Let’s get straight to the point – is Bitcoin worth buying now?

Despite volatility, regulation chatter, and constant headlines, Bitcoin remains the most sought-after digital asset in the world. Its price may fluctuate, but investor interest? Still burning hot. So if you’re asking, “Is BTC a buy?” – you’re not alone.

But here’s the real question: how and where to buy Bitcoin in 2025 safely, easily, and even without KYC? Can you still buy BTC cheap? What’s the best platform to use, especially if you want to use Apple Pay, a credit card, or a bank account?

Let’s explore how to buy Bitcoin safely, where to get the best deals, and why Bitcoin might still be worth buying now.

Key Takeaways

-

BTC remains a viable investment for 2025 due to strong institutional interest and regulatory clarity.

-

You can buy BTC with or without KYC, depending on your preferences for privacy vs. protection.

-

Platforms like Bitunix, Coinbase, and Kraken offer secure, versatile ways to buy BTC online.

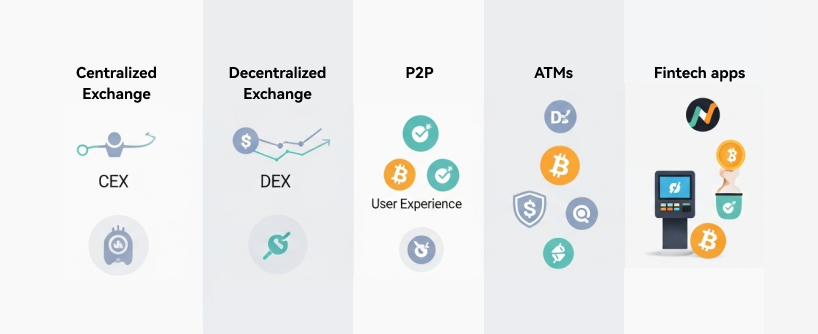

Where to Buy Bitcoin in 2025

In 2025, buying BTC online is easier than ever – but also more confusing, thanks to hundreds of platforms. Here are your main options:

-

Centralized Crypto Exchanges (CEXs): Reliable, easy-to-use, but require KYC.

-

Decentralized Cryptocurrency Exchanges (DEXs): No central authority, but more complex.

-

Peer-to-Peer (P2P) Platforms: Ideal to buy BTC without KYC.

-

Bitcoin ATMs: Fast, anonymous, but come with higher fees.

-

Fintech Apps: Like Cash App, Revolut, or PayPal – great for beginners.

So, where to buy BTC? Let’s look at the most trusted centralized exchanges first.

Centralized Exchanges

Centralized exchanges remain the most user-friendly route to purchase Bitcoin in 2025. These platforms offer high liquidity, customer support, security features like two-factor authentication, and various payment methods.

Top Picks:

Coinbase: Still a dominant player in 2025, Coinbase continues to be one of the most beginner-friendly platforms with robust security features. While their fees are slightly higher than some competitors, they offer insurance on digital assets, an intuitive mobile app, and 24/7 customer support. Perfect for newcomers who value ease of use and security over minimal fees.

Kraken: Known for its advanced trading features and competitive fee structure, Kraken has strengthened its position in 2025 by expanding its educational resources and improving its mobile experience. Their enhanced security protocols and proof of reserves have made them a favorite among more experienced Bitcoin investors.

Bitunix: The rising star of 2025, Bitunix has gained significant market share by offering some of the lowest fees in the industry, a sleek user interface, and innovative features like AI-powered market analysis. Their rapid verification process and broad range of supported countries have made them particularly attractive to international users.

What makes these centralized exchanges stand out? They all offer:

-

Strong security measures, including two-factor authentication

-

Insurance on digital assets (to varying degrees)

-

Regular security audits

-

Compliance with regulatory requirements

-

Customer support options

But remember, many crypto exchanges do come with trade-offs. When using these platforms, you’re trusting a third party with your assets, which contradicts Bitcoin’s fundamental principle of “not your keys, not your coins.” This is why many experienced Bitcoin users transfer their purchases to personal wallets after buying.

