It’s a familiar moment for many traders.

You go to exit a position — maybe take profit or scale down. But one slip in order size flips your entire position. What was supposed to be a sell becomes a buy. That mistake? It’s more common than people admit. And that’s exactly why Reduce-Only exists.

On Bitunix, this powerful but underrated order modifier helps you prevent reversals, overexposure, and unnecessary liquidation risks. Whether you’re new to futures or trading with leverage daily, understanding how and when to use Reduce-Only can save you from costly execution errors.

This guide walks through everything you need to know:

- What Reduce-Only really does

- How Bitunix integrates it into your trading panel

- When to use it

- How it differs from other order types

- And how to activate it — on both mobile and web

Let’s get into it.

When You Only Want to Exit — Not Flip

A Reduce-Only order is exactly what it sounds like. It’s a limit or market order that will only close or reduce an existing position, never open a new one or increase your size.

Think of it like a safety brake: no matter what quantity you enter, the system ensures you’re not taking on new exposure.

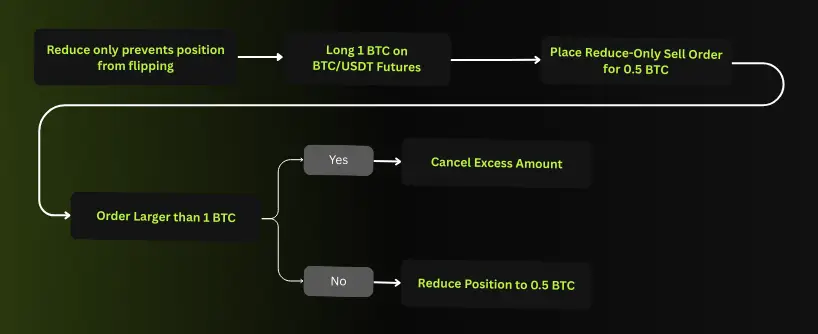

Here’s what that looks like in practice:

- You’re long 1 BTC on BTC/USDT futures

- You want to take profit on 0.5 BTC

- You place a sell-limit order and enable Reduce-Only

If the order executes, you now hold 0.5 BTC. But if you mistakenly enter 1.5 BTC? Bitunix will automatically cap the fill at 1 BTC — it won’t let your position flip to short. The excess 0.5 BTC is canceled.

That simple logic alone prevents:

- Position reversals

- Unintentional exposure increases

- Liquidations caused by mis-execution

How Bitunix Handles Reduce-Only

Bitunix has built the Reduce-Only feature into all its futures trading interfaces — both web and mobile — and the way it works is consistent across contracts.

When you enable the Reduce-Only checkbox, Bitunix enforces three things:

- The order can only close or reduce an open position

- It cannot open a trade in the opposite direction

- If the order is larger than your position, it is automatically adjusted or canceled

This is especially valuable when you’re working with fast markets and larger size.

A quick Bitunix example:

- You’re short 2 ETH on ETH/USDT perpetuals

- You want to close 1 ETH to take partial profit

- You place a buy-limit order, but accidentally input 3 ETH

- Reduce-Only ensures that only 2 ETH can execute; the rest is canceled

That alone could be the difference between banking a win and flipping into an unintended long.

When Should You Use Reduce-Only?

It’s not a tool you use on every trade — but in the right moments, it’s essential. Here are common situations where Reduce-Only is the smartest option:

- Taking Profits During Volatility Let’s say you’ve hit a price target, but the market is moving fast. A Reduce-Only limit ensures you can exit without fear of overshooting and opening the opposite side.

- Manual Stop Orders If you prefer to set stops manually rather than using a dedicated stop-loss, Reduce-Only lets you submit them with confidence — knowing they won’t flip your position.

- Trading Bots or Grid Strategies Bots often place overlapping or sequential orders. A Reduce-Only tag ensures they only exit trades and won’t accidentally compound size during spikes.

- Scaling Out Gradually If your approach involves layered exits (taking profit in chunks), Reduce-Only keeps each one focused strictly on reducing the position — not reversing it.

Benefits for Traders of All Levels

Professional and casual traders alike rely on Reduce-Only for one core reason: execution safety.

Here’s what it brings to your trading toolkit:

- No More Reversals One of the most frustrating errors in futures is flipping long to short — or vice versa — unintentionally. Reduce-Only eliminates that risk.

- Better for Automation Whether you’re using Bitunix’s copy trading system or running your own automation, Reduce-Only ensures systems only reduce — never expand — your position.

- Helps Manage Exposure in Volatile Markets In leveraged environments, size matters. Reduce-Only gives you a simple way to make sure you’re not doubling risk by accident.

- Cleaner Take-Profit and Stop-Loss Management You can stack multiple exit targets or manual stops with peace of mind that none of them will accidentally open new trades.

- Safer for New Users Beginners often make size or direction errors during fast-paced trading. Reduce-Only offers built-in protection, even when confidence is still building.

Common Mistakes to Avoid

Even experienced traders can misuse Reduce-Only if they’re not paying attention. Here are some things to watch out for:

- Entering More Than You Have Bitunix will reject any excess. For example, if you have 2 ETH short and input a Reduce-Only buy order of 3 ETH, only 2 will fill. The rest is dropped.

- Forgetting You Enabled It Sometimes traders leave Reduce-Only on by default. If your order isn’t filling the way you expected, check the setting.

- Trying to Use It to Open a Position Reduce-Only only works to close. If you don’t have an active position, the order won’t execute at all.

- Using It While Pyramiding If your goal is to add to a winning position (i.e., pyramiding), you need to turn off Reduce-Only. Otherwise, your orders may not fill.

