market volatility.

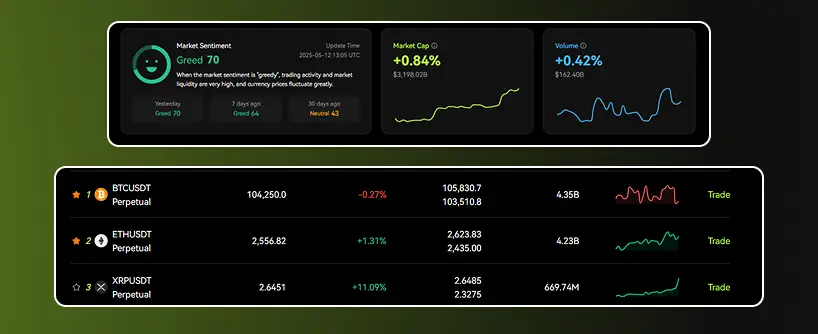

According to industry insights, platforms like Binance and Bybit saw a 30% surge in futures trading volume in 2024, signaling massive profit potential for savvy traders.

Why trade futures? They offer flexibility to profit in both rising and falling markets, high liquidity for quick trades, and strategic tools like perpetual futures, which have no expiration date.

But with great reward comes risk – leverage can amplify losses, and market dynamics demand a solid understanding.

Which is better?

Curious about how to get started?

Every robust trading system consists of several crucial components working in harmony. Here is a step-by-step guide:

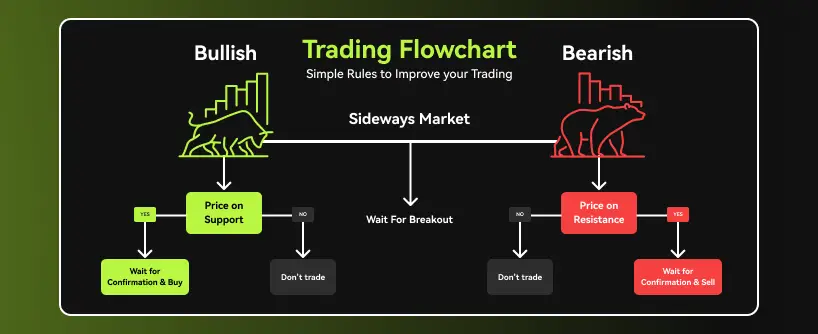

Building a futures trading system starts with a clear strategy tailored to your risk tolerance and goals. Are you a day trader chasing quick gains or a long-term investor hedging against price drops?

Define your approach – will you focus on technical analysis, like moving averages and Fibonacci retracement levels, or blend in fundamental analysis, tracking geopolitical events, and market sentiment?

Your system needs rules for entry, exit, and position size. For example, a simple strategy might involve entering a long position when a cryptocurrency’s price crosses above its 50-day moving average and exiting when it hits a Fibonacci resistance level.

Set a stop-loss to manage risk effectively, capping potential losses at, say, 2% of your capital per trade. Keep in mind, disciplined systems with predefined rules help traders avoid emotional decisions in high-volatility markets.

Not all cryptocurrencies are equal for futures trading. High liquidity and volatility make Bitcoin and Ethereum top choices, as they offer tight spreads and ample trading volume. Altcoins like Solana or Ripple can work for advanced futures trading strategies, but their lower liquidity may increase slippage.

For day trading the futures, stick to assets with high trading volume to ensure smooth entry and exit points. Perpetual futures, popular on platforms like Binance, are ideal for holding positions overnight, as they lack an expiration date. However, watch funding rates – small fees that keep perpetual futures aligned with spot prices.

Before risking real capital, test your system on a demo account. There is a big choice of platforms that offer paper trading, letting you simulate trades in real market conditions. Backtest your strategy using historical data to see how it performs across different market dynamics. For instance, did your system catch the 2024 Bitcoin rally or falter during a bearish dip?

Use metrics like win rate, average profit per trade, and maximum drawdown to evaluate performance. It’s suggested to refine strategies that show consistent profits over 100+ trades.

If your system underperforms, tweak parameters – like adjusting stop-loss levels or entry signals – then retest. This iterative process builds confidence in your trading system.

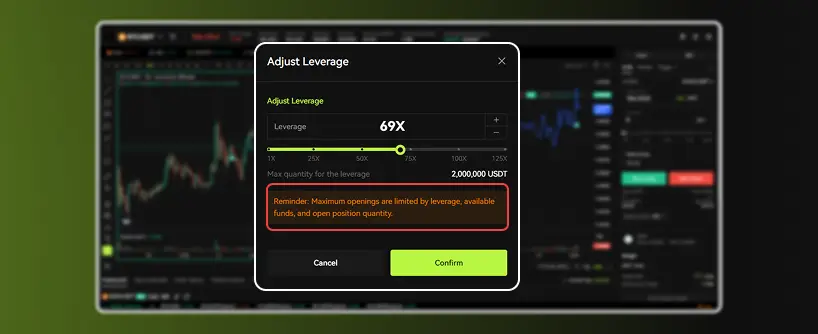

Optimization fine-tunes your system to maximize profits while mitigating risks. Focus on risk management: never risk more than 1-2% of your account per trade, and adjust position sizes based on market volatility.

