Cryptocurrency trading is highly volatile, and prices can move dramatically in minutes. To manage this risk and secure profits, traders use two essential tools: take profit (TP) orders and stop loss (SL) orders. These automated instructions allow you to set clear exit points, reducing emotional trading and ensuring more consistent strategies.

This guide explains what TP and SL are, how they work, how to set them up on any exchange, and includes a Bitunix walkthrough example.

What is a Take Profit Order in Crypto?

A take profit order is an automated instruction to sell a cryptocurrency once it reaches a chosen price level. This allows traders to secure profits without constantly monitoring the market.

Example:

- Buy Bitcoin at $60,000.

- Set a take profit order at $65,000.

- When Bitcoin reaches $65,000, the system automatically sells and locks in profit.

How Does a Take Profit Order Work?

- The trader sets a trigger price at which profits are secured.

- When the market price reaches the trigger, the system executes a sell order.

- TP orders can be placed as either:

- Limit TP Order: Executes at a defined price, but may not fill immediately.

- Market TP Order: Executes instantly at the market price once triggered.

What is a Stop Loss Order in Crypto?

A stop loss order limits potential losses by selling an asset automatically if its price drops to a certain level.

Example:

- Buy Ethereum at $2,500.

- Set stop loss at $2,300.

- If Ethereum falls to $2,300, the system sells to cap your loss at $200 per unit.

Like TP, SL can also be set as:

- Limit SL Order: Triggered then placed as a limit order.

- Market SL Order: Triggered then executed instantly at market price.

Take Profit vs Stop Loss: Key Differences

| Feature | Take Profit (TP) | Stop Loss (SL) |

| Purpose | Secure profits at a chosen price | Limit losses at a chosen price |

| Trigger Condition | Price rises to your target | Price falls to your threshold |

| Execution Type | Limit or market order | Limit or market order |

| Effect on Emotions | Prevents greed-driven overholding | Prevents panic-driven large losses |

How to Set Take Profit and Stop Loss in Crypto Trading?

These steps apply universally across most crypto exchanges:

- Choose a trading pair (e.g., BTC/USDT).

- Select order type: Limit or Market.

- Enter TP and SL values: Decide where you want to exit profitably and where to cap losses.

- Confirm the trade: Review details and place the order.

- Monitor and adjust: Modify orders if market conditions change.

Why Use Take Profit and Stop Loss Orders?

Risk Management

These orders are essential tools for managing risk. In the volatile cryptocurrency market, prices can swing drastically in a short period. By setting up take profit and stop loss orders, you can predetermine your acceptable loss levels and desired profit targets, thus protecting your investments and profits.

Emotional Control

Trading can be emotional, especially in a highly volatile market like crypto. Fear and greed can drive impulsive decisions that might not be in your best interest. take profit and stop loss orders help eliminate the emotional component by automating trade exits, allowing for more disciplined trading.

Consistency

Using take profit and stop loss orders helps ensure that your trading strategy is applied consistently. These orders operate based on predefined criteria, ensuring that your trades follow your planned strategy even when you are not actively monitoring the market.

How to Set Up Take Profit and Stop Loss on Bitunix on the WEB Version

We will look into Setting up TP and SL orders on Bitunix in web version which is a straightforward process. Follow these steps to ensure that your trades are protected and your profits are secured.

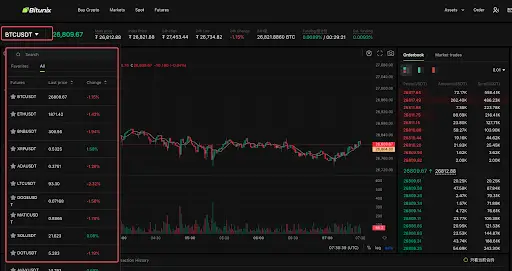

Step 1: To begin log into your Bitunix account using your username and password. If you don’t have an account, you will need to create one and complete the necessary verification processes then click “Futures” on the top of the page.

