In 2025, financial markets are anything but boring. Whether you’re eyeing crypto, commodities, or equities, chances are you’ve come across both futures and options as go-to tools for managing risk, speculating on price, or building hedged positions.

But here’s the thing — these two instruments might seem similar, yet they behave very differently. If you’re deciding between futures vs options trading, this guide lays it all out. No jargon, just real distinctions and examples to help you figure out what fits your portfolio and trading habits best.

Futures vs Options Trading: Key Takeaways

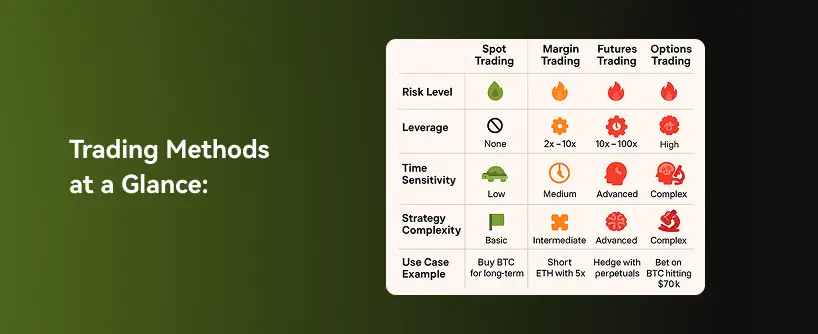

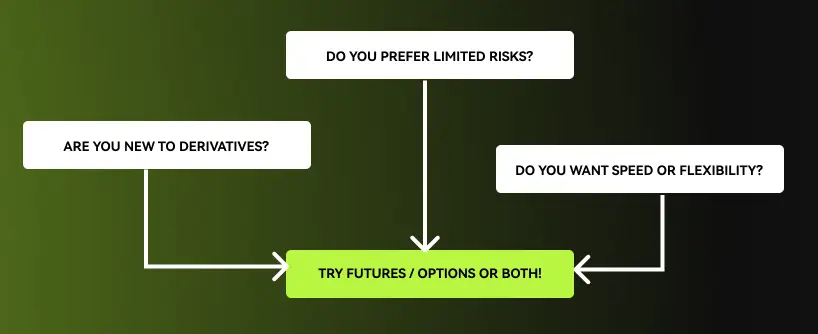

- Futures give you speed, leverage, and simple exposure — but they come with high risk.

- Options are better for creative strategies, protection, and capped downside — but they take time to learn.

- Both tools can work well together, depending on your goals.

- Bitunix supports futures and options trading with real-time controls and mobile execution.

- There’s no one-size-fits-all answer — the right choice depends on how you trade and what you’re trying to achieve.

[ez-toc]

Back to Basics: What Are Futures and Options, Anyway?

Let’s start with the foundations. Futures and options are both derivatives, which simply means they’re contracts whose value is tied to underlying assets like a stock index, a barrel of oil, or Bitcoin, for example.

Futures: The Straight Commitment

With futures, you’re entering a binding agreement to buy or sell something at a specific price on a future date. It’s straightforward — once you’re in, you’re committed.

Core characteristics:

- The deal is mandatory — no backing out

- Common across crypto, oil, gold, and major indices

- Highly liquid and traded on organized exchanges

- Support heavy leverage (on Bitunix, it can go up to 125x)

- Widely used for both speculation and hedging

The performance of a futures contract is reflected in your account balance at the end of each trading day, making daily market movements crucial for traders.

It’s simple: you believe a price will go up, so you buy futures. Expect it to drop? Go short. The rules are clear, and the outcome is binary.

Futures Contract: The Building Block

A futures contract is a cornerstone of futures trading, representing a binding agreement to buy or sell an underlying asset at a specific price on a specific future date. The contract price represents the agreed-upon price for the underlying asset, such as gold, which both parties must honor regardless of market fluctuations.

When you buy a futures contract, you commit to purchasing the underlying asset at a given price, while selling a futures contract obligates you to sell the asset at that price. These contracts are traded on organized exchanges and are marked to market daily, meaning their value is adjusted to reflect the current market price. Understanding the intricacies of a futures contract is crucial for navigating the futures markets effectively.

Options: Flexibility with Limits

Options, on the other hand, offer the right — not the obligation — to buy or sell an asset at a predetermined price before a certain date. Call options provide traders with the right to purchase stocks at a predetermined price before expiration, presenting opportunities for profit in rising markets. That freedom makes them extremely useful, but they come with complexity. Option holders have the right to buy or sell the underlying asset but do not have ownership or shareholder rights unless they exercise their options. The option seller, on the other hand, faces significant risks and must be prepared to fulfill the contract obligations if the options are exercised.

Key differences:

- Your loss is capped (limited to the premium paid)

- Popular for hedging, premium collection, or volatility plays

- Require familiarity with the “Greeks” (Delta, Theta, etc.)

- Flexible strategies but steeper learning curve

- Not always as liquid, especially in smaller markets

The option buyer has the right to execute the contract or trade out of the position before expiration, depending on market movements.