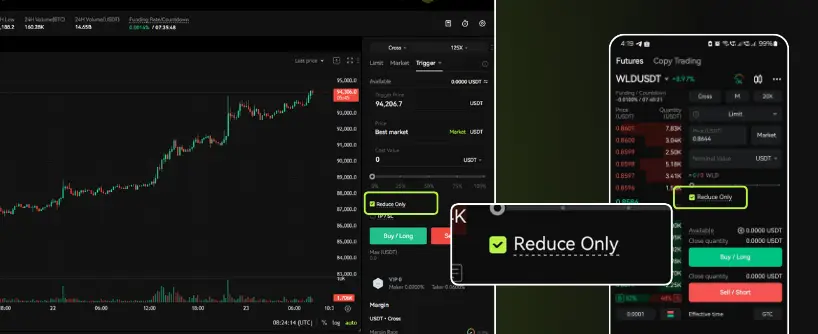

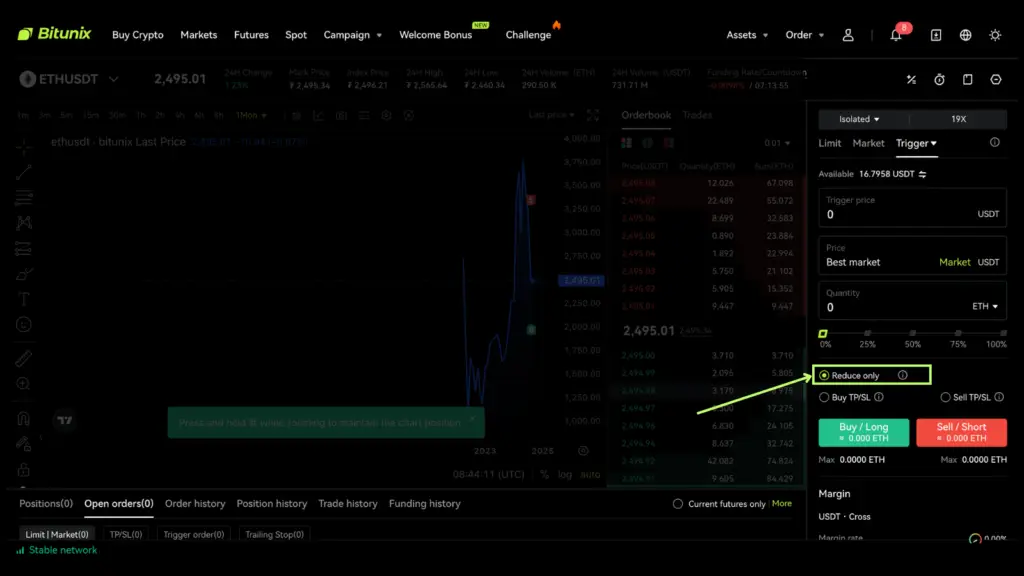

How to Activate Reduce-Only on Bitunix

Whether you’re on desktop or mobile, turning on Reduce-Only is quick.

On Web (Browser)

- Go to theFuturesdashboard

- Select a pair (e.g. BTC/USDT Perpetual)

- In the order panel, enter size, price, and order type

- Below that, check the Reduce-Only box

- Submit your order

On Mobile App

- Open the Bitunix app and go to Futures

- Choose your contract (e.g. ETH/USDT)

- Fill in size and price

- Tap Advanced Settings

- Find and toggle Reduce-Only

- Submit

This modifier is available across all perpetual contracts and can be used with both limit and market orders.

Reduce-Only vs Order Types: What’s the Difference?

Let’s clarify something: Reduce-Only is not a separate order type. It’s a modifier that can be applied to:

- Limit Orders — You set the price. Reduce-Only makes sure the order will not flip your trade.

- Market Orders — Executes instantly, but again, only reduces your position if Reduce-Only is enabled.

| Feature | Limit Order | Market Order | Reduce-Only |

| Set price manually | Yes | No | Yes (modifier) |

| Executes instantly | No | Yes | Depends on market |

| Opens new position | Yes | Yes | No |

| Reduces only | No | No | Yes |

If you’re using both Post-Only and Reduce-Only together, double-check conditions — sometimes they can cancel each other out depending on fill logic.

FAQs

1. What is a reduce-only order?

A reduce-only order ensures an order only decreases or closes an existing position. It prevents opening new trades or reversing direction.

2. What does reduce-only mean in crypto trading?

It means your order will only reduce your exposure. For example, a reduce-only sell order will never flip your long into a short.

3. How do I activate reduce-only in Bitunix?

On the web, check the Reduce-Only box in the order panel. On mobile, toggle Reduce-Only under Advanced Settings before submitting.

4. Can I use reduce-only for spot trading?

No. Reduce-only is only available for futures and margin trading, not spot markets.

5. What happens if my reduce-only order is larger than my position?

Bitunix fills only up to your open position size. Any excess is automatically canceled.

6. Is there an extra fee for reduce-only orders?

No. Reduce-only is included free of charge in all Bitunix futures contracts.

7. Why should beginners use reduce-only orders?

Beginners often make mistakes with order sizes or directions. Reduce-only ensures those mistakes do not lead to unintended trades.

8. Can reduce-only be combined with other order modifiers?

Yes, but be careful. Combining it with tools like Post-Only or Take-Profit/Stop-Loss can sometimes cause rejections if conditions clash.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.

One reply on “How to Use Reduce-Only Orders on Bitunix”

Thanks for any other excellent article. The place else may just anybody get that type of info in such a perfect method of writing? I’ve a presentation next week, and I am at the search for such information.