Have you ever wished you could trade like the pros – without spending years mastering the markets? Crypto copy trading lets you do just that! By automatically replicating the moves of experienced traders, you can potentially profit without needing extensive market knowledge.

But which copy trading strategies actually work? And how do you choose the right trader to copy in a market as volatile as crypto?

Let’s break down the best-performing crypto copy trading strategies, how to minimize risks, and how to pick the top traders to follow. No matter you’re a beginner or an experienced investor, these insights could help you maximize your returns.

Key Takeaways

- Your copy trading account can mirror the strategies of skilled traders automatically, but success depends on trade execution speed and the performance of the traders you follow.

- When starting out, use a demo account on a dedicated copy trading platform to understand how much capital you should risk. Platforms with automated trading preferences and social trading features offer better control, especially when tracking other traders with varying trading styles.

- Copy trading in crypto offers an edge through tools like trading bots, mirror trading strategies, and access to seasoned traders.

What Is Copy Trading?

Before we explore the winning strategies, let’s clarify: What is copy trading?

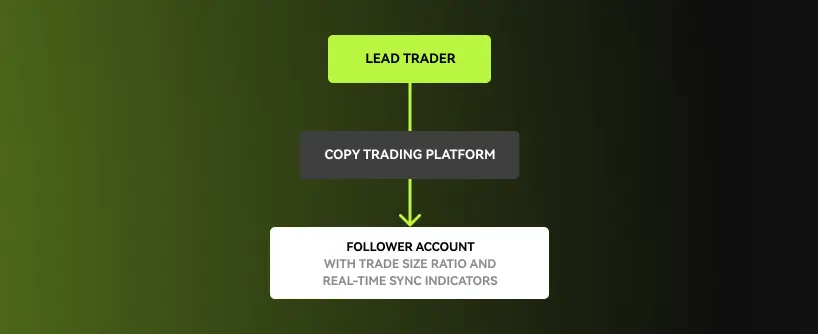

Copy trading is a type of automated trading where your trades are executed based on the trades of experienced or professional traders. With the right setup, you can automatically replicate the trades of top performers in real-time.

On a crypto copy trading platform, you simply connect your trading account to that of a lead trader. Whenever they open, modify, or close a position, your account does the same, all without lifting a finger.

It’s like social trading, but smarter – combining the power of automation, data-driven decisions, and the experience of skilled traders.

But don’t mistake this for “easy money.” Success in copy trading depends heavily on strategy, risk management, and choosing the right traders to follow.

The Mechanics of Crypto Copy Trading

At its core, copy trading creates a bridge between skilled traders and those looking to benefit from their expertise. When you start copy trading, you pick a trader to replicate based on their proven track record, trading style, and performance metrics. Once connected, their trading activities are automatically mirrored in your account, with trade sizes proportionally adjusted to your investment level.

But how exactly does this work in practice? When your chosen trader executes a trade, the copy trading platform’s algorithm instantly replicates that action in your account. If they allocate 5% of their portfolio to Bitcoin futures, the system will allocate 5% of your designated funds to the same position. This synchronization happens in real-time, ensuring you don’t miss potentially profitable market movements.

Some key elements that make copy trading function effectively include:

- Automatic trade replication with customizable risk settings

- Proportional position sizing based on your available capital

- Real-time performance tracking of both lead traders and your portfolio

- Transparent trading histories to evaluate potential traders to follow

The beauty of crypto copy trading lies in its simplicity. You don’t need to understand complex technical market analysis or keep up with market news around the clock – your selected trader handles these responsibilities while you benefit from their decisions.

Why Copy Trading in Crypto Is Gaining Popularity

The crypto market is fast, volatile, and can be overwhelming. But with copy trading tools and platforms offering real-time trader performance metrics, even beginner investors can:

-

Gain exposure to futures and spot markets

-

Replicate the trades of proven traders with extensive market knowledge

-

Reduce emotional decision-making

-

Build a diversified portfolio across multiple traders and strategies

-

Set risk tolerance levels to protect their capital

In short, crypto copy trading is profitable, but only if done right. So what are these top strategies that make all the difference?

Top Performing Copy Trading Strategies in Crypto Markets

Now, let’s explore the most successful approaches traders are using in the crypto copy trading landscape:

Diversified Trader Portfolio Strategy

Rather than putting all your capital behind a single trader, this strategy involves spreading your investment across multiple traders with complementary approaches. Think of it as creating a mutual fund of trading talent.

Why does this work? Different traders excel in various market conditions. Some thrive during bull runs, others excel at range-bound markets, while certain specialists perform best during downtrends. By allocating your capital across these varied profiles, you can achieve more consistent returns regardless of market direction.

The key is selecting traders with genuinely different methodologies rather than multiple people doing essentially the same thing. Look for:

-

Traders specializing in different timeframes (day trading vs. swing trading)

-

Various trading styles (momentum trading, breakout trading, etc.)

-

Different market segments (DeFi tokens, major cryptocurrencies, new listings)

This approach requires more initial research but often delivers more stable performance over time.

Tip: Use a copy trading platform that allows you to allocate percentages of your capital to different traders, adjusting based on performance and risk management tools.

Risk-Adjusted Copy Trading Strategy

This sophisticated strategy involves adjusting your allocation to each trader based on their risk profile and historical volatility. Instead of simply copying traders with the highest returns, you carefully evaluate their risk-adjusted performance.

Successful implementers of this strategy look beyond raw profit percentages to analyze metrics like:

-

Drawdown percentages: Maximum historical losses

-

Sharpe ratio: Return relative to risk taken

-

Consistency of results: Steady gains vs. erratic performance

-

Win/loss ratio: Proportion of winning trades to losing ones

The real advantage here? You can customize exposure based on your personal risk tolerance while still benefiting from a trader’s expertise. Many investors allocate more capital to conservative traders with steady returns while assigning smaller amounts to high-risk/high-reward traders.