So, when we talk about options vs futures trading, the tradeoff comes down to structure vs strategy,obligation vs flexibility.

Options Contract: Understanding the Terms

An options contract offers a different approach, providing the buyer with the right, but not the obligation, to buy or sell an underlying asset at a set price, known as the strike price, before a predetermined expiration date. This flexibility allows the buyer to decide whether to exercise the contract based on the market price of the underlying asset. Options contracts are traded on exchanges and come with their own set of rules and regulations. Key terms to understand when trading options include the strike price, expiration date, and the premium, which is the cost of the options contract. This structure allows for a variety of strategies, making options a versatile tool in the world of financial derivatives.

Real-World Scenarios: When Each Makes Sense

Crypto Markets

Let’s be honest — trading futures and options in crypto leans heavily toward futures.

- Futures are ideal for short-term speculation, scalping, or momentum plays. Bitunix users trade BTC and ETH perps every day using dynamic margin and adjustable leverage.

- Options, however, are often reserved for more advanced traders looking to hedge or take directional views with limited risk.

Bottom line futures: Need speed and capital efficiency? Stick with futures. Futures use leverage to create potential profits and losses and cover a range of deliverables, including various commodities and currencies. Want to protect a long-term spot position or make structured bets? Options may suit you better.

Commodities and Energy

This is where both instruments thrive.

- Futures help secure prices in advance. For example, an airline might buy jet fuel futures to guard against rising costs. The delivery date is the specified time when a commodity must be delivered, and both buyers and sellers are obligated to fulfill their contractual commitments. For instance, if the price of gold rises, the gains or losses are reflected in the investor’s account daily, highlighting the dynamics of trading in the gold market.

- Options are great for “insurance-style” protection. A mining company could buy puts in case metal prices fall but still benefit if prices rally.

Both futures and options in commodities and energy are tied to an underlying security, such as oil or metal prices, which determines their value.

In short: Use futures when locking in matters. Use options when flexibility counts.

Stock Indices and Broader Market Moves

Futures are often used to gain fast exposure to indices like the S&P 500, especially in short-term trades or hedges.

Futures contracts can provide exposure to not only commodities and currencies but also interest rates and financial indices.While futures can provide exposure to indices, options allow traders to capitalize on price movements within the stock market, offering more targeted strategies.

Options are more versatile in building strategies, such as spreads, protective puts, or premium-selling tactics.

Verdict: Traders often favor futures for speed. Portfolio managers lean into options for control and protection.

Comparing the Pros and Cons of Each

Futures Advantages:

- High liquidity in major markets

- Most futures contracts are favored by day traders due to their high liquidity, allowing for quick entry and exit of positions.

- Easy-to-understand structure

- Futures offer straightforward pricing and fewer regulatory complexities compared to stock options, making them more appealing for day traders.

- Margin efficiency lets you control larger positions

- Great for short-term traders

- Futures trading is cost efficient, offering lower commissions and tight spreads

Futures Disadvantages:

- Unlimited downside if you’re wrong

- Can trigger margin calls or liquidations

- Buyers are not required to pay the full contract price upfront, but only need to cover a percentage of the price as an initial margin, which means they do not need to commit the full value initially.

- Not ideal for passive strategies

- Past performance is not indicative of future results, highlighting the substantial risk involved in futures trading

Options Advantages:

- Risk is known from the beginning

- Multiple strategy layers (hedging, income, protection)

- No forced liquidation

- Useful in both trending and sideways markets

- Experienced traders can employ advanced strategies to enhance their trading outcomes

Options Disadvantages:

- Can be difficult to master

- Premiums decay over time

- Execution can be tricky on lower-liquidity tokens

- Options premiums can be influenced by various factors, adding complexity to trading decisions. Option sellers, in particular, face significant risks and potential losses if the market moves against their positions.

Expiration Date: Timing is Everything

The expiration date is a critical element in both futures and options contracts. For futures contracts, the expiration date is when the contract becomes binding, requiring the buyer and seller to settle at the agreed-upon price. In the case of options contracts, the expiration date is the last day the buyer can exercise their right to buy or sell the underlying asset. If the option is not exercised by this date, the contract expires worthless, and the buyer loses the premium paid. Understanding the expiration date is vital for trading futures and options, as it can significantly influence the contract’s value and the potential for profit or loss.

Key Differences

When it comes to trading futures and options, understanding the key differences is crucial for any investor. One key difference lies in the nature of the contracts themselves. Futures contracts obligate the buyer to purchase the underlying asset at a specific price on a specific future date. This means that once you enter a futures contract, you are committed to fulfilling the terms, regardless of market movements. On the other hand, options contracts provide the buyer with the right, but not the obligation, to buy or sell the underlying asset at a specific price. This flexibility allows the option holder to choose whether or not to exercise the contract based on market conditions.

Futures contracts are often used for hedging against price movements. For example, a farmer might use futures to lock in a price for their crop, protecting against the risk of price drops. In contrast, options contracts are frequently used for speculating on market moves. An investor might buy a call option if they believe the price of a stock will rise, allowing them to profit from the price increase without the obligation to buy the stock outright.