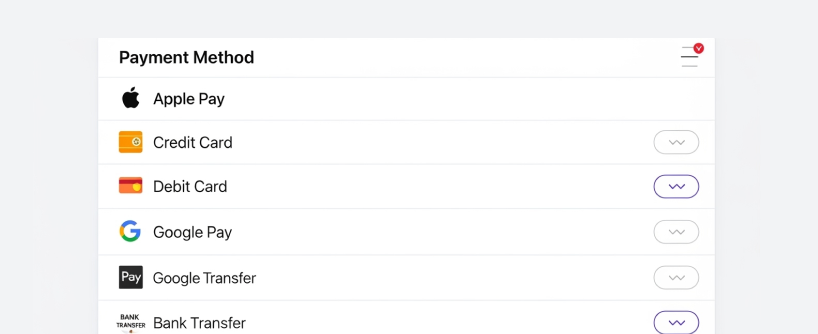

Payment Methods

Flexibility in payment methods is key in 2025’s crypto market. Most major exchanges support:

-

Bank transfers: Still the most cost-effective method for larger purchases, though not always the fastest

-

Credit/debit cards: Convenient but typically incur higher fees (2-4% on most platforms)

-

Apple Pay/Google Pay: Increasingly popular for small to medium purchases due to convenience and relatively reasonable fees

-

PayPal/Venmo: Widely available, but watch out for hidden fees

-

Prepaid cards: Offering privacy benefits, but often with premium fees

The method you choose should depend on your priorities: Are you looking for the lowest fees, fastest processing, or highest privacy? Each payment method presents different trade-offs in these areas.

Buy Bitcoin Without KYC

What if you don’t want to go through ID verification? In 2025, buying BTC without KYC (Know Your Customer) is still possible, but it comes with trade-offs.

Let’s explore legitimate ways to buy Bitcoin without sharing your personal information.

Non-KYC Platforms

Hodl Hodl: A peer-to-peer Bitcoin marketplace that uses multisig escrow to facilitate trades without holding customer funds. In 2025, they’ve enhanced their reputation system and added more payment methods, making P2P crypto trading more secure and accessible.

LocalCoinSwap: This platform has grown significantly by focusing on global accessibility. With support for over 300 payment methods and trades in nearly every country, it’s become a go-to option for those seeking privacy in their Bitcoin transactions.

Guardarian: While not completely KYC-free, Guardarian offers minimal verification tiers that allow smaller purchases with limited personal information. Their unique “progressive KYC” approach has found the sweet spot between regulatory compliance and user privacy.

Bitcoin ATMs: Though fees remain high (often 7-12%), Bitcoin ATMs continue to proliferate globally, with over 75,000 machines worldwide as of 2025. Many still offer transactions below certain thresholds without ID requirements.

It’s important to note that while buying Bitcoin without KYC is legal in most jurisdictions, users should still be aware of and comply with their local tax reporting requirements. Privacy doesn’t equal anonymity in the eyes of regulators, as Bitcoin’s blockchain remains transparent.

When using non-KYC platforms, exercise additional caution:

-

Start with small amounts to test the service

-

Check user reviews and platform reputation thoroughly

-

Be wary of deals that seem too good to be true

-

Understand that no-KYC often means paying a premium of 5-15% above market rates

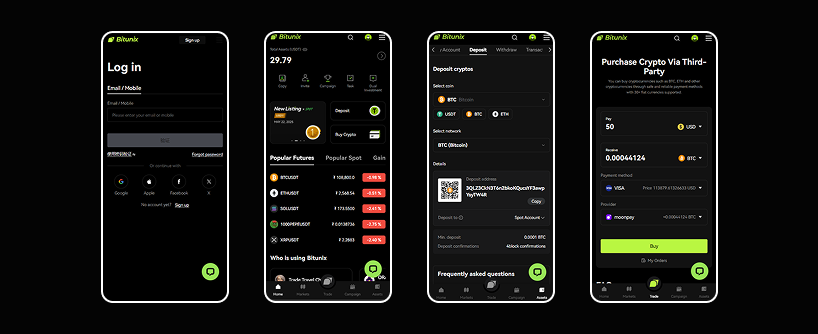

How to Buy Bitcoin on Bitunix

One of the most efficient platforms for 2025, Bitunix offers a clean interface, high security, and no excessive verification for small purchases.

Step-by-Step Guide

-

Create an Account: Sign up on the Bitunix website or app using your email or phone number. Complete KYC if required (optional for small purchases).

-

Deposit Funds: Go to the “Deposit” section and choose your payment method – bank transfer, credit/debit card, or Apple Pay. Bank transfers are the cheapest, while cards offer instant processing.

-

Select Bitcoin BTC: Go to the “Buy Crypto” section, choose BTC, and enter the amount in USD or your local currency. Use a market order for instant purchase or a limit order to set your price.

-

Confirm Purchase: Review the transaction details, including fees and network costs, then click “Buy Now.” Your BTC will be credited to your Bitunix crypto wallet.

-

Store Your Bitcoin: Once purchased, consider transferring your Bitcoin to a personal wallet for enhanced security. Bitunix offers direct withdrawals to both hot wallets and cold wallets with competitive network fees.

