For the past decade, a new way to make payments has evolved, cryptocurrencies with Bitcoin being the largest one. Modelling and understanding the market behaviours of these currencies is essential to those who decide to invest in this new asset.

Cryptocurrencies are also used to do transactions between users which makes the stability of the currency crucial. The largest cryptocurrency, Bitcoin was created in 2009 and since then numerous other cryptocurrencies have been created. However it is only during the last years that they have picked up some recognition.

The cryptocurrency market has evolved dramatically since the inception of Bitcoin in 2009. Thousands of cryptocurrencies are now available, each trading on various exchanges around the world, understanding the concept of “market price” is now incumbent for both novice and experienced traders.

The thing is crypto assets don’t trade in reference to transparent financial data like a company’s earnings reports. Instead, digital currencies such as Bitcoin, XRP and Ethereum are a new and distinct asset category with unique value propositions which derived their value from their use cases, utility, adoption and supply chain. They aren’t tied to governments, companies, or commodities but offer traders access to revolutionary decentralized payment networks.

Although it’s cumbersome to determine what each cryptocurrency market price should be worth, financial analysts use tools to calculate each crypto’s current market price. But what is the market price for cryptocurrencies, and how do people use it to evaluate the cost of different digital assets?

Market price, in the context of cryptocurrencies, is a term that represents the current value of a particular digital asset (lets say BTC) in the open market. It is the price at which a cryptocurrency is bought or sold at any given moment. This blog post will help you have a concrete knowledge on the intricacies of market price in the crypto space, exploring how it is determined, factors influencing it, and its significance for traders and investors.

Understanding Market Price

Market price is the most recent price at which a cryptocurrency has been traded. It reflects the equilibrium between supply and demand at a specific point in time. Unlike traditional assets, cryptocurrencies are traded 24/7 on multiple exchanges, which means the market price can fluctuate continuously.

Market price is the actual amount people pay for a product, asset, or service. For instance, whenever a buyer and seller complete a transaction, the cost at which both parties settle their trade (selling and buying price) is the market price. We describe it as the point where supply and demand are in equilibrium.

Contextually, supply refers to how much of an asset or service is available, while demand measures how many people want it. As demand increases and supply decreases, the market price goes up that is what gives BTC its value because the asset is scarce and is in high demand. Also, if demand decreases and supply increases, the market price declines.

While supply and demand are the two key factors that determine the price of a cryptocurrency, there are however a range of other factors that may influence supply and demand – like utility, mass adoption, tokenomics, and market sentiment, all of which we’ll explore in this guide.

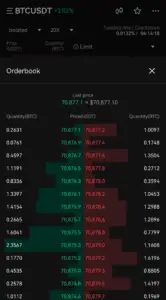

On certain exchanges, traders analyze “ask” and “bid” on the order prices to determine the market price.

The bid price is the most a buyer is willing to spend on an asset, while the ask price is the lowest a seller will go to part with their asset. The market price always exists somewhere between the bid and ask prices (the “bid-ask spread”). Supply and demand influence the day-to-day price fluctuations in the quoted bid and ask prices.

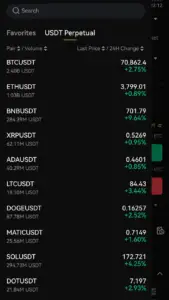

Crypto currency exchanges, such as Bitunix, show lists of the most recent bid and ask prices for cryptocurrencies to help buyers and sellers analyze trading activity. The current market price is the last recorded trade of a respective cryptocurrency.

The market price is the result of the interaction of traders, investors, and dealers in the stock and crypto currency market. In order for a trade to occur, there must be a buyer and a seller that meet at the same price. Bids are represented by buyers, and offers are represented by sellers.

What Does Market Capitalization Mean?

As discussed in our previous blog post, “Market capitalization” (or market cap) is the aggregate dollar amount of the entire asset across all fractional ownership assets. With traditional assets and cryptocurrencies, the market cap directly correlates to the current market price. Financial analysts divide an asset’s current market cap by its available supply to determine the market price per unit.

The market cap also helps traders compare the current valuation and risk profiles of various companies, cryptocurrencies, or assets. In relation to traditional assets, established companies with large market caps, typically exhibit low risks but may not provide rapid growth like small companies. Alternatively, trading in companies with a lesser market cap (e.g., a small biopharmaceutical company) are more vulnerable to risk, but they may offer high growth potential should the venture succeed. Traders compare and contrast the market caps of different assets to evaluate risk and calculate hypothetical future prices before committing their funds.