Step 2: Once logged in, navigate to the trading interface. This can typically be found under the “Trade” or “Markets” section on the platform’s main menu. Here, you will see the trading pairs available and the interface for placing orders then click on BTCUSDT on the left to open the list and select the futures.

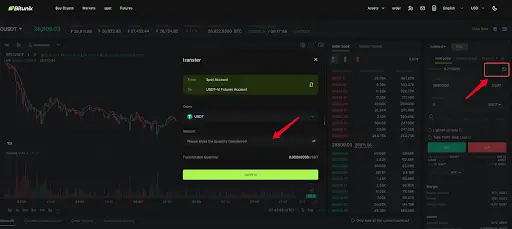

Step 3: Transfer Funds

You need to have funds in your derivatives account to initiate a trade to do this you will have to deposit onchain to your wallet or buy directly using your credit card or any other means but if you have funds in your spot wallet then click the small arrow button on the right to open the transfer menu and enter the amount to transfer funds from the spot account to the futures account, click confirm.

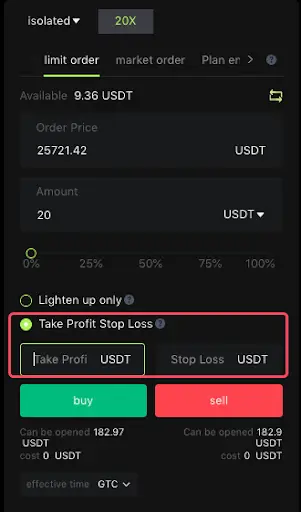

Step 4: Enter Your Trade Details

In the trading interface, you will need to enter the details of your trade: Click Isolated on the right to switch position modes. Click on the number to switch the leverage multiplier. Different varieties support different leverage multiples.

Next choose the type of order you wish to place. For setting take profit and stop loss orders, you will typically use the “Limit” or “Market” order types. Next enter the price at which you wish to buy or sell the asset, specify the amount of the cryptocurrency you wish to buy or sell.

Step 6: Confirm and Place Your Order

Review your trade details, including the take profit and stop loss levels. Once you are satisfied, confirm and place your order. The system will now automatically execute the orders based on the specified criteria.

After successfully placing the order, you can view your orders under Open Orders at the bottom of the page. You can also cancel your order before they are filled. If the order is filled, you can find it under Position. Click take profit and stop loss to view current take profit/stop loss orders.

How to Modify Take Profit and Stop Loss on Bitunix

Markets are dynamic, and conditions can change rapidly. You might need to adjust your take profit and stop loss orders as the market evolves. Here’s how you can modify these orders on Bitunix.

Navigate to the “Open Orders” section in your Bitunix account. This section lists all your active orders, including those with TP and SL instructions. Identify the order you wish to modify and select it. There should be an option to “Modify” or “Edit” the order details. Next change the take profit and stop loss levels according to the new market conditions or your updated trading strategy.

For example, if the market is more bullish than expected, you might raise your take profit level. Conversely, if volatility has increased, you might tighten your stop loss level to reduce potential losses. Next you should review the changes you have made to ensure they align with your revised trading strategy. Confirm and save the modifications. Your order will now execute based on the updated take profit and stop loss levels.

Practical Examples of Setting Take Profit and Stop Loss Order on Bitunix

Let’s assume you want to trade the BTC/USDT pair. Here’s a step-by-step guide on how to set up and modify TP and SL orders.

Initial Trade Setup:

-Buy Bitcoin: $70,000

– Take Profit: $75,000 (targeting a $5,000 profit per BTC)

– Stop Loss: $68,000 (risking a $2,000 loss per BTC)

Steps:

- Log into Bitunix and navigate to the BTC/USDT trading pair.

- Enter a buy order for Bitcoin at $70,000.

- Set the take profit order at $35,000 and the stop loss order at $28,000.

- Confirm and place the order.

Modifying the Order:

After some time, Bitcoin’s price starts trending upwards, and you decide to adjust your take pofit and stop loss levels to lock in more profit and reduce risk. Go to the “Open Orders” section and select the BTC/USDT order, modify the take profit level to $77,000 and the stop loss level to $70,500 then confirm the changes made.

