It’s a familiar moment for many traders.

You go to exit a position — maybe take profit or scale down. But one slip in order size flips your entire position. What was supposed to be a sell becomes a buy. That mistake? It’s more common than people admit. And that’s exactly why Reduce-Only exists.

On Bitunix, this powerful but underrated order modifier helps you prevent reversals, overexposure, and unnecessary liquidation risks. Whether you’re new to futures or trading with leverage daily, understanding how and when to use Reduce-Only can save you from costly execution errors.

This guide walks through everything you need to know:

Let’s get into it.

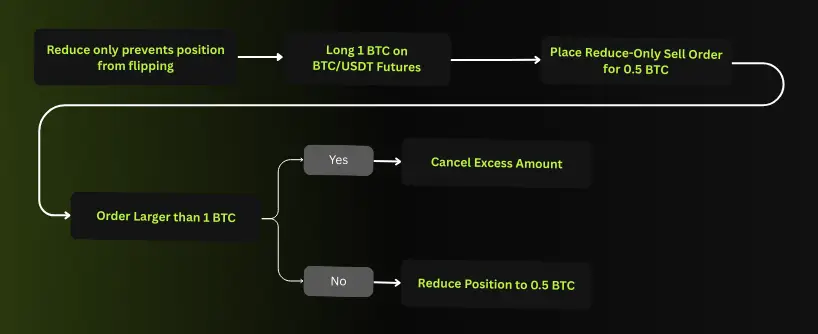

A Reduce-Only order is exactly what it sounds like. It’s a limit or market order that will only close or reduce an existing position, never open a new one or increase your size.

Think of it like a safety brake: no matter what quantity you enter, the system ensures you’re not taking on new exposure.

Here’s what that looks like in practice:

If the order executes, you now hold 0.5 BTC. But if you mistakenly enter 1.5 BTC? Bitunix will automatically cap the fill at 1 BTC — it won’t let your position flip to short. The excess 0.5 BTC is canceled.

That simple logic alone prevents:

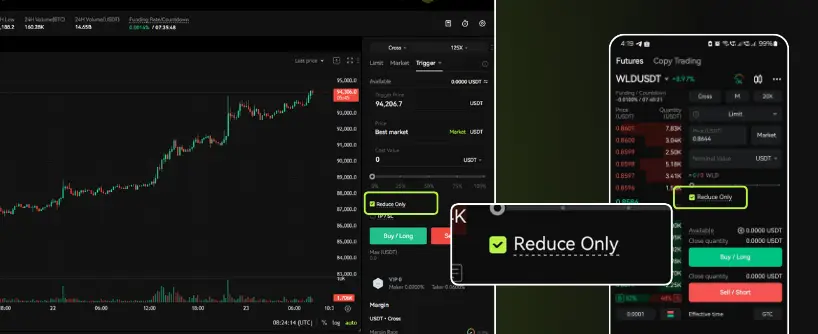

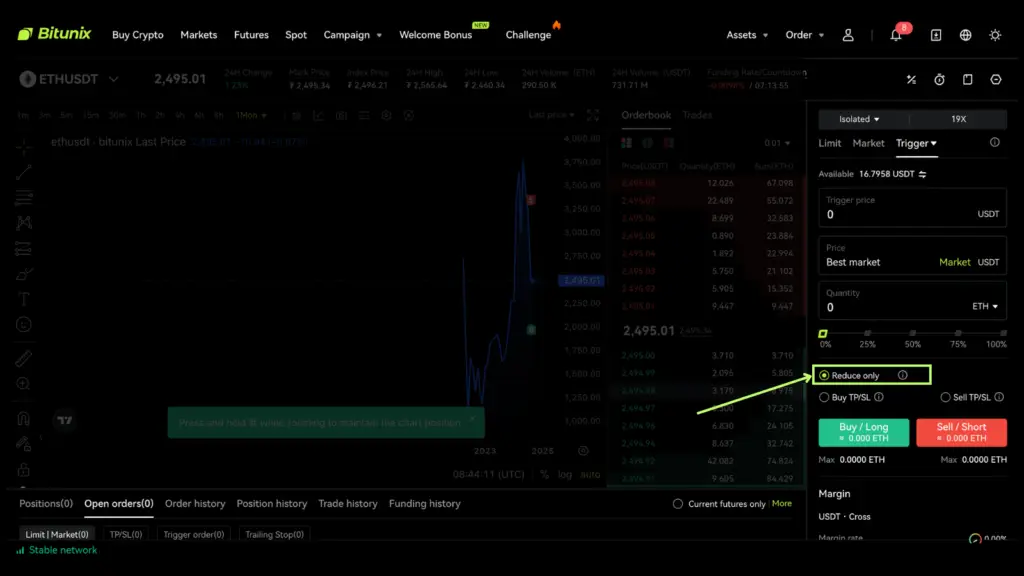

Bitunix has built the Reduce-Only feature into all its futures trading interfaces — both web and mobile — and the way it works is consistent across contracts.

When you enable the Reduce-Only checkbox, Bitunix enforces three things:

This is especially valuable when you’re working with fast markets and larger size.

A quick Bitunix example:

That alone could be the difference between banking a win and flipping into an unintended long.

It’s not a tool you use on every trade — but in the right moments, it’s essential. Here are common situations where Reduce-Only is the smartest option:

Professional and casual traders alike rely on Reduce-Only for one core reason: execution safety.