For example, in a high-volatility market, reduce leverage to avoid margin calls, where you must add funds to maintain your position. Incorporate profit-taking strategies, like scaling out of positions at key Fibonacci retracement levels or locking in gains when a trade hits 3x your risk.

Regularly review your system’s performance, adapting to changing market conditions, such as shifts in market sentiment or regulatory news.

Hedging protects your crypto portfolio from adverse price movements. Suppose you hold 1 Bitcoin at $60,000 but fear a price drop. You could sell a Bitcoin futures contract at $60,000. If Bitcoin falls to $55,000, your spot loss of $5,000 is offset by a $5,000 profit in the futures market. This strategy is ideal for crypto investors seeking stability in unstable markets.

Hedging requires understanding initial margin (the upfront capital) and maintenance margin (the minimum to keep a position open). Use low leverage to minimize margin calls, and monitor funding rates for perpetual futures.

But keep in mind, hedging isn’t foolproof – it may cap upside potential – but it’s a powerful tool for risk-averse traders.

Perpetual futures (perp) and spot trading serve different goals. Spot trading involves buying and holding the actual cryptocurrency, ideal for long-term investment but limited to profiting from price increases. Perpetual futures, with no expiration date, let you trade on margin, go long or short, and use leverage for amplified gains. However, they carry higher risks due to funding rates and potential liquidation.

For futures trading for beginners, spot trading is simpler but less flexible. Perps suit active traders who thrive on market moves and can handle high volatility. According to 2024 analysis perps dominate crypto trading volume, reflecting their popularity among futures traders.

Ready to level up? Advanced strategies can boost your edge. Try:

Backtest these strategies rigorously, as crypto markets are unforgiving to untested ideas.

Risk management is the backbone of successful futures trading. Use stop-loss orders to exit positions automatically if the market moves against you. Diversify across assets to spread risk and avoid over-leveraging, which can lead to rapid losses.

80% of futures traders fail due to poor risk management. Monitor margin requirements closely – initial margin gets you in, but maintenance margin keeps you there. Stay informed about geopolitical events and regulatory shifts, as they can trigger sudden price changes.

A disciplined trader treats losses as learning opportunities, not setbacks.

Let’s walk through a real-world example: You’re trading Bitcoin futures on Binance with $5,000 capital. Your system uses a 50-day moving average crossover for entries and Fibonacci retracement levels for exits.

One day, Bitcoin crosses above its 50-day moving average at $65,000, signaling a long position. You enter with 5x leverage, controlling $25,000 worth of Bitcoin. You set a stop-loss at $63,500 (2% below entry) and a take-profit at $68,000 (a Fibonacci resistance level).

Bitcoin hits $68,000 three days later, yielding a $3,000 profit ($600 per $1,000 risked). This disciplined approach, backtested for consistency, showcases the power of a structured trading system.

Even seasoned traders stumble. Over-leveraging is a top mistake, amplifying losses in volatile financial markets. Ignoring contract rollovers – when traditional futures expire – can disrupt your strategy.

Emotional trading, like chasing losses, often leads to bigger setbacks. It’s advised to stick to your system, even during market turbulence.

Avoid these pitfalls by setting strict rules, using demo accounts to practice, and reviewing trades weekly. Stay educated on market trends and platform updates to keep your edge sharp.

The crypto futures market in 2025 is a land of opportunity, but only for those armed with a robust trading system.

Creating a profitable futures trading system requires blending technical knowledge, market understanding, risk management discipline, and psychological preparedness. It demands persistent refinement, but the potential rewards include both financial returns and intellectual satisfaction. Remember these key principles as you develop your personal trading system:

Remember that consistency comes from process, not prediction. The market will always surprise, but a well-designed system helps overcome uncertainty with confidence.

Perpetual futures are crypto derivatives with no expiration that use funding rates to mirror spot prices, enabling continuous leveraged trading. Traditional futures contracts have fixed settlement dates and must be rolled over at expiry.

Margin trading lets traders borrow capital to increase exposure while position sizing defines how much capital is risked on each trade. Keeping leverage modest and risking only a small portion of capital helps manage drawdowns and market volatility.

Backtesting strategies apply your entry rules, exit rules and position sizing on historical OHLCV data. Analyzing metrics such as win rate, maximum drawdown and average return guides iterative refinements and builds system confidence.

Profit-taking strategies include scaling out positions at predefined price levels and employing trailing take-profit orders to secure gains while preserving potential upside during swings in volatility.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Futures trading involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.