Trading cryptocurrencies successfully requires more than simply deciding when to buy or sell. The way you place your order determines how the trade is executed, the price you get, and the risk you carry. These instructions to the exchange are called crypto order types, and understanding them is one of the foundations of becoming a confident trader.

Most beginners stick to basic orders like market or limit, but advanced tools such as stop-loss, trailing stops, and trigger orders are equally important. In this article, we will explore all the major order types used in cryptocurrency trading, explain how they work with examples, and show how they are implemented on Bitunix.

As the name suggests, a market order allows you to trade, buy and sell crypto at the current market price. In simple terms, when you place a crypto buy or sell order, the trade is filled in immediately. This type of order is executed as soon as possible, as long as there is enough liquidity on the exchange.

When placing a market order, you receive the best price of the crypto asset depending on the bid and ask spread on the order book. For example, if you place a market order of 1 ETH at 3800 USD, your order is filled in immediately.

Limit order in crypto trading is an order to buy and sell a crypto asset at a specific price. As compared to market order, a limit order is filled only when the price of the asset meets the limit order price set by the trader.

So for example, if you want to buy Bitcoin , let’s say at $59,000 you can simply set the amount and the desired price under limit order. Limit orders give you more control over the execution price, ensuring that you only buy or sell at the prices you’re comfortable with.

Additionally, buying or selling cryptocurrencies at a specified price helps in reducing the risk of slippage in market order. Slippage in trading refers to the difference between the expected price of a trade and the actual price at which the trade is executed.

A stop-limit order in cryptocurrency trading is a type of order that combines the features of a stop order and a limit order. It helps traders set a specific price range for buying or selling an asset, providing more control over trade execution. Let’s take a look at how stop limit order works in crypto trading.

Stop Price: This is the price at which the stop-limit order is triggered. When the market reaches this price, the stop-limit order becomes a limit order.

Limit Price: Once the stop price is reached, the stop-limit order turns into a limit order with a specified limit price. The trade will only be executed at this limit price or better.

Take profit order is used to lock in profits when a position reaches a certain price. This order type automatically sells your asset once the target price is hit, ensuring you secure your gains. Using Take Profit is an important element in creating your trading strategy. Usually Take Profit is clubbed with Stop Loss order to maximise the price impact on your trades.

A stop-loss order automatically sells a position if the price falls to a predetermined level. This helps protect against significant losses by limiting the downside risk. To place a stop-loss order, you need to choose a specific price level at which you wish to exit on.

This can be based on a percentage of the invested capital, a particular price point, or a predetermined total profit and loss (PnL) amount. This price is usually set below the current market price for long positions and above the current market price for short positions.

To place a stop loss order in your trade position, you need to select an amount that is below the current market price of the asset you are trading on. Once the asset price reaches your stop loss price level, your contract closes immediately.

For example, you place a long position (buy) on BTC at $63,000 and you modify your order by setting a stop loss at $62,500. Then if the price of BTC reaches the specified price level of $62,500 or less, then your open order closes immediately.

