If you’re looking to try crypto futures but everything sounds too technical or risky, you’re not alone. A lot of traders feel the same way before jumping in. That’s exactly why we built Bitunix the way we did — to strip away the noise and give people a platform that just works.

We won’t pretend it’s easy money or some shortcut to fast profits. It’s not. But it’s a powerful tool when used right. So in this guide, we’ll walk you through the actual steps to start futures trading on Bitunix, explain how our platform works, and share a few things we’ve learned from doing this day in and day out.

[ez-toc]

What Are Crypto Futures?

Futures let you trade crypto based on where you think the price is headed. You don’t need to own the coin — you’re just predicting movement.

If you think the market’s about to climb, go long. If you think it’s dropping, go short. Either way, you’re working with a contract, not a wallet full of tokens.

Now, there’s leverage too. With Bitunix, you can borrow exposure. So a small balance opens a much bigger position. But that power cuts both ways. You win more — or you lose faster. That’s where risk tools come in, and we’ve built those right into the platform.

Getting Started

Create Your Account

Just sign up with your email. We keep the process quick — you’re not stuck in paperwork. Once you’re in, turn on 2FA. It’s optional, but really, don’t skip it. That one step can save you from a lot of trouble later.

Move Your Funds

Go to your Wallet, then transfer funds from Spot to Futures. USDT, BTC, ETH — all supported. No delay. You’ll see it reflect immediately and be good to go.

Use the Dashboard

Our layout shows your order types, leverage settings, live chart, and trade history in one place. You won’t need a manual. Just take five minutes and click around — it’s all pretty self-explanatory once you’re in it.

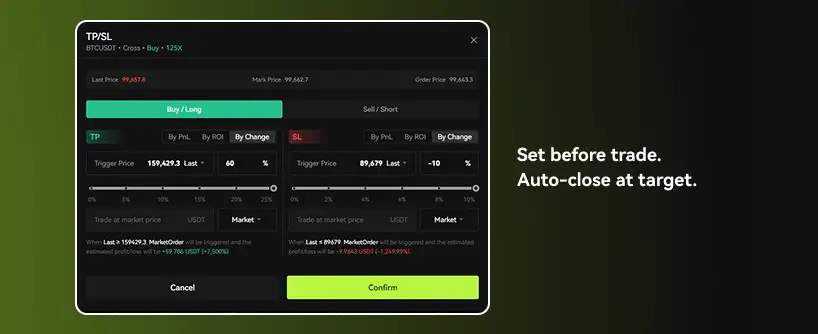

Use the Risk Tools — Always

Set them. Every time. A stop-loss cuts your loss if the trade goes wrong. A take-profit grabs your gains before the market turns. Set both when placing the trade, and you won’t have to babysit it.

Don’t Touch Max Leverage

We offer 125x, sure. But we don’t recommend jumping to that right away. If you’re new, try 5x or less. Go higher when you’re comfortable — not because it looks exciting.

Reduce-Only= Smart Exit

If you just want to shrink your position, not open something new, use “Reduce-Only.” Simple tools are often overlooked, but it prevents a lot of mess-ups.

Why People Stick With Bitunix

-

Fast trade execution. No lag.

-

Clean layout. No feature overload.

-

Straightforward fees. You’ll see costs before you confirm.

-

Mobile apps works — full functionality, not watered down.

-

Security matters here. Cold storage, monitoring, access controls.

Conclusion

We’re not here to tell you futures trading is easy. It’s not. But it’s real, and it’s effective when used properly.

If you want to test your strategy, protect your portfolio, or just go beyond simple buys and sells — this is the way. Bitunix gives you tools. You bring discipline.

We built this platform so you can trade without second-guessing everything. No mystery fees, no endless tutorials, just tools that work when you do.

FAQ

-

How do I fund the Futures account? Just move funds from your Spot wallet to your Futures wallet. No extra steps.

-

Should I use high leverage? Not at first. Start small. Build your rhythm. Leverage works for you or against you — depending on how you use it.

-

Can I trade on my phone? Yes. The mobile app has everything — trades, charts, stop-losses, all of it.

-

Are fees hidden? No. You’ll see them clearly before you submit the order. No fine print surprises.

Key Takeaways

-

Trade price movements, not coins

-

Use stop-loss, take-profit, and reduce-only — every trade

-

Start with low leverage, not max

-

Bitunix runs fast, runs clean, and keeps things transparent

One reply on “Beginner’s Guide to Futures Trading on Bitunix in 2025”

I have read a few good stuff here. Definitely value bookmarking for revisiting. I wonder how so much attempt you place to make the sort of magnificent informative web site.