Keep in mind that risk management really matters: Always check if the trader uses stop-losses, position sizing, and has a documented risk strategy.

Trend-Following Copy Trading

This classic strategy mirrors traders who ride major trends rather than timing tops and bottoms.

Why does it work?

Trend-following reduces the need to predict exact market conditions. You simply follow traders who identify and ride ongoing trends in spot and futures markets. It’s ideal for medium to long-term investors who prefer less frequent trades but solid risk-adjusted returns.

Look for: Traders with a proven track record of identifying and profiting from sustained market trends.

Market Condition Adaptive Strategy

This dynamic approach involves switching between different types of traders based on broader market trends. For example, during strong bull markets, you might allocate more capital to aggressive growth traders focusing on futures with leverage. When markets show signs of topping out, you might shift to traders who excel at short-selling or hedging strategies. During sideways markets, copy traders who specialize in range-bound strategies or yield farming.

To execute this strategy effectively, you need to:

-

Identify which market conditions each potential trader performs best in

-

Develop reliable indicators for recognizing major market shifts

-

Create a systematic reallocation plan

This strategy requires more active management but can significantly outperform static approaches when implemented correctly.

Automated Risk Management Overlay Strategy

Even the best traders have losing streaks. This strategy involves implementing your own risk management layer on top of copy trading. For instance, you might:

-

Set maximum drawdown limits that automatically pause copying if losses reach a certain threshold

-

Implement take-profit rules that secure gains at predetermined levels

-

Gradually increase allocation to traders who demonstrate consistent performance

-

Reduce exposure during unusually volatile market periods

Many Forex trading platforms offer these customization options, allowing you to add an extra layer of protection beyond the trader’s own risk management approach.

Specialized Niche Expertise Strategy

Instead of copying general crypto traders, this strategy focuses on specialists who have demonstrated exceptional skill in particular market segments. These might include:

-

DeFi token specialists

-

NFT market traders

-

Layer-1 blockchain investment strategists

-

IDO/new listing opportunity traders

-

Options and derivatives experts

By identifying traders with deep expertise in growing crypto niches, you can gain exposure to opportunities you might otherwise miss while benefiting from specialized knowledge in these complex market segments.

How to Select the Right Copy Trading Platform

Your success in crypto copy trading depends significantly on choosing the right platform. As you evaluate options, consider these critical factors:

Trader Selection and Transparency

How many successful traders does the platform host, and how thoroughly can you evaluate them? Look for platforms that provide:

-

Comprehensive past performance metrics beyond simple profit percentages

-

Long-term track records (minimum 6-12 months)

-

Transparent trading histories showing all wins and losses

-

Clear information about trading strategies and approaches

-

Risk metrics like maximum drawdown and Sharpe ratio

The best platforms allow you to thoroughly examine a trader’s history before committing any capital.

Fee Structure and Cost Consideration

Copy trading services aren’t free, but the fee structures vary widely. Compare:

-

Performance fees (percentage of profits)

-

Subscription costs for following specific traders

-

Standard trading fees (spreads, commissions)

-

Withdrawal fees and minimums

Be particularly wary of platforms with high performance fees combined with subscription costs, as these can significantly eat into your returns.

Risk Management Tools

Superior copy trading platforms provide robust tools to manage your risk exposure:

-

Ability to set maximum drawdown limits

-

Options to adjust the copy ratio (trading with reduced leverage)

-

Stop-loss settings at the account level

-

Customizable trade size limits

-

Emergency stop buttons to halt all copying instantly

These features can protect your capital during unexpected market movements or if a previously successful trader begins underperforming.

Platform Security and Regulation

Never compromise on security. Prioritize platforms that offer:

-

Regulatory compliance in reputable jurisdictions

-

Strong security measures (2FA, cold storage of funds)

-

Insurance funds or investor protection schemes

-

Transparent company history and leadership

-

Positive reviews from long-term users

Remember that copy trading platforms hold your funds, making security even more critical than with information-only services.

Is Crypto Copy Trading Right for You?

Despite its advantages, copy trading isn’t suitable for everyone. Consider these questions:

-

Are you comfortable delegating trading decisions to others?

-

Do you have realistic expectations about potential returns and risks?

-

Are you willing to spend time researching traders before copying them?

-

Can you accept that even the best traders have losing periods?

-

Do you understand the fee structure and how it impacts returns?

If you answered yes to these questions, copy trading could become a valuable component of your crypto investment strategy.

Final Thoughts

If you want to profit from crypto without being an expert, copy trading is a smart choice. But remember:

-

Start small – Test strategies before going all-in.

-

Diversify – Follow multiple expert traders to reduce risk.

-

Use risk management – Always set stop-loss orders.

Ready to copy the pros in financial markets? Pick a reliable platform from many copy trading platforms, copy successful traders trades, and let your portfolio grow! Start crypto copy trading smartly, and make market volatility your opportunity.

FAQs

Is crypto copy trading profitable?

Yes, it is possible to make money with copy trading, but success depends on several factors. The key aspects are choosing the right trader, market conditions and good risk management.

How much capital do I need to start a copy trading account?

You can start with as little as $100 on many platforms, but the more you invest, the more flexibility you have to diversify across multiple traders.

What is the benefit of copy trading compared to trading bots?

Copy trading allows you to replicate strategies of real traders, whereas trading bots follow pre-coded algorithms. Both have value, but copy trading uses human trading skills.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.

Leave a Reply