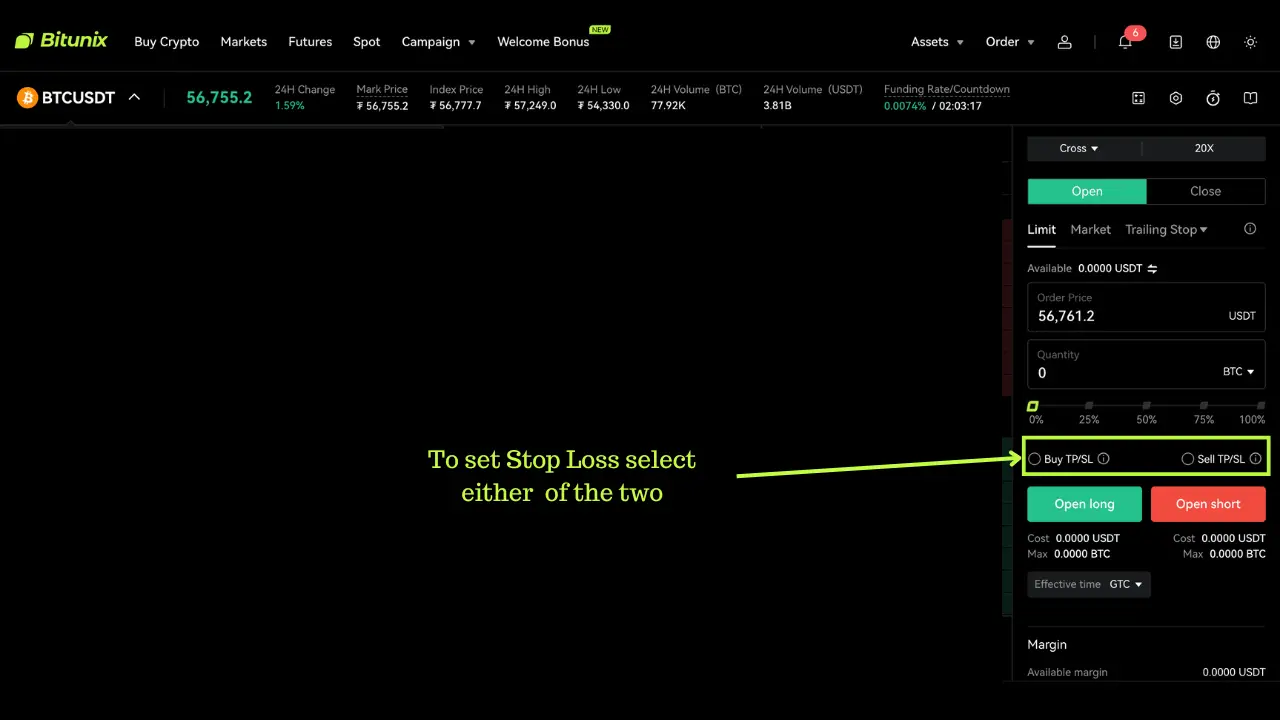

Setting stop-loss on Bitunix is very easy. First, choose the amount and leverage. Next, choose Buy TP/SL or Sell TP/SL. TP means Take Profit and SL means Stop-Loss.

Trailing stop loss is an advanced tool designed to secure profits as the market moves in your favor. Unlike a regular stop-loss, which stays fixed, a trailing stop follows the price at a set percentage or dollar distance.

How it works:

Why it is useful:

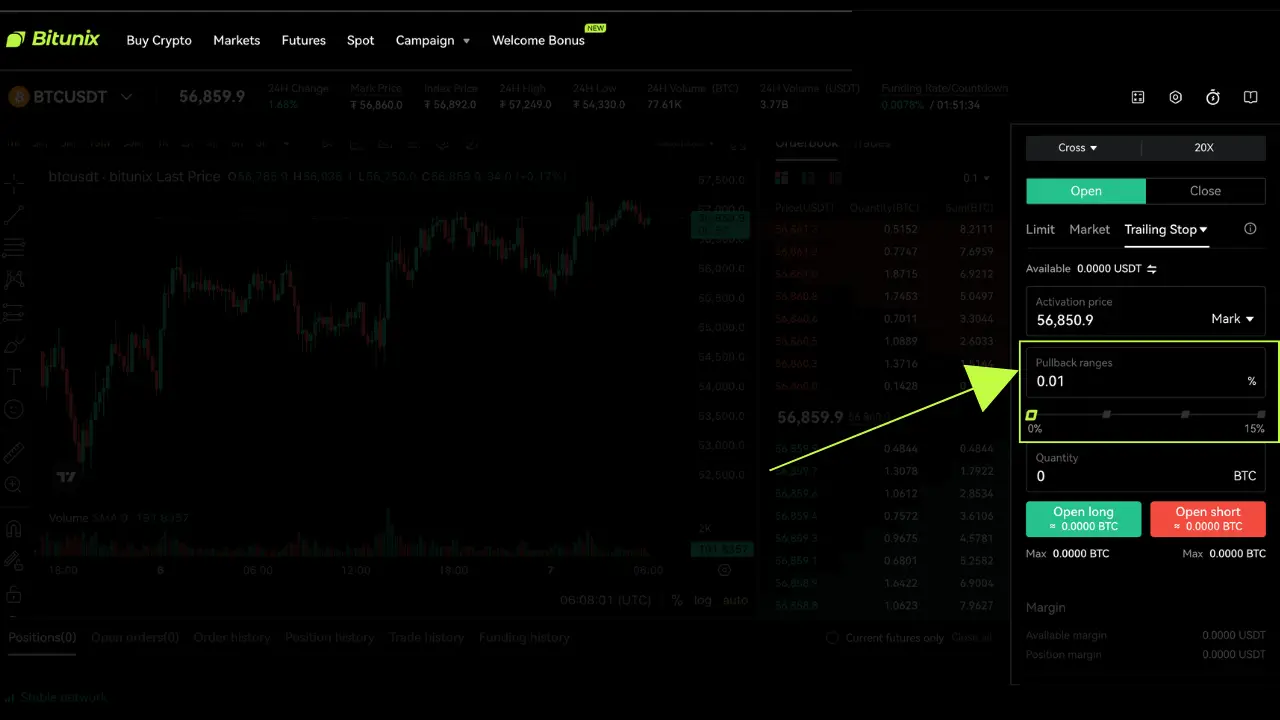

Bitunix trailing stop:

Special note for Bitunix users: If your position has moved more than 2% in the last hour or is within 1% of your stop-loss, trailing stop adjustments may be restricted to prevent execution errors.

