Imagine setting up the perfect crypto trade, only to watch the opportunity slip away because your order expired too soon. It’s a frustrating but common mistake, especially in volatile markets where timing can mean everything.

That’s where GTC orders — or Good ‘Til Canceled orders — come in. Understanding how they work is not just a technical detail. It’s about taking full control over your trading strategy, especially as crypto markets evolve faster than ever before. Whether you’re trading Bitcoin, Ethereum, or newer assets on Bitunix, mastering order types like GTC is becoming an essential skill.

Where Timing Meets Strategy: The Role of GTC

At its core, a Good ‘Til Canceled order is exactly what it sounds like: an order that stays open until either it gets filled at your set price or you manually cancel it. Unlike a standard Day Order, which expires automatically at the end of the trading session, a GTC order remains active indefinitely.

This staying power gives traders a major tactical edge. You do not have to sit at your screen for hours waiting for prices to hit key levels. You set your strategy in advance and let the system execute it when conditions are right.

How GTC Orders Play Out in Crypto Trading

Consider a scenario where you believe Bitcoin will dip to $58,000 before rebounding. Instead of babysitting the chart, you place a GTC limit buy order at $58,000. Whether it takes two hours or two days, your order remains active, waiting for the market to come to you.

If Bitcoin drops to $58,000, your buy order automatically triggers. If not, it simply stays in the order book. For fast-moving crypto markets, GTC orders remove the need for panic trades and sleepless nights.

Why Traders Rely on GTC in 2025’s Volatile Markets

In 2025, the crypto landscape has become even more volatile and fragmented. Asset tokenization is accelerating, Layer-2 ecosystems are booming, and regulatory events cause sudden swings. GTC orders allow traders to set price targets well in advance, reduce emotional decisions, and give long-term strategies breathing room.

GTC vs Other Order Types

| Time-in-Force | Stays Open | Auto-Expires | Use Case |

| GTC | Until filled/canceled | No | Swing entries/exits |

| Day | Session only | Yes | Intraday trades |

| IOC | Partial fill only | Yes (instant) | Quick scalps |

This table shows why GTC orders are preferred for systematic strategies compared to day or immediate-or-cancel orders.

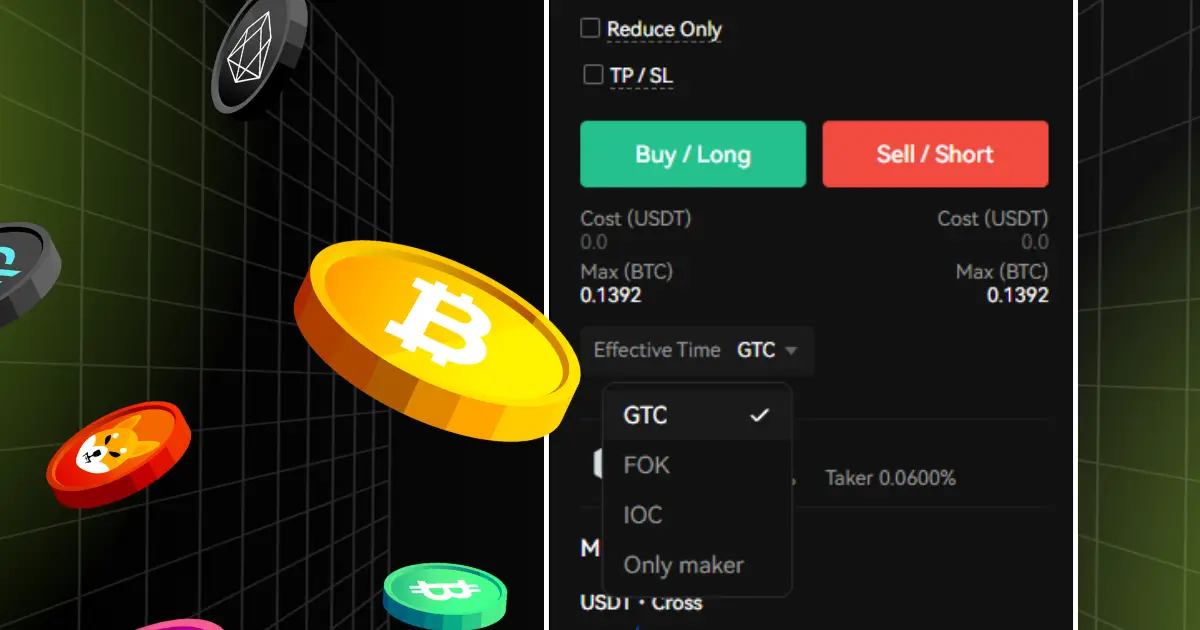

How to Place a GTC Limit Buy on Bitunix

- Pick your trading pair (e.g., BTC/USDT).

- Choose Limit Order, enter your target price.

- Under Time-in-Force, select Good ‘Til Canceled.

- Click Buy and your order stays live until filled or canceled.

How to Cancel an Open GTC Order

- Open the Orders tab.

- Locate the GTC order you want to cancel.

- Click the cancel icon.

- Confirm and the order disappears from the book.

Why GTC Orders Are Becoming Essential in 2025

Liquidity shifts faster, price spikes are sharper, and market windows open and close in minutes. In this environment, Good ‘Til Canceled orders are not just a convenience but a necessity. They give you systematic control, reduce missed opportunities, and support both entry and exit planning.

On Bitunix, placing and managing GTC orders is simple, reliable, and built for traders who want to stay ahead of volatility.

Conclusion

A GTC order is more than a trading tool. It is a discipline mechanism that enables you to pre-plan entries and exits, protect against emotional trades, and align with long-term strategies. Whether you are targeting Bitcoin dips, altcoin swings, or futures setups, GTC helps you trade smarter.

Trade with precision. Manage with confidence. Master GTC with Bitunix.

FAQs

What does GTC mean in trading?

GTC stands for Good ‘Til Canceled. It is an order type that remains open until the trader cancels it or it gets filled at the set price.

How long does a GTC order last on crypto exchanges?

On platforms like Bitunix, GTC orders can remain active indefinitely, sometimes for weeks or months, until manually canceled.

Can you set stop-loss with a GTC order?

Yes. Traders can combine GTC orders with stop-loss instructions to automate risk management and exits.

Is GTC better than day orders in volatile markets?

In fast-moving crypto markets, GTC orders are often better than day orders because they allow swing entries and exits without expiring at session end.

Does a GTC order lock collateral?

Yes. The order reserves the required funds or collateral in your account until it is either filled or canceled.

How do you cancel a GTC order on Bitunix?

You can cancel a GTC order from the Open Orders tab. Locate the order, click the cancel icon, and confirm to remove it from the book.

What risks come with unattended GTC orders?

Unattended GTC orders may trigger unexpectedly during volatility, potentially filling at unwanted times. Regular monitoring and risk controls are advised.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.