Payment Methods Supported

Bitunix supports a wide range of payment methods, including:

-

Apple Pay

-

Google Pay

-

Credit/Debit Cards

-

Bank Transfer

-

Prepaid Cards

Is Bitcoin a Buy Right Now?

Bitcoin remains the dominant digital currency despite short-term fluctuations. The launch of Spot Bitcoin ETFs, greater interest from sovereign wealth funds, and increasing adoption by traditional investors suggest that Bitcoin continues to play a central role in the crypto asset space.

Institutional Activity & Regulation Impact

The Securities and Exchange Commission (SEC) has clarified guidelines on crypto platforms, boosting investor confidence. Countries like Singapore and Switzerland now classify BTC as a legitimate asset class. Institutional investors continue to treat Bitcoin as a hedge against inflation and currency devaluation.

So, is BTC worth buying now?

If your risk tolerance aligns with the extremely volatile nature of Bitcoin, and you understand your investment goals, then yes, BTC remains a strong buy in 2025.

Smart Buying Tips

Ready to make your Bitcoin purchase? Here are some strategic approaches to consider.

How to Buy Bitcoin Cheap

Dollar-cost averaging (DCA): Rather than trying to time the market with a large purchase, consider buying smaller amounts at regular intervals. This strategy has historically reduced the impact of volatility on long-term returns and eliminated the stress of timing the market.

Compare fees meticulously: Exchange fees can vary dramatically, from under 0.1% to over 4%. For larger purchases, especially, shopping around can save you substantial money. Some exchanges also offer fee discounts for:

-

Using their native tokens

-

Maintaining minimum balances

-

Trading above certain monthly volumes

Consider time of day and week: Bitcoin markets operate 24/7, but volatility and liquidity often follow patterns. Weekends typically see lower trading volumes, sometimes leading to higher volatility. Many experienced traders prefer to make larger purchases during high-liquidity periods.

Avoiding Common Mistakes

Neglecting security: Never underestimate the importance of security. Use unique, strong passwords, enable two-factor authentication, and consider hardware wallets for significant holdings. Remember that exchanges, even reputable ones, can be hacked.

Forgetting about taxes: In most jurisdictions, buying Bitcoin isn’t taxable, but selling or trading it likely is. Keep meticulous records of your purchases to make tax compliance easier.

Falling for scams: If something sounds too good to be true in the Bitcoin world, it almost certainly is. Common scams to avoid include:

-

“Guaranteed” investment returns

-

Bitcoin “multipliers” or “doublers”

-

Fake exchanges with unusually low fees or high returns

-

Unsolicited investment advice via social media

Overlooking network fees: When transferring Bitcoin between digital wallets or exchanges, network fees can vary significantly. During periods of high network congestion, these fees can spike dramatically. Consider the timing of your transfers to minimize costs.

Keeping large amounts on exchanges: While convenient, leaving substantial Bitcoin holdings on exchanges exposes you to counterparty risk. For long-term holdings, consider self-custody solutions like hardware wallets.

Final Thoughts: Should You Buy Bitcoin in 2025?

The answer depends on your risk tolerance and investment goals.

-

Buy if: You believe in Bitcoin’s long-term potential and can handle volatility.

-

Avoid if: You need short-term guaranteed returns (crypto is extremely volatile).

With institutional backing and a finite supply of 21 million coins, Bitcoin remains a compelling digital asset, but its volatility demands caution. Start small, stay informed, and take your first step into the world of decentralized digital currency today.

Remember, Bitcoin isn’t just a cryptocurrency- it’s a financial revolution. Will you be part of it?

FAQs

Why does it seem like Bitcoin remains unchanged despite market events?

While short-term volatility can be extreme, Bitcoin remains unchanged in its core fundamentals – its supply cap, decentralized nature, and trustless system built on blockchain technology. These characteristics help it stand resilient amid economic shifts and contribute to its lasting appeal in the global financial system.

What should I know before selling Bitcoin in 2025?

Selling Bitcoin is easy but requires planning. Consider your exchange account’s withdrawal limits, current bitcoin’s price, and applicable transaction fees. Selling via decentralized exchanges may offer privacy, while centralized platforms provide liquidity and convenience – each with different trade-offs.

Are transaction fees still a concern when buying or selling Bitcoin?

Yes, transaction fees remain a key factor in both buying and selling BTC. Fees vary by network congestion, crypto platform, and payment method. For cost-conscious investors, choosing the right exchange account and avoiding peak transaction times can help minimize costs.