The spot trading landscape in 2025 is entering a new era, driven by a wave of altcoins delivering more than just hype. While Bitcoin and Ethereum remain dominant, emerging tokens like Hyperion, SUI, BONK, Injective (INJ), and XDC are taking center stage in both retail and institutional portfolios.

These altcoins are not just speculative assets. They represent new infrastructure, upgraded blockchain efficiency, real-world use cases, and increased interoperability. As crypto traders look beyond the giants, these tokens have become some of the best crypto to buy now for long-term growth or swing trading.

[ez-toc]

Hyperion (HYN): A New Standard in Data Infrastructure

Hyperion is capturing attention for its decentralized mapping and location data network. In an AI-powered world, reliable geospatial data is crucial. Hyperion allows developers and businesses to access decentralized location services, creating opportunities across logistics, mobility, and smart cities.

Key Features:

- Decentralized global mapping system

- Uses Proof-of-Presence for data verification

- Active development partnerships in Asia and Europe

Why Hyperion Is on the Radar: Its increasing integration with decentralized apps and real-world logistics companies makes it a serious player. In 2025, it’s showing early signs of maturing into a Layer-1 data solution.

Use Case in Spot Trading: Traders are accumulating HYN based on its network expansion. Its daily volume spikes whenever announcements of new partnerships or node rewards go live, making it ideal for strategic entries.

SUI: The Scalable Layer-1 for Mass Adoption

SUI, developed by Mysten Labs, has become a benchmark for next-generation Layer-1 chains. Its core strength lies in parallel transaction processing, which drastically improves scalability without sacrificing decentralization.

Why Traders Are Watching SUI in 2025:

- sui price climbed over 250% since January

- Backed by major VCs and adopted in Southeast Asian blockchain infrastructure

- Used in gaming, DeFi, and digital identity platforms

SUI’s Technology Edge: SUI uses the Move programming language (developed by Facebook’s Libra team) to prevent typical smart contract vulnerabilities. Its unique consensus mechanism also allows for fast finality, which is crucial for DeFi apps.

Spot Market Insight: High trading volume and centralized exchange support have made SUI a favorite on altcoin exchange platforms like Bitunix. Its fast transactions and relatively low fees make it friendly for traders who rotate liquidity.

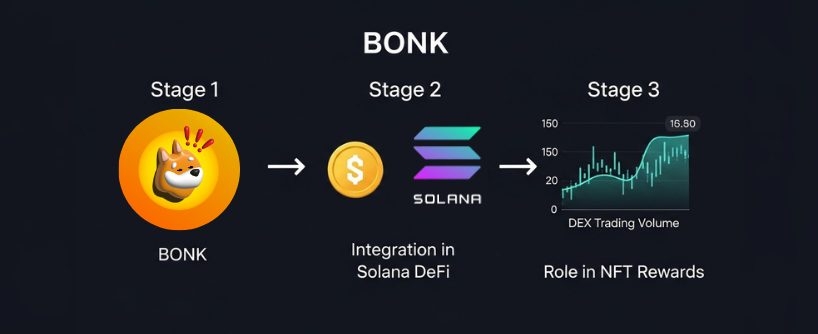

BONK: The Meme Coin with DeFi Muscles

Once considered a typical Solana-based meme coin, BONK now plays a more significant role in DeFi. It has integrated with Solana’s staking, NFT platforms, and ecosystem incentives, giving it actual utility.

2025 BONK Highlights:

- Surpassed bonk coin daily volume of $100 million on DEXs

- Used as a reward token on Solana dApps and NFT platforms

- Included in meme index funds across multiple exchanges

Why It Matters in Spot Markets: Meme tokens like BONK can generate fast momentum trades. But BONK stands out due to strong community support, consistent developer updates, and integrations with real use cases on Solana.

Traders looking for altcoin trading opportunities with upside exposure are watching BONK for high-frequency setups.

INJ: Injective’s Institutional Push

Injective Protocol (INJ) focuses on building a scalable, interoperable Layer-1 blockchain optimized for financial applications. In 2025, it’s one of the few chains offering native order book modules and cross-chain trading via Cosmos IBC.

Key Strengths of INJ:

- Native support for perpetual futures and options

- Close integration with AI-based trading analytics

- Real-world asset tokenization on-chain

Why Traders Trust INJ: With a rapidly growing DeFi ecosystem and support for smart contracts, INJ is positioned as a serious tool for professional traders and institutions. It appeals to both short-term volatility traders and long-term ecosystem believers.

INJ’s inclusion in Bitunix’s crypto spot trading pairs has driven up liquidity, giving traders a tight-spread, high-volume asset to rotate into.

XDC: Enterprise-Grade Blockchain with Real Adoption

XDC Network is known for bridging blockchain with traditional finance systems. Built with enterprise integration in mind, XDC offers near-zero gas fees, fast confirmations, and compliance layers, making it popular among global trade organizations.

XDC Use Cases:

- Document digitization in global trade

- Tokenized invoices for supply chain finance

- Cross-border remittances

Why XDC Is Trending in 2025:

- xdc price increased steadily following new utility token rollouts

- Partnerships with ISO-compliant institutions

- Featured on regulated trading platforms in the UAE and Singapore

XDC is appealing to traders focused on stable, utility-driven growth. Its tokenomics and partnership ecosystem make it a potential dark horse in the altcoin race.

Comparing Performance: Altcoin Rotation in 2025

In the current market, swing traders and spot-focused investors are rotating between these tokens based on announcements, ecosystem expansion, and protocol upgrades.

Here’s what makes each token ideal for different strategies:

| Token | Strength | Ideal For |

| HYN | Data infrastructure | Long-term holding |

| SUI | Scalability | Active trading and staking |

| BONK | Meme + DeFi | High-volatility plays |

| INJ | Financial dApps | Professional traders |

| XDC | Enterprise blockchain | Institutional-grade portfolios |

This variety offers flexibility. Whether you’re managing a meme-heavy portfolio or targeting low-risk entries into utility coins, the spot market in 2025 gives more options than ever.

Bitunix: Your Altcoin Gateway

Bitunix supports all five of these rising altcoins on its spot trading platform. With deep liquidity pools, low trading fees, and advanced order tools, Bitunix is well-positioned for both beginner traders and professionals.

You can:

- Access real-time charts for SUI, INJ, BONK, and more

- Use stop-limit and market orders for fast execution

- Monitor sentiment indicators and market data across tokens

For altcoin trading in 2025, a responsive and secure platform like Bitunix is essential.

FAQs

Which altcoin is the best to buy now for 2025?

There’s no one-size-fits-all answer. Hyperion, SUI, INJ, BONK, and XDC all offer different value propositions depending on your strategy.

Are meme coins like BONK still worth trading?

Yes. BONK has evolved beyond hype, integrating with DeFi platforms and offering more liquidity than many small-cap altcoins.

What makes SUI different from other Layer-1 chains?

SUI uses parallel transaction processing and the Move language, making it more secure and scalable than most alternatives.

Can I trade these tokens on Bitunix?

Yes. Bitunix offers spot trading for all five altcoins with fast execution and advanced order options.

How do I manage risk with altcoins?

Use stop-loss orders, trade smaller sizes on volatile tokens like BONK, and diversify across altcoins with different use cases.

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.