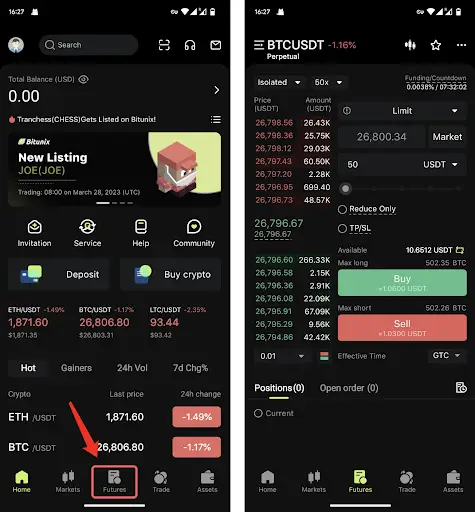

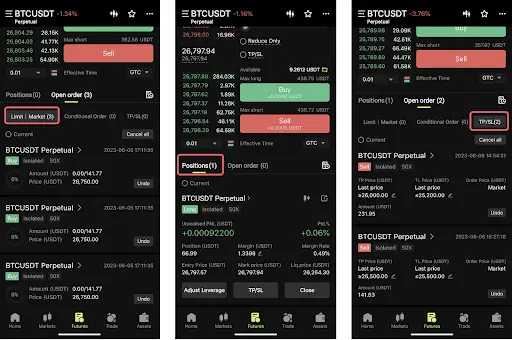

How to Set Up Take Profit and Stop Loss on Bitunix on the Mobile APP

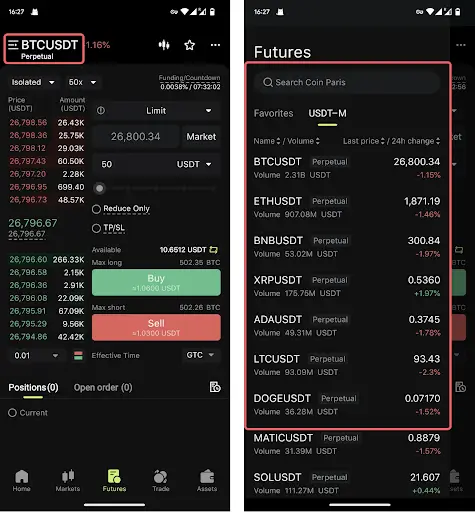

Login to your Bitunix account on the mobile application, select “Futures” at the bottom. If you don’t have an account, you will need to create one and complete the necessary verification processes then click “Futures” at the bottom.

Click BTC/USDT on the top left to change trading pairs. You can use the search bar or directly click the list below to find the futures you want to trade.

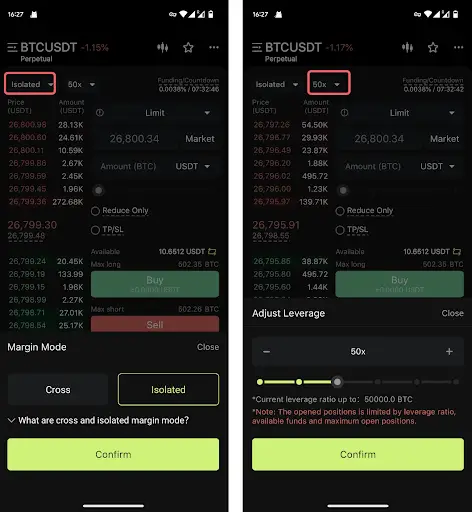

Next select margin mode and leverage. By default, Bitunix offers the cross leverage so you will have to change it to your preferred choice.