Determination of Market Price

The market price is determined through the interaction of buyers and sellers on exchanges. When a buy order matches a sell order at a particular price, a trade occurs, and this price becomes the latest market price. The process is dynamic and ongoing, influenced by various market participants and their trading strategies.

Several factors can influence the market price of cryptocurrencies. Understanding these factors can provide insights into the volatility and price movements in the crypto market.

Supply and Demand

The fundamental economic principle of supply and demand is a primary driver of market price. When the demand for a cryptocurrency exceeds its supply, the price tends to rise using bitcoin as a case study, the crypto currency cam into limelight in 2008 when the whitepaper was written then officially launched in the year 2009. The asset started trading with as low as $0.05 in July 18, 2010 but overtime,

BTC has grown to an All-time-High of $73,488 due to the increase in demand which superseded the supply. Conversely, when supply outstrips demand, prices typically fall. The supply of most cryptocurrencies is controlled by a predetermined issuance schedule, often governed by the blockchain protocol itself.

And that is why some cryptocurrencies don’t have great value because they don’t have small supply and neither is the supply hard-capped meaning no new tokens should be created. Tokens like dogecoin have unlimited supply making the market price highly volatile.

Market Sentiment

Market sentiment refers to the overall attitude of investors towards a particular cryptocurrency or the market as a whole. Positive news, such as regulatory approvals, technological advancements, or endorsements by prominent figures, can boost market sentiment and drive prices up. Negative news, such as security breaches, regulatory crackdowns, or market manipulations, can have the opposite effect.

Crypto is always a speculative asset, meaning it’s worth whatever people pay. In a bull run (which are times when most asset are outperforming), there’s a positive market sentiment, you’ll generally see prices increasing across the market, whereas, in a bear run (when assets are underperforming), there’s a negative market sentiment, you’ll generally see prices decreasing across the market.

Trading Volume

Trading volume is the total number of coins or tokens traded within a specific period. Higher trading volumes often indicate a high level of interest and can lead to more significant price movements. Low trading volumes, on the other hand, can result in price stagnation and higher volatility due to less liquidity.

In addition to trading volume, tokenomics also affects market price of an asset it refers to the economic properties of a given token. In other words, the fundamentals that may make a cryptocurrency valuable or appealing to investors – for example, yields, burns, consensus mechanism, token supply, and token allocations. You can usually find all this information in a token’s whitepaper. If you can’t find a whitepaper (or if that whitepaper makes no sense), you might be looking at a bad investment.

Market Manipulation

Cryptocurrency markets are still relatively young and less regulated compared to traditional financial markets, making them susceptible to manipulation. Whales, or large holders of cryptocurrencies, can influence market prices by placing large buy or sell orders. Tactics such as pump-and-dump schemes, where the price is artificially inflated and then sold off for profit, can distort market prices leading to fail projects or pyramid scheme example is the FTX $FTT token.

Following an investigative article from CoinDesk, reporting that FTX’s sister company Alameda Research was using FTT tokens as collateral for further loans, many investors had serious questions over the companies’ exposure to FTT. Binance, among many, sold off holdings and this sudden bank run caused a sudden drop in price of more than 90% for FTT token.

Poor tokenomics may also contribute to a cryptocurrency losing value. A common example of poor tokenomics includes unlimited and uncontrolled supplies meaning supply will always outpace demand.

However, more specific examples include flaws with the protocols behind tokens, for example, LUNA/UST. UST was an algorithmic stablecoin, backed by LUNA and BTC reserves, and pegged to the value of a dollar. When one whale unstaked and liquidated more than $2 billion in UST, the huge sell-off caused the stablecoin to depeg, bringing in many arbitrage traders looking to make money from the discrepancy in price. This, in turn, caused a bank run, crashing both UST and LUNA and wiping an estimated $40 billion off the market.

Finally, scams like rug pulls – can wipe off the value of a given cryptocurrency in seconds. Rug pulls involve a new token being created, hyped, and then dumped by the project creators at the point the token reaches an ATH. One of the most notable rug pulls was LUNY – a yield aggregator for Solana – that attracted millions in funding for its initial dex offering.

Days after launch, all raised capital was sent to an untraceable mixing service and social media for the project shutdown, with an estimated $6.7 million stolen. Learn more about rug pulls and how to avoid them. Coingecko Price aggregator next to Coinmarketcap, estimates more than 900 cryptocurrencies on average fail each year.

Technological Developments

Technological advancements and updates to a cryptocurrency’s underlying blockchain can impact its market price. For example, successful implementation of scalability solutions, security enhancements, or new features can increase the attractiveness of a cryptocurrency, driving up its price. Conversely, technical failures or security breaches can lead to price declines.