To set Trailing Stop on Bitunix, click on Trailing Stop. Then move down to the slider bar “pullrange” and drag the button to set the trail percentage.

You can choose your order type on Bitunix by clicking on Effective time.

A GTC order remains open until you cancel it. Unlike day orders, it does not expire at the end of the trading session.

If you want to buy BTC at $55,000, you can place a GTC order and walk away. Even if it takes weeks for the market to dip, your order will still be waiting.

This order type is perfect for patient traders with specific entry targets.

Traders can use GTC orders to target specific price levels, regardless of how long it takes for those prices to be reached. This allows traders to avoid short-term market fluctuations and focus on their desired entry or exit points.

GTC orders remain in effect indefinitely, allowing traders to set and forget them without worrying about them expiring by default.

GTC orders are particularly useful when you have a specific price target that may not be reached immediately. They are well-suited for patient investors who are willing to wait for favorable market conditions.

For example, if you’re looking to buy crypto at a lower price than the current market value, you can place a GTC buy order at your target price and wait for the market to dip.

A trigger order in crypto trade, also called conditional order, is executed when certain predefined conditions are met. These conditions can be based on the price of the crypto asset, timing of the market, or the trade strategy you intend to use.

To enter a trigger order, you can specify the conditions based on the asset price you desire, the target profit, stop loss or trailing stop strategy. When the market meets the criteria of your trigger order, then the order gets exectued.

Benefit of using Trigger Order: In a wildly volatile market, you can use trigger order to protect your assets from losses and benefit from any upside in the market.

For example, if you place an order of 10 ETH with a stop loss set at $3200, then a sell order will get executed when the price of ETH drops to $3200.

Besides the stop loss, you can also set a take profit order under the same contract. So, let’s say you want to exit the contract when ETH reaches $3500. So, when the price of ETH reaches this price a sell order will get executed, leaving you with a profit.

A maker order allows you to add liquidity to the order book of an exchange rather than taking liquidity (leverage). This means you can enter into a trade at a limit price of an asset. Which means you can buy or sell crypto assets at a desired price of your choice. What is particularly different in this order type is that your order is not filled in immediately. It gets filled only when a taker is available to take the assets at your desired price.

For example, if you place a long position on BTC at $59,000 while the asset is trading at $57,000 or you place a short position on BTC at $61,000.

Low trading fees: Since you are a maker and add liquidity to the order book of the exchange, you bear lesser trading fees as compared to other orders.

More control: As you are a maker on the exchange, you can make strategic entry and exit into the market.

Understanding and utilizing the various types of crypto orders is vital for effective trading. Each order type has its unique benefits and is suited to different market conditions and trading strategies.

Whether you prioritize speed, control, or risk management, there’s an order type to match your goals.

Crypto order types are different instructions you give an exchange to execute trades. They determine when and how your buy or sell is processed, balancing speed, price control, and risk management.

A market order executes immediately at the best available price. It prioritizes speed over price precision.

A trailing stop loss is an advanced order that automatically adjusts with the market price, locking in profits as the asset rises while still protecting against downturns.

It “trails” the price by a set percentage or amount. For example, if you set a 5% trailing stop on BTC at $30,000 and the price rises to $33,000, the stop shifts to $31,350. If the price drops to that level, the trade closes automatically.

Yes. Buy ETH at $3,000 and set a trailing stop of 10%. If ETH rises to $3,500, the stop moves up to $3,150. If ETH then drops to $3,150, your order closes, securing $150 profit.

A stop-loss closes your position when the market reaches a predefined level, limiting losses. On Bitunix, you can set stop-loss under Buy TP/SL or Sell TP/SL.

Bitunix trailing stop is a feature that allows you to place a trailing stop order. To set it, click on Trailing Stop in the order menu and adjust the percentage slider to your preference.

Most major exchanges, including Bitunix, KuCoin, and BingX, support stop-loss. Trailing stop loss is less common, but Bitunix offers it natively.

Bitunix may restrict adjustments to your trailing stop in this scenario to avoid technical misfires or accidental premature closure of positions.

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.