Here’s what it brings to your trading toolkit:

Even experienced traders can misuse Reduce-Only if they’re not paying attention. Here are some things to watch out for:

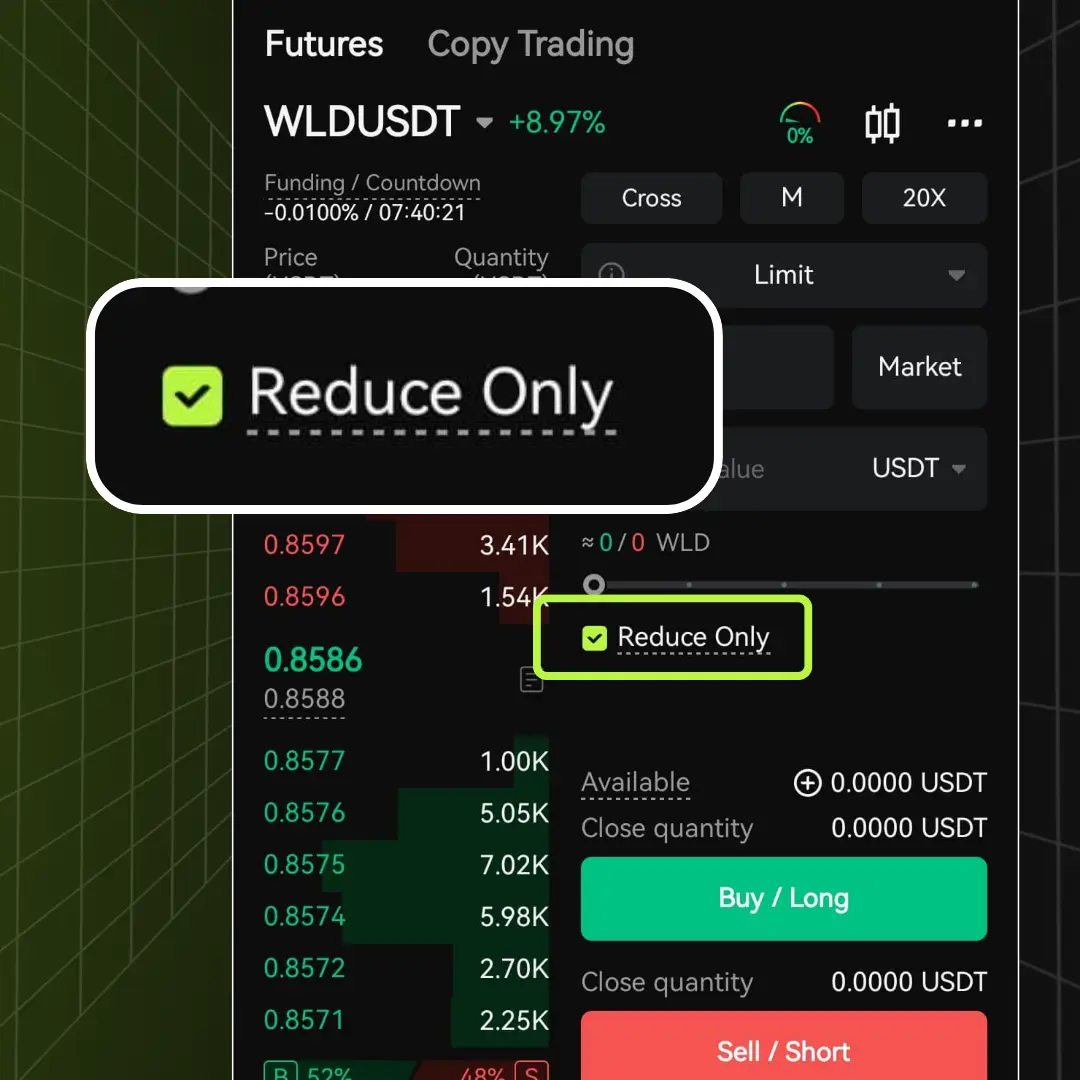

Whether you’re on desktop or mobile, turning on Reduce-Only is quick.

This modifier is available across all perpetual contracts and can be used with both limit and market orders.

Let’s clarify something: Reduce-Only is not a separate order type. It’s a modifier that can be applied to:

| Feature | Limit Order | Market Order | Reduce-Only |

| Set price manually | Yes | No | Yes (modifier) |

| Executes instantly | No | Yes | Depends on market |

| Opens new position | Yes | Yes | No |

| Reduces only | No | No | Yes |

If you’re using both Post-Only and Reduce-Only together, double-check conditions — sometimes they can cancel each other out depending on fill logic.

A reduce-only order ensures an order only decreases or closes an existing position. It prevents opening new trades or reversing direction.

It means your order will only reduce your exposure. For example, a reduce-only sell order will never flip your long into a short.

On the web, check the Reduce-Only box in the order panel. On mobile, toggle Reduce-Only under Advanced Settings before submitting.

No. Reduce-only is only available for futures and margin trading, not spot markets.

Bitunix fills only up to your open position size. Any excess is automatically canceled.

No. Reduce-only is included free of charge in all Bitunix futures contracts.

Beginners often make mistakes with order sizes or directions. Reduce-only ensures those mistakes do not lead to unintended trades.

Yes, but be careful. Combining it with tools like Post-Only or Take-Profit/Stop-Loss can sometimes cause rejections if conditions clash.

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.