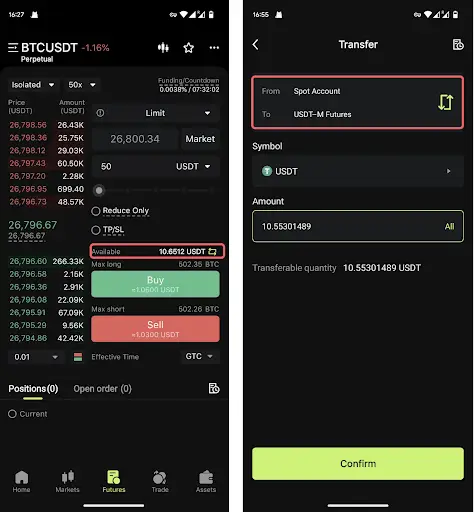

Click the arrow icon to the right of the available balance to transfer funds from the spot account to the futures account.

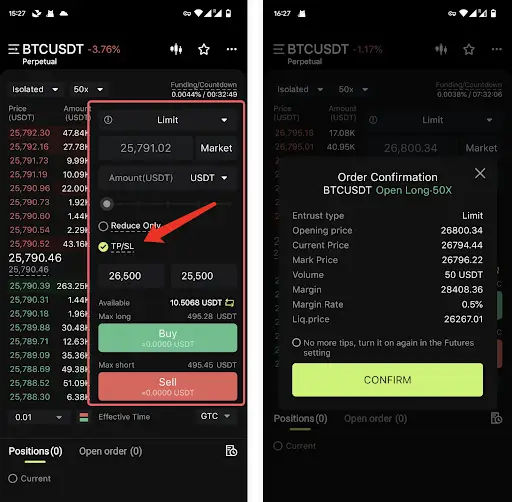

Place your order on the right side of the screen. If you choose limit order, you need to enter the price and amount. If you choose market order, you only need to enter the amount.

Check the TP/SL box and enter price for take profit and stop loss. Then, click Buy if you want to open a long position, or click Sell if you want to open a short position.

After placing the order, it will appear in Open Orders if it’s not filled right away. Users can click [Cancel] to cancel the pending order. If the order is filled, it will be found under Positions. The placed take profit and stop loss order can also be found under Open Order.

Tips for Effective Use of Take Profit and Stop Loss on Bitunix

The cryptocurrency market is highly dynamic. Regularly review and adjust your take profit and stop loss levels based on the latest market conditions and your evolving trading strategy. You should also leverage technical analysis to set more accurate take profit and stop loss levels. Indicators such as moving averages, Bollinger Bands, and Relative Strength Index (RSI) can provide valuable insights into market trends and potential reversal points.

In addition to that, avoid putting all your capital into a single trade. Diversifying your trades across different cryptocurrencies can help spread risk and reduce the impact of a single market movement.

Letting emotions drive your trading decisions can lead to significant losses. Stick to your predefined take profit and stop loss levels to maintain discipline and avoid impulsive decisions. If you are new to using take profit and stop loss orders, start with smaller trades. This approach allows you to learn and refine your strategy without risking significant capital.

FAQ

1. What is a take-profit order in crypto?

It is an instruction to automatically sell cryptocurrency once it reaches a set price, securing profits without manual action.

2. How does take profit work in crypto?

When the price reaches your chosen level, the system triggers a sell order. Depending on the type (limit or market), it may execute instantly or wait for your limit price.

3. Can you take profit without selling crypto?

Not directly. To realize profits, you must sell or convert into another asset, although you can also use crypto lending or collateralized loans to access value without selling.

4. Is it good to take profits from crypto?

Yes. Regularly taking profits helps protect gains and reduce exposure to sudden volatility.

When should I sell crypto for profit?

Common strategies include selling at resistance levels, after strong rallies, or when your target risk-reward ratio is reached.

5. What is the best take-profit strategy in crypto?

Using a percentage-based approach (e.g., selling portions at +10%, +20%) combined with technical analysis is considered effective.

6. What is a good take profit percentage for crypto?

This varies, but many traders aim for 5%–20% depending on volatility, time horizon, and strategy.

7. Can I make $100 a day from crypto?

It is possible with sufficient capital, strategy, and discipline, but daily consistent profits are challenging in volatile markets.

8. How much do I need to make $100 a day trading crypto?

If you target a 2% daily return, you would need about $5,000 in trading capital. Higher leverage reduces the capital required but increases risk.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.