Another key difference is the level of leverage involved. Futures contracts typically offer higher leverage than options contracts, which can lead to significant profits if the market moves in your favor. However, this also means that losses can be substantial if the market moves against you. Options, with their capped downside risk (limited to the premium paid), provide a more controlled risk environment.

Understanding these major differences is essential for developing an effective investment strategy and managing risk tolerance. Whether you are looking to hedge against price movements or speculate on market trends, knowing when to use futures vs. options can make a significant impact on your trading outcomes.

What If You Used Both?

There’s no rule saying you have to pick only one.

Example: You’re long ETH using a futures contract. To protect yourself, you buy a put option. If ETH dumps, your loss is limited. If it pumps, you profit.

By closing out an option position, traders can manage risk and secure profits or losses before expiration.

This kind of combination — trading in options and futures — gives you both aggression and safety. That’s something more experienced traders start doing once they’ve mastered the basics.

Futures Options: A Hybrid Approach

Futures options blend the characteristics of both futures and options contracts, offering a unique financial derivative. Both options and futures are types of financial instruments with distinct characteristics and market mechanisms. A futures option grants the buyer the right, but not the obligation, to buy or sell a futures contract based on the underlying stock at a specific price, known as the strike price, before a set expiration date.

These instruments are traded on exchanges and are governed by various rules and regulations. Futures options provide a hybrid approach to trading futures, combining the flexibility of options with exposure to the underlying futures market. They can be used to hedge risk, speculate on market movements, or generate income. However, they also carry significant risks, including market volatility and potentially unlimited losses, making it essential to thoroughly understand the contract terms before trading.

By following this structured approach, the new sections integrate seamlessly into the existing article, maintaining its informative and conversational tone while providing valuable insights into futures and options trading.

Risk Management Comes First

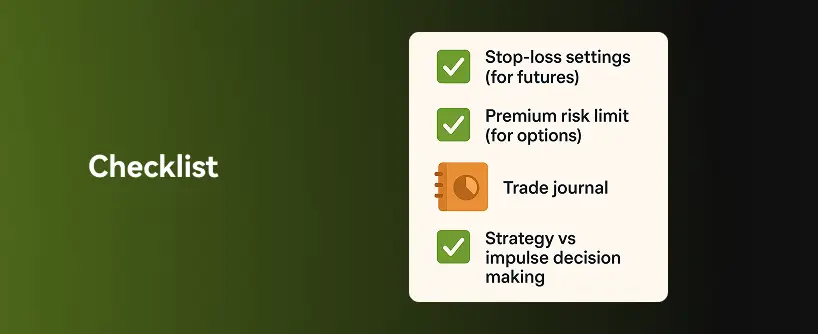

Both futures and options trading come with substantial risk, making it crucial to have a solid risk management plan in place.

Before entering any position — futures or options — think through your risk plan.

Ask yourself:

- Can I check this trade daily? (Futures need attention.)

- Am I okay with sudden liquidations if I’m wrong?

- Do I want fixed losses, even if that limits upside?

- Understanding the financial implications when an option expires is crucial for managing risk effectively.

- Is this trade part of a broader plan, or a one-off?

Deciding between options vs futures trading gets a lot easier once you know how much risk you’re truly willing to accept.

FAQs: Common Questions About Futures vs Options

Q: Are futures more dangerous than options?

Generally, yes. Futures can expose you to unlimited losses due to leverage. Options cap your max loss at the premium you paid. An option contract provides the buyer with the right, but not the obligation, to buy or sell an underlying asset at a specific price before the expiration date.

Q: Can I use both in one strategy?

Absolutely. Many traders hedge their futures positions using options, especially during high-volatility events.

Q: Which one is better for beginners?

Options are safer in terms of risk, but they’re more complicated. Futures are simpler but riskier. Start small with either. Investors can also choose to sell options if they anticipate a decline in market prices, using put options to secure potential profit or mitigate losses.

Q: What’s the tax difference in 2025?

It depends on your country. In the U.S., futures may qualify for special tax treatment under Section 1256. Options follow standard capital gains rules. Consult a tax pro.

Q: Does Bitunix support both?

Yes. Bitunix offers advanced tools for trading futures and options, with leverage, SL/TP settings, and risk control on both desktop and mobile.

Q: What if I want passive income, not active trading?

Options might be better — selling covered calls or cash-secured puts can generate yield. Futures are more hands-on.

Closing Thoughts

In the world of trading futures and options, there’s no clear winner — only what works best for you. Some traders use futures to move fast. Others build complex strategies with options. And many use both to balance offense and defense.

If you’re just starting out, don’t feel pressured to master everything at once. Start with small trades, learn from real outcomes, and refine your edge.

No matter your strategy, make sure the tools you choose match your experience, personality, and tolerance for risk.

Sophisticated traders often employ advanced strategies to optimize their trading outcomes, balancing risk and reward.

Leave a Reply