How Market Price is Reflected on Exchanges

Market price on exchanges is determined by the most recent transaction between a buyer and a seller, reflecting the equilibrium of supply and demand at that moment. It continuously updates based on new trades, capturing real-time market sentiment and activity.

Bid and ask orders in the order book also influence the market price by showing the highest price buyers are willing to pay and the lowest price sellers are willing to accept. High trading volume and liquidity typically result in a more accurate and stable market price. This price is prominently displayed as the current price or last price on trading platforms, guiding subsequent trading decisions. Here’s how market price is typically reflected on exchanges:

Order Book

The order book is a list of all buy and sell orders placed on an exchange. Buy orders (bids) and sell orders (asks) are listed with their respective quantities and prices. The highest bid and the lowest ask indicate the closest possible transaction, reflecting the current market price.

Tickers

A ticker is a real-time display of the most recent transaction price of a cryptocurrency. It provides a quick snapshot of the market price and is often displayed prominently on exchange platforms.

Candlestick Charts

Candlestick charts are graphical representations of price movements over specified time intervals. Each candlestick shows the opening, closing, highest, and lowest prices within a given period, providing a visual summary of market price fluctuations.

Volume Indicators

Volume indicators on exchanges show the total trading volume for a cryptocurrency within a specific time frame. High trading volumes often correlate with significant price movements and can be a crucial indicator for traders.

The Significance of Market Price for Traders and Investors

Understanding market price is vital for making informed trading and investment decisions in the crypto market. Here are some reasons why market price is significant:

Entry and Exit Points

For traders, identifying the right entry and exit points is crucial for profitability. The market price helps traders decide when to buy or sell a cryptocurrency. For example, buying at a lower market price and selling at a higher price can yield profits. Conversely, avoiding purchases during price peaks can prevent losses.

Portfolio Valuation

Market price is essential for valuing a cryptocurrency portfolio. By knowing the current market price, investors can calculate the total value of their holdings and assess their portfolio’s performance. This information is critical for making adjustments to the portfolio and aligning it with investment goals.

Arbitrage Opportunities

Arbitrage involves buying a cryptocurrency on one exchange where the price is lower and selling it on another exchange where the price is higher. This strategy relies on market price discrepancies between exchanges.

Understanding market price dynamics across different platforms can help traders exploit arbitrage opportunities. Market price fluctuations are inherent in the crypto market. By monitoring market prices, traders and investors can implement risk management strategies, such as setting stop-loss orders to minimize potential losses or taking profits at predetermined price levels.

Challenges in Determining Accurate Market Price

Despite the importance of market price, determining an accurate and reliable market price in the crypto market poses several challenges:

The cryptocurrency market is highly fragmented, with numerous exchanges operating independently. This fragmentation can lead to price discrepancies across different platforms. Aggregating data from multiple exchanges is necessary to obtain a more accurate market price. Some cryptocurrencies, especially newer or lesser-known ones, may have low liquidity.

Low liquidity can result in significant price volatility and make it challenging to determine a stable market price. Fake trading volume, or wash trading, is a practice where traders create artificial trading activity to inflate the apparent volume and manipulate the market price. Identifying and excluding fake volume is crucial for accurate market price determination.

The crypto market is known for its rapid and sometimes extreme price movements. Sudden spikes or drops in market price can occur due to market sentiment, news events, or large trades. These rapid changes can make it difficult to ascertain a consistent market price.

Tools and Resources for Tracking Market Price

Several tools and resources are available to help traders and investors track market prices such as websites like CoinMarketCap, CoinGecko, and CryptoCompare aggregate market data from various exchanges, providing real-time market prices, trading volumes, and other essential metrics for numerous cryptocurrencies.

Most cryptocurrency exchanges offer real-time price tracking and trading tools. Popular exchanges like Binance, Coinbase, Bitunix and Kraken provide comprehensive market data, including order books, trade histories, and price charts. Automated trading bots can also help monitor market prices and execute trades based on predefined criteria. These bots can operate 24/7, allowing traders to take advantage of market opportunities even when they are not actively monitoring the market.

As a trader staying informed about the latest news and developments in the crypto market is important for understanding market price movements.

Conclusion

The market price in cryptocurrency reflects the dynamic interplay of supply and demand, market sentiment, trading volume, and other influencing factors. For traders and investors, understanding market price is essential for making informed decisions, managing risk, and optimizing their strategies.

The cryptocurrency market is poised for further growth, so there will be development in accurately calculating a tokens market price staying informed and utilizing reliable tools and resources will be key to successfully navigating this fast-paced and often volatile landscape.

As some of this aggregator are not accurate it is important to comprehensively understand market price and the factors that influence it.

Leave a Reply